Could I know where the data table come from? It from Defilama? Thanks.

Sure. It’s GeckoTerminal from CoinGecko and the second one is from DefiLlama.

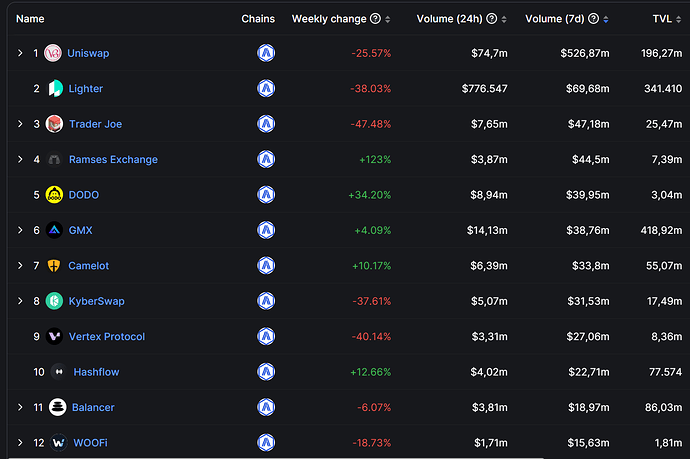

Yes, absolutely. If Ramses can achieve all that without any external stimulus, imagine what it can do with it. Regarding your market cap metric… once again it’s not a good one to measure a DEX’s worth. If you want to use it in any tangible way you have to calculate SOTV/MC (share of trading volume/market cap), as an example Ramses has .26m of mcap with 3.034m volume, which gives SOTV/MC of 11.66. Compare it to Camelot which has an mcap of 9.85m and trading volume of 4.918m which gives an SOTV/MC of 0.49. Just from those values alone you can tell that Ramses is extremely undervalued when looking at what it achieves with it’s extremely limited resources compared to Camelot, which already received a substantial boost from the ecosystem.

I’ve seen this thrown around a lot, and I think it’s completely wrong. Both are trying to do the same thing, and pretending that they’re completely different is a delusion.

I made an argument against the usage of the market cap metric some 40 messages ago. TL;DR, its far too basic to make a decision solely upon it.

DB from DefiEdge here. To chip in a little here, Ramses is one Great projects on Arbitrum. Working with them so far now, and all I can say is they still have a lot In store bring into the Arbitrum Ecosystem.

The fact that their reward system is permission whereby they’re offering immediate earnings when a position is created which is a great deal .

Also, they prioritize security which is one Big Factor affecting the whole Defi Ecosystem as a whole recently.

Can people read the proposal properly for once? It’s clearly stated 100% of the ARB any partner protocol receives will be recycled and rebribed. You are suddenly obviating the fact that when there is ARB matching, the protocols will bribe more money from their own funds to compete and match it, injecting more money into the ecosystem. Protocols that are building on Arbitrum. Thats the literal whole point.

100% of the ARB will land in the hand of users participating. Everyone can participate in the same “bribe distribution marketplace”, and there is no “ramses friends” benefiting in any way or form as some claim here. Its fully open for everyone to participate, including new protocols as Ramses constantly onboard new protocols that want to bribe.

All Ramses is vouching for – this is a much more healthy distribution since it will land in users aligned with Arbitrum success (they are literally locked for 4 years) instead of mercenary rented liquidity that will leave as soon as the dump free tokens are gone.

In any case, time will tell, and we already know that giving free dump tokens to LPers has never ever worked to provide any value – whereas here we have the choice to explore a potentially better route.

The point is that recycling is a terrible way to allocate ARB incentives. There could be multiple scenarios where the ARB allocated is kept entirely by the ve holders.

You don’t get it – recycling is precisely the solution to pool2 emissions rented liquidity being useless. It incentivizes participating protocols and users to inject more money from their own funds to catch the matching and have good bribe efficency.

By definition, there is literally no worse way to distribute anything than giving 100% of it to LPers in exchange for 0 participation or alignment. What vote bribing does is create a marketplace for the grants that is much more capital efficient than just giving it away for free.

I’m not sure if you are serious by valuing a DEX performance by the marketcap of the incentive token. Also, 91% of RAM is locked so your metric doesn’t even make sense (FDV is $3.5m+)

Anyhow, it barely has any correlation in most cases. Biggest volume AMM in the planet (UniV3 CL) doesn’t even have an incentive token. That means the marketcap of their incentive token is $0.

Only thing that matters when valuing a DEX is performance in terms of TVL/volume and fee generation, as it’s expected to scale somewhat linear with more adoption.

Atleast those ve holders are locked for 4 years and are actively participating in the ecosystem. Alternatively, incentivising LPs is a short sighted solution which will be farmed and mercenary capital will leave off once arb incentives are over. And you can’t really expect the mercenary LPs to hold arb. Most will dump as fast as they can. Pretty sure a bunch of other protocol’s proposals on this forum may have suggested to incentivise LPs, which is eventually going to get farmed and dumped.

A lot of replies here are talking about Ramses proposal being disingenuous and trying to prop up their protocol numbers, do you really believe all other protocols are 100% altruistic and not asking for grants without getting any upside for their own products/protocols? With grants to any protocol of course there is going to be increase in value for the said protocols which by extension will bring value to Arbitrum.

PS: Would suggest anyone who doesn’t understand the Solidly model’s profitability fully to check out the below article

Indeed it appears highly profitable for Ramses, but not so much for Arbitrum holders.

Are Ramses holders not Arbiturm holders? And why is the expectation that no new users are going to come to Ramses? imo this seems a bit short sighted

I think that always giving the tvl graph or the price as an argument is not always relevant. Indeed Ramses was a victim from the start, like a good number of ve(3,3), of mercenaries who simply came to farm and dump their tokens. Having a lot of TVL is good, making sure it is used is better, Ramses has one of the best ratios currently.

A lot of work has since been and is constantly being done by the entire team to improve the model in order to correct certain gaps to gradually make their DEX more and more efficient, which, on certain aspects, allows them to be as competitive as the other major Arbitrum DEXs.

I understand that some people are wondering about the amount to be allocated to Ramses, but to say that the proposal is “comical” seems to me disproportionate or even inappropriate. I think it’s normal to have a minimum of ambition. This grant can be a very great catalyst to once again attract new liquidity to the DEX which no longer has much to do with its initial version.

With a larger TVL, Ramses will be able to take a more significant place alongside other DEXs and will be able to be more often available to users to allow them to trade at a lower cost.

Perhaps the proposal is missing enough data for people that isn’t aware of Ramses metrics, as I see many ppl try to picture it as a “random DEX with $260k marketcap token”.

Last 7d Arbitrum DEX volumes (source: https://defillama.com/dexs/chains/arbitrum)

Just leaving this here for future reference. Of course its just a snapshot of last 7-days and doesn’t tell the full picture of the chain, but clearly illustrates the point that Ramses isn’t “some random DEX” and constantly performs on the top level.

Hey kingofsparkles, I understand the concern considering the brief and tumultuous history of Arbitrum grant distribution, but if you read our recent blog or X posts, you’ll find our growth strategy has changed significantly since we tried to move onto Arbitrum with the OATH token. You’ll notice further that the OATH token isn’t nearly as liquid on Arbitrum as it was a year ago.

Read about this here: Understanding Token Economics: Part 3 | OATH Ecosystem

Long story short, we’ve been working on a brand new project and token exclusively for Arbitrum. This effort has been ongoing for months now and we’ve been working on onboarding partners and other ecosystem contributors ourselves! This is all part of our new OATH Chapters initiative, and Ramses has played a pivotal role in helping us make it a success.

Our team is comprised of 35 people with a roster of 5 projects and growing. I invite you to follow @OATHFoundation on Twitter to stay on top of upcoming projects and tokens being created as part of the OATH Chapters program.

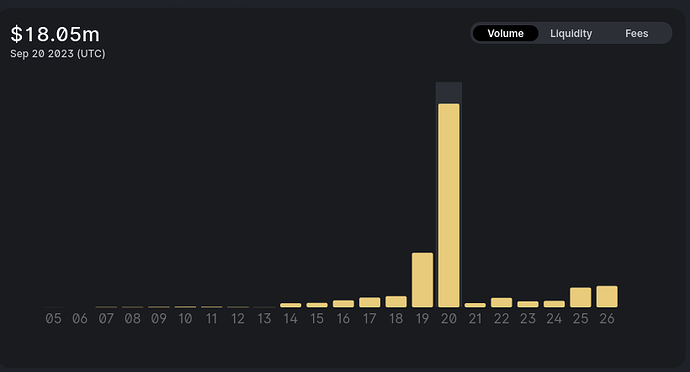

Interesting to see such a spike just before the application… just an observation.

The latest data shown on the official info page is also now incorrect by several magnitudes. Please could the team clarify if this is an issue? As part of the grant process it is imperative that we have accurate data.

The official page is displaying daily volumes of billions with $100ms of fees - far from what the onchain data says it is. Please can you correct this ASAP, this is concerning timing for showing potentially misleading information.

I’m not sure what’s wrong with the analytics page (must be a temporary UI bug im assuming) but that is not what you can see on dune boards, llama indexer or dexscreener.

Ramses volume has been steady $2-5M / 24h since CL was introduced over 3 months ago. Afaik that spike was caused by sudden surge of volume in some stable pairs (which happened to other dexes too).

Of course I agree with you that sudden spike is just out of the ordinary – we are always talking about the average volume of $2-5M/24h that has been happening for months when talking about dex metrics. Don’t think that is relevant for any of the data on this thread since that still falls within top5 volume in arbitrum.

I was taking a look at this unusual spike for USDC/USDC, is there a specific reason that

- sep 20, 18m of volume on this pair made $49 of fees

- sep 25, 1.75m of volume on this pair made $39 of fees?

Is this dashboard accurate? @Dog @North

https://cl.analytics.ramses.exchange/#/arbitrum/pools/0x562d29b54d2c57f8620c920415c4dceadd6de2d2

yeah they lowered the fee on a couple pairs and gamma took in a chunk of liquidity I think from a couple whales and was killing it with super tight ranges. That was also before Camelot copied them again.