First off, thanks to Entropy Advisors for the thoughtful design and rollout of DRIP Season 1. Targeting critical nodes such as correlated loops is a smart approach that goes beyond chasing short-term inflows. We’ve also seen Arbitrum grow in mindshare and inflows. By aiming for structural improvements and retention rather than temporary TVL spikes, DRIP is clearly positioned to deliver lasting benefits for Arbitrum DeFi.

At TID Research, we actively manage onchain portfolios using delta-neutral strategies such as lending, LPing, and leveraged staking. From this perspective, we’ve been impressed with DRIP so far—most listed assets can be swapped in and out with very minimal slippage and price impact, which speaks to the quality of the design.

That said, one thing we’ve noticed is that since LP activity isn’t directly incentivized, most trades still route through existing liquidity (mainly Uniswap and Fluid). Liquidity is growing, but not always fast enough to keep up with demand for leverage. In practice, swaps up to ~$100k–200k are fine, but around ~$300k we start seeing noticeable price impact, and at ~$500k execution can sometimes become difficult. For example, a trader farming with ~$10k at 10x leverage can comfortably enter and exit positions, but bigger strategies quickly run into constraints. We see a similar pattern across some stables and ETH LRTs.

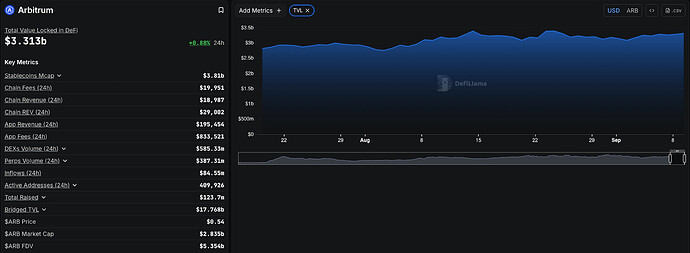

It’s also interesting to compare with the Linea Ignition program. DRIP’s budget is around ~$40m at current prices, while Ignition’s is ~$35m. Yet in the past week, Linea’s TVL has grown ~200–300%, versus ~10–15% for Arbitrum.

Some of this difference comes from Arbitrum’s already larger TVL base and different emission schedules, but a big driver seems to be that Linea has been actively incentivizing LPs on Ethrex. This makes it possible for users to easily build leverage and fully farm Ignition rewards without running into liquidity bottlenecks—so $1 of inflow can multiply into ~$10 of TVL. On Arbitrum, the same inflow might only stretch to ~$3–5 of TVL because swap liquidity is the limiting factor.

Overall, we think DRIP has a very strong foundation, and it’s exciting to see how it’s already supporting the ecosystem. Adding some consideration for LP incentives or integration of native minting/redemption—whether in later epochs or in a future season—could make the program even more impactful and ensure that the DAO’s investment translates into the strongest possible growth.