SECTION 1: APPLICANT INFORMATION

Provide personal or organizational details, including applicant name, contact information, and any associated organization. This information ensures proper identification and communication throughout the grant process.

Applicant Name: Anol

Project Name: Copin Analyzer

Project Description: Copin.io is a protocol that enables users to explore, analyze, and copy on-chain traders from the Perpetual DEXs including GMX (v1, v2), Polynomial, Kwenta and more.

Team Members and Roles: [List team members and their roles/responsibilities]

- leecopin: CEO & Co-founder

- Anol0x: CMO & Co-founder

- Tothehellxxx: CTO / Backend / Smart contract developer

- vietdn: COO / Product Owner

- jack_poterio: CPO / Product Manager

- Development team: Comprising 11 core contributors working full-time across various roles such as Product Owner, Product Manager, QC, tester, Back-end, front-end, smart contract, UX/UI designer.

- Business & Community team: Consisting of 6 core contributors working full-time across positions like community manager, ecosystem manager, BD, content creator, marketer, and graphic designer.

- Linkedin company: LinkedIn Login, Sign in | LinkedIn

Project Links: [Enter Any Relevant Project Links (website, demo, github, twitter, etc.)]

- Website: https://copin.io/

- DApp: https://app.copin.io/

- Document: https://docs.copin.io/

- Twitter: https://twitter.com/copin_io

- Telegram Global (Chat): Telegram: Contact @Copin_io

- Github: Copin Protocol · GitHub

- Discord: Copin Analyzer

- Substack: https://copin.substack.com/

Contact Information

Point of Contact (note: this should be an individual’s name, not the name of the protocol): [forum handle]

Point of Contact’s TG handle: @anol0x, @leecopin

Twitter: https://twitter.com/0xanol, https://twitter.com/tungle_eth

Email: anol@copin.io, lee@copin.io

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Provide details on your team’s past and current experience. Any details relating to past projects, recent achievements and any past experience utilizing incentives. Additionally, please provide further details on the state of your product, audience segments, and how you expect incentives to impact the product’s long-term growth and sustainability.

Team experience

(Any relevant experience that may be useful in evaluating ability to ship, or execution with grant incentives. Please provide references knowledgeable about past work, where relevant. If you wish to do so privately, indicate that. [Optional, but recommended]):

The Copin team is exceptionally well-suited to execute this project, combining a wealth of experience, a deep understanding of the crypto market, and a shared passion for innovative Web3 solutions.

Most of our team members have been engaged with the crypto market since 2017, starting with trading and gradually evolving their interest into a passion for startup ideas. This long-standing involvement has provided us with an in-depth understanding of the market dynamics, especially in the perpetual trading segment. Our collective experience in crypto trading is a significant asset, ensuring that we are well-versed in the needs and behaviors of our target users.

The journey of our team began in earnest in 2020 when we came together to transform our shared vision into reality by starting a company dedicated to Web3 innovations. Since then, we have ideated and experimented with various products, learning from each attempt. While many initial ideas did not reach fruition, these experiences were invaluable in sharpening our focus and refining our approach.

The inception of Copin in April 2023 marked a pivotal moment where our combined knowledge, market understanding, and entrepreneurial desire converged. We believe that our deep comprehension of the crypto field, coupled with our shared drive and resilience, uniquely positions us to make a significant impact with Copin. Our journey through successes and failures has equipped us with the versatility and insight necessary to create a product that not only meets market needs but also pushes the boundaries of what is possible in the DeFi space.

In essence, our team’s blend of proven entrepreneurial success, extensive crypto market experience, and a history of persistent innovation forms the perfect foundation to carry out the ambitious goals set forth in this proposal for Copin.

Projects that we have built. Which includes:

- Mintty: NFT marketplace for Vietnamese

- TrustGem: The Leading Web3 Community of Transparent Reviews

- TrueDrop: The fully on-chain NFT Launchpad for everyone

- Check our projects link here: Decentralab

What novelty or innovation does your product bring to Arbitrum?

Copin’s application is novel in the DeFi sector due to its unique approach in harnessing big data to transform the utilization of on-chain data from perpetual DEXs. By converting intricate on-chain transactions into user-friendly visual analytics, we empower users, especially those without technical expertise, to effectively leverage this data.

Additionally, our platform addresses the relatively untapped area of decentralized copy trading. While prevalent in centralized finance, the full potential of copy trading in DeFi remains underexplored. Copin.io is bridging this gap, offering a service where less experienced investors can benefit from the strategies of seasoned traders, thereby enhancing their decision-making and risk management abilities.

The current landscape of DeFi, particularly the perpetual DEX market with a valuation exceeding $2 billion, is dominated by centralized exchanges. Copin is poised to disrupt this dynamic by significantly increasing the market share of DEXs. We aim to achieve this by offering a comprehensive, user-centric trading platform that caters to the diverse needs of the DeFi community.

Thus, the novelty of Copin lies in its combination of data-driven insights, user-focused design, and a groundbreaking approach to decentralized copy trading. This holistic solution not only enhances the utility of perpetual DEX data but also positions decentralized copy trading as a significant innovation in the crypto market. We envision creating a new era in DeFi, where it stands on par with centralized platforms, fostering a financial ecosystem that is more inclusive, transparent, and empowering for users.

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes, the Copin project collaborates with other projects on Arbitrum. Specifically, Copin plans to integrate data across all Perpetual DEXs present on Arbitrum. Currently, we have integrated data from GMX (v1, v2), enabling users to analyze and evaluate on-chain traders easily and comprehensively through performance metrics like PNL, ROI, etc. Additionally, we are expanding our integration to include GMX v1, v2 as a liquidity source, providing users with more options and helping the ecosystem to attract users interested in copy trading through GMX.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

Yes, Some comparable protocols similar (but not directly) to Copin in the on-chain data segment include Nansen, DeFiLlama, Arkham… However, these projects process spot data and smart money data. In contrast, Copin focuses on perpetual DEX on-chain data.

And some comparable protocols in the decentralized copy trading segment include: Perpy.finance, perps.ai, tradao.xyz, app.alfred.capital, …

How do you measure and think about retention internally? (metrics, target KPIs)

At Copin, we adopt a approach to measure and analyze retention, utilizing a range of metrics and KPIs that reflect our platform’s engagement and user satisfaction levels. Our methodology for assessing retention includes the following key performance indicators:

- User Engagement Metrics:

- New Users: Defined by first-time interactions with Copin, such as account creation or initial copy trading activity. This metric helps us identify the influx of new users to our platform.

- Daily Active Users (DAU): Calculated as the sum of new and existing users actively engaging with our platform daily, including trading, analyzing trader profiles, or participating in copy trading.

- Monthly Active Users (MAU): Represents the number of unique users engaging with our platform within a month. The MAU/DAU ratio provides insights into user stickiness and engagement depth.

- Trading Activity Metrics:

- Average Daily/Weekly/Monthly Trading Volume: Measures the total trading volume facilitated by Copin, providing insights into the platform’s liquidity and user activity levels.

- Average Daily/Weekly/Monthly Protocol Fees: Calculates the fees generated from trading activities, serving as a direct indicator of platform utilization and financial health.

Furthermore, we actively seek user feedback through community channels such as Telegram/Discord to inform our product development and ensure our offerings meet the evolving needs of our users.

By closely monitoring these KPIs, Copin is committed to continuously enhancing our platform’s user experience, fostering long-term retention, and building a loyal and active trading community within the DeFi ecosystem.

Relevant usage metrics

Please refer to the [OBL relevant metrics chart 5]. For your category (DEX, lending, gaming, etc) please provide a list of all respective metrics as well as all metrics in the general section:

| Category | Relevant Metrics |

|---|---|

| General Metrics | Daily Active Users; Daily User Growth; Daily Transaction Count; Daily Protocol Fee; Daily Transaction Fee; Daily ARB Expenditure and User Claims; Incentivized User List. |

| Perpetuals (for copy trading) | For each tradable asset: Trading Volume: A daily time series, also measured in USD. Open Interest: A daily time series measured in USD. List of Copiers: A comprehensive record of individuals or entities that have engaged in trading activities. This list should include trader addresses and the volume of trades executed. Copier Net P&L Improvement: The change in traders’ profit and loss accounts, reflecting on the platform’s fairness and attractiveness to traders. Funding Rate Stability: Tracks the fluctuations in the funding rates, assessing the balance between long and short positions and market sentiment. Liquidations: A daily time series measured in USD. |

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan: Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant): No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?: [Yes/No, and provide explanation]

Yes. Traders from GMX v1 on the arbitrum ecosystem are the origin and first source of inspiration for us to build the “explore & analyze on-chain trader” feature, with the goal of displaying detailed performance statistics. of a trader on GMX (Arbitrum). After discovering a few traders with very good performance on GMX, we continued to optimize and develop the copy trading feature from these traders.

On what other networks is the protocol deployed?: [Yes/No, and provide chains]

No.

What date did you deploy on Arbitrum mainnet?: [Date + transaction ID. If not yet live on mainnet, explain why.]

The date we deployed on Arbitrum mainnet: 27/2/2024

Transaction ID: Arbitrum One Transaction Hash: 0x1c2836b802... | Arbitrum One

Do you have a native token?: [Yes/No/Planned, link tokenomics docs]

No

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

Copin has never run any incentive programs in the past.

Current Incentivization: How are you currently incentivizing your protocol?

N/A

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program? [yes/no, please provide any details around how the funds were allocated and any relevant results/learnings(Note: this does NOT disqualify an applicant)]

No.

Protocol Performance:

[Detail the past performance of the protocol and relevance, including any key metrics or achievements, dashboards, etc.]

- Total copy trading volume: > $83 millions

- Total copied orders (transactions): 36,615

- Total users (copiers): 1095

- All-time statistics from Aug 2023 - until Feb 28, 2024

- Traction mainly increased from the beginning of January 2024 to the present. Without any incentives.

- Source: Copin Stats | Copin Analyzer

Protocol Roadmap:

[Describe relevant roadmap details for your protocol or relevant products to your grant application. Include tangible milestones over the next 12 months.]

Core features:

![]() A perpetual on-chain data structure: Trader data, position data.

A perpetual on-chain data structure: Trader data, position data.

![]() Data filtering by statistics & percentile ranking

Data filtering by statistics & percentile ranking

![]() Single backtesting & multiple backtesting

Single backtesting & multiple backtesting

![]() Referral program

Referral program

![]() Telegram alert bot

Telegram alert bot

![]() Trader comparison & Similar traders

Trader comparison & Similar traders

![]() NFT subscription for premium features

NFT subscription for premium features

![]() Wallet management: Account abstraction ERC4337 with smart wallet infrastructure

Wallet management: Account abstraction ERC4337 with smart wallet infrastructure

![]() Mobile application for iOS and Android

Mobile application for iOS and Android

![]() Integrate on-chain data from perp DEXs on the arbitrum system: HMX, Gains, MUX, Vertex, …

Integrate on-chain data from perp DEXs on the arbitrum system: HMX, Gains, MUX, Vertex, …

![]() Launch fee rebates vesting contract for DCP

Launch fee rebates vesting contract for DCP

![]() Grants Distribution Dashboard

Grants Distribution Dashboard

GMX v1 Integration

![]() GMX v1 trader explorer

GMX v1 trader explorer

![]() GMX v1 trader leaderboard

GMX v1 trader leaderboard

![]() GMX v1 trader top opening positions

GMX v1 trader top opening positions

![]() GMX trader profile

GMX trader profile

![]() Copy trading with GMX v1 trader via CEX APIs

Copy trading with GMX v1 trader via CEX APIs

![]() Integrate decentralized copy trading using GMX v1

Integrate decentralized copy trading using GMX v1

GMX v2 Integration

![]() GMX v2 trader explorer

GMX v2 trader explorer

![]() GMX v2 trader top opening positions

GMX v2 trader top opening positions

![]() GMX v2 trader leaderboard

GMX v2 trader leaderboard

![]() GMX v2 trader profile

GMX v2 trader profile

![]() Integrate decentralized copy trading using GMX v2

Integrate decentralized copy trading using GMX v2

Audit History & Security Vendors: [Provide historic audits and audit results. Do you have a bug bounty program? Please provide details around your security implementation including any advisors and vendors.]

This is the audit result for DCP through GMX v1: onchain-copytrading/audits/Copin DCP_Audit_Report.pdf at gmx-v1 · copin-protocol/onchain-copytrading · GitHub

Security Vendors: DAudit

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

No, Copin has not been exploited

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: [Enter Amount of ARB Requested]

230,000 ARB

Justification for the size of the grant 11:

[Enter explanation. More details are better, including how you arrived at the required funding for individual categories of expenses covered by your grant plan]

Our grant request is divided into two main categories, each with a specific estimated funding requirement:

1. DCP Fee Rebates:

- Increase the total transacted volume on the Copin protocol

- Currently at ~$2M daily volume with ~300 daily orders

- Targeting ~$5M daily volume (150% growth) with an average 500 daily orders

- The reason why Copin are targeting ~$5M daily volume (150% growth):

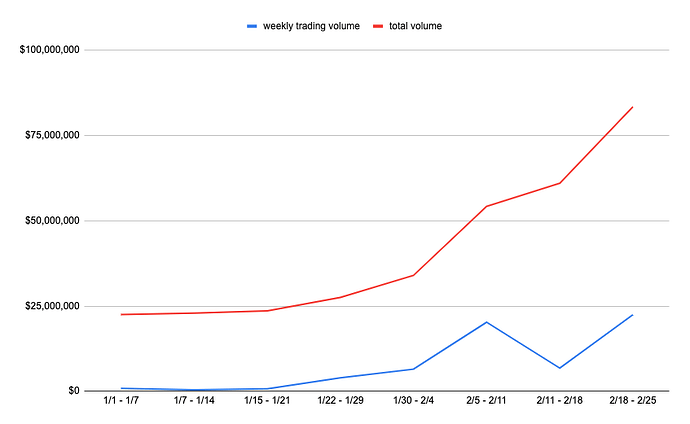

- Copin.io targets a 150% growth in trading volume to $5M daily due to a consistent 30% weekly increase in recent months. This growth has been organic, with no incentives used, indicating a strong base of $2M daily volume from other liquidity sources. This is the statistical tracking table from the Copin protocol over the past 2 months.

| Time | New users | Total users | Weekly trading volume | Total volume | % volume growth |

|---|---|---|---|---|---|

| 1/1 - 1/7 | 18 | 733 | $831,164 | $22,477,537 | |

| 1/7 - 1/14 | 39 | 772 | $407,724 | $22,885,260 | 1.81% |

| 1/15 - 1/21 | 165 | 937 | $688,258 | $23,573,518 | 3.01% |

| 1/22 - 1/29 | 42 | 979 | $3,920,949 | $27,494,467 | 16.63% |

| 1/30 - 2/4 | 23 | 1002 | $6,467,573 | $33,962,041 | 23.52% |

| 2/5 - 2/11 | 44 | 1046 | $20,240,413 | $54,202,453 | 59.60% |

| 2/11 - 2/18 | 29 | 1075 | $6,791,862 | $60,994,316 | 12.53% |

| 2/18 - 2/25 | 28 | 1103 | $22,433,213 | $83,427,529 | 36.78% |

This is the data table from the Copin database. You can see more statistics on our dashboard here: Copin Stats | Copin Analyzer

-

The $5M target is feasible, aiming to maximize user engagement with trading fee rebates and competitions as motivators, which are expected to convert and acquire users effectively, thereby proving the decentralized copy trading model’s efficacy and creating a momentum for further growth within the Arbitrum ecosystem.

-

Allocated 200,000 ARB to cover the 90% rebate of all fees paid to the platform back to users. This includes an execution fee of ~$1 per transaction plus a protocol fee of 0.025% of the trade size, in addition to the trading fee (from GMX v1) of 0.07% of the trade size.

| Type | Description | Fee |

|---|---|---|

| Execution Fee | GMX v1 execute open / increase / decrease / close position, modify market margin. | ~0.00021 ETH (~0.5$) each |

| Trading Fees | GMX v1 Open/Close Fee | 0.07% * trade_size |

| Protocol Fee | Each order Copin placed | 0.025% * trade_size |

- To achieve this, at a target of $5M daily volume and 450 daily orders, across 12 weeks (84 days), it would require:

- USD equivalent = ($5M * 0.095% + 500 * $1) * 84 * 90% = $396,900

- ARB amount = $396,900 / $2 = 198,450 ARB at an ARB price of $2

Figures may change or be flexible depending on actual trading fees as well as ARB’s price

- DCP Competitions: Designated 30,000 ARB to reward active users on the platform, encouraging deeper engagement in Copin’s copy trading activities and contributing positively to the Arbitrum ecosystem.

Grant Matching: [Enter Amount of Matching Funds Provided - If Relevant]

N/A

Grant Breakdown: [Please provide a high-level overview of the budget breakdown and planned use of funds]

The $ARB tokens received from the grant will be allocated strictly in accordance with the guidelines set forth by the Arbitrum Foundation, ensuring that they are used to incentivize user engagement and growth within the Arbitrum ecosystem. The distribution plan for the ARB tokens is as follows:

| Category | Allocation | Description |

|---|---|---|

| Growth Protocol Activities: Decentralized Copy Trading (DCP) Fee Rebates | 200,000 ARB | Users will be rewarded 90% trading-fee rebates after each successful copy trade on the protocol, paid in $ARB based on the amount of fees paid. |

| Decentralized Copy Trading (DCP) Competitions | 30,000 ARB | The copy trading competition spans 6 rounds, over 2 weeks each. Offering a 5,000 ARB prize pool per round allocated to the top performers: 1st place receives 2,000 $ARB; 2nd to 5th receives 500 $ARB; 6th to 10th receives 200 $ARB |

Funding Address: [Enter the specific address where funds will be sent for grant recipients]

TBD

Funding Address Characteristics: [Enter details on the status of the address; the eligible address must be a 2/3, 3/5 or similar setup multisig with unique signers and private keys securely stored (or an equivalent custody setup that is clearly stated). The multisig must be able to accept and interact with ERC-721s in order to accept the funding stream.

Safe wallet, 2/3 multisig

Treasury Address: [Please list out ALL DAO wallets that hold ANY DAO funds]

N/A

Contract Address: [Enter any specific address that will be used to disburse funds for grant recipients]

TBD

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Clearly outline the primary objectives of the program and the Key Performance Indicators (KPIs), execution strategy, and milestones used to measure success. This helps reviewers understand what the program aims to achieve and how progress will be assessed.

Objectives: [Clearly state the primary objectives of the grant and what you intend to achieve]

Receiving a grant from Arbitrum will empower Copin to significantly enhance user engagement and interaction within the Arbitrum ecosystem through two strategic campaigns: the Decentralized Copy Trading (DCP) fee rebates and the DCP Competitions. Here is a detail of how this grant will catalyze a surge in user interactions:

DCP Fee Rebate Programs:

-

Directly incentivize active copy trading on Copin by offering rebates on trading fees. This not only encourages users to trade more frequently but also attracts users looking for cost-efficient trading solutions on Arbitrum.

-

By reducing the cost of copy trading, we anticipate a higher retention rate of users who begin to see Copin and the Arbitrum network as their go-to trading platforms due to the tangible financial benefits.

DCP Competitions:

-

Allocate a portion of the grant to launch highly publicized copy trading competitions. This competition will be designed to showcase the capabilities of Copin’s platform while encouraging users to engage deeply with the trading tools available.

-

Use the grant to offer attractive rewards for competition participants. This will not only draw existing users into deeper engagement but also attract new users from the broader DeFi community who are enticed by the competitive aspect and the potential rewards.

As users participate in the competition, we expect a significant uptick in transactions on the Arbitrum network, thereby directly contributing to its vibrancy and user engagement metrics.

Execution Strategy:

[Describe the plan for executing including token distribution method (e.g. farming, staking, bonds, referral program, etc), what you are incentivizing, resources, products, use of funds, and risk management. This includes allocations for specific pools, eligible assets, products, etc.]

Copin’s execution strategy for distributing the granted funds is meticulously planned to maximize engagement and incentivize participation within the Arbitrum ecosystem, ensuring a focused and impactful use of resources. Here’s how we plan to execute and manage the distribution:

1. Fee Rebates Incentive:

- Allocation: 200,000 $ARB is allocated for fee rebates, with the following distribution conditions:

- Will apply the max daily cap mechanism to receive fee rebates

- If the max daily cap is exceeded, the next user will not receive fee rebates

- If the max daily cap is not exceeded, the remaining balance will be accumulated and divided evenly among the remaining days, until the end of the 12-week cycle (84 days).

- After 84 days, if all caps are not used to incentivize users, they will be returned to the DAO.

For example: allocation is 200k ARB for 84 days.

- The maximum cap on day 1 is 2380 ARB, but I only use 1380 ARB for fee rebate, the remaining 1000 ARB will be accumulated for the remaining amount.

- Max cap on day 2 = (200k - 1380)/83 = 2393, if only 1000 ARB is used, the remaining 1393 ARB is accumulated.

- Max cap on day 3 = (200k - 1380 - 1393)/82 = 2406 ARB

…- Until the 84 days expire, the remaining ARB balance will be returned to DAO.

- Distribution Method: Users engaging in copy trading will receive 90% of their trading fees back as rebates, paid in $ARB. All copy trading orders executed (including open, increase, decrease, close) during the DCP fee rebates event period (12 weeks, 84 days) will be eligible to receive incentives.

Copin will perform the following tasks:

- Listen GMX execution fee + GMX trade fee + Copin protocol fee.

- Daily push up the list of addresses, the amount each address will receive fee rebate, with merkle proof.

- Build an interface page to view this list & merkle proof.

- Build an interface page so users can claim fee rebates.

2. Competitions:

- Format: The competition consists of 6 rounds, each lasting 2 weeks. A total prize pool of 5,000 ARB per round is distributed among the top performers, with

- 1st place receiving 2,000 $ARB.

- 2nd to 5th places each receiving 500 $ARB.

- 6th to 10th places each receiving 200 $ARB.

- Participant Eligibility: All Copin users (Copiers) are automatically entered into the Copy Trading Competition during its active periods. Participation is recorded automatically for users executing copy trades via GMX on the ARB network.

- Performance Tracking: Copy trading performance metrics are snapshot and ranked at the end of each round. Rankings are transparently displayed on a leaderboard page, ensuring clear and public visibility.

- Prize Distribution: Winners are announced, and prizes are awarded one week after the conclusion of each round, fostering ongoing engagement and competition within the community.

3. Unused Funds Management:

- In the event that the allocated funds are not fully utilized by the end of the 12-week period, the remaining ARB will be returned to the DAO. This ensures accountability and the responsible use of the granted resources.

A rigorous monitoring system is in place to oversee the distribution of incentives and assess the effectiveness of the strategy. Adjustments will be made as necessary to ensure the optimal impact and alignment with our goals.

By aligning our execution strategy with these structured incentive mechanisms, Copin aims to significantly increase user activity and trading volume on the Arbitrum network, contributing positively to the ecosystem’s growth and vibrancy.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

[Provide relevant design and implementation details]

The 200,000 ARB tokens will be distributed through a carefully designed architecture that aligns with the DCP fee rebates structure as outlined in the image provided. Here’s how the distribution will unfold:

Based on these components, the DCP fee rebates for each user will be 90% of the total net-trading-fees paid, after accounting for the sum of the fees involved in the trade execution. The fee rebates will be paid in $ARB, directly incentivizing users to continue trading on the platform and contribute to the liquidity and activity on the Arbitrum network. The trading fee rebate amount will be displayed and allow users to claim through Copin’s interface.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

[Please also justify why these specific KPIs will indicate that the grant has met its objective. Distribution of the grant itself should not be one of the KPIs.]

| KPIs | Description | Source of Truth |

|---|---|---|

| Copy Trading Volume | This key metric tracks the total volume of trades executed through our copy trading feature. It’s a direct indicator of the feature’s popularity and effectiveness, highlighting the aggregate trading activity and the platform’s liquidity. | Copin Stats, Dune Dashboard |

| Copier number | Measures the total number of users actively participating in copy trading. This KPI helps us gauge the adoption rate of our copy trading service and understand the breadth of our user base interested in leveraging the strategies of experienced traders. | Copin Stats, Dune Dashboard |

| Copiers Net P&L Improvement | Tracks the profitability improvement of users utilizing the copy trading feature. It serves as a qualitative measure of the value our platform provides to users, indicating how effectively Copin helps users optimize their trading strategies and financial outcomes. | Copin Stats, Dune Dashboard |

| Daily Active Users | The count of unique users who interact with our platform daily. DAU is a crucial metric for understanding our platform’s day-to-day engagement and the stickiness of our user interface and features. | Dune Dashboard |

| Daily User Growth | This metric highlights the daily increase in our user base, providing insights into our platform’s growth trajectory and the effectiveness of our marketing and user acquisition strategies. | Dune Dashboard |

| Daily Transaction Count | Measures the number of transactions processed on our platform each day. This KPI is essential for assessing the platform’s operational volume and the overall user activity level. | Dune Dashboard |

| Daily Protocol Fee | Represents the total fees generated by our platform daily. It’s a vital financial metric that indicates our revenue streams from trading activities and the economic value Copin contributes to the broader DeFi ecosystem. | Dune Dashboard |

Grant Timeline and Milestones:

[Describe the timeline for the grant, including ideal milestones with respective KPIs. Include at least one milestone that shows progress en route to a final outcome. Please justify the feasibility of these milestones.]

We request that the grant for DCP fee rebates be streamed and DCP competition be streamed over 12 weeks

| Timeline | ARB Amount | Ideal Milestones | KPIs |

|---|---|---|---|

| March 15 | N/A | Ready DCP through GMX v1, including audit results from 3rd party | |

| April 15 | N/A | Ready to go live all resources for event incentives: fee rebates and competitions (including event interface page, leaderboard page, claim reward page, user reward contract.) | |

| Week 1 - 4 | 76,666 ARB (66,666 ARB fee rebates & 10,000 ARB competitions) | DCP Fee Rebates & DCP Competitions | Volume accumulation > $75M; Transaction > 15,000 |

| Week 5 - 8 | 76,666 ARB (66,666 ARB fee rebates & 10,000 ARB competitions) | DCP Fee Rebates & DCP Competitions | Volume accumulation > $200M; Transaction > 30,000 |

| Week 9 - 12 | 76,666 ARB (66,666 ARB fee rebates & 10,000 ARB competitions) | DCP Fee Rebates & DCP Competitions | Volume accumulation > $450M; Transaction > 45,000 |

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

[Clearly explain how the inputs of your program justify the expected benefits to the DAO. Be very clear and tangible, and you must back up your claims with data]

Receiving a grant from the Arbitrum ecosystem will significantly amplify Copin’s capacity to foster both growth and innovation within the ecosystem. Here’s a clear and tangible explanation, backed by data, on how the grant inputs correlate with the expected benefits:

-

Enhancing Trading Efficiency and Accessibility: By utilizing the grant to scale our data aggregation and analysis infrastructure, we’re set to enhance the trading experience on perpetual DEXs within Arbitrum. This improvement directly addresses a vital need for more accessible and efficient trading tools, expected to attract a broader user base. With over 2 million traders currently active across various perpetual DEXs and a trading volume exceeding $330 billion, the introduction of Copin’s advanced trading insights and decentralized copy trading features stands to significantly increase user engagement and transactions on the Arbitrum network.

-

Decentralized Copy Trading (DCP) Incentives: The grant will fund a comprehensive incentives program, including fee rebates and competitive trading events, directly encouraging active participation. By rebating 90% of trading fees and organizing competitions with a total of 30,000 ARB in rewards, we aim to stimulate substantial growth in both the number of trades and the volume of trading on the Arbitrum network. This strategy is projected to not only attract new users but also to retain them, contributing to a vibrant and active trading community.

-

Data-Driven Growth: Copin’s focus on leveraging on-chain data to provide actionable insights for traders represents a key value proposition for the Arbitrum ecosystem. By making complex data easily accessible and understandable, we aim to empower traders to make more informed decisions, thereby increasing the overall efficiency and liquidity of the market. This approach is grounded in the belief that informed trading leads to more sustainable growth and a more robust ecosystem.

-

Commitment to the Arbitrum Ecosystem: Our team’s dedication to building on Arbitrum is unwavering. The grant will further solidify our commitment, enabling us to allocate more resources towards developing and optimizing our platform specifically for the Arbitrum network. This commitment is expected to drive long-term benefits for the ecosystem, including increased transaction volume, higher user engagement, and the attraction of new projects and builders inspired by Copin’s success.

In conclusion, the grant will serve as a catalyst for Copin to significantly contribute to the growth and innovation of the Arbitrum ecosystem. Through strategic investments in technology, incentives, and community engagement, backed by a data-driven approach, we anticipate delivering tangible benefits that will enhance the overall health and dynamism of the ecosystem.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: [Onboarding Checklist from OBL 8]. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting]

Yes

First Offense: *In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?: [Y/N]

Yes