The DeFi Renaissance is on Arbitrum! View opportunities at https://arbitrumdrip.com/

Entropy’s Approach to Incentives

Before diving into DRIP Season One, our team felt it was important to share more about our approach to the design of DRIP and how learnings from both Arbitrum’s previous programs (STIP, LTIPP, etc) and others across the industry influenced our strategy.

In short, incentives are extraordinarily good at temporarily producing the numbers we ask of them. It should come to no surprise that the vast majority of participants in DeFi are ROI-driven and there is a large pool of capital that actively rotates to the highest advertised yields. In every incentive program, the same story plays out: metrics look great during the reward period, but revert back to previous levels (sometimes even lower) following the program’s conclusion.

Retention has always been a key challenge in crypto, and we believe it is due to not all TVL being created equal. In fact, it is actually quite trivial to design an incentive program that attracts mercenary capital and artificially inflates TVL or activity. This is why Entropy approaches incentives as a mechanism to drive structural upgrades that make a DeFi ecosystem more robust. Put more plainly, if a chain’s incentive program wants the post-campaign baseline to settle materially higher, something substantive must change in its DeFi ecosystem.

Persistent value comes from new deployments, market parameter changes, market depths that enable better execution at meaningful size, or listings of promising assets across a variety of venues. In our minds, incentives are one tool available to ecosystem teams that can be leveraged to unlock structural changes to a chain’s DeFi ecosystem. This is not to say that efficiency metrics and target KPIs are not important, but Entropy treats these more as health indicators and believes the success of DRIP should be measured based on the structural changes achieved and the retention that follows.

In anticipation of DRIP, we synthesized this thesis into a short article thesis and shared it on launch day.

Season One: Loop Smarter on Arbitrum

The following information is outlined in an official Arbitrum blog post and parts were shared in previous updates. Reposting the information + some additional details here again for convenience.

- Start: September 3, 2025

- Planned End: January 20, 2026

- Season One Budget: 16M ARB (base) + 8M ARB (discretionary)

- Length: 20 weeks (10 two-week epochs)

Season One of the DRIP program is focused on growing leverage looping on Arbitrum One. Earn ARB by borrowing against an eligible list of yield-bearing ETH and stable assets on participating lending platforms.

The primary objective of Season One is to grow the leverage looping of yield-bearing ETH and stables on Arbitrum. Why focus on leverage looping? On mainnet, the looping of yield-bearing assets has been a primary driver of lending market growth in the last year; however, a small fraction of this activity currently takes place on any Ethereum L2s, including Arbitrum. Entropy believes that there is a significant opportunity to enable this activity on Arbitrum, but doing so requires a solid foundation, which is the motivation behind our secondary objectives this season:

- Increase the optionality of venues for Arbitrum users to borrow/lend.

- Increase the availability of differentiated yield source assets through new listings.

- Increase supply caps and LTVs on newly listed yield-bearing assets.

- Grow the PT/YTs markets of those assets so that there is sufficient liquidity to eventually sustain leverage loops without incentives.

- Grow the market share of Arbitrum lending markets versus their deployments on competitive ecosystems.

The distribution of rewards designed around a phased rollout. Season One begins with a month-long ramp up discovery phase in order to establish necessary baseline data and validate initial theses. During this phase, only 15% of the Season’s base budget will be allocated. Starting in epoch 3, the season transitions to a 3-month performance-based model to maximize efficiency and competition. During this performance phase, markets and projects that are more successful will receive a greater share of the total incentives. The majority of the season’s budget is reserved for the performance phase. Finally, in the last month of the program, rewards will be tapered in an effort to boost retention.

In each epoch, each participating lending market has an allocation of DRIP rewards. Within this allocation, the reward pool is split between a number of campaigns which are determined through conversations between Entropy and each lending market. For the initial discovery phase, campaigns and allocations were influenced by factors like current market position; however, eventually these will be guided by performance. All campaigns are variable rate and include both new and existing supply.

Rewards must be claimed through Merkl on the Arbitrum DRIP homepage and will be claimable until April 30th, 2026.

Participating Lending Markets

Eligible Collateral Assets

Season 1 Data & Metrics

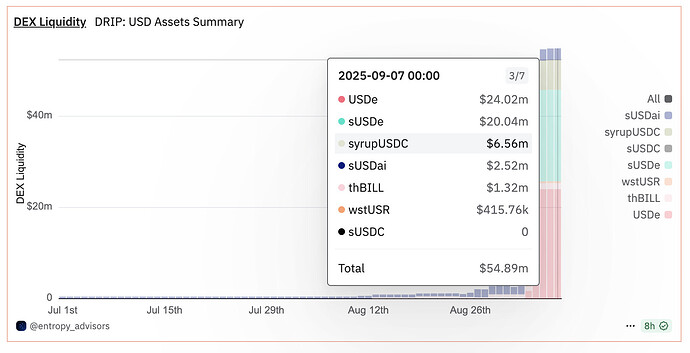

Entropy’s data team has created 3 public dashboards that measure performance of DRIP across the participating lending markets, ETH assets, and USD assets.

- Lending Markets: https://dune.com/entropy_advisors/drip-season-1-lending-protocols

- ETH Assets: https://dune.com/entropy_advisors/drip-season-1-eth-assets

- USD Assets: https://dune.com/entropy_advisors/drip-season-1-usd-assets

While the performance of DRIP and its participants will be judged based partially on the quantitative metrics available on Entropy’s dashboards, discretionary qualitative elements such as co-incentives, participation in co-marketing, “sufficient” DEX liquidity, and others will be taken into account when evaluating performance.

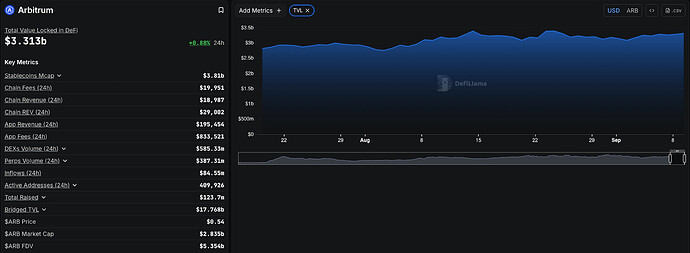

Overall, we’re seeing some early traction with stable assets in particular. Since the start of DRIP last week, there has been over $70m in net-new eligible USD assets minted on Arbitrum.

Additionally, Arbitrum has seen a $75m increase (~25%) in USDC borrowed on eligible lending markets.

Lastly, we’ve also seen an impressive increase in DEX liquidity for the eligible stable assets, despite this not being directly incentivized.

DRIP Launch Marketing

First, we’d like to thank delegates for their help amplifying the launch of the program on social media. From our perspective, the launch was successful and captured a good amount of attention. The following list of posts & threads combined for just over 800k views. Please note that the list is not exhaustive and does not include the numerous follow up posts from participants highlighting early traction or those from the Arbitrum community.

Official Arbitrum Announcements

- DRIP Launch: https://x.com/arbitrum/status/1963227143288279250

- Teaser Video: https://x.com/arbitrum/status/1962896422597988444

- Blog Post: Introducing DRIP: The DeFi Renaissance Incentive Program on Arbitrum

Posts from Entropy Advisors

- Article on how Entropy approaches incentives: https://x.com/EntropyAdvisors/status/1963240701467963658

- Entropy Twitter spaces: https://x.com/EntropyAdvisors/status/1962953290960027667

- Entropy ETH & USD Asset Dashboards: https://x.com/EntropyAdvisors/status/1963975548310520235

- Entropy Lending Protocol Dashboard: https://x.com/EntropyAdvisors/status/1963618094376784270

Participating Protocol Announcements

- Aave: https://x.com/aave/status/1963250783123558505

- Morpho: https://x.com/MorphoLabs/status/1963228085672972320

- Maple: https://x.com/maplefinance/status/1963242663756599311

- Fluid: https://x.com/0xfluid/status/1963326652936753663

- Euler Labs: https://x.com/eulerfinance/status/1963232117300596854

- Dolomite: https://x.com/Dolomite_io/status/1963227887408209951

- Silo Labs: https://x.com/SiloFinance/status/1963289870086148138

- USDai: https://x.com/USDai_Official/status/1963393711850893777

- Spark: https://x.com/sparkdotfi/status/1963228840890691905

- Resolv Labs: https://x.com/ResolvLabs/status/1963261959404740873

- Theo: https://x.com/Theo_Network/status/1963255714677223676

- GMX: https://x.com/GMX_IO/status/1963316225158910100

- Kelp: https://x.com/KelpDAO/status/1963241410687291758

- Etherfi: https://x.com/ether_fi/status/1963230803762045226

- Merkl: https://x.com/merkl_xyz/status/1963235983983313294

Mentions in Crypto Media

- Blockworks: Arbitrum kicks off $40M incentive program with focus on leveraged looping - Blockworks

- CoinDesk: https://www.coindesk.com/markets/2025/09/03/arbitrumdao-incentivizes-defi-growth-with-24m-arb-token-rollout

- The Defiant: https://thedefiant.io/news/blockchains/arbitrum-launches-season-one-of-usd40-million-defi-incentive-program

- Yahoo Finance: https://finance.yahoo.com/news/arbitrum-launches-40m-defi-incentive-212836047.html

- DL News: Arbitrum floats $40m token incentive reward for DeFi users – DL News

- And many more

Mentions by Crypto Influencers

- Stephen Defi Dojo: https://x.com/phtevenstrong/status/1963281697140584758

- Taiki Maeda: https://www.youtube.com/watch?v=8r9_mwUsZQE

Looking Forward

With the season now live, Entropy is monitoring both performance of the program and other factors such as marketing conditions that may impact ETH/USD borrowing rates and competing incentive programs. Although the plan is to run DRIP season one with all included assets and lending markets for the full 10-epoch duration, Entropy Advisors will actively be judging the effectiveness of the program throughout its lifecycle. Our team reserves the ability to alter the list of participants or the season’s structure depending on performance & market conditions.

Our team has also received several inquiries about Season 2 of DRIP and its focus. While DRIP’s next focus is still in the ideation phase, verticals that are top of mind are RWAs, DEXs, and perps.

Disclaimer

Participation in the DeFi Renaissance Incentive Program (“DRIP”) involves risks. Leveraged strategies such as looping can result in liquidation or total loss of funds. ARB rewards do not compensate for potential losses. You should carefully assess your own risk tolerance before participating.

Nothing in this post or the DRIP program constitutes financial, legal, or investment advice. All participants are solely responsible for their own decisions and for complying with all applicable laws and regulations in their jurisdiction.

Rewards are not guaranteed. The amount and distribution of ARB depends on program parameters and user activity. Program terms, eligible assets, and budget allocations are subject to change at the discretion of the ArbitrumDAO.

Merkl, the Arbitrum Foundation, and the DRIP Committee are not responsible for smart contract risks, protocol vulnerabilities, or losses incurred on third-party platforms. DRIP is a community-governed initiative: Entropy Advisors manages program operations but does not control ArbitrumDAO governance or treasury decisions.

Merkl, the Arbitrum Foundation, and the DRIP Committee shall have no liability to you should they fail to make a payment of rewards to you, for any reason, including without limitation whether this be in relation to the amount you do or do not receive or a payment that does not go to your nominated wallet address. If you receive a payment that is not intended for you or if you receive more than you should have received, you shall, upon request, immediately return this to an address nominated by the Arbitrum Foundation.