Applicant information

- Name: HELIX

- Address (Headquarters): 112 Robinson Rd, #12-01, Singapore 068902

- City, State, Postal Code: Singapore, Singapore 068902

- Country: Singapore

- Website: https://helixfinance.io

- Primary contact Name: Jitendra Singh Jaitawat

- Title: Co-founder & CEO

- Country: Singapore

- Email, Telegram, Forum, & other methods of contact: Email : admin.helix@heli-cap.com | TG: @jsjaitawat

Executive Summary

Winner of the 2023 TADS awards for Tokenised Debt & Bond, HELIX is the first RWA DeFi protocol leveraging Big-data & AI to connect on-chain investors to sustainable & uncorrelated yields from real-world private credit.

Vertically integrated lending suite:

HELIX offers a comprehensive end-to-end lending suite that includes a KYC platform, a credit analytics platform, a primary loan marketplace, a planned decentralized credit scoring system, and a planned secondary loan marketplace designed for institutional and accredited on-chain investors such as DAOs, treasuries, crypto high net worth individuals (HNWIs), and digital asset yield funds.

Successful Web2 backing:

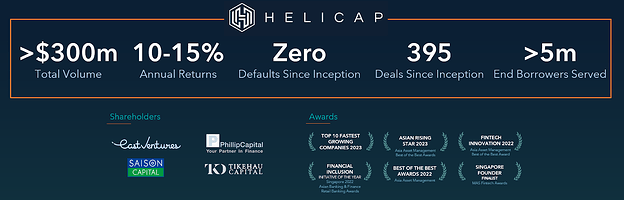

HELIX was incubated with Helicap, a leading ASEAN private debt and credit analytics platform known for its impressive track record of more than US$300m in deal volume. Notably, Helicap stands out as one of the few private credit platforms globally to maintain a perfect record of 0 defaults over the past 6 years since its inception. Helicap has won multiple fintech awards in Asia and is backed by prominent institutional investors such as Tikehau Capital with US$47bn in AUM, Phillip Capital with US$35bn in AUM and Saison Capital which is backed by Credit Saison, a Japanese financial services conglomerate with US$30bn in AUM.

Tenured debt and blockchain veterans:

Team is made up of veterans with > 80 years of combined experience in blockchain and fintech from Huobi Ventures, Citigroup, Nomura, Goldman Sachs, Morgan Stanley, Archipelago, JL Capital and Deutsche Bank.

Strong investor support:

Project is backed by prominent Web3 investors like Superscrypt, Saison Capital, Outlier Ventures, Emurgo Ventures, NewTribe Capital, Wave Digital Assets, Comma3 Ventures, YTWO Finance, Emoote Capital, CA Capital, Xtream Capital, along with angel investors such as CEO & COO of Wormhole Labs, Jason Lee (ex-COO of Algorand Foundation), Jackson Chan (Synthetix DAO Council & Co founder of Layer Labs) and Steve Lee (ex-Blocktower executive), among others.

Proprietary credit analytics:

At the core of this innovation is HELIX’s proprietary Credit Analytics platform, a Big Data solution adept at processing millions of loan data points to deliver near-real-time insights on credit and fraud. This platform’s defensibility lies in its comprehensive analysis capabilities, proactive fraud detection, and continuous post-investment monitoring, backed by six years of proprietary data across various lending categories and Southeast Asian countries. Furthermore, as the only RWA platform globally with a track record spanning over 6 years through Helicap’s business, which has allowed us to amass millions of important loan data points, protocol is uniquely positioned to incorporate machine learning models for default prediction.

Given the very institutional nature of offerings at HELIX that includes a lot of proprietary and confidential information, some details in this application form are not shared here on the public forum but a detailed dataroom has been prepared and will be sent to the Screening Committee via email for their review.

Key Information

1. Expected Yield:

9-11% + additional rewards in the form of HELIX native tokens

2. Expected Maturity:

12 months

3. Underlying asset:

Private credit - a diversified portfolio of senior secured loans

4. Minimum/Maximum transaction size:

Minimum: 100,000 USDC

Maximum: 10,000,000 USDC

5. Current AUM for product

USDC 3.5M. More details about the underlying portfolio AUM to be sent to the Screening Committee via email.

6. Current AUM for issuer

USDC 3.5M. More details about the underlying portfolio AUM to be sent to the Screening Committee via email.

7. Volume of transactions LTM

Details to be sent to the Screening Committee via email.

8. Source of first-loss capital

Details to be sent to the Screening Committee via email.

Basics and background

1. How will this investment improve Arbitrum’s RWA ecosystem?

Firstly, our product addresses the pressing need for high, stable and sustainable yield opportunities in the institutional DeFi space. We provide diversified yields sourced from real-world private credit assets, akin to MakerDAO’s approach with RWA. This strategy is poised to attract larger risk-averse DAO treasuries, offering yields derived from real-world assets, which presents a less volatile alternative to yields based on token emissions. Additionally, these yields are stable due to the lack of correlation of returns with both crypto assets and traditional public market risky assets such as equities and bonds, further enhancing their appeal to institutional investors seeking reliable investment options.

Secondly, we are poised to drive significant innovation within the Arbitrum ecosystem. Our proprietary Credit Analytics platform processes millions of loan data points, providing real-time credit and fraud insights, backed by six years of proprietary data from various lending sectors in Southeast Asia. With the unique position of being the sole RWA private credit platform with a track record of 6 years, we are able to leverage extensive loan data to incorporate machine learning for accurate default prediction, enhancing our private credit deal origination at HELIX for Arbitrum.

Thirdly, as we scale beyond Southeast Asia and APAC, where we are sourcing our immediate set of highly curated deals leveraging Helicap’s deal origination capabilities, we have a planned decentralized credit approver mechanism that will continue to ensure the quality of deals brought onto the platform. These credit approvers will not be random token holders; instead, they will comprise a thoroughly vetted panel of global credit institutions and individual credit professionals like CPAs and CFAs with a proven track record in the private credit space. They will be incentivized to perform credit due diligence. Leveraging HELIX’s proprietary credit analytics and other aspects of each deal, they will provide detailed credit memos. A deal will only be made available to lenders on the platform if a majority of the Credit Approvers have approved it. We envision that these approvers will be akin to real-world credit agencies such as S&P, Moody’s, and Fitch, where no single loan is approved by just one agency but by multiple agencies. Moreover, these approvers can be integrated with other future private credit protocols, enhancing their composability and utility.

Fourthly, as HELIX is targeting institutions, this will not only enhance the reputation of Arbitrum as an institutional-grade Layer 2 solution but also secure more sticky and long-term TVL that doesn’t dissipate like retail investments in a bear market.

Lastly, we are looking to address financial inclusion in emerging markets. These loans will support borrowers in underserved sectors such as consumer, agriculture, education, and SMEs, generating meaningful real-world changes.

2. Identify key management personnel and individual experience. Also include third parties utilized for managing assets and their qualifications.

We are a team of battle-hardened veterans with more than 80 years of combined experience across asset management, private credit, technology and blockchain from Goldman Sachs, Huobi Ventures, Citigroup, Nomura, Morgan Stanley, Archipelago, JL Capital and Deutsche Bank. We pride ourselves on our end-to-end, integrated approach, featuring dedicated teams across various functions such as syndicated loans, credit funds, marketing, HR, technology, operations and legal, business development, and blockchain.

A brief profile of some of the core team members:

Jitendra S Jaitawat - Co-founder & CEO

https://www.linkedin.com/in/jsjaitawat

Jitendra is the Co-Founder and CEO of HELIX. He is a seasoned industry leader with over 17 years of experience, primarily building financial products and services. Most recently, he served as the Founding CTO of Helicap, where he led the development of an award-winning proprietary credit analytics and investments platform that funneled the growth of Helicap to a leading Fintech platform in ASEAN with more than US$300 million in deal volume with zero defaults. Prior to that, he spent more than a decade at Goldman Sachs across Tokyo and Singapore, where he built and oversaw platforms managing hundreds of billions of dollars in AUM.

David Z Wang - Co-founder & President

https://www.linkedin.com/in/dzwgroup

David, the Co-Founder & President of HELIX and Group CEO of Helicap, has nearly two decades of investment banking experience with firms like Morgan Stanley, Credit Suisse, and Nomura. In 2016, he founded 33 Capital, a tech-focused investment firm in Southeast Asia, leading successful investments including a FinTech company that went public on the Singapore Stock Exchange. Recognized as a Top FinTech Leader by the Singapore FinTech Association in 2019 and a Singapore Founder Finalist at the MAS FinTech Awards in 2020, David leverages his extensive background in wealth management and venture capital to facilitate access to quality alternative investments. He holds a University Scholar degree from the National University of Singapore and a FinTech certification from MIT.

Caleb Lim - VP of Growth

https://www.linkedin.com/in/caleblimkl

Caleb, VP of Growth and a Founding Member at HELIX, has expertise spanning across TradFi and DeFi. Previously, Caleb was a pioneer at Huobi Ventures in Singapore, engaging in legal negotiations, equity and token investments, and post-investment management. He frequently shares his insights on the future of Real-World Assets on speaker panels, such as EthDenver, and is currently a mentor for Outlier Ventures’ RWA Accelerator Programme. Caleb’s career began in investment banking at Deutsche Bank, where he focused on leveraged finance and M&A transactions, participating in deals exceeding US$3bn. He holds degrees in Chemical Engineering and Business from the National University of Singapore.

Wilbert Johan - Strategy & Partnerships Lead

https://www.linkedin.com/in/wilbertjohan

Wilbert is responsible for Web3.0 go-to-market strategy at HELIX. Prior to joining HELIX, Wilbert was an investment analyst at VenturaxVentures where he worked to analyze startups in the blockchain and sustainability tech space. He is passionate about all things Web3.0 (DeFi & NFTs), and is actively involved in the Web3.0 space with a portfolio of over 100 unique NFT projects. Wilbert was an advisor for a Solana Blockchain gaming project on sustainable tokenomic design and GameFi integration and also advised another DeFi Option Vault (DOV) project on GameFi and NFT vault strategy, establishing key partnerships with other project founders.

3. Describe any previous work by the entity or its officers/key contributors similar to that requested. References are encouraged.

This is not our first startup. Our team has successfully built one of the leading private debt and credit analytics businesses in ASEAN, Helicap, which has originated over $300m in deal volume with a perfect record of 0 defaults over the past 6 years since its inception.

4. Has your entity or its officers/key contributors been subject to an enforcement action, criminal action, or defaulted on legal or financial obligations? Please describe the circumstances if so.

None.

5. Describe any conflicts of interest for your entity and key personnel.

None.

6. Insurance coverages, guarantees, and backstops Name of insurer or guarantor Per incident coverage Aggregate coverage

Details to be sent to the Screening Committee via email.

7. Historical tracking error in your proposed product, or similar to that being proposed Product 2024 YTD 2023 2022 2021

Details to be sent to the Screening Committee via email.

8. Brief reason for above tracking error

Details to be sent to the Screening Committee via email.

9. Please describe any experience your firm has in working with decentralized organizational structures

While the Protocol hasn’t worked directly with any DAO yet, but it has onboarded and worked with web3 native organizations and has experience navigating the KYC processes and other requirements in context of web3 native organizations.

10. What is your entity’s current assets under management, assets held in trust, total value locked, or equivalent metric for your legal structuring?

Protocol completed a successful pilot program on Ethereum mainnet a few weeks back with current TVL of USDC 3.5M.

11. How many of these assets held are present on Arbitrum One, if any?

Protocol has just very recently been deployed on Arbitrum One and is kicking off a pilot program on the Arbitrum ecosystem, as we speak.

Plan design

1. Please describe your proposed product, including a description of the underlying assets and, if more than one asset, the proposed allocation among assets and general investment guidelines. Where appropriate, include targeted maturity mix and credit quality. Attach supplementary documents as appropriate.

Details to be sent to the Screening Committee via email.

2. Do investors have any shareholder, investor, creditor or similar rights?

Details to be sent to the Screening Committee via email.

3. Describe the legal and contractual structuring for your product including regulatory bodies overseeing your business and the product and identifying all legal jurisdictions interacting with your product. Attach supplementary documents as appropriate.

Details to be sent to the Screening Committee via email.

4. Would Arbitrum’s assets be bankruptcy remote from your own entity and its officers/key contributors? If so, please explain the legal and contractual basis. On a confidential, non-reliance basis, provide any third party legal opinions to support the conclusions.

Details to be sent to the Screening Committee via email.

5. How are Arbitrum’s assets protected vis-a-vis the bankruptcy of the brokerage or applicable financial institution (e.g., bank deposit insurance, securities insurance, etc.)?

Details to be sent to the Screening Committee via email.

6. Does the Issuer issue more than one asset? If so, what is the priority relationship between different asset classes?

Details to be sent to the Screening Committee via email.

7. Provide a detailed cash flow diagram that shows the flow of funds from ARB/Fiat conversion, investment in underlying asset, pasyment of expenses, sale of underlying asset, and repayment (Fiat/ARB conversion), including the counterparties and legal jurisdictions involved.

Details to be sent to the Screening Committee via email.

8. Describe anticipated tax consequences (if any) in transacting on the underlying and/or receipt of yield.

Details to be sent to the Screening Committee via email.

9. Describe the process and expected timeline for liquidation of assets, if given instructions to do so by Arbitrum governance.

Details to be sent to the Screening Committee via email.

10. What amount of first-loss equity will Sponsor provide to ensure over-collateralization, how is the first-loss equity denominated, and what is the source of capital?

Details to be sent to the Screening Committee via email.

11. Describe the liquidity and stability of the proposed underlying assets, including anticipated settlement times from the sale of the underlying to the repayment of ARB.

Details to be sent to the Screening Committee via email.

12. If relying on the blockchain for any of the transactional flows, please describe any blockchain derived risks and mitigations.

HELIX manages blockchain-derived risks by adhering to stringent security protocols and ensuring audits are conducted prior to smart contract deployment. Separately, HELIX smart contract doesn’t pool any capital in the smart contract instead the flow of funds is directly between the LP wallet and the underlying issuer wallet which further reduces the surface vector of any smart contract related risks.

13. Does the product rely on any derivative product (swaps,OTC agreements)?

No.

14. List all the third party counterparties linked to your assets including and not restricted to prime broker if any, custodian, reporting agent, banks for derivatives or loans and provide primary contact details for the third party counterparties

Details to be sent to the Screening Committee via email.

15. Can you explain how is risk management (inv and operational) being done? Can you provide a copy of your risk management policy?

Details to be sent to the Screening Committee via email.

Performance reporting

1. What are your proposed performance benchmarks? If this is substantially different from the underlying assets, please explain why

Details to be sent to the Screening Committee via email.

2. Describe the content, format, preparation process, and cadence of performance reports. This should include proof of reserves, if appropriate. Please include a sample report.

Details to be sent to the Screening Committee via email.

3. Who provides the performance reports in respect of the underlying assets?

Details to be sent to the Screening Committee via email.

4. Describe any formal audit process and timing of such audits.

Details to be sent to the Screening Committee via email.

Pricing

1. Provide a copy of your standard contract, or one similar to what is being proposed here.

Details to be sent to the Screening Committee via email.

2. Fee summary: Inclusive of the full scope of services requested. Product Fee schedule If asset based Fee calculation for our plan if asset based Annual fee if flat fee Any other fees (including redemption or minting fees)

Details to be sent to the Screening Committee via email.

3. Describe frequency of fee payment and its position vis-a-vis payment priority compared with other expenses (i.e., cash waterfall)

Details to be sent to the Screening Committee via email.

Smart Contract/Architecture

1. How many audits have you had and name of auditors? Please provide a copy of reports.

Our smart contract code has been audited by OtterSec. Link to the audit report here: A Journey from HELIX Protocol

2. Is the project permissioned? If so, how are you managing user identities? Any blacklisting/whitelisting features?

Yes, HELIX is a permissioned protocol where LPs undergo KYC/KYB and other onboarding requirements. Post which, LPs are required to mint a soulbound KYC NFT that gives them gated access to the deals on the platform.

3. Is the product present on several chains? Are there any cross chain interactions?

HELIX is currently only live on Ethereum and Arbitrum One mainnet. There are no cross-chain interactions at the moment.

4. Are the RWA tokens being used in any other protocols? Please describe the various components of the ecosystem

HELIX LP Tokens (ERC-721) are not being used in any other protocols at the moment but we are in the process of exploring composability with other DeFi protocols (eg. Lending and Borrowing, yield aggregators etc.).

5. How are trusted roles/admins managed in the system? Which aspects of the solution require trust from users?

All sensitive admin actions in the protocol are governed by mult-sig approvals both for protocol global configurations as well as individual deal workflows to prevent any single admin user from executing any actions individually.

6. Is there any custom logic required for your RWA token? If so please give any details.

No, HELIX LP token is a standard ERC-721 token.

Supplementary

1. Please attach any further information or documents you feel would help the screening committee or ARB tokenholders make an informed decision.

Details to be sent to the Screening Committee via email.