RADIANT CAPITAL STIP ADDENDUM

Information about STIP/STIP Backfund

1. Can you provide a link to your previous STIP proposal (round 1 or backfund)?

2. How much, in the previous STIP proposal, did you request in ARB?

2,852,044 ARB

3. What date did you start the incentive program and what date did it end?

Radiant’s incentive program started on 11/6/23 and ran through* 3/22/24

4. Could you provide the links to the bi-weekly STIP performance reports and Openblocks Dashboard?

Radiant’s bi-weekly STIP updates

https://dune.com/radiant/stip-final

https://www.openblocklabs.com/app/arbitrum/grantees/Radiant

5. Could you provide the KPI(s) that you deem relevant for your protocol, both in absolute terms and percentage change, month over month, for the first of each month starting from October 2023 until April 2024, including the extremes? If you don’t know what KPI might be relevant for you or how to properly define them, please refer to the following document: Arbitrum DAO OpenBlock Labs Incentive Onboarding Spec 1

Performance Recap Post-grant Approval

Following the grant approval, Radiant DAO launched several strategic initiatives aimed at fostering self-sustaining growth within Radiant and Arbitrum ecosystem partners.

Check out Radiant’s “Starb Wars” themed STIP introduction video: https://twitter.com/RDNTCapital/status/1720117437855834435

Initiatives and Outcomes

- Dynamic Liquidity Provider Airdrop

Initial STIP dLP TVL: 43.85M

End dLP STIP TVL: 57M

Growth from STIP: 30%

Incremental TVL: 13.15M

Initial Total Unique Users: 248,164

End Total Unique Users: 261,421

New Users: 13,538

STIP user growth: 5.46%

In exchange for users enhancing the utility of Radiant by locking Dynamic Liquidity tokens (RDNT/ETH liquidity), there are three primary rewards:

-

Activate RDNT emissions on deposits & borrows

-

Share in platform fees generated by the protocol

-

Obtain voting power for governance via the Radiant DAO

Learn more about dLP here.

Based on the current price of RDNT, ETH, and ARB (as of April 23rd), an ROI of 457% was achieved. Note that dLP is long-term liquidity on Arbitrum as users need to lock liquidity for 6 months to 1 year to have qualified and is the backbone of the Radiant ecosystem. Radiant has achieved one of the largest volatile liquidity pairs in all DeFi- largely thanks to Arbitrum! Additionally, significant amounts of dLP were locked via partner yield optimizer protocols Magpie and Plutus DAO, leading to increased awareness of these protocols on Arbitrum.

Results can be verified by referencing the data used to airdrop ARB to eligible users here, and on the Dune queries linked above.

As mentioned in the bi-weekly STIP updates, the milestones from the original proposal were revised to be less confusing for end users, though in both cases, Milestone 4 was achieved.

Another facet of Radiant’s STIP proposal was the gatekeeping of ARB, which would not be distributed unless milestones were achieved.

All updated milestones and transactions are viewable via Radiant’s STIP transparency dashboard.

At the end of STIP, 150,000 ARB was returned to the incentives multisig

- Radpie Lending Incentives

Total Arb spent: 338,603

Initial STIP TVL: 3.29M

End STIP TVL: 27.50M

Growth from STIP: 736%

Radpie, a subdao of Magpie, is a yield optimizer built on top of Radiant. While this campaign was not included in the initial proposal, the Radiant engineers were not confident about launching the GMX v2 markets in time for STIP. Therefore, as detailed in our bi-weekly updates Radiant shifted funds towards Magpie.

Check out the “Starb Wars” themed “Magpielicious Crumb” collaboration video: https://twitter.com/RDNTCapital/status/1720117437855834435

- Camelot v3 RDNT/ETH LP Incentives

Total Arb spent: 166,764

STIP end LP Value: $1.4M

Weekly Fees: $3.75K

Monthly Fees: $35.92K

Total Fees: $401K

As the initial STIP proposal mentioned, Radiant prioritized growing liquidity on Arbitrum native Dexes. However, the Gamma strategies exploit caused a setback in this liquidity pair. Additionally, the initial plan was to have Dopex create options markets off this liquidity pair, but the support for Camelot LPs was unavailable over the STIP period.

Based on the initial milestones set, up to 242,158 ARB was allocated for this initiative, though 166,764 was spent.

![]()

Check out the “Starb Wars” themed “Camelorian” collab video: https://twitter.com/RDNTCapital/status/1721694808324915478

https://x.com/RDNTCapital/status/1752002980067307669

- Plutus DAO plsRDNT Incentives

Total Arb spent: 82,417

Initial TVL: $88.27K

End TVL: $728.01K

Growth from STIP: 724%

The transition from hosting plsRDNT liquidity on Chronos Dex to Balancer/Aura led to an increase in TVL and plsRDNT demand for Plutus DAO. The liquidity pool grew significantly, partly due to the Arbitrum grant incentives, which began on December 11th.

Check out the “Starb Wars” themed “Grogus” collaboration video: https://www.youtube.com/watch?v=8NxG1rHIajA

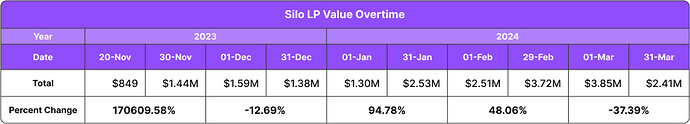

- Silo RDNT Market

Total ARB spent: 50,000

Initial market value: 0

STIP End market value: 2.4M

It was a pleasure to work with Silo Finance on the first Radiant lending market. It may seem odd for two lending markets to collaborate. However, Silo specializes in isolated markets, which is a suitable home for an RDNT lending market. This initiative was not in the original STIP proposal. Still, for the same reason as Magpie above, due to the delay in listing GMX v2 assets, there was an opportunity to expand RDNT utility on Arbitrum via Silo.

Check out the “Starb Wars” themed “Han Silo” collaboration video:

https://twitter.com/RDNTCapital/status/1727361296465858925

6. [Optional] Any lessons learned from the previous STIP round?

a. There was an overlap across one campaign with Camelot, where they were distributing ARB to the same RDNT/ETH LP. Better coordination would have improved the efficiency of incentives across this initiative. This is a non-issue for this round of STIP as all campaigns are internal within the Radiant protocol, excluding one that has been confirmed not to have overlapping ARB rewards.

b. Some forum comments from Radiant’s previous STIP proposal urged us to focus more on lending and borrowing incentives. Radiant did not have the infrastructure to facilitate dual emissions at the time but is now available via Angle protocol. Regardless, we believe many of the campaigns discussed above performed well, and we believe we have a new suite of campaigns discussed below that have the capability to add utility, users, and TVL to Arbitrum.

New Plans for STIP Bridge

7. How much are you requesting for this STIP Bridge proposal?

1,426,022 ARB– 50% of the previous amount granted to the Radiant DAO.

8. Do you plan to use the incentives in the same ways as highlighted in Section 3 of the STIP proposal? [Y/N]*

N

9. [Only if answered “no” to the previous question] How will the incentive distribution change in terms of mechanisms and products?

While Radiant was pleased with the campaign results from the first round of STIP, market dynamics, and plans should always adapt to the current meta.

Many of the campaigns conducted in the first round were used to bootstrap liquidity or new markets with success, where they are now properly established and should be self-sustaining.

For this round, Radiant recommends focusing on new core markets and the impending Radiant v3 Innovation Zone (RIZ), a.k.a. isolated lending.

Core Markets

Radiant is confident these core markets represent the largest opportunity for the Arbitrum ecosystem, providing lend/borrow utility for these protocols and the highest upside in acquiring liquidity.

These are tentative reward figures. Given that the supply caps, interest rate parameters, and amount of RDNT emissions will be known closer to listing, they will be updated once further information is available. Flexibility is important to achieve the best results. If the above-proposed incentives are overallocated, Radiant will distribute them to other initiatives below, such as isolated lending for Renzo or Kelp ETH, or return unused ARB to the Incentives multisig as we have done previously.

Radiant will provide Dune analytics covering TVL and user growth for these markets.

weETH

Radiant is actively discussing this initiative with the Ether Fi team. They have voiced a willingness to collaborate on incentives and co-marketing to increase the success of this new market with a combination of Ether.Fi points and/or incentives.

There is an immense opportunity for Arbitrum to attract billions in LRT liquidity. Radiant is confident Ether Fi is leading the pack in terms of PMF, safety (oracles, withdrawals enabled), and on-chain liquidity.

Pending risk assessments such as supply/borrow caps and interest parameter recommendations from our risk manager, the market is estimated to launch around the time ARB grants will begin to be released.

GMX v2 gmBTC & gmETH

As mentioned above, it was unfortunate that we were unable to launch the GMX v2 initiative earlier. However, recent proposals from Aave & Chaos Labs will allow the devs the appropriate information to list these markets safely. In addition, Radiant could not previously support dual emissions but has now integrated Angle Protocol’s MERKL to facilitate the use of ARB as emissions to lenders and borrowers.

Based on the market size, we believe gmBTC and gmETH are great candidates for the core market. Pending risk assessments such as supply/borrow caps and interest parameter recommendations from our risk manager, the market is estimated to launch around the time ARB grants will begin to be released.

Radpie wstETH vault

Radpie is a yield optimizer built on top of Radiant and a SubDAO to Magpie protocol. Radiant is collaborating with Lido Finance and Magpie on this campaign. Lido has also agreed to match the requested ARB with incentives.

As the leading LST by a wide margin, we strongly believe this initiative will be successful with the combined co-marketing efforts of 3 major DeFi players on Arbitrum.

Radiant v3 (RIZ): Isolated lending

![]()

Approved by the Radiant DAO on January 11, Radiant is preparing for the launch of v3 isolated lending. The completed codebase is currently under audit with Blocsec, and the Open Zeppelin audit will begin on May 20. Radiant expects RIZ to be live in early July.

Check out the Radiant v3 teaser on YouTube!

The RIZ launch will line up with 50-66% of the duration of the STIP campaign, and incentives should be expected to be spent during this time frame of early July-August.

Radiant’s design includes a USDC RIZ vault, which automatically assigns USDC to isolated pools based on utilization and the highest yield opportunities. Radiant recommends bootstrapping this USDC vault with a portion of the ARB grant to enable users to borrow against isolated assets and allow for leverage.

Below is a sneak preview of the UI for RIZ:

Additionally, Radiant requests to use a portion of the ARB grant to bootstrap the Isolated assets, carefully chosen as leading tokens in their sectors with room for growth, and added utility of lending and borrowing. While the total ARB to be used is disclosed below, the individual ARB assigned to each asset will be carefully decided based on the market dynamics at the time of listing. If any of the below assets are unlisted before the end of STIP bridge, the ARB will be reassigned to listed assets or returned to the Arbitrum DAO.

Isekai dLP conversion incentives

Isekai is a design optimization platform that builds on existing DeFi infrastructure to enhance yield for liquidity providers, drive liquidity for its underlying protocols, and ultimately reduce friction for end users.

A campaign for Radiant to incentivize dLP (RDNT/ETH liquidity) deposits into Isekai on Arbitrum.

By incentivizing dLP deposits into Isekai, Radiant ensures that more dLP, and subsequently RDNT tokens, are locked up forever on Arbitrum. For Isekai, more dLP deposits will kickstart Isekai’s yield flywheel, bringing more users who seek optimized governance yield to Arbitrum. Radiant requests up to 50,000 ARB for this campaign.

Concluding remarks on Addendum Incentives:

Any unutilized ARB will either be reallocated to overperforming campaigns with advance notice via bi-weekly updates or returned to the Arbitrum Incentives multisig, as Radiant did previously in STIP.

10. Could you provide the addresses involved in the STIP Bridge initiative (multisig to receive funds, contracts for distribution, and any other relevant contract involved), and highlight if they changed compared to the previous STIP proposal?

Radiant STIP multisig:

0x712e3396F039243aBda1858B5b85cdCDD0878976

Angle Merkl distributor creator contract:

0x8bb4c975ff3c250e0ceea271728547f3802b36fd

Radpie incentives multisig:

0x294A419eb4c5ddd2dd7Fb3161489AFc5EeD9780A

- Could you share any feedback or suggestions on what could be improved in future incentive programs? What were the pain points, and what was your general evaluation of the experience?

While it’s important for protocols to submit proposals on how they plan to spend grants with KPIs and accountability, protocols with a proven track record should be given leeway to adjust spending in real-time as market dynamics and trends shift quickly in this industry. The arbitrum incentives workgroup appeared to allow this flexibility via bi-weekly updates.

The introduction of advisors and council members to normalize the submission and vetting process was a great idea, and Radiant wholeheartedly supported it.