SECTION 1: APPLICANT INFORMATION

Applicant Name: Product Lead

Project Name: Rage Trade

Project Description:

Rage Trade is a multi-chain perp aggregator that works across all compatible chains (EVM L2s, L1s, AppChains, Cosmos, etc).

We offer a streamlined trading experience, allowing you to select the optimal trade routes to open leverage trades.

With the Rage v2 aggregator, you can enjoy a multi-perp, multi-chain experience with a UI/UX you are historically familiar with.

Our product offers:

- Aggregated liquidity across all perps.

- Best routing: best price, funding rates, cheapest fee, and token rebates.

- Enhanced bridging across multiple chains and assets.

- One referral link across all perp markets.

Team Members and Roles:

- Product Lead - Founder

- Fin Quant - Lead, Business Development

- Fin Dev - Lead Engineer

- Success Daniel Ndu - Data Analyst

- Frontend Dev - Frontend Engineer

- Proto Dev - Backend Engineer

- Senior Dev - Solidity Developer

Project Links:

- Website - https://www.rage.trade/

- App - https://www.app.rage.trade/

- Twitter - https://twitter.com/rage_trade

- Discord - Discord

- Github - Rage Trade · GitHub

- Docs - https://docs.rage.trade

Contact Information

Point of Contact: Product Lead

Point of Contact’s TG handle: Telegram: Contact @crypto_noodles

Twitter: https://twitter.com/crypto_noodles

Email: productlead@rage.trade

Do you acknowledge that your team will be subject to a KYC requirement?: [Yes]

SECTION 2a: Team and Product Information

Team experience:

The Rage Team comprises dedicated teammates led by Noodles, who started talking about perps on Twitter, showing off how much he knows about DeFi. With that as a starting point, he pulled in some of the best developers. We’ve rolled out cool stuff like the 80/20 recycled liquidity Tricrypto vault, the Delta Neutral trader PnL hedged GLP vaults, and now our Rage V2 Aggregator. We’re all about genuine innovation, even without launching a token. This shows how committed we are and that we’re ready to make good on everything we’ve promised in this proposal.

We are one of the earliest projects on the Arbitrum ecosystem and all our product launches have begun on arbitrum.

Our team has also successfully designed and implemented incentive programs, such as the one we currently run on GMX v2, offering an additional 25% in addition to up to 75% open/close fee rebates provided by GMX. Our GMX incentives started on 2024-01-03 and are still ongoing.

During this incentive program, volume has risen 668% from the time incentives started to an all-time high of $26.6m.

Source: Dune Analytics

What novelty or innovation does your product bring to Arbitrum?

Rage Trade v2 presents a trading experience substantially closer to that of centralized alternatives as we offer services like best price routing (similar to centralized prime brokers and aggregators). We also aggregate competitions, incentives, and referrals — making the experience unified like a centralized exchange.

Also, with Rage, users are assured of consolidated access to liquidity and multiple perp routes on arbitrum combined with a simple user interface.

Our novel approach of prioritizing users and their experience has yielded positive results, with more than 1,600 new traders onboarded to Arbitrum through our integrated markets since our launch barely four months ago.

Our arbitrum-based markets (GMX v1, v2) have also witnessed more than $200m in trading volume.

Source: Rage Trade V2 - Stats

Is your project composable with other projects on Arbitrum? If so, please explain:

At Rage Trade v2, we’ve embraced composability as a core principle of our design and functionality, especially within the Arbitrum ecosystem. Our platform is engineered to be a one-stop shop for traders who wish to make perpetual trades on Arbitrum.

To foster composability, we offer an easy-to-use SDK that perp protocols can easily use to get onboarded on our aggregator.

As we onboard more arbitrum perp markets, traders can be assured of deeper, consolidated liquidity and trade routes — ultimately leading to more composability on Arbitrum.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

We primarily compete with other aggregators like MUX, LogX, and Unidex.

Rage stands apart primarily because we have no liquidity pools; thus, we do not compete directly with the perps we aggregate. We are a pure aggregator, and this directly benefits our users as they can be assured of a broader range of perp markets than our competitors.

Furthermore, we focus on user experience by making the best aggregation experience possible through best price routing, aggregated incentives/competitions, and a singular referral system.

How do you measure and think about retention internally? (metrics, target KPIs)

We measure retention values via our Rage V2 Stats dashboard on Dune.

The dashboard contains the following metrics:

- Daily Active Users

- Daily User Growth

- Daily Transaction Count

- Daily Transaction Fee

- Trading Volume

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan: [Yes]

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?:

The first iteration of our product had GMX, which is native to arbitrum. Currently, we have four dex perp markets integrated (two of which are native to arbitrum — GMX and Hyperliquid).

Our Hyperliquid integration went live on the 15th of February: https://x.com/rage_trade/status/1758099879862391065?s=20

On what other networks is the protocol deployed?:

Rage currently integrates protocols deployed on Arbitrum and Optimism. Below are the protocols we support by chain

- Arbitrum: GMX v1 & v2.

- Optimism: Synthetix

- Appchain: Hyperliquid

What date did you deploy on Arbitrum mainnet?:

Rage does not have any contracts deployed. However, our first integration of an arbitrum-based perp market went publicly live on 30th November 2023.

See: https://x.com/rage_trade/status/1730225622515937548?s=20.

It is also important to note that contracts we had previously deployed do not play any role in our V2 and, as such, do not count.

Do you have a native token?:

No, we are planning a token generation event in June/July 2024. Hence, users who are onboard due to the LTIP incentives we roll out will be rewarded with Rage Tokens at the token generation event.

Furthermore, we will announce our point system by the end of March with more details about our TGE.

Past Incentivization:

Yes, we have received a grant from the Arbitrum Foundation and GMX. The grants are being used to offer 25% trader fee rebates. We intend to continue to run this 25% trade fee rebate and eventually slow fee rebates down as we ramp up our trader competitions.

On the other hand, we got a grant from GMX, which is being used in the following ways:

- 25% rebate of open/close fees on GMX v2 trades: 13,000 ARB (Used so far)

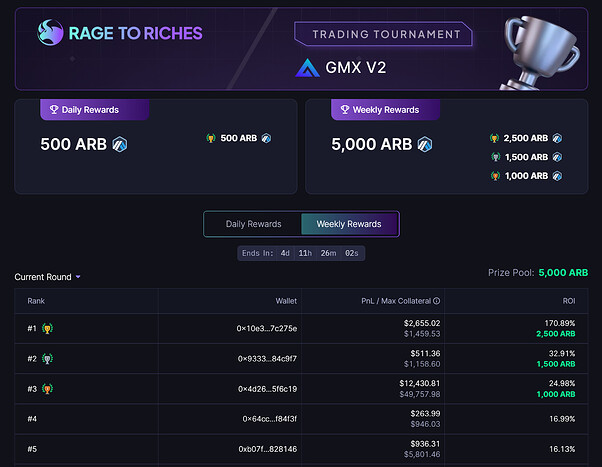

- Weekly and Daily Trading competition starting 28th February: 5,000 ARB weekly and 500 ARB Daily

Current Incentivization:

We are currently running an incentive program for our GMX v2 market. The program offers 25% in open and close fee rebates for GMX v2 trades.

When combined with the up to 75% fee rebates natively offered by GMX, traders could be experiencing free trades on GMX v2.

The incentives have proven instrumental as trader volume has greatly increased so far.

Some key stats:

- Between 14 February and 20 February, we hit a weekly all-time high of $26.6m traded on GMX v2 — a 668% increase in volume since the program’s start.

We also launched a weekly trading competition on February 28th, 2024, and will spend 5,000 ARB weekly and 500 daily on it.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

Yes, we have received a grant from the Arbitrum Foundation and GMX. The grants are being used to offer 25% trader fee rebates. We intend to continue to run this 25% trade fee rebate and eventually slow fee rebates down as we ramp up our trader competitions.

Protocol Performance:

Rage Trade v2 was publicly launched on November 30th, 2023. Since then, we have achieved the following:

- Over $240 million in cumulative volume has been traded across all the markets we aggregate. (More than 90% of this volume is from arbitrum markets)

- Onboarded over 1800 traders. (More than 90% are onboarded to the arbitrum markets).

- There have been over 27k trades across the markets we aggregate, with more than 50% occurring on our integrated arbitrum markets.

- We have swiftly released a lite and pro version in response to our user base.

Source: Rage Trade V2 Stats

Protocol Roadmap:

Over the next 12 months, we will integrate all perp protocols available on Arbitrum.

More specifically, we want to integrate three more arbitrum-based exchanges besides GMX in the next three months.

We will incentivize users to trade through all arbitrum perp markets as we integrate them.

Audit History & Security Vendors:

Rage Trade Aggregator has been audited by Peckshield. You can view the audit report here.

Security Incidents:

None

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 1,250,000 ARB

Justification for the size of the grant:

Once granted, we will use the grant to host multiple weekly and daily trading competitions. Below is a breakdown:

| Breakdown | Total | |

|---|---|---|

| Daily Trader Competition | 8.9k ARB * 90 days | 800k ARB |

| Weekly Trader Competition | 50k ARB * 9 weeks | 450k ARB |

We are already running trading competitions on a small scale with remarkable levels of success.

On the opening day of the trader competition, we made a record-high daily trading volume of $8.8m, with another record set days later of $10m.

Using a fraction of the 100k ARB grant we received from GMX, we have generated more than $240m in volume since we started distributing incentives to GMX v2 users.

With a 1.25m ARB grant, we can attract traders and scale our volumes compared to what they are now.

Grant Matching:

NIL

Grant Breakdown:

The grant given to Rage Trade will be 100% allocated for user rewards — primarily incentivizing trading via trader competitions. The primary goal is to boost trading activities and increase volume on the Arbitrum chain. Our focus on trading competitions rather than rebates is because competitions can significantly benefit smaller users.

Since we have designed our trading competition to be ranked by ROI, smaller traders can have a chance and be more incentivized to participate.

We will run daily competitions for 90 days and weekly competitions for nine weeks.

Funding Address: 0xee2A909e3382cdF45a0d391202Aff3fb11956Ad1

This is our Arbitrum Multisig, which is separate from our core treasury address. This address is a 3/4 multisig consisting of core contributors/treasury controllers. All wallets are hardware signed with keys stored in cold storage. The multisig is able to accept and interact with ERC-721s.

The signers are:

- arb1:0x507c7777837B85EDe1e67f5A4554dDD7e58b1F87

- arb1:0xc30603461Be4C49CF8076797C18F48292fFDe03A

- arb1:0xd3FB3eD59e5A7674003625241551A6Ffa63d2C50

- arb1:0xF16E2dB1102e0067bAB490fF1EF23da2B3D30964

Treasury Address:

NIL

Contract Address:

NIL

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Clearly outline the primary objectives of the program and the Key Performance Indicators (KPIs), execution strategy, and milestones used to measure success. This helps reviewers understand what the program aims to achieve and how progress will be assessed.

Objectives:

The goal of the grant is to:

- Increase trading volume on Rage Trade (and thus on Arbitrum-based DEXs) through trader competitions.

- Promote the trading competitions using marketing tactics like those effectively leveraged by other successful exchanges.

Execution Strategy:

The incentives will primarily be sent to the wallets of winners of the trading competitions.

Only traders trading via our Arbitrum markets will be incentivized. In our trading competition, the playing field is more level as we will use ROI to measure trader success during the competition, similar to the technique used by GMX Blueberry Club. This ultimately increases inclusion since retail and smaller players can participate in these competitions.

We will follow three simple processes to implement the proposal:

- Initiate trading competition. Set up Dune dashboards or subgraphs for metric tracking, and announce the initiative.

- Regular Updates and Reporting: Monitor and adjust based on platform performance, trader engagement, and community feedback.

- Review and Analysis: Conduct a thorough post-implementation review to identify improvements and insights for the Arbitrum ecosystem’s growth.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

Ultimately, the trader competition will serve as a way to onboard users while we deliver a superior user experience that drives user retention.

Rage Trade’s perp aggregator facilitates trading against deep on-chain liquidity that is unified across various perp DEXs. Users benefit from access to the collective liquidity pool, ensuring ample trading opportunities and improved market depth.

Our platform simplifies trading with a unified view and a user-friendly experience. Additionally, the platform offers ease of moving funds from other chains we support onto Arbitrum, eliminating unnecessary complexity and reducing barriers to entry to Arbitrum.

Finally, the trading competition will kick off a flywheel of trading activities on Rage’s arbitrum markets that could fund future trading competitions, making the process self-sustaining.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

Our main goal is getting users who primarily trade on centralized exchanges to trade through Rage via trading competitions ranked by ROI, which are fairer to small traders. We will measure the success of our efforts primarily by trader volume, fees, and users onboarded on arbitrum-based markets we integrate.

Currently, we have:

- More than $240 million in volume (>$190m from arbitrum-based perp dexes)

- Over 1,800 users onboarded with (>1,600 users on arbitrum markets)

All stats will continually be published on Dune.

Grant Timeline and Milestones:

| Milestone | Source of Truth | Deadline |

|---|---|---|

| $90m | Rage Trade v2 Stats/Onchain Transactions | Month 1 |

| $150m | Rage Trade v2 Stats/Onchain Transactions | Month 2 |

| $250m | Rage Trade v2 Stats/Onchain Transactions | Month 3 |

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

The grant will improve our efforts in onboarding users onto Rage Trade and the markets we aggregate. Up till now, the majority of our trading activities have been on arbitrum-based dexes, and we expect that the trading competition will cause an explosion of new users into the Arbitrum ecosystem.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream? [Yes]

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 10. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, we agree to comply.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting]

Yes, we will provide bi-weekly updates. Real-time updates will be on our Dune dashboard.

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?:

Yes