SECTION 1: APPLICANT INFORMATION

Provide personal or organizational details, including applicant name, contact information, and any associated organization. This information ensures proper identification and communication throughout the grant process.

Applicant Name:

Sam Trautwein

Project Name:

Hourglass

Project Description:

Hourglass is a new DeFi primitive built around an EVM compatible orderbook. Hourglass’s combination of oracle based pricing and post trade settlement for makers makes it uniquely suited for cross chain swaps, stablecoins, and RWAs. Hourglass is live now at www.hourglass.money. For most stablecoin pairs hourglass is 90%+ cheaper than other solutions.

Team Members and Roles:

- Sam Trautwein - CEO, cofounder

- Trevor Morgan - cofounder

- Anon - SWE

- Dan Shiferaw - Founding SWE

- Dylan Nguyen - BD, operations

Project Links:

Mainnet is live at https://www.hourglass.money.

Gitbook: https://tristero.gitbook.io/hourglass-docs

Twitter: https://twitter.com/0x_hourglass

Contact Information

Point of Contact: Sam Trautwein

Point of Contact’s TG handle: @coastalism

Twitter: @futurenomics

Email: admin@tristero.xyz

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Team experience:

Sam Trautwein, CEO:

Stanford CS, YC Alum. Prior experience: Cofounder of Carbon, an early stablecoin company. Partner at Steel Perlot. Director of Strategy for Wyre, a leading crypto payments company. Seed investor in Ondo and Agora.

Reference is Nick van Eck of Agora. We encourage you to reach out to Nick - we are working closely with him and the rest of the Agora team.

Trevor Morgan, co-founder: Columbia Math. Partner at Tribe Capital.

Dan Shiferaw, Founding Engineer, former SWE at Youtube, crypto startup veteran.

Anonymous, Senior Engineer: Ivy League CS, crypto startup veteran.

Dylan Nguyen, Business Development: Stanford SymSys.

What novelty or innovation does your product bring to Arbitrum?

Hourglass’ core technical innovation is our on-chain EVM orderbooks which we call “Minute Markets”. On chain order books, while referenced in the Ethereum whitepaper, so far have not been viable due to Ethereum’s technical constraints (a large reason that liquidity in DeFi is largely centered around AMM’s). Our first live product is our cross-chain bridge which you can find at www.hourglass.money, but we view this protocol as a general liquidity solution for any assets that do not require on-chain price discovery, such as stablecoins and RWA’s.

Hourglass is well positioned for these applications due to superior security and capital efficiency than leading alternatives. By doing away entirely with on-chain pools, Hourglass eliminates the potential for pool hacks - perhaps the greatest security concern for DeFi liquidity solutions today. Our pool-less design is also dramatically more capital efficient than pool-based solutions; by matching on-chain demand to off-chain liquidity, we essentially do not have to pay an “overhead” for maintaining a large liquidity pool.

As a result, our cross-chain bridging fee is just 1bp - or .01% - per trade. In many cases, this is at least 90% cheaper than alternatives. As trades incur zero slippage and are not constrained by pool size, Hourglass is particularly effective for medium to very large trade sizes: Hourglass supports much larger orders than AMM based systems with far less capital, without ever putting user funds at risk. Our speeds are competitive as well: orders are batched into epochs and are currently settled every 5 minutes.

Our synchronous, delayed settlement order book system is a natural pairing for RWA and stablecoin projects. Imagine customers using eth on ARB to purchase and receive a RWA (like Ondo) through Hourglass: market makers would mint and disburse the RWA on demand with Hourglass handling matching and escrow, protecting both parties from counterparty (i.e. rug) risk. This provides a significantly safer + more capital efficient solution to pool based systems, as RWA/stablecoin projects tend to have very deep off-chain liquidity and derive almost no value from on-chain price discovery (a core feature of pool based systems that comes with distinct capital efficiency and security tradeoffs).

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes. Hourglass is designed to be a plug-and-play liquidity solution for any project needing to implement single or cross-chain stablecoin swaps. Natural use cases here are as a bridging solution and an on-ramp/gateway for RWA or stablecoin projects. Our long term vision is one where Hourglass provides a global liquidity layer that provides safe, cheap, and fast value transfer.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

As far as we know - no. While Hourglass does function as a bridge, our protocol design is fundamentally different thanks to our on-chain order books and a pool-less liquidity solution. Different design, of course, comes with different benefits and ideal use cases. A prime example of this is Hourglass’ function as a highly efficient on-ramp for RWA’s.

How do you measure and think about retention internally?

- Number of unique (active) wallets that place repeat trades.

- Target KPI: 25% of wallets placing return trades within a month.

- Proportion of fees paid by repeat traders

- Target: 30%+ of volume associated with repeat traders

- Integrations with other protocols

- In our long term vision, HG exists as a behind-the-scenes liquidity layer for dApps, ecosystems, and more.

Relevant usage metrics:

- Total ARB wallets

- Total new ARB users

- Percentage of ARB that make repeat trades

- Weekly and total ARB volume transferred

- Percentage of volume associated with ARB rebates

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?:

Yes

On what other networks is the protocol deployed?:

Optimism, Polygon, BSC, Ethereum, and Avalanche. Our protocol facilitates cross chain swaps, allowing users to move funds to Arbitrum.

What date did you deploy on Arbitrum mainnet?: [Date + transaction ID. If not yet live on mainnet, explain why.]

Feb 13

https://arbiscan.io/address/0xb7B4DADF35bDe8F795907641404FD28Ee106E307

Do you have a native token?:

Planned. We’re finalizing details but the token would be a governance token and function in a similar fashion to Curves.

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

None

Current Incentivization: How are you currently incentivizing your protocol?

We’re preparing to roll out our points system in the next few weeks.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

No

Protocol Performance:

Since launching our beta on January 16, we have done $1.9mm in total volume and $370k on Arbitrum. Transaction sizes are currently capped at $25k, increasing weekly.

Our bridging fees (just 1 bp - .01%) provide significant savings for Arbitrum traders, and are in many cases at least 10x cheaper than our competitors.

Our Dashboard here displays current Arbitrum-related metrics: https://www.hourglass.money/dashboard

Protocol Roadmap:

Our protocol is live; at this point our priorities for our roadmap are threefold:

- Reaching volume and user milestones.

- Expanding our supported chains and assets

- Integrating with channel partners

Our first priority, volume, is where we would most directly benefit from an Arbitrum LTIPP grant; we are hoping to supercharge user acquisition by providing gas and bridge fee rebates on our protocol. We’ve run some experiments with gas subsidies and found that charging users the full price of gas meaningfully lowers transaction frequency. Our point system, explained later in this application, will be live during the LTIPP grant period. We believe ARB rebates on fees, combined with our point system, would incentivize users to place large, consistent trades. As our fees are already best-in-class or near best-in-class for all of our bridge routes, we will be able to use ARB very efficiently. Key milestones here are 25mm, 200mm, and 500mm total ARB volume, as well as weekly volume milestones of 2mm, 10mm, and 50mm total ARB volume.

To our second priority, we are incorporating new assets and chains on a weekly basis. With our recent additions of FDUSD and DAI support, our range of stablecoins now cover 95% of daily global stablecoin volume. We will also be launching Base and CCTP support by EOM.

For our third priority, integrating with channel partners, we have a number of integrations and partnerships in the works - we would be happy to share information on those privately. We’re very focused on tokenized treasuries due to our designs compatibility with RWAs. Increasing our traction on Arbitrum increases our likelihood of securing partners to build with us on the Arbitrum ecosystem, further increasing Arbitrums TVL. We are hoping to hear the LTIPP council’s feedback on ideal projects on Arbitrum that we can support.

Audit History & Security Vendors:

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

It has not.

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size:

125,000 ARB

Justification for the size of the grant:

We will be using all funds for user gas and bridge fee rebates. Below we provide our fees, current ARB volume, volume projections, and lastly, expected total ARB gas costs.

To date, gas costs on Hourglass’ ARB trades have amounted to an average of 33 bps (.033%) per trade, or $2 USD. This consists of 30 to 60 cents in ARB costs to users per transaction and $1-2 in LayerZero send fees. Bridge fees are just 1 bp (.01%) additionally. (We believe it is important to note here that our batched settlement system will significantly lower user costs over time - with more trades, we will be able to batch several LayerZero messages together within each 5 minute epoch. Of course, we hope a LTIPP grant will allow us to reach this point much faster.)

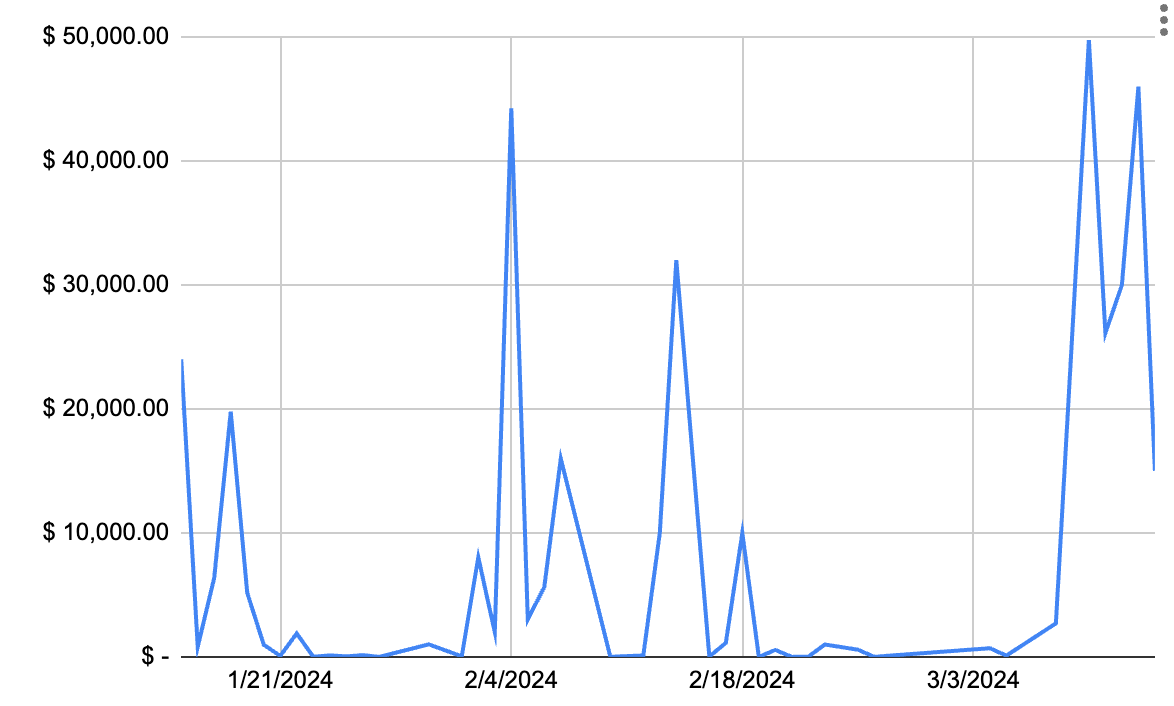

Hourglass Daily Volume on Arb

As of March 15th, we have supported $367,000 in total volume to and from Arbitrum over 232 total trades for an average trade size of ~$1.5k. $150,000 volume has occurred within the week of March 8-15. We are seeing consistent weekly volume growth, are doubling transaction caps each week (currently at $25k), and our market makers are currently ramping up their capital base by 10x. Considering these factors along with with our points marketing campaign launching by April 1 lead us to a conservative projection of $650k weekly ARB volume by April 22nd (LTIPP incentive period start date).

At a conservative weekly volume growth rate of 25% per week, we project total ARB volume of ~$253mm and weekly ARB volume of $11.8m by the end of the post-incentives grant period (14 weeks from the beginning of the incentives period). Utilizing our previously mentioned average trade size and gas costs and an ARB value of $2, we project ~185,000 ARB total in gas and bridging fees. As we do expect modest increases in trade sizes and decreases in gas costs, we are requesting 125,000 ARB.

These numbers align with our medium targets (further described later in this application) of $10mm weekly ARB volume and $200mm total ARB volume. As we are only using grant funds for gas and bridging fees and are returning any unused funds, ARB will only be spent if we are making progress on our KPIs.

Grant Matching:

N/A

Grant Breakdown:

Funds will be used to subsidize gas.

Funding Address:

0xBEa2a8C8797b8943412E1E8CCD65812d33Bc80d3

Funding Address Characteristics:

2 of 3 multisig with private keys securely stored.

Treasury Address:

N/A

Contract Address:

N/A

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives:

- Improve RWA liquidity and TVL on ARB by subsidizing bridging costs for market participants.

- Increase KPI’s of unique ARB wallets, weekly and total ARB volume, and % of wallets placing repeat trades.

Execution Strategy:

We will use LTIPP grant funds to subsidize gas for users on arb on a first-come first-serve basis. Our protocol charges a fee of 1 bp which goes to the market maker on each trade. Users still need to pay for gas. Especially for small transactions, this can represent a meaningful cost. We will be rolling out a points system soon, and ensure that at least one points season will take place entirely within the grant timeline.

We also wish to address any concerns of sybil and wash trading:

Systems where anonymous parties can profit through network interactions are prone to wash trading/sybil attacks. While wash trading cannot be prevented in a decentralized system, our proposed use of the grant does not allow any party (including Hourglass) to profit through network activity: the user receives no profit from placing a trade and still incurs a cost through the time value of money (the amount of the trade would be locked in our contracts for some period of time). We are hoping to use the grant to lower the cost of placing trades to 0. Due to the decentralized nature of our product there is no way we can prove that a wallet placing a trade has no affiliation to our team or investors. However, the program we have laid out in this application does not lead to any direct upside for either Hourglass or our team in engaging in such activity. We do not believe a higher standard can be achieved without violating the tenants of decentralization.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

Our points system will provide additional rewards for users who interact with our protocol on a consistent basis (weekly, monthly). Arbitrum users will be notified that we have received an LTIPP grant and that we can provide especially low priced swaps.

We will also provide our traders regular metrics on how much they are saving in our routes vs. other bridges in order to encourage them to return to our protocol. We expect the majority of users to remain so long as they are aware of their savings: Hourglass is significantly cheaper in most routes we offer, especially for medium to very large sized trades.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

Our KPIs are:

- Volume on Arbitrum (weekly and total)

- Quantity of active ARB wallets that have placed trades

- number of repeat trades (2, 5, and 10 trades within a 30 day period)

- % of all Hourglass trades placed on ARB: higher percentage indicates success of the rebate incentive.

Source of truth: https://www.hourglass.com/dashboard

Grant Timeline and Milestones:

We will provide bi-weekly marketing updates on our on-chain activity, and ensure that we have at least one full 6-week points season during the grant duration, with targeted marketing for Arbitrum users.

Milestones here are 25mm, 200mm, and 500mm total ARB volume, as well as weekly volume milestones of 2mm, 10mm, and 50mm total ARB volume.

Our middle targets (200mm total and 10mm weekly ARB volume) would prove that Hourglass can handle substantial volume for existing DeFi markets - just outside of current top 10 ARB bridges by volume. Our final volume targets (500mm total and 50mm weekly ARB volume) would place us close to leading bridges - just 25% outside of top 5 ARB bridges by volume. We believe these targets are achievable with gas rebates, as our ARB swap fees throughout our points campaign would be incredibly cheap ($10 on a $100,000 trade).

Bridge volume in Arbitrum, courtesy of DeFi Llama

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

In short: We seek to increase TVL and innovation on Arbitrum by providing best-in-class bridging fees and security, and providing an optimal, highly efficient liquidity solution for stablecoin and RWA projects (several of which we are currently in talks with - please reach out privately for more information.) We are working closely with several RWA projects, and believe it makes sense to build with them on Arbitrum, which we view as the leading DeFi ecosystem.

Most of today’s leading liquidity protocols are pool based: >90% of monthly bridging volume on Arbitrum comes from pool-based bridges. However, we believe DeFi is moving beyond pool based solutions and that Hourglass’s on-chain order-books will prove to be an important step in that direction. Pools work well for trustless price discovery but have a number of limitations: they are increasingly capital inefficient as trades sizes approach the total amount of the assets in the pool, cannot fulfill trades larger than the total pool size, and pose a serious security risk as on-chain pools are a honeypot for hacks.

In this application, we have frequently mentioned Hourglass’ core advantages over pool-based solutions: namely, capital efficiency and security. Here we highlight more specific distinguishing characteristics. Firstly, Hourglass provides batched post-trade settlement, which is the norm in most mature markets for reasons of 1) liquidity and 2) counterparty risk. This allows for efficient arbitrage between any off-chain liquidity source and DeFi. Market makers are able to lock in a price for a quantity of an asset and then have a fixed amount of time to secure the other side of the trade. Smart contracts handle escrow risk, making the trades trustless for takers. Secondly, Hourglass is able to bridge off-chain liquidity into DeFi very efficiently, with trade sizes theoretically capped only by the depth of off-chain liquidity. This is why we believe Hourglass is the best solution to date for projects such as RWA and stablecoin projects with very deep off chain liquidity and no need for on-chain price discovery. By providing a liquidity and settlement onramp - some of the most fundamental and challenging needs of such projects - we hope to encourage these projects to build on Arbitrum. We believe Arbitrum has the potential to play a large role in RWAs and hope to be a part of that narrative.

Lastly, we will provide a broader perspective of our benefits for 1) DeFi projects and 2) DeFi participants:

Poor, expensive liquidity is a major hurdle for most early stage DeFi projects. By providing a secure and highly capital efficient liquidity and settlement solution, Hourglass allows DeFi projects to save fees, focus on innovating in their area of expertise, and pass savings onto their users.

Providing an improved liquidity solution will also increase the rate of DeFi participants migrating onto Arbitrum. Expensive, slow, and/or difficult bridging is a key UX bottleneck for getting users onto any chain. As our bridge makes this process cheaper and easier (and more attractive by way of our points campaign), users will more readily migrate funds and activity onto ARB, increasing ARB’s TVL.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 39. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, no.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting]

Yes, we will provide bi-weekly updates on the Arbitrum Forum that references this dashboard.

First Offense: In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?: [Y/N]

Yes