Hi, this is Brook from TiD Research. This is a high-level discussion with many details still to be clarified, but I find the exploration quite compelling.

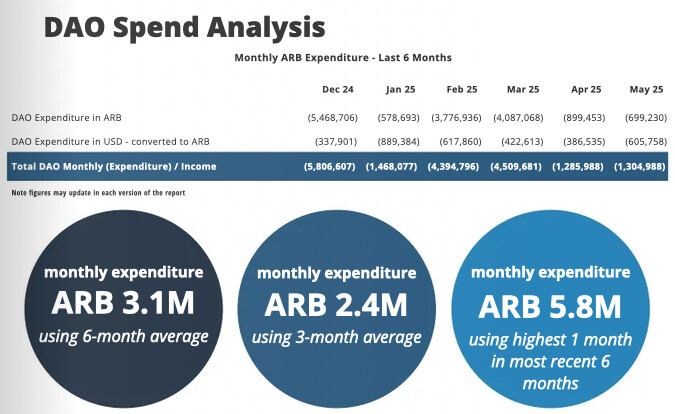

Instead of framing this as a pure ARB buyback, we could view it as a mechanism to offset the persistent ARB sell pressure caused by DAO expenditures. According to the token flow report, the DAO has spent an average of 3.1M ARB per month (~1% of circulating supply) over the past six months—a meaningful amount.

However, I agree with @GFXlabs: if the DAO continues to sell ARB to raise stablecoins for expenses, borrowing stablecoins via bond issuance to then buy back ARB, only to sell it again later, is inefficient. A better approach would be to use stablecoins raised from the bond issuance to directly fund part of the DAO’s expenses , thereby reducing the need to sell ARB.

One of the most important factors why Microstrategy can be so successful is that it provides those who are too conservative to hold BTC directly at the moment but still want to be exposed to the potential upside a risk-remote instrument to invest. The bond reduces the risk of capital loss, and the embedded written call option provides upside exposure.

Even though the underlying of the bond is essentially BTC and the asset corresponding to the option is MSTR, but they’re highly correlated and move in the same direction most of the time. MSTR holders seem not too worried about the embedded option being triggered as it’s only possible when the price of MSTR goes up by a lot to cross the conversion price, and the selling pressure following the redemption will be most likely to be absorbed by the organic market demand.

So I do think we might be able to copy the Microstrategy model and apply it on ARB to a certain extent. We can look at the issuance of the bond as a way to give TMC enough time to accumulate yields from stable coin investments.

Ideally, if we can really structure the bond to set coupon rate at 0%, we can use the fund raised to cover the DAO monthly spending and at maturity use the yields earned by TMC to repay. The arrangement might be able to reduce selling of ARB.

Overall I think this is a very meaningful discussion, but there’s a lot to be confirmed.

Convertible Bond Terms & Option Design

Would it be possible to share a set of example terms for the convertible bond? For instance:

- What is the indicative conversion price and conversion ratio?

- Given the plan to issue zero-coupon bonds, how do you envision structuring the embedded option to ensure investor appeal without offering a periodic yield?

- Are there any benchmarks (e.g., MicroStrategy, Coinbase’s convertible bonds, or DeFi-native deals) you’re using to inform pricing and term design? It would be helpful to understand the rationale and trade-offs.

Sizing & Buyback Schedule

Is there a target issuance size under consideration? If the primary goal is to support the ARB price, one reasonable framing might be to offset ARB emissions (~180–200M ARB over 12–18 months). This could help define:

- The buyback size and schedule: Will it follow a fixed monthly schedule, or adjust dynamically based on emission flow or price volatility?

- Will there be a public buyback framework to ensure transparency and avoid front-running?

Underwriting & Demand Discovery

- Would it make sense to build a soft orderbook first by gauging institutional interest in the bond issuance? This would help calibrate demand and optimize pricing.

- Who would be responsible for underwriting, marketing, and distributing the bonds?