Application Template

SECTION 1: APPLICANT INFORMATION

Provide personal or organizational details, including applicant name, contact information, and any associated organization. This information ensures proper identification and communication throughout the grant process.

Applicant Name: Michelle Davis

Project Name: Chromatic Protocol

Project Description:

Chromatic Protocol is a decentralized perpetual futures protocol that provides permissionless, trustless, and unopinionated building blocks which enable participants in the DeFi ecosystem to create balanced two-sided markets exposed to oracle price feeds and trade futures in those markets using various strategies.

It has 3 main innovations(Partitioned LP with dynamic fees, permissionless listing of futures market, separation of index and settlement token) implemented that bring uniqueness.

Team Members and Roles:

The Chromatic team is composed of backend development, frontend development, markup development, design, and business & marketing departments.

- Harry: CEO

- David: CTO

- Chris: Tech Lead

- Louis: CPO

- Sarah: COO

- Mitchell: Back-end dev

- Karl: Back-end dev

- Justin: Back-end dev

- Linda: Front-end dev

- John: Front-end dev

- Audrey: UX/UI design

- Victor: Marketing & Defi research

- Michelle: Marketing & BD

Project Links:

- Service

- Website : https://chromatic.finance

- Launch App(Arbitrum): https://app.chromatic.finance/

- Linktree: https://linktr.ee/chromaticprotocol

- Community

- Twitter: https://twitter.com/chromatic_perp

- Medium: https://medium.com/@chromatic-protocol

- Discord: Chromatic Protocol

- Zealy: https://zealy.io/c/chromatic/questboard

- Airdrop: Chromatic Protocol

- Developer Docs

Contact Information

Point of Contact (note: this should be an individual’s name, not the name of the protocol): Michelle_Chromatic

Point of Contact’s TG handle: @chromaticperp

Twitter: @digonchain

Email: info@chromatic.finance

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Provide details on your team’s past and current experience. Any details relating to past projects, recent achievements and any past experience utilizing incentives. Additionally, please provide further details on the state of your product, audience segments, and how you expect incentives to impact the product’s long-term growth and sustainability.

-

We have expertise in finance.

- C-levels of our team bring experience from the traditional finance sector, having founded and operated an algorithm-based derivative trading company for 7 years. During this time, they conducted in-depth research and development into algorithmic futures trading strategies within the traditional finance market. They successfully managed an Asset Under Management (AUM) of $50 million.

-

We have experience in operating and growing various IT services.

- Our CEO successfully founded a tech startup and merged it with one of the largest IT conglomerates. He used to serve as CEO or CTO of IT companies, leading stable teams and driving growth. He designed the Chromatic Protocol and actively participated in its implementation as a hands-on developer.

- The CTO is a full-stack developer and serial entrepreneur who has operated various tech startups and investment companies. Also, he holds the title of Registered Fund Manager. He reviewed and led all technical aspects of the Chromatic Protocol, from mechanism design to smart contract development, frontend development, audit, etc.

- Our CPO led the UX Design global group registered in many countries, responsible for various services including e-commerce and entertainments, etc., targeting users in multiple countries and driving significant growth. He designs and operates user experiences of the Chromatic Protocol and is deeply involved in marketing and community management.

- Our COO brings extensive experience providing business and marketing strategy and business analytics while working as a consultant at one of the biggest global business consulting firms. He is responsible for the business operation of the Chromatic team and also handles external tasks such as marketing, business development, and investment.

What novelty or innovation does your product bring to Arbitrum?

-

Partitioned LP with dynamic fees: Combining the advantages of Order Book and AMM

- In futures DEX, Order Book LP has the advantage of stable futures price determination based on supply and demand between makers and takers, but it requires expensive Market Makers. Insufficient liquidity in the Order Book leads to significant price spreads.

- On the other hand, AMM LP allows anyone to provide liquidity, but the oracle-based price determination mechanism exposes LPs to significant delta risk. To overcome the limitations of oracle prices, a formula-based dynamic fee has been introduced. However, the deterministic price based on the formula may lead the protocol into a death spiral due to algorithm failures.

- Chromatic Protocol combines the advantages of AMM LP and Order Book LP to create an AMM LP that operates like an Order Book. Chromatic’s AMM LP is divided into 72 bins, each applying a different trading fee. Makers supply liquidity to their desired fee bin based on market conditions, while takers utilize the margin of the fee bin they can tolerate based on expected profits.

- Price discovery in a two-sided market like the futures market, determined by supply and demand between makers and takers, has been proven through the 200-year history of futures markets in traditional finance. A truly innovative price discovery mechanism has not yet been introduced in the crypto futures market. The Partitioned LP with dynamic fee system of the Chromatic Protocol will be a decentralized finance innovation beyond the binary paradigm of AMM LP and Order Book LP. Furthermore, it will prove to be a suitable ecosystem for Arbitrum to experiment and grow innovative decentralized finance.

-

Permissionless listing of futures market: Uniswap for futures DEX

- The DEX dominance in the crypto spot market accounts for about 15%, but in the futures market, DEX dominance has yet to exceed 2%. The high DEX dominance in the spot market is due to Uniswap’s decentralization, which allows anyone to freely create and trade in the market. On the other hand, most crypto futures DEX monopolize listings and control the creation and destruction of free markets. This is because they have not found a proper futures price determination mechanism corresponding to Uniswap’s famous x * y = k.

- The Chromatic Protocol enables balance between takers and makers even in low-liquidity futures markets through the partitioned LP with dynamic fee system. For example, if a futures market for a new token with an expected sharp increase of about 20% opens on Chromatic, makers can supply liquidity only to the high fee bins of long direction, obtaining fees that match their risk. Additionally, makers can supply liquidity to the short direction, providing hedging opportunities for takers in long positions and earning fees and PnL.

- With Partitioned LP, if a variety of futures markets can be freely created, the participation and trading volume of makers and takers can increase dramatically. The crypto futures market is more than three times larger than the spot market. Just as Uniswap has contributed to the TVL and Trading Volume of the Ethereum ecosystem through permissionless listing in the spot market, Chromatic Protocol’s permissionless listing can contribute even more to the TVL and Trading Volume of the Arbitrum ecosystem.

-

Separation of index and settlement token: Limitless number of futures markets

- The futures market consists of settlement tokens and underlying indices. The underlying index is the target of the futures contract, and the settlement token is the means of payment for the futures contract. Usually, futures exchanges allow only a limited number of settlement tokens due to liquidity issues. Once again, thanks to Partitioned LP, Chromatic can create futures markets that maintain balance between takers and makers even with low liquidity.

- To maximize the benefits of permissionless listing, the Chromatic Protocol separates settlement tokens and indices. Any ERC-20 token can be a settlement token. Stablecoins, native coins like ETH or ARB, or even meme coins like PEPE can be settlement tokens. From the index perspective, any price feed provided by oracles can be an index. Therefore, not only crypto assets but also fiat currencies, NFTs, commodities, and more can be the subject of futures contracts. Chromatic is integrated with three oracles including Chainlink, Pyth, and SUPRA to provide indices. Currently, a Push-based data feed is used, but a Pull-based data stream is being developed for faster trading. The fast Pull-based oracle will be introduced soon after optimization.

- With various settlement tokens and indices from three oracles, it is theoretically possible to create almost an infinite number of futures markets. Moreover, anyone can freely create the desired markets through permissionless listing. Through Chromatic, Arbitrum will become an ecosystem where all futures markets traders desire exist.

Is your project composable with other projects on Arbitrum? If so, please explain:

- Chromatic was designed from the ground up as a Modularization of perp DEX.

- In traditional financial markets, the roles of futures exchanges are well defined and operate independently: Traders, Brokers, Exchanges, Market Makers, Liquidity Providers.

- In contrast, even in crypto futures exchanges, the roles are not properly decomposed, and exchanges directly perform the roles of brokers or market makers.

- Chromatic separates the roles of exchange, broker, and MM, providing a modular design, technical support, and competitive fee structure for other projects to participate and perform each role. Through this, Chromatic aims to position itself not as just one futures DEX but as a DeFi Infrastructure within the Arbitrum ecosystem.

Entities and methods that can utilize the Chromatic Protocol are as follows:

-

Broker Project teams seeking to quickly launch an innovative Perp DEX

- Chromatic Protocol’s Smart Contracts and Frontend services are open-sourced. Teams looking to implement a futures exchange based on Partitioned LP can quickly launch a new service by forking the Chromatic Protocol. Using the Chromatic Protocol, most existing futures DEXs can be implemented. By configuring combinations of Partitioned bins and Settlement-Index pairs, the GLP of GMX or the risk-based LP of Level Finance can easily be replicated in Chromatic. Similarly, entirely new and creative futures DEXs can be constructed using Chromatic.

-

Crypto trading teams executing Supply-side or Demand-side trading strategies

- With unique trading strategies and quant teams, trading teams can utilize the Vault (Pool) of Chromatic LPs to execute strategies. To support them, Chromatic has released the Smart Contracts of Reference Pools, allowing them to create Vaults with their own strategies by adjusting portfolio, rebalancing, and risk management parameters. By setting Vault fees and recruiting liquidity providers to their Vaults, they can earn not only profits from their strategies but also Vault fee income.

-

Token Foundations within the Arbitrum ecosystem

- Due to the nature of futures markets, settlement tokens show high demand and trading volume. If there are foundations looking for use cases for their tokens, they can open multiple futures markets with their tokens as settlement tokens in the Chromatic Protocol.

- For example, if a BTC futures market with $SUPRA token as the settlement token is opened, $SUPRA holders can trade various futures without converting their tokens to USDT and increase their $SUPRA quantity. Alternatively, by creating various Vaults that provide liquidity with $SUPRA and distributing profits to $SUPRA holders, they can expect the effect of $SUPRA being locked up.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

- Perennial

- GMX V2

- Hyperliquid

How do you measure and think about retention internally? (metrics, target KPIs)

https://dune.com/chromatic_finance/chromatic-protocol-stats

General

- Users

- Total users

- Daily Active Users

- Daily User Growth

- Transaction Count

- Daily Transaction Count

- Daily “Open Position” Transaction Count

- Daily “Close Position” Transaction Count

- Daily Liquidation Transaction Count

- Fee

- Daily Trade Fee

- Daily Protocol Fee

Perpetuals

- TVL

- Daily TVL

- Daily TVL for LP

- Trading Volume

- Daily Total Trading Volume

- Daily Long Position Trading Volume

- Daily Short Position Trading Volume

- Open Interest

- Daily Total Open Interest

- Daily Long Position Open Interest

- Daily Short Position Open Interest

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

- Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

- No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?:

- Yes. Chromatic Protocol was deplyed on the Arbitrum testents Goerli and Sepolia since November 2023. It is now deployed on the Arbitrum mainnet(Arbitrum One) and live since 21st February 2024.

On what other networks is the protocol deployed?:

- No. Currently, Chromatic Protocol is Arbitrum native project.

What date did you deploy on Arbitrum mainnet?: [Date + transaction ID. If not yet live on mainnet, explain why.]

-

February 16, 2024

-

ChromaticLens

0x3B7F614389d0b6a5e20dBd3FC3CAE297Ea791590- 0x5d55fca649a638693d1bac3fccc8ae8597f290771c2ed75376444d9460b4b217 (Feb-16-2024 04:03:43 AM +UTC)

-

ChromaticMarketFactory

0x0b216AB26E20d6caA770B18596A3D53B683638B4- 0xf2887702a196634c2938a7bc2b38d38d8f25386dd8c8844322705fa29a1367fe Feb-16-2024 04:03:07 AM +UTC

-

ChromaticRouter

0xbCc97243f965EcbE31071887B5DDBA1Add8E220a- 0x98501d4ebde660f4ffca369e392e404f870740a367620d910de01150dcb85831 (Feb-16-2024 04:03:40 AM +UTC)

-

ChromaticVault

0x19631A51aeDcd831E29cbCbCfe77010dAfd3343a- 0x6d15705e406181217f41ee2f45fea21eb89b85138eb740c4e59afed36b2a0f19 (Feb-16-2024 04:03:25 AM +UTC)

-

DiamondLoupeFacet

0xAa12e135f36Ff54c7378891C26c07d30b3125B74- 0xfe4ed5672af5c7c231846ed939739bb24997feae048ae17b6dacd8cadc356fc5 (Feb-16-2024 04:02:36 AM +UTC)

-

KeeperFeePayer

0xfd11DBb0398Dd3B0523B598ad50BD857273dB3C3- 0xabca7d6da81fbe49ae94381f668dd2e2533a88411aedb040d99ac628310356ef (Feb-16-2024 04:03:11 AM +UTC)

-

MarketAddLiquidityFacet

0x632111083F0E8538aaC52E66416e111A5A84E5D1- 0xb93b1c20811b5300939436f35b736e4378665faa9265d6cf536c0edb71adf808 (Feb-28-2024 07:13:16 AM +UTC)

-

MarketDiamondCutFacet

0x986d08402c3ED15167BF2969DfF52Bb065b1e76E- 0x1f9534da9bc9a582ae8c5f2725795df7f69197d045c4d69bffe8d165cf42477e (Feb-16-2024 04:02:32 AM +UTC)

-

MarketLensFacet

0x6C2c1764faF6d28a9582c156FefB9dbA39161661- 0x90101a1f9ec236c14aa2006fc7a0deaa2ebd0fbf5f7f00bccab622a8ffd073c5 (Feb-28-2024 07:13:24 AM +UTC)

-

MarketLiquidateFacet

0xD859492325d2035C73A3D317918590Dc673c58f0- 0xd350b365c803e404886b5cb9376bf6809526aa3d322d6eaa2599a79c3c6308eb (Feb-28-2024 07:13:35 AM +UTC)

-

MarketRemoveLiquidityFacet

0xCd92fAf0F5bcc980F2EdEee2c74352B8C9eB90c8- 0x1085e1522db83f03dd9ed6b0c0179f62701107911741c2bbe2dea76a0725e8b6 (Feb-28-2024 07:13:20 AM +UTC)

-

MarketSettleFacet

0x05e1c4EDF0259b596Aad383046ccC5f86496B51D- 0x956664e83cf3361f782612f578264e753fe91308110740ccc264582580dab01c (Feb-28-2024 07:13:40 AM +UTC)

-

MarketStateFacet

0xEd8F31F4Ba61beAF9bdc0ed32387De5901A418c1- 0x34de588db58c348b11d9cf1d48b3858c339781592df60c83f19d527db23b5788 (Feb-28-2024 07:13:12 AM +UTC)

-

MarketTradeClosePositionFacet

0x1D63B2c2fd603458F52BdcC4293cD9085A91e8Cb- 0xc27e99d4b5fcafe3a01fe07e3c5416b83e255b093fc18adf4abd1bd5cd9ee45f (Feb-28-2024 07:13:32 AM +UTC)

-

MarketTradeOpenPositionFacet

0xBB7Ae79A07aBeDD635B6b4143ef494D8a0ca342B- 0xeaa9d04726fa26b98a41382d989ee76112e502d79470441e9e2b3948b4f5526b (Feb-28-2024 07:13:28 AM +UTC)

-

Mate2Liquidator

0x4D54c6AEC4b35872D38f90ea9C4E53B2fb7dE411- 0x4947ff271827dddbbb000f6202b1bb0f7fe032a5a1bb249f69d9b7eec726e272 (Feb-16-2024 04:03:32 AM +UTC)

-

Mate2VaultEarningDistributor

0x87caD3a187DE10Cff3A5b8b1015731D1dAb5a8BA- 0x8b3a0ac8bb521c758ec1124678bc043ff7cb558df0050ba5a05fb9be9c599493 (Feb-16-2024 04:03:19 AM +UTC)

-

CLBTokenDeployerLib

0xf0ba5F54af8D3DFD379ce97E6597D63dEeEA794d- 0x61ed9f685b3148f93a9e3c34d50751b942804a1b8a01abb934ee141e413f8e76 (Feb-16-2024 04:02:24 AM +UTC)

-

MarketDeployerLib

0x32cab76C8ca739333b6BF9B5C4BAC8A19F3c2B4F- 0x5e57a6c01aba9cd387b2dbb22c4cb60e2d3c6983a7ae363e97bc44d1ef0b97bb (Feb-16-2024 04:02:29 AM +UTC)

-

OracleProvider_BTC_USD

0x1448d17473F01F648Dec4eB2294ADE4ada81eA91- 0xa43b5b87362578671374eece4484217b0ef9b03508c2648819fab3e16a0f9600 (Feb-16-2024 04:03:46 AM +UTC)

-

OracleProvider_USDT_USD

0x764C4D3690EFD806350483b8EAd1e10714ea4aC7- 0x76586ba142773470ace8c946313c38d2508dbc9725203201cf6a74073f8c3948 (Feb-16-2024 04:03:50 AM +UTC)

-

ChromaticAccount

0x866652cFD0772e4A303FF8ffef1cC416e226C4A6- 0x98501d4ebde660f4ffca369e392e404f870740a367620d910de01150dcb85831 (Feb-16-2024 04:03:40 AM +UTC)

-

AutomateBP

0xA56392164D9392AB35f91CE00DEBE5F41e54eFdC- 0x8c7c387c5e0c304e0d4efff0b805e688de5763fa7ff45c38d69d84c23e4ef3d1 (Feb-29-2024 02:44:17 AM +UTC)

-

AutomateLP

0xb3C0d606327f406ce51B8C210b730460f372BF05- 0x5ea2020665963bb40b8d099635221d00edd041151eb25943e570bd138590b5f9 (Feb-16-2024 05:00:20 AM +UTC)

-

ChromaticBPFactory

0xfb913c25e35F48A0809a0a7420e4Ea77859CFb0E- 0x5e8ab1e886e7b51a1151c1ed20a784db17c8ea90fa147030deedef7237eb3781 (Feb-16-2024 05:05:20 AM +UTC)

-

ChromaticLP

0x848f268CaAAF07DA06826f2B6364a9067af33605- 0x6ac7534b1bcfddd18075831385f340f12d2124854c69bd85ae32a0afaf08ca1e (Feb-27-2024 07:48:17 AM +UTC)

-

ChromaticLPLogic

0x3e13AF6d1a3ed3b69E44Dd92F96bcAe471F9F238- 0xcc7cdf290a71b2c4edacda8efc824c761ed525eacc2f23ed3d61d5c0e6657e06 (Feb-28-2024 07:07:50 AM +UTC)

-

ChromaticLPRegistry

0xc337325525eF17B7852Fd36DA400d3F9eEd51A4a- 0x02e0f7d6dca8463fe3e93417ba5ee781dd05134bad62a64a4d5e194c4775c8d2 (Feb-16-2024 04:59:51 AM +UTC)

Do you have a native token?:

- Planned

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

- No

Current Incentivization: How are you currently incentivizing your protocol?

Reward Programs

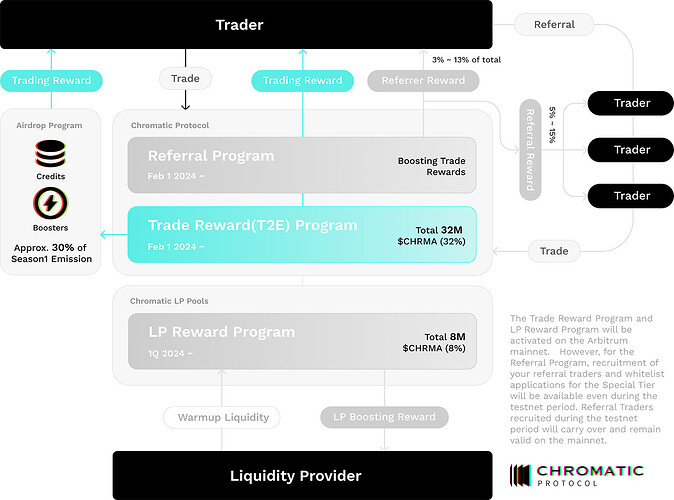

- Trade Reward Program: The Trade Reward Program is a strategic initiative designed to foster active engagement from traders, who are integral to the protocol DAO right from its launch. The program’s primary objective is to airdrop points in proportion to trading fees, and the points can be converted into CHRMA tokens after listing on the DEX.

- Referral Program: The program operates by rewarding referrers based on their performance in acquiring traders. Moreover, the program is designed to provide rewards not only to referrers but also to traders who join through the Referral Program.

- LP Reward Program: The LP Reward Program is a strategic initiative designed to foster active participation from Liquidity Providers (LPs), the linchpins of the protocol DAO, right from its inception. The program is structured to airdrop points to LPs in proportion to the liquidity they provided, and the points can be converted into CHRMA tokens after listing on the DEX.

Community Reward Programs

- Airdrop Program: Airdrop Season 1 will be assessed based on community activities and contributions during the Testnet (Arbitrum Goerli, Sepolia) period and the initial phase of the Mainnet (Arbitrum One).

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program? [yes/no, please provide any details around how the funds were allocated and any relevant results/learnings(Note: this does NOT disqualify an applicant)]

- No

Protocol Performance: [Detail the past performance of the protocol and relevance, including any key metrics or achievements, dashboards, etc.]

Social Stats :

- Twitter : 20.3k

- Discord : 33.9k

- Medium : 5.1k

- Zealy : 46.5k (most active project in Defi, 5th most active project in the entire field)

Here are the statistics for the testnet in the two months leading up to the mainnet launch:

- Total transactions: 272,618

- Total fees: $1,065,887

- Total Value Locked (TVL): $33,817,951

- Cumulative Wallets: 6,938

- Daily Active Wallets: 2,795

The current mainnet metrics for approximately two weeks are as follows:

(Dune : https://dune.com/chromatic_finance/chromatic-protocol-stats)

- Total fees: $5,262

- Total Value Locked (TVL): $112,873

- Cumulative Wallets: 1,288

Protocol Roadmap:

2024 January

- (Completed) 24 Jan: Deadline to apply for the Special Tier of Referral Program.

- (Completed) 24 Jan: Liquidity Boost Round #0 Pre-registration 1. (Until 30 Jan 23:59 UTC)

- (Completed) 31 Jan: Liquidity Boost Round#0 Pre-registration 2. (Until 6 Feb 23:59 UTC)

2024 February

- (Completed) 7 Feb: Liquidity Boost Round#0 Pre-registration 3. (Until 13 Feb 23:59 UTC)

- (Completed) 16 Feb: Audit completion. Currently, Chromatic Protocol is undergoing an audit with Halborn to ensure more secure trading environments.

- (Completed) 21 Feb: Chromatic Protocol launch on the Arbitrum Mainnet!

- You can create your referral link and share, or register other’s link as your referrer before the reward program starts in 28 Feb.

- (Completed) 21 Feb: Liquidity Boost launch.

- (Completed) 28 Feb: Trade Reward & Referral Program launch.

2024 March

- 31 March: Airdrop Season 1 ends.

2024 April

- Season1 Random Box opening !

2024 H1

- $CHRMA token launch and DEX listing.

- In the first half of 2024, $CHRMA Token is scheduled to be launched, with its listing on the Decentralized Exchange (DEX). This milestone marks a significant step in our journey toward establishing a Chromatic Protocol’s DAO ecosystem.

Audit History & Security Vendors: [Provide historic audits and audit results. Do you have a bug bounty program? Please provide details around your security implementation including any advisors and vendors.]

Chromatic Protocol engaged Halborn to conduct a security assessment on the smart contracts beginning on December 4th, 2023 and ending on February 7th , 2024.

- Report released 19th February 2024: PublicReports/Solidity Smart Contract Audits/Chromatic_Protocol_EVM_Contracts_Smart_Contract_Security_Assessment_Report_Halborn_Final.pdf at master · HalbornSecurity/PublicReports · GitHub

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

No

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

1. Requested Grant Size: 50,000 ARB

2. Justification for the size of the grant :

As we are entering a phase of active marketing efforts, we anticipate significant improvements in our metrics going forward.

During the approximately two months leading up to the mainnet, our testnet metrics were as follows:

- Total transactions: 272,618

- Total fees: $1,065,887

- Total Value Locked (TVL): $33,817,951

- Cumulative Wallets: 6,938

- Daily Active Wallets: 2,795

The current mainnet metrics for approximately two weeks are as follows:

(Dune : https://dune.com/chromatic_finance/chromatic-protocol-stats)

- Total fees: $5,262

- Total Value Locked (TVL): $112,873

- Cumulative Wallets: 1,288

Of course, it is acknowledged that the environments of the mainnet and testnet may differ, and metrics may vary. Our realistic initial goals in 12 weeks for the mainnet are as follows:

- Total Value Locked (TVL): $1M

- Daily volume: $2.5M

- Cumulative Wallets: 10k

- Daily Active Wallets: 500

The volume/TVL ratio stated in the initial goals is 2.5. Chromatic Protocol is designed to operate without the need for an insurance fund, allowing for high capital efficiency and trading volume even with a low TVL.

Currently, Chromatic Protocol applies a certain percentage of trading volume as fees. Similar to Uniswap v3, the fee rate for traders varies depending on the liquidity provided and the trading assets. Chromatic Protocol offers a range of fee rates from 0.01% to 10%. Based on the existing trading data, the average fee rate is observed to be 0.87%. As TVL continues to increase, it is anticipated that the average fee rate will decrease to around 0.2%. Therefore, using this as a basis for calculating trader fees, the daily USD equivalent is approximately $5,000.

We aim to refund approximately 25% of the fees paid to Chromatic Protocol back to traders. However, traders are still responsible for paying gas fees, which may become more burdensome as the price of ETH rises.

Additionally, alongside ARB incentives, we plan to offer CHRMA point incentives of equivalent value to facilitate the simultaneous growth of the network and protocol. We intend to distribute 298 ARB tokens, equivalent to approximately $600 worth, as Trading Rewards on a daily basis. The remaining portion will be allocated as $CHRMA incentives, allowing traders to receive refunds of up to 25% of their fees.

LP(Makers) will be able to directly or indirectly receive the increasing trading fee in the future. Therefore, LP rewards are planned to be distributed at half the level of trade rewards. Additionally, referrals for the dissemination of network effects could be vital for Key Opinion Leaders (KOLs), thus, an equal amount of incentive as LP will be used for retention through referrals.

Many decentralized exchanges that have received STIP or venture funding initially focused on mining trading volume. During this period, while the number of transactions on Arbitrum increased successfully, the challenge lied in sustaining growth thereafter, resulting only in heightened competition among platforms only within the Arbitrum ecosystem.

We aspire for LTIPP to be long-term and by broadening our perspective, we aim to avoid competing to gather users within Arbitrum. Moreover, as many mainnets like Blast, Starknet, and Scroll are currently striving to attract users, it is a crucial time for Arbitrum, the most remarkable DeFi mainnet, to endeavor in retaining users.

Hence, our focus is on ensuring that existing Arbitrum users perceive Arbitrum as more attractive than other mainnets and do not leave. (While it is technically possible to employ strategies that penalize users for using wallets on other mainnets, we will refrain from such approaches as it may portray us as overly aggressive.)

Our strategy is defined by maintaining existing Arbitrum users, activation through incentives, and expansion through the referral system. When designing the referral system from the outset, we utilize formulas that include time-weighted averages (Referral Program | Chromatic Protocol). This is to encourage users to stay in Arbitrum even after LTIPP ends and for KOLs to continue maintaining their referrer tiers by ensuring that traders’ retention is long-term rather than driven solely by short-term trading demand.

The specific incentive allocation plan is as follows:

- Maintenance of Arbitrum users and PerpDex onboarding : 20%

- LP Incentives: 30%

- Trading Incentives: 50%

2.1. Retention of Arbitrum Users and PerpDex Education

Target Market:

We aim to avoid aggressive user competition within Arbitrum for PerpDex. Rather than targeting users who are already actively using PerpDex on other mainnets, our focus will be on users who are active within Arbitrum but have not yet extensively used PerpDex. Currently, Arbitrum has a total of 18,139,608 wallets. However, only 718,097 wallets have used PerpDex. There are currently 17,421,511 wallets that are not yet familiar with PerpDex exclusively on Arbitrum. Our goal is to onboard 0.01% of these wallets to Arbitrum’s PerpDex, and we are confident that Chromatic will be the safest and easiest PerpDex they can access.

2.2. LP

We are the pioneering protocol within PerpDex that allows LPing freely. LPs can choose fees ranging from 0.01% to 10% and select desired trading pairs, making us the only PerpDex with such flexibility. We push the boundaries of LP decentralization by maximizing LP freedom. These features enable easy expansion of trading assets to include all assets where oracles exist (forex, commodities). Moreover, the platform can evolve into one where users can bet on anything, including LRT. Therefore, it is crucial to encourage Arbitrum users who are not yet familiar with PerpDex to explore various DeFi ecosystems.

2.3. Trading

It is crucial to onboard users genuinely committed to trading rather than cherry pickers. We will closely monitor user activity to prevent wash trading and Sybil attacks, updating campaigns accordingly.

Chromatic will offer higher incentives to users based on past trading volumes to incentivize those who have previously used Chromatic. Even after LTIPP ends, we will strive to maintain momentum among highly engaged users to encourage continued participation on the exchange.

Chromatic stands out from other exchanges by allowing users to set Take Profit and Stop Loss when initiating trades, eliminating unnecessary liquidation systems. This allows new users to start their trading journey with a safe experience. However, as users may not be familiar with PerpDex, we aim to provide ARB as an incentive mechanism.

3. Grant Matching:

We plan to distribute 400,000 CHRMA point (0.4% of FDV), which is approximately equivalent in value to the ARB requested, considering our Fully Diluted Valuation (FDV).

We have an incentive programs running for Traders & LPs now.

We don’t have a token yet and the TGE is scheduled on June / July 2024. Right now it’s CHRMA points which is off-chain reward, and after TGE, members will be able to exchange those off-chain reward 1:1 to actual $CHRMA token.

4. Grant Breakdown:

- Acquisition of non-PerpDex Users(20%) : 10,000 ARB + 80,000 CHRMA points on pro-rata distribution per quest completion.

- LP(30%) : 179 ARB/day + 1,429 CHRMA points/day

- Trader(50%) : 298 ARB/day + 2,381 CHRMA points/day

5. Funding Address:

arb1:0xD705fE7f014A78694cb621734e1e838FF327f2F2 (Chromatic Inc’s Gnosis Safe address)

6. Funding Address Characteristics:

3/5 multisig with unique signers and private keys securely stored.

7. Treasury Address:

Chromatic Protocol does not have a DAO

8. Contract Address:

N/A

Team Chromatic will create a new address for disbursing funds for grant recipients onnce we get to receive grants.

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Clearly outline the primary objectives of the program and the Key Performance Indicators (KPIs), execution strategy, and milestones used to measure success. This helps reviewers understand what the program aims to achieve and how progress will be assessed.

1. Objectives:

1.1 Onboarding Arbitrum users unfamiliar with PerpDex onto the safest PerpDex platform.

1.2 To achieve this, we will conduct reward and retention campaigns targeting both new and existing users.

1.3 Expand trading pairs to include all assets available for betting, in addition to BTC.

2. Execution Strategy:

2.1 Acquisition of non-PerpDex Users

2.1.1 Strategy: The initial step in onboarding users on Arbitrum unfamiliar with PerpDex.

2.1.2 Distribution amount: 10,000 ARB + 80,000 CHRMA points

2.1.3 Specifics:

- Users must complete quests to qualify, with rewards being unlocked proportionally upon quest completion.

- Examples of quests include, but are not limited to:

- Providing a minimum amount of LP.

- Providing LP for a minimum duration.

- Innovative LP utilization using Chromatic’s unique features.

- Engaging in a minimum number of trades.

- Trading for a minimum amount.

- Developing alpha opportunities using Chromatic’s unique features.

2.2 LP

2.2.1 Strategy: Strive to provide a unique LP experience on Chromatic.

2.2.2 Distribution amount: 179 ARB/day + 1,429 CHRMA points/day

2.2.3 Specifics: Expand the range of tradable assets to include rich and innovative options, including BTC, which is currently available for LP supply.

2.3 Traders

2.3.1 Strategy: Encourage ongoing participation from onboarded traders and allow them to experience the advantages of a secure PerpDex that sets Chromatic apart from other platforms.

2.3.2 Distribution amount: 298 ARB/day + 2,381 CHRMA points/day

2.3.3 Specifics: Reward traders proportionally to the fees they pay. Additionally, efforts will be made to offer more rewards to traders using APIs and SDKs, making it easier to onboard professional traders.

3. What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

3.1 Stickiness Evaluation through Accurate KPIs

We will utilize KPIs as the dependent variable and conduct a causal analysis through LTIPP to assess Chromatic’s contribution to Arbitrum. Although causal analysis may be challenging due to selection bias, omitted variable bias, etc., Chromatic will evaluate the impact of LTIPP accurately through doctoral-level research.

3.1.1 Stickiness Evaluation with Precise KPIs

Furthermore, we plan to evaluate stickiness through Difference-in-Differences (DID) analysis, using LTIPP as the treatment. Specific metrics for evaluation include the transition from non-PerpDex users on Arbitrum to PerpDex users, fees from listing new altcoins, on-chain transactions, LP participation rates, and trader participation rates.

3.2 Stickiness Specifics

3.2.1 Safest PerpDex Experience:

The most adverse experience for PerpDex users occurs when they face liquidation. Users are more likely not to return if they experience significant liquidations, such as those resulting from leverages exceeding 500x. Chromatic provides traders with the safest trading experience by guaranteeing profits and preventing liquidations through its unique pre-defined Take Profit/Stop Loss features. This approach helps traders secure profits without overexerting themselves, thereby increasing user retention.

3.2.2 Global Referral Program:

Analysis of traffic on both testnet and mainnet reveals that our user base is not biased toward any continent or language. We have users from diverse continents and languages. We have also deployed localized marketing strategies and closely collaborated with KOLs. Our referral program, utilizing a time-weighted average and segmented into three tiers based on trading volume and invited active wallets, is designed to recruit sustainable, high-retention users effectively.

3.2.3 Maximum Free and Secure LP:

Chromatic’s LP strategy is the freest and safest among all PerpDex platforms. While currently limited to BTC, users will soon be able to create LPs for their desired trading assets or even create trading pairs that are unimaginable elsewhere, utilizing various fee rates actively. Moreover, LPs for not only USDT, BTC, and ETH but also ARB-exclusive LPs are designed. Our LPs are engineered to be the most flexible and secure.

4. Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy. [Please also justify why these specific KPIs will indicate that the grant has met its objective. Distribution of the grant itself should not be one of the KPIs.]

4.1 Non-PerpDex User on Arbitrum to PerpDex Users

According to our research, there are 17,421,511 wallets on Arbitrum that have not used PerpDex. We aim to target at least 0.01% of these wallets to experience PerpDex. Therefore, by the end of the campaign, we expect a minimum of approximately 1,700 new users to have the opportunity to use PerpDex.

4.2 Fee from Listing New Altcoins

As of the current launch of the mainnet, only BTC is listed. However, as stability is ensured, more LPs and trading assets will be listed. We anticipate earning more than twice the fee revenue from new pairs compared to the current BTC listing by the end of the campaign.

4.3 On-chain Transactions

All our trading and keeper activities are conducted on-chain, significantly increasing the volume of transactions on Arbitrum. With transactions abundant on both the LP and trading sides, we anticipate a cumulative transaction volume of 300,000 by the end of the campaign.

4.4 LP Participation Rates

We are currently the only PerpDex that allows users to create LPs directly on-chain. Users have the freedom to create LPs with their desired fee rates and trading assets. By effectively implementing our catchphrase “Maximum Freedom,” we will increase LP participation rates.

4.5 Trader Participation Rates

We have not yet fully opened our incentive system. Soon, a random box system combined with game-fi will be launched, adding another layer of excitement to trading. Additionally, a point-based burning and gaming system will be developed to provide traders with further incentives to settle in Arbitrum.

5. Grant Timeline and Milestones:

5.1

Chromatic divides its 12-week schedule into two main parts. The first 6 weeks aim to acquire a minimum of 5,000 new wallets among existing wallets on Arbitrum that have not yet experienced PerpDex. Efforts will be focused on ensuring that new users have a positive initial experience with PerpDex. Our Zealy account has consistently ranked 1st in the DeFi sector and maintained a position in the top 5 among all Web3 companies since January 2024. Additionally, we receive ongoing mentions on platforms such as Twitter, QQ, Weibo, and Telegram.

5.2

The second 6 weeks will focus on maintaining retention of new LPs and users. We will launch new assets based on community feedback and add all new assets not available on other decentralized exchanges. Furthermore, we will create a platform for KOLs to actively participate in the referral program. Our referral program, which considers a time-weighted average of trading volume and the number of invited wallets, assures us that an explosive referral program will be established even after the LTIPP ends.

6. How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

Currently, there are many PerpDexes on Arbitrum, but only a few operate with all trades occurring on-chain, and many use modified oracles instead of native oracles. However, we conduct all transactions entirely on-chain and use native oracles without any modifications. Additionally, unlike typical PerpDexes, we minimize guidelines for LPs, allowing anyone to create LPs freely.

Our goal is to provide truly decentralized PerpDex to Arbitrum users and to convey to those who have not yet used Arbitrum that PerpDex can be entirely safe. We aim to gradually expand the range of trading assets aggressively. With an oracle, anyone can create LPs and provide trading opportunities. Furthermore, we have the potential to bet on anything for which there is an oracle. All of this is accomplished through on-chain transactions.

7. Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

- Yes

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL . Along with this list, please answer the following:

1. Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

- Yes

2. Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard?

- Yes.

We have already released a dashboard on Dune. We will update the dashboard to meet OBL’s data requirements and provide bi-weekly updates.

The Chromatic team includes multiple AI and Business Analytics experts. We have no difficulty in extracting/processing the data required by the program and will provide insightful and fresh lessons derived from the data.

3. First Offense: In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

- Understood and agreed

4. Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

- Yes

5. Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?

- Yes