Overall have had an overwhelmingly positive experience with Ramses, and believe they deserve a grant and hope for its success.

Have voiced thoughts and concerns privately, but I think would be good to be addressed in public -

Would it be possible to release an outline or a model of how it would play out and the efficiency behind it, given current parameters, without assuming price goes up?

Statistics like ve voting apr, partner bribe recapture rate, emissions, weekly voting incentives to emission dollar value, etc would be helpful.

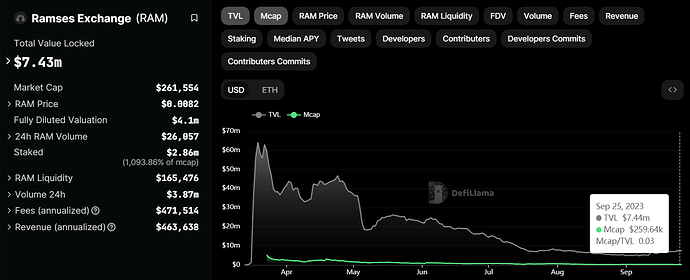

I think most people in this conversation agree that Ramses promotes efficient liquidity and has high volume, and is an addition to the network overall.

To me the question to voters are two things at large:

- Does the Solidly flywheel work?

- Even if it does, is it fundamentally right to give a grant whose primary utility is to pump the token?

I truly believe that the flywheel works. But is it possible to say the same for average ecosystem participant? The average voter? Again, is arguing “well, the token will pump” as one of the fundamental features of why this grant is effective for the ecosystem convincing?

Unless liquidity is incentivized externally (which clearly isn’t the desire here), then money is being handed out exclusively to tokenholders while the liquidity providers earn the exact same amount as before (the weekly emissions).

To state otherwise would be assuming that since there are more incentives distributed to lockers, people will buy and lock, price will go up, incentives received by users will be worth more, people provide more liquidity, fees are higher, so on so forth.

Of course, the bull case is that as a result of this flywheel, more people will buy and lock, introducing new users who commit four years of a long term vested interest in the overall Arbitrum ecosystem.

It’s easy to convince a small subset of partners and believers that this model works, because we invested a lot of time into studying and learning about the system.

Many others won’t feel the same - and I hope that some projections with hard numbers can be offered by the team to clarify its vision and how it will help the ecosystem grow at large.