Applicant information:

Name: Centrifuge

Address (Headquarters): Grafenauweg 8 (k/f labs)

City, State, Postal Code: Zug, 6300

Country: Switzerland

Website: https://centrifuge.io/

Primary Contact:

Grayson Alto

Title: DeFi BD & Research

Country: United States

Email, Telegram, Forum, & other methods of contact:

Telegram: @graysonalto

Email: grayson@k-f.co

Forum: @graysonalto

Twitter: https://twitter.com/AltoGrayson

Key Information

Expected Yield: Liquid Treasury Fund (LTF) targets returns from the short-end of the Treasury Bill curve at 0-6 months in duration. The three-month rate as of 4/29/24 is 5.26%.

Expected Maturity: The fund consists of rolling maturities. The current average maturity is 5.6 months.

Underlying asset: Short-duration U.S Treasury Bills

Minimum/Maximum transaction size: 500,000 USDC/USD minimum.

Current AUM for project: Centrifuge - $289,288,674

Current AUM for issuer: Anemoy – $9,669,838

Volume of transactions LTM: Anemoy - $9,669,874 [fund was launched in November 2023]

Source of first-loss capital: N/A

Basics and Background

Centrifuge was one of the first RWA protocols to support Arbitrum’s mission of supporting every corner of DeFi, including real-world assets.

Arbitrum Network Support From Day 1

In September of 2023, we launched Liquidity Pools on Arbitrum allowing investors to access Centrifuge pools directly from the Arbitrum network. Centrifuge has since been developing the ecosystem and demand for RWAs on Arbitrum, starting with a webinar with Offchain Labs co-founder Steven Goldfeder in November sharing the vision for bringing RWAs to Arbitrum. Centrifuge is fully operational on Arbitrum and ready to accept investments from day one. Centrifuge is multi-chain by design, all of the liquidity and TVL will stay on Arbitrum.

Decentralization Is Our DNA

Centrifuge itself is a fully decentralized DAO, and comes with an active ecosystem and contributors. A partnership in this capacity would further the network effects of our relationship by connecting both ecosystems. The Centrifuge ecosystem consists of issuers and liquidity providers, which the Arbitrum ecosystem can onboard at any time.

TVL On The Most Trusted RWA Protocol

An investment through Centrifuge’s platform will bolster RWAs on Arbitrum by bootstrapping network liquidity for one of the largest RWA protocols onchain. The Stable Treasury Endowment Program was set up not only to improve treasury health, but to strengthen projects built on Arbitrum. Using Centrifuge will grow RWA TVL on the Arbitrum network on the most well-recognized RWA protocol. Bootstrapping liquidity on Arbitrum would also further the case for building DeFi primitives composable with our permissioned tokens on the Arbitrum network itself.

Start With Treasury Bills, Expand Beyond

Centrifuge is asset agnostic, meaning we do, and will continue to support diversified, high-quality RWA credit asset managers and issuers. As Arbitrum develops beyond phase-1 in the STEP program, Centrifuge will be able to play a key role as a one-stop solution for onchain credit. By onboarding Centrifuge, the path to other assets becomes a more seamless journey.

Introducing Anemoy

Anemoy is a web3 native asset manager built on Centrifuge. The Anemoy Liquid Treasury Fund (LTF) is a regulated, fully onchain actively managed fund for direct access to <6 month US Treasury Yield. The fund is approved and regulated by the BVI Financial Services Commission (BVI FSC). The fund TVL is $9.7M and has committed allocations of an additional $10M from GnosisDAO and $20M from Frax.

Centrifuge proposes that the The Stable Treasury Endowment Program starts with an allocation to Treasury bills through Anemoy. Anemoy is waiving all management fees (15bps annually) on the Arbitrum Network starting from when the Arbitrum Foundation subscribes to the fund, ending May 1st, 2025. This is a move to not only attract the Foundation, but also incentivize other players on the network as a whole. Additionally, all third-party service provider fees are waived until the AUM reaches 50M USDC (currently 9.7M USDC). This brings fees to zero initially, and very low thereafter.

-

Identify key management personnel and individual experience. Also, include third parties utilized for managing assets and their qualifications.

Anemoy’s fund mandate is transparent and clear: to hold a diversified, stable mix of T-Bills with maturities between 0-6 months. All fund investment management is handled within Anemoy by the team. No third parties are utilized in managing assets.

All third-party service provider details are listed later in the application. A summary of the most relevant:

- Custodian of T-Bills: Unnamed U.S systematically important bank [name can be requested by committee]

- Primer Broker: StoneX

- Banking: First Citizens Bank

- Fund Admin: Trident Trust

- Fund Auditor: MHA Caymans

Core Team:

- Lucas is the pioneer of Real-World Assets and the protocols that bring them onto the blockchain. His career has been dedicated to bridging the realms of technology and finance to upgrade our financial system. He’s co-founder and CEO of Centrifuge.

- Cassidy is an experienced entrepreneur and Economist. She previously worked at the Federal Reserve on interest rate policy. Prior to Centrifuge, she founded and advised multiple companies in the blockchain space. She’s co-founder and CSO of Centrifuge.

- Martin is a serial entrepreneur with 30 years in the software industry. He co-founded Taulia (acquired by SAP) and Ebydos (acquired by ReadSoft). He’s the Director of Anemoy and Co-founder of Centrifuge.

- Eli is a corporate lawyer with 25 years of experience in commercial transactions, financial services and regulatory matters. He’s worked in Asia, Europe and the United States with companies such as the CME, Euroclear Bank, and SGX. He’s General Counsel to Centrifuge and Chief Compliance Officer of Anemoy.

-

Describe any previous work by the entity or its officers/key contributors similar to that requested. References are encouraged.

Centrifuge is a decentralized RWA protocol with $570M worth of assets financed as of 4/29/2024, and $289M currently on the platform. Some relevant partners to Arbitrum include MakerDAO, BlockTower, Aave, Frax, and GnosisDAO. Centrifuge is happy to facilitate introductions between organizations as requested. Brief descriptions of our work below:

MakerDAO:

In the summer of 2022 we proposed alongside institutional lender, BlockTower, to launch a $220M securitization pool on Centrifuge. The underlying assets were made up of senior loan positions in invoice financing, trade finance, or other short term receivables. Today, BlockTower pools on Centrifuge have around $190M in assets. The BlockTower arrangement was the first time a credit fund’s operations had been brought onchain, requiring immense legal and operational work to bring to fruition. Much of our DAO protocol work since has taken learnings and structures from this arrangement to implement elsewhere.

Centrifuge began working closely with MakerDAO in 2020 when our first real estate credit pool was proposed with New Silver. Since then, New Silver has launched another pool with MakerDAO titled New Silver II, where they got a debt ceiling increase from $20M to $50M.

Aave:

The Centrifuge RWA Market on Aave was launched in 2021 marking the first institutional grade RWA lending market. This allowed users to deposit stablecoins in return for senior or junior tranches of credit directly within the Aave application. The Aave DAO recently has approved to onboard the Aave Treasury into Centrifuge Prime, to allocate an investment into the Anemoy US Treasury Bill fund.

Celo:

Celo is another network using Anemoy on the Centrifuge platform to better their long-term sustainability for their treasury. They invest in Anemoy’s LTF and have intentions to diversify into other assets including Flow Carbon’s offset pool. Centrifuge is live on Celo through Liquidity Pools, marking the first use case of our multi-chain product. TVL remains on the Celo network, akin to this proposal with Arbitrum.

GnosisDAO:

Some of our newest clients include GnosisDAO, who decided to allocate a portion of their treasury to Centrifuge Prime, mainly the Anemoy Liquid Treasury Fund. The GnosisDAO proposal includes $10M being allocated. Karpatkey is the financial service provider for GnosisDAO who is now managing the day to day operations of all investments including in RWAs.

Frax:

Frax is another DAO that recently decided to onboard the Anemoy Liquid Treasury Fund. The Frax treasury will be bringing $20M to RWAs as outlined in this recent proposal. This is a strong step in the direction of working towards long term sustainability of the DAO in light of ongoing liabilities and ecosystem development.

Web3 Foundation:

The Web3 Foundation, a not-for-profit organization that supports Web3 teams and open-source projects through funding, advocacy, research and collaboration, recently announced their investment with Anemoy on the Centrifuge platform. They are like the Arbitrum Foundation in that they were looking to protect purchasing power to support the long term vision of their projects through the already established legal organization.

-

Has your entity or its officers/key contributors been subject to an enforcement action, criminal action, or defaulted on legal or financial obligations? Please describe the circumstances if so.

No.

None.

-

Insurance coverages, guarantees, and backstops Name of insurer or guarantor Per incident coverage Aggregate coverage

One-hundred percent of Anemoy assets are held at insured, and in the case of invested assets, in systemically important financial institutions, negating the need for additional insurances that ultimately increase the cost for investors. The underlying holdings of the Anemoy Liquid Treasury Fund are held at licensed US banks covered by Federal Deposit Insurance Corporation (FDIC) for cash assets, and the Securities Investor Protection Corporation (SIPC) for securities. The licensed fund administrator, Trident Trust, ensures proper operations of the fund contractually. Insurance such as Directors and Officers (D&O) Insurance is not relevant to the investor because this protects the directors and does not add anything from an investor protection standpoint.

-

Historical tracking error in your proposed product, or similar to that being proposed Product 2024 YTD 2023 2022 2021

The Anemoy Liquid Treasury Fund (LTF) does not suffer from tracking error as the fund directly holds the underlying assets. These assets, T-Bills, have readily available market prices meaning the NAV is easily calculated by our BVI licensed fund administrator, Trident Trust. A tracking error in this context is the divergence between the price behavior of the LTF tokens, and the underlying prices of portfolio assets. This is not applicable for LTF tokens as the relationship between NAV and token price is identical. LTF tokens do not trade on the secondary market, meaning the only prices come from primary issuance and redemption. The fund NAV is updated daily, and in the case of an issuance/redemption, the NAV is updated at the exact time of such action.

N/A.

-

Please describe any experience your firm has in working with decentralized organizational structures

A majority of Centirfuge’s focus since inception, starting with MakerDAO and Aave, has been with decentralized organizations. Question number three above details some of those partnerships.

Centrifuge itself is also a fully decentralized DAO, and believes in decentralization as proven by our actions. The Centrifuge DAO has control over protocol operations. The Centrifuge governance forum can be found here.

-

What is your entity’s current assets under management, assets held in trust, total value locked, or equivalent metric for your legal structuring?

Current protocol TVL is $289M. Centrifuge over its lifetime has financed $570M in assets.

Although we recently began supporting Arbitrum, no Arbitrum clients have yet deployed TVL.

Plan design

-

Please describe your proposed product, including a description of the underlying assets and, if more than one asset, the proposed allocation among assets and general investment guidelines. Where appropriate, include targeted maturity mix and credit quality. Attach supplementary documents as appropriate.

Centrifuge is the tokenization platform connecting onchain capital and asset managers in an efficient, transparent, and programmatic way. All issuers must go through the Pool Onboarding Process (POP) via Centrifuge governance which consists of strong due diligence among the community. Anemoy’s POP application can be found here. Centrifuge is open source and asset agnostic in nature, allowing a diverse set of funds and managers to come onchain to manage pools. As part of The Stable Endowment Treasury Program, the Anemoy Liquid Treasury Fund I, is a natural first investment choice for the services requested.

Advantages of Centrifuge:

Transparency:

The Centrifuge app, such as the Anemoy pool, provides unparalleled transparency, showing the individual T-Bill positions as held by the fund. Subscriptions are done in USDC or USD. Investors have the ability to view their holdings, returns, and overall fund composition via Centrifuge in near real-time, which can be further verified offchain or onchain. Additionally, users can see all activities conducted by the fund including, redemptions, investments, asset transfers, and idle excess cash such as USD in the bank. Our partnership with Trident Trust enables us to accurately and efficiently publish an onchain record of portfolio data and net asset valuations.

Below is an example of a dashboard via the Centrifuge App that allows users to track their portfolio holdings, historical returns, as well as history of in- and outflows into the pools.

Efficiency:

Asset managers on the platform have unique efficiency due to our fund management platform streamlining many back office operations. These efficiencies in reporting, operations, and programmability ultimately save money for the end investors through low fees charged by issuers on Centrifuge. On the asset management side, Centrifuge drives efficiencies in reporting allowing all the flow data to be aggregated and act as a single source of truth for back office purposes.

Diversification:

Onboarding with Centrifuge allows the Arbitrum Foundation to access a multitude of different asset classes once the program develops beyond stable yields. All investments made through the platform can be managed within the portfolio management features on our application. Centrifuge is committed to furthering adoption of a multitude of asset classes onchain for all Centrifuge clients.

Below is a simple table representing further diversification opportunities:

| Strategy | Description | Targeted Returns | Liquidity Thresholds |

|---|---|---|---|

| Liquidity | Lowest risk while maintaining US Treasuries, MMF, AA+ rated short term bonds | 5-6% | Daily |

| Preservation | Investments in senior secured loans such as real estate, corporate bonds etc. | 6-8% | 3-6 months |

| Acceleration | Trade finance, non-bank originators, emerging markets | 8-20% | 3-24mo |

Institutional Grade Token Utility:

Centrifuge is bringing institutional grade utility to RWA tokens, not currently observable in the market. Current utility offerings around RWA tokens are insufficient for reputable institutions to interact with from a compliance perspective. We are actively working to integrate them into a few different use cases such as lending and other DeFi primitives. See our recent proposal on Centrifuge’s forum. Centrifuge is setting up use cases to allow investors to 1) pledge RWA tokens as collateral to borrow at high LTVs, and 2) gain instant redemptions as lenders are able to buy the short-term liability when users request to redeem shares. This happens in an institutional grade, permissioned environment by all parties interacting with the contracts and the contracts themselves.

The Anemoy Liquid Treasury Fund

The Anemoy Liquid Treasury Fund invests exclusively in U.S T-bills with a maximum maturity of 6-months, and focuses on maximizing interest rates and minimizing price and duration risks. The fund invests in ongoing rolling maturities, meaning as one Bill expires, the fund aims to buy a bill with a maturity six-months out. This ensures a diversified mix of Bills between 0-6 months. US T-Bills are held directly by the fund with our custodian, and AUM can be viewed onchain. The fund is a BVI-licensed fund open to non-US Professional Investors.

The Anemoy LTF onboarding proposal via governance can be found here.

Below you will find the current asset makeup of Anemoy’s Liquid Treasury Fund as of 4/21/2024.

The Centrifuge app takes transparency seriously as a core value to investors. In the assets tab, anyone can see the individual bills held by the Anemoy Liquid Treasury Fund, with the CUSIP securities identification number available.

Above is a detailed view in our UI of a single T-Bill security.

Benefits of the Anemoy structure include:

- Daily Liquidity: The fund offers daily redemption orders with settlement in 8-48 hours in USDC or USD.

- Direct Ownership: The tokens serve as direct evidence of ownership of the fund shares, allowing cost-efficient redemptions and providing full legal claims on assets.

- Investor Protection: Prospective investors must adhere to the Know Your Customer (KYC) and anti-money laundering requirements of a BVI-regulated professional fund, ensuring a secure and transparent investment environment well-protected from regulatory risk and sanctions enforcement.

- Transparency: Centrifuge provides near real-time onchain visibility of holdings, returns, and tokenized U.S. Treasury Bills.

Anemoy LTF tokens are the individual shares in the BVI fund, and come with full legal shareholder recourse rights to the underlying assets under BVI law (shares are issued as tokens following BVI law). The token price directly reflects the NAV of the fund with fees already withheld from the price. As mentioned above, the NAV is updated daily and when an investor invests/redeems in the fund before any investment or redemption. The token is not a rebasing token.

Yes, investors have full legal shareholder recourse rights to assets of the BVI professional fund.

-

Describe the legal and contractual structuring for your product including regulatory bodies overseeing your business and the product and identifying all legal jurisdictions interacting with your product. Attach supplementary documents as appropriate.

The Anemoy Liquid Treasury Fund is approved and regulated by the BVI Financial Services Commission (BVI FSC) as a professional fund. This is the same structure BlackRock chose for its ‘BUIDL’ fund.

The Certificate of Recognition can be seen below:

A high level graphic showing the advantages of our legal structure can be found below:

The graphic shown above summarizes why Anemoy’s chosen legal structure is the safest, most compliant structure for RWA products currently available. The graphic shown above can be found here.

-

Would Arbitrum’s assets be bankruptcy remote from your own entity and its officers/key contributors? If so, please explain the legal and contractual basis. On a confidential, non-reliance basis, provide any third party legal opinions to support the conclusions.

Yes, Anemoy is established under BVI law as a segregated portfolio company. The assets held in the relevant US Treasury portfolio are exclusively owned by the shareholders that have purchased shares in the fund. Under BVI law, the tokens themselves represent share ownership in the Fund in the same manner as a share certificate. As this is ownership of a segregated portfolio company, all of the assets in the dedicated portfolio (Treasury Bills in this case) are by law owned by the fund shareholders. In case of bankruptcy, these assets would be liquidated and the proceeds would be distributed to tokenholders by operation of British Virgin Islands law. So from the start, the tokenholders have direct ownership of the portfolio assets.

-

How are Arbitrum’s assets protected vis-a-vis the bankruptcy of the brokerage or applicable financial institution (e.g., bank deposit insurance, securities insurance, etc.)?

While a bankruptcy of an Anemoy service provider would not directly impact Arbitrum or its assets, the bank and custodian used by Anemoy are both covered under US government insurance schemes through the Federal Deposit Insurance Corporation (FDIC) and the Securities Investor Protection Corporation (SIPC) respectively.

-

Does the Issuer issue more than one asset? If so, what is the priority relationship between different asset classes?

At the moment, Anemoy only manages the Liquid Treasury Fund.

Anemoy is in the process of setting up a fund of funds to offer investors access to DeFi yields. The asset classes will complement each other, allowing investors to achieve a blended strategy with high DeFi yields and stable treasury rates.

-

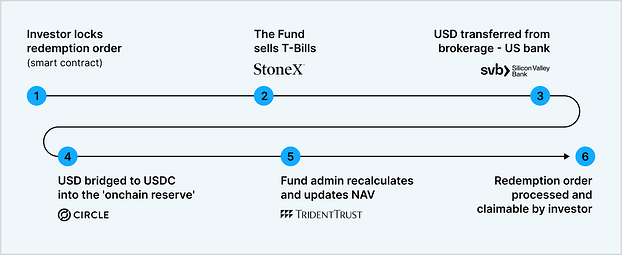

Provide a detailed cash flow diagram that shows the flow of funds from ARB/Fiat conversion, investment in underlying asset, payment of expenses, sale of underlying asset, and repayment (Fiat/ARB conversion), including the counterparties and legal jurisdictions involved.

The following graphic depicts the normal flow of funds and key third parties involved. The Anemoy fund can only be subscribed to using USDC/USD. It was conveyed to Centrifuge that the Arbitrum Foundation will do the swap from the ARB token to USDC.

Once the USDC (on the Arbitrum network) is received by Anemoy’s wallet, Anemoy can convert the USDC to USD via our Circle partnership, and deposit the USD in our bank account. Anemoy then buys securities using StoneX as our prime broker. Those securities are moved into custody.

The process is simply reversed when redeeming shares from the fund.

Potential future fees are automatically withheld, negating the need for other transfers on behalf of the Arbitrum Foundation.

-

Describe anticipated tax consequences (if any) in transacting on the underlying and/or receipt of yield.

None. There are no corporate taxes in either the BVI or Cayman Islands.

-

Describe the process and expected timeline for liquidation of assets, if given instructions to do so by Arbitrum governance.

Redemption requests are immediate and will be executed as soon as possible during business hours (any hour of a day on which banks and security exchange markets in the US are open to the public and are generally carrying on their normal banking and market functions). A redemption is usually settled on the same business day (any day on which banks and security exchange markets in the US are open to the public and are generally carrying on their normal banking and market functions). Anemoy is not restricting redemptions with cutoff times. Only cutoff times for domestic US wires and markets apply. Anemoy can mint and burn LTF tokens and process stablecoins at any time. Investors can additionally notify and arrange redemptions with Anemoy via Telegram or email to ensure the shortest possible processing times.

Redemption Process:

- Redemption Request: Investors submit a request for redemption onchain using its Arbitrum wallet which is processed immediately, locking the number of LTF tokens (fund shares) they wish to redeem.

- Liquidation: The underlying Treasury Bills are of the most liquid of all financial assets making them immediately liquidatable during market hours.

- Calculation of Redemption Amount: The net asset value (NAV) for the redemption date is calculated, which will determine the value of the shares to be redeemed.

- USD wire: The USD settlement amount is wired from the prime broker account to the fund’s US bank account.

- USDC exchange: USD is exchanged to USDC via the fund’s Circle account.

- Withdrawal: The USDC is then immediately sent back to the foundation address.

Instant Redemptions

Using existing lending markets, Centrifuge is setting up the infrastructure to allow instant redemptions as lenders are able to buy the short-term liability when users request to redeem shares. We expect this to be live by the time STEP investments actually take place. This means that Investors no longer have to wait for offchain settlement during banking hours, and can get instant liquidity on redemptions in full .

-

What amount of first-loss equity will Sponsor provide to ensure over-collateralization, how is the first-loss equity denominated, and what is the source of capital?

N/A. There is no need for first-loss equity.

-

Describe the liquidity and stability of the proposed underlying assets, including anticipated settlement times from the sale of the underlying to the repayment of ARB.

The market value of U.S Treasury bills is around $25 trillion according to the St. Louis Fed, making it the most liquid asset class in the world. We expect from the sale of treasuries to repayment of ARB to be around 8-48 hours.

The underlying government T-bills can be sold T+0 on business days.

Additionally, Centrifuge is setting up use cases to allow investors to 1) pledge RWA tokens as collateral to borrow at high LTVs, and 2) gain instant redemptions as lenders are able to buy the short-term liability when users request to redeem shares. This allows investors to use the lending market to circumvent the offchain redemption process entirely.

-

If relying on the blockchain for any of the transactional flows, please describe any blockchain derived risks and mitigations.

The investment and redemption process, as well as the tokenization and origination process, is fully automated by smart contracts. This creates a transparent and auditable trail.

The flow of funds onchain is fully restricted through a combination of account abstraction and custom permissioning built into the Centrifuge protocol. Once stablecoins are moved into the pool contract, the asset manager can trigger a transfer only to the predetermined off-ramp, specifically the Circle wallet. Vice versa for repayments and redemptions, any on-ramped funds are directly moved to a wallet that can only be used to move stablecoins into the pool.

The contracts themself have been extensively audited, to reduce the risk of technical issues, by Spearbit, SR Labs, a Code4rena audit, and more. More recently an extensive invariant test suite has also been developed, in partnership with Recon.

N/A.

-

List all the third party counterparties linked to your assets including and not restricted to prime broker if any, custodian, reporting agent, banks for derivatives or loans and provide primary contact details for the third party counterparties

Anemoy uses a U.S systemically important institution for T-bill custody [name can be shared with the committee upon request], StoneX as our registered prime broker, First Citizens Bank as our US bank, Trident Trust as our professional fund administrator, and Circle as our USDC/USD bridge.

Regulated Prime Broker - StoneX:

StoneX is a US based prime broker who originates our U.S Treasury Bills. StoneX serves 54,000 institutional clients with $20 billion in assets with over a 100 years in business.

Fund Custodian - [Name revealed privately to the committee upon request]

USDC On/Off Ramp - Circle:

Anemoy has an institutional account with Circle Mint to directly mint or redeem USDC with/for the underlying USD needed to buy U.S Treasuries.

Bank - First Citizens Bank:

Anemoy uses First Citizens Bank as our rail between USD received from Circle, to then buy Treasuries via StoneX. USD Funds are immediately transferred during business hours when they are deposited.

Professional Fund Administrator - Trident Trust Company (BVI) Ltd:

Anemoy uses Trident as our Professional Fund Administrator. The administrator’s role is to provide financial, accounting, corporate, administrative, registrar, and transfer agency services. The Administrator also conducts AML and KYC checks on investors. The Administrator additionally runs the net asset value(NAV) calculations for Anemoy used for investing and redeeming shares.

Auditor - MHA Cayman:

MHA Cayman is a specialist provider of audit services to the asset management industry, and has offices in London and the BVI .Anemoy works with MHA Cayman to provide annual audits to investors.

Legal Counsel - Ogier:

Ogier Advises Anemoy on BVI law issues and has prepared offer documentations, corporate constitutional documentation and internal policies.

-

Can you explain how is risk management (investment and operational) being done? Can you provide a copy of your risk management policy?

Anemoy sets a benchmark in financial security. The T-Bill investment carries essentially no investment risk and duration risk. Operational risk is minimized due to a highly simplified and streamlined process. Legal and regulatory risk is minimal as the fund is fully licensed under BVI law. The BVI Financial Services Commission is one of the world’s only regulators actively allowing and regulating funds such as the one being proposed. This allows Anemoy to not provide services in the gray areas of the law.

Trident Trust oversees meticulous KYC/KYB/AML protocols. Anemoy ensures stringent BVI compliance standards are met, safeguarding against illicit activities. Daily NAV checks are completed and overseen by seasoned Professional Fund Administrators and reviewed by Trident Trust to maintain stability and integrity for the pool. Access to pivotal financial hubs like Circle, StoneX , and bank accounts are prudently restricted, bolstering asset protection measures.

Performance reporting

-

What are your proposed performance benchmarks? If this is substantially different from the underlying assets, please explain why.

Our performance benchmark is the same as the underlying assets that make up the fund, a mix of U.S Treasury Bill rates with maturities of 1-6 months. Anemoy does not anticipate the fund performance to be any different than the underlying assets that it consists of before potential fees.

Below is the current yield curve as of 4/21/2024 pertaining to U.S. Treasury bills.

| 1M | 2M | 3M | 4M | 5M | 6M |

|---|---|---|---|---|---|

| 5.49% | 5.51% | 5.45% | 5.44% | 5.41% | 5.39% |

-

Describe the content, format, preparation process, and cadence of performance reports. This should include proof of reserves, if appropriate. Please include a sample report.

The Anemoy Liquid Treasury Fund is a regulated BVI professional fund. The British Virgin Islands Financial Services Commission (FSC) requires fund administration by a licensed fund administrator and annual audits by a licensed fund auditor.

The fund admin has the continued responsibility to do administration and accounting of all assets under management (AUM), the net asset value of the fund (NAV), cash reserve, and investor onboarding and reporting. Our fund admin, Trident Trust, does these tasks daily. Investors can at any time check the Anemoy LTF token price, their LTF holdings, the fund NAV, and the AUM onchain on the Centrifuge protocol updated by Trident Trust. Trident Trust also sends monthly investor statements regarding the investors portfolio.

Please see our previous monthly performance report shared privately with the committee as an example.

The fund admin, Trident Trust, does it daily. Investors can at any time check the Anemoy LTF token price, their LTF holdings, the fund NAV, and the AUM onchain on the Centrifuge protocol. Trident also sends monthly investor updates. Anemoy works closely with Trident Trust on all aspects of the fund.

“We’re excited to work with Anemoy to build one of the first tokenized, regulated funds that maintains an onchain record of portfolio data and net asset valuations. This increases transparency while streamlining typically burdensome reporting and reconciliation processes,” David Mungall, Trident Trust’s Head of Fund Administration for the Caribbean said in a recent press release.

In addition to fund administration as a continued effort, a fund auditor does an annual audit and FSC reporting. Our fund auditor MHA Cayman will perform its first fund audit for December 31, 2024.

Pricing

Please see the Subscription Agreement and Private Placement Memorandum (PPM) shared privately.

-

Fee summary: Inclusive of the full scope of services requested. Product Fee schedule If asset based Fee calculation for our plan if asset based Annual fee if flat fee Any other fees (including redemption or minting fees)

Under this proposal, we propose waiving all management fees associated with Anemoy on the Arbitrum network for the first year ending May 1st, 2025.

Additionally, third-party service provider fees are currently being waived for all investors until AUM reaches 50M USDC (currently 9.7M). This means there are zero fees on the Anemoy LTF product for the time being.

Third-party fees are fixed (no spread of the underlying AUM) for custody, fund administration and audit, as well as banking and brokerage per fed wire and trade. At 50M USDC in AUM, the fees will represent around 15bps annually, and diminish as the AUM grows beyond 50M USDC.

Typically, there is a standard 15 bps (0.15%) management fee, which includes all gas fees paid by the Fund including the Centrifuge protocol fee of 7.5 bps. The management fee is charged daily onchain and paid out from the cash reserve in USDC with a direct impact on the NAV and LTF token price. Charging the management fee started on 3/27/2024. Because there is one NAV being continually calculated regardless of which chain the TVL sits on (as shown in the UI), Arbitrum waived fees will be rebated upon redemption of shares.

-

Describe frequency of fee payment and its position vis-a-vis payment priority compared with other expenses (i.e., cash waterfall)

The fund administrator calculates fees. Fee calculations are part of the fund administration and reporting. The fees are charged on a daily basis onchain in USDC with a direct impact on the NAV and LTF token price. That means all fees are paid before any redemptions are satisfied.

Smart Contract/Architecture

The Centrifuge protocol has received many audits over the years. The most recent audits were performed by Spearbit (via Cantina), SRLabs, and a Code4rena audit contest. The list of all Centrifuge audits including reports can be found here in our GitHub.

-

Is the project permissioned? If so how are you managing user identities? Any blacklisting/whitelisting features?

Yes, Anemoy is KYC only and open to non-U.S professionals. User identities are stored in a database with our fund administrator.

Centrifuge is building towards adoption of institutional DeFi, and will always prioritize full compliance with Issuers on the protocol.

Centrifuge is currently available on Arbitrum, Base, Celo, Ethereum and our RWA L1, Centrifuge Chain. There are cross-chain interactions between the EVM networks and Centrifuge Chain, to maintain bookkeeping.

-

Are the RWA tokens being used in any other protocols? Please describe the various components of the ecosystem

Anemoy LTF tokens are currently not being used on other protocols. We are actively working to integrate them into a few different use cases such as lending and other DeFi primitives. See our recent proposal here on Centrifuge’s forum. Centrifuge is setting up use cases within top-tier lending protocols to gain liquidity and allow for instant redemptions. This all would happen in an institutional grade, permissioned environment by all parties.

-

How are trusted roles/admins managed in the system? Which aspects of the solution require trust from users?

The Anemoy Liquid Treasury Fund 1 is a regulated BVI professional fund. The British Virgin Islands Financial Services Commission (FSC) requires fund administration by a licensed fund admin and annual audits by a licensed fund auditor. The fund admin has access to all third-party service provider accounts and does investor onboarding and reporting. Additionally, the Centrifuge protocol gives real-time onchain visibility of all assets, the NAV (including fees and cash reserve), and the LTF token price. The fund admin also makes sure that the real-world assets are in line with what is presented on the Centrifuge protocol.

The Centrifuge smart contracts enforce rules around administration of the pool, ownership of assets from issuance to purchase by an investor, and permissions around who may access a pool.

Investors need to trust the regulatory and legal framework, which is common for institutional-grade asset management and also used by many other traditional financial institutions, for example, BlackRock for its BUIDL product.

The tokens are ERC-20 standard compliant, with permissioning built in.

Supplementary

-

Please attach any further information or documents you feel would help the screening committee or ARB tokenholders make an informed decision.

Please see the Anemoy Liquid Treasury Fund deck here.