Overview

With STIP Round 1’s recent conclusion, the Jones DAO team wants to guide the Arbitrum community through a look-back at how this process impacted the protocol.

Before diving into the review, Jones wants to first thank the Arbitrum DAO, all DAO delegates who reviewed the proposal, and the Arbitrum DeFi community for supporting Jones.

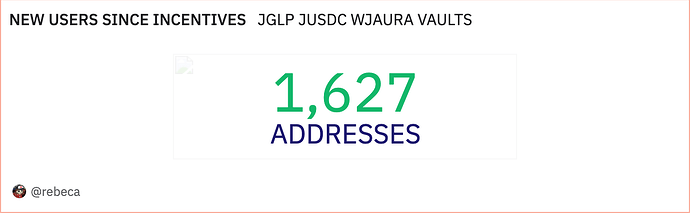

During the STIP Round 1 campaign, Jones recorded very substantial growth in key metrics such as TVL & user growth.

The goal of Jones’ STIP campaign was always to support users of Jones while introducing more stablecoin & yield strategy utility to Arbitrum. As you take a look at the metrics and breakdowns that follow, it will be clear how beneficial the STIP campaign was in satisfying both of these goals.

Protocol Metrics

Here’s a look at some of the most important protocol metrics that experienced significant change:

Source: https://dune.com/rebeca/jones-dao-stip-performance

For Jones, metrics like user growth and TVL are more important than fees or transactions. Other protocols such as AMMs or Perp DEXs may rely more heavily on transactions or fees to track performance, but Jones strategies are not intended to have much interaction from the user on a day-to-day basis.

As you can see from the graphs above, STIP Round 1 positively affected Jones’ TVL & user growth in a big way. TVL rose more than 100% over in the first month of STIP and stayed that way until the conclusion of STIP at the end of March.

During the campaign, we also welcomed over 1,600 new users and have continued to see sustained user activity past the end of STIP. Jones experienced 1 year of growth in just 4 months.

Breakdown by Strategy

jGLP

During the Jones STIP campaign, jGLP saw a remarkable TVL increase from $8.8M to $20M, marking a 125% growth. This surge was fueled by a robust rewards plan and the appreciating value of GLP component tokens. jGLP emerged as the top vault for GLP, providing liquidity for GMX V1 users and demonstrating an attractive alternative to ETH LSTs.

Source: Jones - Stats

The focus on jGLP in the STIP rewards distribution plan complemented its stellar yield performance. The strategy surpassed yield expectations with an average APY of around 30% from November 2023 to March 2024. This success not only pleased holders but also injected value back into the Arbitrum ecosystem. The campaign highlighted the viability of jGLP as a high-yielding and stable option, which outperforms ETH staking derivatives.

jUSDC

Like jGLP, jUSDC also experienced an impressive increase in TVL. Before STIP, jUSDC TVL was around $5.5M and rose to over $11.5M. This represents an incredible 110% increase in TVL, nearly on par with jGLP.

This rise in TVL meant that new USDC holders found value in Jones’ strategy offering when compared to the many other stable strategies across the ecosystem. In the future, Jones strives to be recognized as the bedrock of decentralized yield, exceeding the rates of yield instruments such as sDAI & RWA issuers while providing a crypto-native & composable experience to users.

jUSDC also became much more widely used in lending protocols across Arbitrum during this campaign. Savvy, Dolomite, and Rodeo all experienced very high utilization of their jUSDC markets during STIP Round 1.

jAURA

In relative terms of bringing new tokens to Arbitrum, jAURA was by far the most well performing strategy out of the three. The vast majority of pre-existing wjAURA tokens on ETH Mainnet were bridged over to Arbitrum because of the STIP program. Moreover, many jAURA positions were converted into wjAURA and brought over, highlighting how well the rewards plan worked for that type of strategy user.

During the STIP Round 1, jAURA:

- Nearly doubled in amount of AURA locked

- Further solidified its place as the #1 vlAURA strategy

- Distributed ~675,000 AURA to jAURA users

Source: Jones - Stats

jAURA has retained the vast majority of the locked AURA that came into the protocol during the STIP campaign, and has grown even larger since.

Source: https://defillama.com/protocol/jones-dao

ARB Distribution

What Went Well

From sentiment garnered throughout the Jones community & the greater Arbitrum ecosystem, it seemed that users were pleased with the way Jones’ STIP campaign was run.

They were able to easily deposit their tokens in our STIP farms to begin earning rewards on Day 1 with no hiccups. Claims were smooth and simple, and reward tracking was available on Jones as well as in wallet tracking applications such as DeBank.

Since the vaults have a very unique incentive structure, Jones farmers were much more likely to stick around during the campaign rather than hop around to a bunch of different protocols.

What Would We Change

One issue with protocol growth during this campaign was the lack of retention after the campaign ended. This was common among many protocols, but Jones was among those hit the hardest. In the Jones team’s opinion, since user behavior shows preference for GMX V2 over GLP, users more than likely swapped out of jGLP after the campaign to migrate over to GMX V2. Likewise, of the many stable strategies available to users, jUSDC may not have been attractive enough to keep users engaged. If allowed to participate in a future campaign, incentivizing our new GMX V2 strategies, which are set to arrive very soon, would be a priority.

Another change would be deciding not to incentivize the jAURA strategy.

There are two major reasons:

1.) The jAURA strategy is already extremely high performing

2.) It was the farm that had the most outsized amount of rewards flow to whales.

Those rewards would be better spent going towards new launches such as the GMX V2 strategies.

This process was a great learning opportunity for the Arbitrum DAO & Jones DAO. In the coming weeks, Jones will look to release a proposal for the STIP Bridge program should it pass governance.

Looking forward to continued participation in Arbitrum DAO grant programs!