SECTION 1: APPLICANT INFORMATION

Applicant Name: SFPmkt

Project Name: SafePal

Project Description:

Founded in 2018, SafePal is a comprehensive non-custodial crypto wallet suite backed by industry leaders such as Binance, Animoca Brands, and Superscrypt. SafePal aims to empower users to own their crypto adventure by accessing opportunities securely in the decentralized world via its hardware wallet, mobile app, and browser extension wallet solutions.

The SafePal platform serves more than 10 million users across the globe in 200+ regions and countries, supporting 15 languages, 100+ blockchains with their tokens and NFTs. It also encompasses crypto asset management solutions like cross-chain swapping, trading and yielding tools for users.

Team Members and Roles:

Founded in 2018, SafePal is managed by a team of more than 100 experts in security, data science, hardware and software engineers, and global growth. SafePal has grown substantially in scale and service offerings. Till today, SafePal offers a comprehensive suite of hardware, mobile, and extension wallets serving more than 10 million users globally. Tfhe core management team of SafePal includes:

- Veronica, CEO & Co-founder

- Harry, Head of Product

- Leaner, Head of Tech

Project Links:

- Website: https://www.safepal.com/

- Twitter: https://twitter.com/iSafePal

- Support Twitter: https://twitter.com/safepal_support

- Discord: https://discord.com/invite/BuKynZqRNj

- Telegram:Telegram: View @SafePalwallet

- Instagram: https://www.instagram.com/isafepal/

- Facebook: https://www.facebook.com/iSafePal

- Youtube: https://www.youtube.com/channel/UCfqztNiZWV62Eu9kiqKf6WQ

- LinkedIn: https://www.linkedin.com/company/safepal/

- Github: https://github.com/SafePalWallet

Contact Information:

- Point of Contact: @SFPmkt [forum handle: @SFPmkt]

- Point of Contact’s TG handle: @DadaZ5

- Twitter: @iSafePal

- Email: marketing@safepal.com

Do you acknowledge that your team will be subject to a KYC requirement?:

Yes

SECTION 2a: Team and Product Information

Team experience:

Over the past six years, SafePal has leveraged its team’s profound expertise in blockchain development to release a total of 130 versions spanning across hardware firmware releases, extension updates, and App upgrades. These iterations have extended support to over 100 blockchain ecosystems, encompassing 15 languages and reaching a user base exceeding 10 million across more than 200 countries and regions worldwide. SafePal has garnered a substantial user presence in various regions including North America, Europe, Asia-Pacific, and South America.

Since 2021, SafePal has undertaken over 100 incentive activities in collaboration with different ecosystem partners using custom quest campaign tools built in the SafePal wallet. These initiatives have collectively engaged 5.24 million participants and the estimated rewards reached $50 million in USD equivalence.

Moreover, SafePal has secured substantial grant support exceeding $1 million in USD equivalence from foundations such as Telos, Ton, Mantle, Rootstock, Nervos, and Flare, showcasing a profound comprehension of community-driven incentives. We would love to provide references privately.

What novelty or innovation does your product bring to Arbitrum?

SafePal aims to build a thriving community and hub to onboard users safely and seamlessly into Web3. As the onboarding gateway for Web3 users, SafePal has been dedicated to providing a complete cycle of the Web3 user journey to enhance crypto adoption.

Therefore, we have tailored experiences related to Arbitrum for every step in the cycle of “User Onboarding → Fiat on-ramp and off-ramp → Explore on-chain DApps → Cross-chain Swaps & Bridges → DeFi Yield Farming → Secure Assets → Daily Expenses & Utility.”

Currently, we have supporting Arbitrum including these aspects:

- Comprehensive support for securing Arbitrum assets, including Arbitrum coins, tokens, and NFTs, with a rich selection of 2 hardware wallets, 1 browser extension wallet, and 1 mobile app wallet to help users conveniently store and manage their assets.

- SafePal Gas Station supports users in easily buying small amounts of crypto for gas fees on Arbitrum with stablecoins, enabling the quickest onboarding process and assisting users in making their first Arbitrum transactions.

- Support for fiat on-ramp and off-ramp for users to convert EUR and GBP into ARB compliantly.

- Allow full access and experience of Arbitrum DApps on all SafePal products. This enables users to connect to any application on Arbitrum through the built-in Web3 browser.

- Support ARB natively in SafePal Swap and SafePal Bridge, a native cross-chain aggregator built by SafePal. This has enabled users to perform cross-chain swaps and bridges with ARB and interact with the Arbitrum ecosystem.

- Integrated with the ARB name service, allowing users to utilize .arb domain names for transactions. This feature enhances accuracy by automating the wallet address input, leading to a more streamlined user experience.

- Manage daily expenses via Arbitrum: SafePal banking gateway feature gives users the ability to manage their offline daily expenses and utilities via Arbitrum, which was launched on March 7, 2024.In order to improve the gateway for crypto adoption, SafePal has recently invested in Swiss bank Fiat24, launched an in-app banking gateway, and linked a virtual crypto Visa card built on Arbitrum. This is the first crypto-friendly banking gateway and visa card. It exclusively brings utility to Arbitrum. The grant we are applying for is to incentivize the SafePal banking gateway.

SafePal banking gateway Introduction

SafePal banking gateway is an in-app banking gateway and linked virtual crypto Visa card! This new service offering will pave the way to onboard more users into Web3 and accelerate the bridging of crypto to real-world utilities.

As the entire application is built on the Arbitrum chain, all daily expenses, bank transfers, deposits, and top-ups of SafePal banking gateway users are transactions on Arbitrum. This could draw in many new users who are experiencing the Arbitrum chain for the first time.

SafePal banking gateway Visa card is a crypto-focused Visa card and in-app banking services USDC(ARB) as the default deposit currency. Users can swap their crypto with SafePal across 40+ blockchains into USDC on Arbitrum to be deposited into their bank accounts in the mobile wallet, to be stored as $USD, $EUR, and $CHF for various transactions and expenses.

Users can set up individually owned, fully compliant bank accounts after completing the KYC and onboarding process by Fiat24 in the SafePal mobile wallet app without any account creation or management fees.

After creating the bank accounts in the SafePal mobile wallet, the credentials are minted as NFTs on Arbitrum, ensuring all related transactions are securely and transparently recorded on-chain. The crypto Visa cards are also linked to third-party payment platforms like Paypal, Google Pay, Apple Pay, and Samsung Pay for smooth and seamless payments.

The banking gateway and Visa card will be rolled out first to selected regions in Europe before extending to the entire continent, and other countries (excluding the USA and US-sanctioned nations). The list of supported countries/regions for the service will be consistently updated and can be viewed here. SafePal and Fiat24 also plan to roll out Mastercard services in Q3 this year as part of a global expansion, meaning users around the world will also be able to experience crypto-friendly living.

This new service offering will pave the way to onboard more users into Arbitrum and accelerate the bridging of crypto to real-world utilities.

Product Highlights for SafePal Banking Gateway and Visa Card:

- On-chain and transparent: After creating the bank accounts in the SafePal mobile wallet, the credentials are minted as an NFT on Arbitrum, and all related transactions will be broadcast on-chain, providing a transparent, immutable ledger for users.

- All built on Arbitrum: USDC on Arbitrum is the default deposit cryptocurrency to provide stability and safeguard card owners from market volatility. Users can swap their crypto with SafePal across 40+ blockchains into USDC on Arbitrum, which is deposited into their bank accounts in the mobile wallet and stored as $USD, $EUR, and $CHF for various transactions and expenses. Every time users make deposits, utilize cryptocurrency for daily expenses, manage their account setting or make transfers with their other bank accounts, will conduct transactions on the Arbitrum chain. These all related transactions will be broadcast on-chain. We use Fiat24 CHF24, EUR24 and USD24 tokens as tokenized deposits exclusively to book the transactions and balances on the Arbitrum. Each CHF24, EUR24 and USD24 tokenised deposit token is mapped 1:1 to a unit of equivalent fiat currency in Fiat24 correspondent bank.

- No annual fees: Eligible users can open individually owned and compliant Swiss bank accounts under their name for free with no account creation or annual management fees

- Truly crypto-friendly: Users will be able to utilize cryptocurrency for daily expenses, and make seamless transfers with their other bank accounts compliantly — eliminating the excessive scrutiny and restrictions of traditional bank accounts while improving accessibility to on and off-ramps

- Spend crypto with ease: The virtual Visa cards support 3rd payment party platforms like Paypal, Google Pay, Apple Pay and Samsung Pay for smooth and seamless payments.

Here is Coindesk’s report on the SafePal banking gateway.

With all of these built or to be built, we believe they will lower the onboarding threshold to the Arbitrum ecosystem and bring the most comprehensive user experience for both mainstream and crypto-native users.

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes, as a comprehensive wallet suite, we fully support all ecological dapps on Arbitrum. Users can easily access all decentralized applications build on the Arbitrum via the SafePal app, browser extension wallet, and hardware wallet, such as GMX, Uniswap, AAVE, Curve, SushiSwap, Camelot, Radiant, Balancer, Magpie, and more.

Meanwhile, we try to build Arbitrum applications and projects natively to the wallet experience. One example is our collaboration with Fiat24, a protocol built on Arbitrum, to provide users with an integrated banking gateway within the app. This includes a virtual crypto Visa card that is also based on the Arbitrum platform.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

SafePal has extended its support to over 100+ blockchains. We stand out as one of the few wallets that provide a combination of hardware, software, and browser extension wallets, along with a range of services like swapping, earning, trading coins, and NFTs within the app.

For a complete list of supported assets, please visit our page: SafePal Assets | Explore 100+ million assets including Bitcoin, Ethereum, Solana and more

Please check the recent announcements we have integrated with other chains.

- Sui: SafePal Blog|Safepal-officially-supports-sui-network-sui|SFP|SafePal Crypto Wallet

- Aptos: SafePal Blog|Aptos|SFP|SafePal Crypto Wallet

- Ton: SafePal Blog|Ton|SFP|SafePal Crypto Wallet

- Klaytn: SafePal Blog|Safepal-officially-supports-klaytn-klay|SFP|SafePal Crypto Wallet

- Polygon zkEVM: SafePal Blog|Safepal-officially-supports-polygon-zkevm|SFP|SafePal Crypto Wallet

- Mantle: SafePal Blog|Safepal-officially-supports-mantle-mnt|SFP|SafePal Crypto Wallet

- Linea: SafePal Blog|Safepal-officially-supports-linea-mainnet|SFP|SafePal Crypto Wallet

How do you measure and think about retention internally? (metrics, target KPIs)

Under the guiding principle of respecting user privacy and security, we find that monitoring retention and wallet behavior data is of significant value.

In order to improve the gateway for crypto adoption, SafePal has recently invested in Swiss bank Fiat24, launched an in-app banking gateway, and linked a virtual crypto Visa card built on Arbitrum. The grant we are applying for is to incentivize the SafePal banking gateway.

Through this SafePal banking gateway, it solves the current high-frequency pain points faced by Web3 users: compliant on-ramp, off-ramp and using crypto for daily consumption. We increase retention by establishing users’ daily usage habits and prompting users to top-up their SafePal banking gateway.

Measure 1. By building users’ daily usage habits to use the SafePal banking gateway frequently, thereby increasing the retention of Arbitrum transactions.

We believe that users are likely to develop using habit and have a high probability of retention after completing KYC, making the first deposit, binding payment methods, and completing the first purchase. Users are likely to further spend or transfer the deposited money to other bank accounts, leading to on-chain transactions and more retained active users.

Here is an example of a user journey: After completing KYC for the SafePal banking gateway onboarding, a user deposits swap 100 USDC on Arbitrum and chooses to convert it to EUR. Their bank account balance will show EUR, and their SafePal wallet will hold an equivalent amount of EUR24 tokens on Arbitrum. They can use the SafePal banking gateway Visa card for purchases on Amazon or bind it to PayPal, Apple Pay, Google Pay, and Samsung Pay for offline purchases like Starbucks coffee. They can also wire funds to other bank accounts.

By integrating this card into your daily consumption and linking it with various platforms, the chances of using this card more frequently will significantly increase.All these activities will broadcast on-chain with Fiat24 tokens on Arbitrum, bringing transactions on-chain frequently.

Measure 2. Depositing with USDC on Arbitrum to SafePal banking gateway, coupled with incredibly low top-up fees and a tier top-up rates system, promotes a consistent habit of depositing and transferring or daily consumption.

Users must swap other currencies to USDC Arbitrum for the deposit, as it’s the default deposit currency also avoiding currency fluctuations. Funds are stored as USD, EUR, and CHF for intra-transfer and expenses. Transactions will be broadcast on-chain with Fiat24 tokens (CHF24, EUR24, and USD24) for recording transactions and balances on Arbitrum. Each token represents an equal amount of fiat currency in Fiat24’s corresponding bank.

Additionally, the card has no account creation or annual management fees, only required top-up fee rates of 0.6%-1%. Users don’t need to pay gas fees for daily online and offline purchases and the bank will pay for the gas fee.

We also provide a tiered top-up rate system. Users who frequently reach certain top-up amounts will benefit from lower top-up fees. This promotes more frequent consumption and on-chain transactions.

In summary, SafePal guides users to finish the onboarding process and establish a daily spending habit with the SafePal banking gateway to increase retention. When users top up, they are more likely to continue using the card for spending or bank transfers, leading to on-chain retention.

Our current focus lies on the following key metrics and has built according to tracking backend system for such monitoring operations:

- New opened bank account/Number of NFT minted:

To open a bank account with SafePal, users must complete two main steps.

Step 1: Mint an NFT on the Arbitrum chain. This NFT acts as the on-chain client identification and grants access to the e-banking portal.

Step 2: Users need to pass the Fiat24 (Swiss bank) KYC process to register for a bank account. Once the NFT is minted, users must undergo the Fiat24 KYC process to become SafePal banking gateway user. This is a fully compliant business process, necessitating users to complete KYC. KYC is a milestone in the onboarding process, and we will closely monitor retention.

The KPI is to onboard users who completed both steps and open a SafePal banking gateway account.

- Daily transaction count:

All real-world payment transactions (i.e. transfer 100 EURO from HSBC to Fiat24 account, or buy a starbucks coffee with the SafePal banking gateway Fiat24 Visa card) are booked on Arbitrum.

We also highlight the fact that no single transaction can be faked, as all on-chain ledgers have to 100% match off-chain bookings, otherwise the entire booking system will be in chaos, with serious legal consequences for the bank. The KPI is to get 42,000 transactions booked on Arbitrum within a 12-week incentive period.

-

Daily active users on Arbitrum:

Users who authorize and make transactions on Arbitrum daily using SafePal hardware wallet, software wallet, and browser extension wallet.

Also, after the launch of the native product on Arbitrum on March 7th, adding daily active users utilize the SafePal banking gateway within the SafePal wallet. -

Monthly active users on Arbitrum:

Active users who authorize and make transactions on Arbitrum within a month using SafePal hardware wallet, software wallet, and browser extension wallet.

Also, after the launch of the native product on Arbitrum on March 7th, active users utilizing the SafePal banking gateway within the SafePal wallet in a month.

Relevant usage metrics - Please refer to the OBL relevant metrics chart 31. For your category (DEX, lending, gaming, etc) please provide a list of all respective metrics as well as all metrics in the general section:

Category: General

As Wallets are not included in any other categories featured in the OBL relevant metrics chart 31, we’ll focus primarily on data from the General category, which also echos with our actual targeted metrics.

The following are the key metrics that DAO contributors will monitor, as they are pertinent to the incentive plans SafePal intends to implement on Arbitrum:

- New opened bank account/Number of NFT minted

- Daily Arbitrum Transaction Count

- Daily Arbitrum Transaction Volume

- Daily Arbitrum Active Users

- Monthly Arbitrum Active Users

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?

No, the SafePal wallet suite supports 100+ blockchain.

On top of that, SafePal complete support to the Arbitrum ecosystem. This includes SafePal’s software wallet, hardware wallet, and browser extension wallet, all of which support coins, tokens, and DApps on the Arbitrum network. Additionally, we facilitate the display and trading of Arbitrum NFTs, and support the ARB name service in SafePal wallet suite.

Here are the supported tweets and blog:

- How to use SafePal Wallet with Arbitrum ARETH

- How to send $ARETH with .arb domain name in SafePal Software Wallet – SafePal Help Center

- Support NFTs of Arbitrum

On what other networks is the protocol deployed?

SafePal wallet suite operates as a decentralized multi-chain wallet. It currently supports over 100 blockchains. Please view a complete list of all supported chains and tokens at this link: SafePal Assets | Explore 100+ million assets including Bitcoin, Ethereum, Solana and more

What date did you deploy on Arbitrum mainnet?

The SafePal banking gateway and Visa card product we partnered with Fiat 24 has been launched in SafePal wallet from March 7, 2024.

Here is the detail of the SafePal banking gateway: SafePal Blog|Safepal-launches-1st-crypto-friendly-banking-gateway-and-visa-card|SFP|SafePal Crypto Wallet, and the organice media coverage from Coindesk: https://www.coindesk.com/business/2024/03/07/crypto-wallet-safepal-ventures-into-banking-with-new-usdc-visa-card/

SafePal has supported Arbitrum mainnet since our V.3.0 app version released on November 25, 2021. Here is the official announcement.

Do you have a native token?

Yes. SFP is a decentralized BEP-20 and ERC-20 utility token serving as the growth engine of the SafePal ecosystem. It can be used to purchase SafePal products at a discount and is converted seamlessly to gas across chains in the app, in addition to rewarding token holders and education programs.

For more details please visit: https://safepal.com/en/sfp

The SafePal banking gateway and Visa card product we partnered with Fiat 24 has 1 NFT and 3 tokens booked on Arbitrum.

Fiat24 account NFT (ERC721): 0x133CAEecA096cA54889db71956c7f75862Ead7A0

Three Fiat24 Booking Tokens (ERC20):

// EUR24 Contract: 0x2c5d06f591D0d8cd43Ac232c2B654475a142c7DA

// USD24 Contract: 0xbE00f3db78688d9704BCb4e0a827aea3a9Cc0D62

// CHF24 Contract: 0xd41F1f0cf89fD239ca4c1F8E8ADA46345c86b0a4

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

As a wallet, we’ve established substantial partnerships with key ecosystem players to foster sustainable growth. In designing our incentive programs, we carefully and responsibly create quest tasks that genuinely benefit the ecosystem. We also actively combat token spammers and robotic accounts. We’re currently running two long-term incentive programs:

- Giftbox: a quest-based model for post-token-launch projects. It’s designed to build brand awareness and connect with a quality user base through educational tasks and social media.

- Wallet Holder Offerings: a growth strategy for pre-token-launch projects. It helps acquire early-stage seed users through whitelist filtering and customized task designs.

All of the in-app SafePal incentive programs are equipped with strict whitelist mechanisms that prevent fake accounts, bulk-created accounts, and malicious accounts. They effectively filter out the real target audience and stimulate effective behavior through verifiable quest tasks, which improves on-chain activity.

Here are some of the data highlights of previous incentive programs: (Due to the confidentiality agreement signed with partners, only part of the cooperation model can be disclosed.)

- A coin built on 8+ chains.

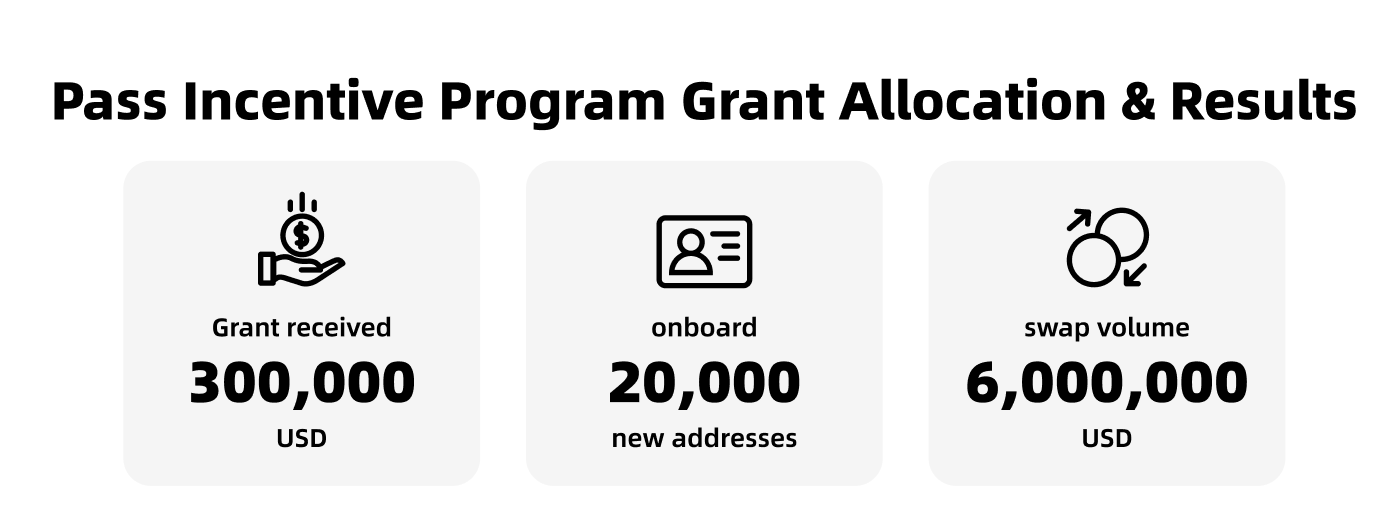

300,000 USD were distributed, resulting in a total of 6 million USD in swap volumes and 20,000 new onboard users.

By the second week, the 20,000 new onboard users had a 54% retention rate. This was due to the task design part of rebates, which required users to activate and interact in the second and third weeks to make a claim.

Note: It’s important to clarify that the swap statistics pertain to direct swaps completed as part of the incentive program, excluding ongoing transactions on the SafePal platform.

- SFP Airdrop

The SafePal airdrop incentive allocates 10 million SFP, resulting in an increase of 480,000 active addresses over a continuous period of nearly 4 weeks.

Insights from our past successful events will apply to upcoming Arbitrum incentive programs.

- Strict whitelist mechanisms

- Stimulate effective behavior through verifiable quest on-chain tasks

- Sustained user engagement in the communication channel for a long-term plan

- Establish immediate and long-term rewards for users’ on-chain transactions.

Current Incentivization: How are you currently incentivizing your protocol?

Our token incentive program continues to run since 2021, and the community consistently shows high enthusiasm and anticipation towards this program.

Moreover, we maintain strong collaborations with global web3 communities and KOLs, tirelessly working to enhance our brand exposure and influence.

Regarding the SafePal banking gateway, which was launched on March 7, now includes a Points program to incentive users. This program features various card levels that are associated with different point values. These points correspond to varying top-up rates, designed to encourage daily spending and increase on-chain transactions.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

Yes, we’ve received grants from various Foundations for incentives exceeding $1 million in USD equivalence. We can only disclose certain aspects of our collaboration model due to confidentiality agreements with our partners. Here is one of the example:

- Layer 1

Following the integration, we executed a short-term incentive campaign aimed at increasing new user engagement and chain transactions.

Grant Arrangement and Results: We received a grant of 40,000 USD. We allocated 15% of this amount for technical access support, while the remaining 85% was used as rewards to incentivize users who completed on-chain tasks, such as Mint NFT and swap. These incentives, offered for three days, resulted in an increase of 5,000 new active users.

Protocol Performance:

- Total Users: 10 Million+

- AUM: $30 Billion+

- Total Trading Volume: $100 Billion+

Protocol Roadmap:

SafePal Banking Gateway Launch Plan

Q1 2024

- Launch SafePal banking gateway in selected European regions

- Test functionality and user experience

- Prepare for the incentive program

Q2 2024

- Initiate incentive program within the existing SafePal user base of 10 million

- Encourage adoption and onboard users to increase on-chain transactions of the SafePal banking gateway

Q3 2024

- Plan to expand banking offerings worldwide

- Provide services to international users

Audit History & Security Vendors:

SafePal offers diversified products and services, with the core projects including:

SafePal Hardware Wallets:

SafePal Software Wallets:

The audit and open-source conditions for these specific products are as followed:

- All of the SafePal Hardware Wallets were audited by Keylabs, a prestigious hardware security audit team located in Europe. Keylabs is famous for hacking Ledger and Trezor at the Berlin C3 Conference in 2018, becoming one of the earliest security team hacking into both of the biggest hardware wallet brands on the market.

- In the meantime, SafePal actively embraces open-sourcing and all the above core wallet products have been open-sourced. For more information, please visit our Github.

SafePal partnered with Fiat24 to provide a SafePal banking gateway Visa card.

Grant Thornton Switzerland conducts financial and regulatory auditing.

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents

No, SafePal has never been exploited since founded in 2018.

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size:

140,000 ARB

Justification for the size of the grant:

-

The grant we apply for will be used to incentivize the increase of new Arbitrum NFT holders and on-chain transactions.

Having just launched the SafePal banking gateway on March 7th (the product this grant incentive program is for), we aim to onboard 7,000 users, complete KYC, and make 42,000 transactions, which would represent entirely new growth.

1) New Arbitrum NFT holders

Incentive users to open bank accounts through the SafePal banking gateway, which contributes to new NFT holders on Arbitrum. (This product just launched on March 7, 2024)

-

Currently at 336 NFT holders (1st week of the product launch)

-

Targeting 7,000 ARB NFT holders with newly opened bank accounts

2) On-chain transactions.

Incentive regular cryptocurrency deposits and daily expenses, which contribute to transactions on the Arbitrum network.

-

Currently at 650 Arbitrum on-chain transactions. (1st week of the product launch)

-

Targeting 42,000 on-chain transactions for 3 month period

-

Each new account will make 6 transactions in the program period.

Initial data analysis over the first week since the product launch on March 7th indicates promising user engagement. On average, each new account is making 3-5 transactions within the first week of onboarding. This includes common activities such as:

- Opening a bank account - minting NFT on Arbitrum

- Activating the SafePal banking account - Authorizing EUR consumption limit

- Depositing with USDC Arbitrum - Authorizing USDC

- Signing the transaction

- Activate a virtual Visa card and link it with Apple Pay, Google Pay, Samsung Pay, and PayPal for daily online and offline purchases.

2. We will be using two types of incentivization in 2 phrases:

Phrase 1: Incentivize fee rebate for account opening→ lower cost to onboard—> more new account holders

-

Incentivisation 1: Open a bank account through SafePal banking gateway and mint NFT on Arbitrum.

- Mint an NFT on the Arbitrum chain. This NFT acts as the on-chain client identification and grants access to the e-banking portal.

- Users need to pass the Fiat24 (Swiss bank) KYC process to register for a bank account. Once the NFT is minted, users must undergo the Fiat24 KYC process to become SafePal banking gateway users. This is a fully compliant business process, necessitating users to complete KYC. KYC is a milestone in the onboarding process, and we will closely monitor retention.

-

The KPI is to onboard users who completed both steps and open a SafePal banking gateway account.

Phrase 2: Incentives dropped to frequent transfer accounts—>more frequent on-chain transactions→nurture more stickiness of on-chain activeness

- Incentivisation 2: Deposit, make intra-bank transfers and use crypto regularly on Arbitrum

- Top-up/Deposit: USDC on Arbitrum is the default deposit cryptocurrency. Users can swap their crypto with SafePal across 40+ blockchains into USDC on Arbitrum, which is deposited into their bank accounts in the mobile wallet and stored as $USD, $EUR, and $CHF for various transactions and expenses.

- Daily transactions: Every time users make deposits, utilize cryptocurrency for daily expenses, or make transfers with their other bank accounts, will conduct transactions on the Arbitrum chain. Transactions will be broadcast on-chain with Fiat24 tokens (CHF24, EUR24, and USD24) for recording transactions and balances on Arbitrum. Each CHF24, EUR24, and USD24 token represents an equal amount of fiat currency in Fiat24’s corresponding bank.

- The KPI is to let onboarded users make their first deposit and 1st online or offline purchases.

3. Based on our past growth experience, the CPA (cost per acquisition) for a legitimate web3 user is at least USD$10, depending on the complexity of the quest tasks.

In line with the data from our 2023 incentive program, we allocated 300,000 USD, resulting in the successful onboarding of nearly 31,000 users. This leads to a cost per acquisition (CPA) of 10, a figure which suggests that our incentive program was indeed quite adept at driving user acquisition.

As the uesr onboarding process for such a new service requires a KYC onboarding process, the CPA is likely higher. So we double the single-action CPA to USD$20.

As we want to stimulate two major actions from the wallet accounts:

1) Onboarding: New Banking Gateway Account Onboarding Initiative

- Action required: Open a bank account, mint an NFT on the Arbitrum blockchain and pass bank KYC requirements.

- Incentive: $20 USD per user

- Target: 7,000 users

- Total estimated cost of onboarding user incentives: $20 USD per user *7,000 users = $140,000

2) Activating: Making First On-Chain Deposits

- Action required: Make an initial deposit with 10 USDC (ARB)

- Incentive: $10 USD per user

- Target: 21,000 transactions

- Estimation: Each onboarding user to complete at least 3 transactions

- Calculation: 7,000 new users expected to achieve 21,000 transactions for the onboarding process

- Total estimated cost of onboarding user incentives: $10 USD per user *7,000 users * 3 transactions per user = $70,000 USD

- Transaction Types:

- Opening a bank account - This involves minting an NFT on Arbitrum.

- Activating the SafePal banking account - This process authorizes a EUR consumption limit.

- Depositing with USDC Arbitrum - This authorizes a USDC consumption limit.

- Signing the transaction.

3) Retention: Incentivize users to continue using SafePal banking gateway after opening an account.

- Action Required: Users must link their account to Apple Pay, Google Pay, or Samsung Pay. They must make their first online or offline purchase through these platform of more than $10 USD/EUR within one month of opening their account.

- Incentive: $10 USD per user

- Target: 21,000 transactions

- Estimation: Users are expected to complete a second deposit and 2-3 additional online/offline transactions within 12 weeks, totaling at least 3 transactions per user for post-onboarding retention .

- Calculation: Expect 7,000 onboarded users to generate 21,000 transactions after onboarding for retention purposes.

- Total estimated cost of onboarding user incentives: $10 USD per user * 7,000 users * 3 transactions per user = $70,000 USD

Therefore, the total CPA for each user who completes the three incentivized onboarding and retention actions mentioned will be $20+$10+$10=$40.

3. As we are targeting 7,000 ARB NFT holders (new accounts) and 42,000 on-chain transactions, it would require

- USD equivalent = 7,000 new accounts with the transaction behavior * $40 = $280,000

- ARB amount = $280,000/$2 = 140,000 ARB (assume ARB price is $2)

It’s worth noting that after completing the onboarding process, users may engage in other Arbitrum on-chain transactions, such as:

- Bridging assets to the Arbitrum chain

- Swapping assets to Arbitrum in SafePal swap, particularly swapping to USDC Arbitrum to top-up the SafePal banking gateway

- Topping up

- Exchanging currencies

- Making intra-transfers

- Making online and offline purchases

- Exploring Arbitrum DApps

We believe that the activities available on the Arbitrum chain in the SafePal wallet, along with incentives, will improve user retention. This will encourage users to continue using the SafePal banking gateway to increase on-chain transactions after they complete the onboarding process.

Grant Matching: [Enter Amount of Matching Funds Provided - If Relevant]

Not applicable

Grant Breakdown: [Please provide a high-level overview of the budget breakdown and planned use of funds]

The grant will be used for the 12-week cycle incentive program, which aims to boost the number of new Arbitrum account holders and on-chain transactions. Here is the breakdown of grant:

1. 70,000 ARB to incentivize users who open SafePal banking gateway accounts, mint NFTs on the Arbitrum blockchain, and pass bank KYC requirements.

- We aim to get 7,000 users to open a bank account, mint an NFT on the Arbitrum blockchain, and pass bank KYC requirements within the 12-week period.

- Incentive: $20 USD / 10 ARB per user

- Target: 7,000 users

- Total estimated cost of onboarding user incentives: $20 USD per user *7,000 users = $140,000

- ARB amount = $140,000 / $2 = 70,000 ARB (assume ARB price is $2)

2. 35,000 ARB to incentivize users to make their first deposit to SafePal banking gateway on Arbitrum

- We aim to generate 21,000 transactions on Arbitrum from 7,000 new users. After onboarding, these users are expected to make an initial deposit of 10 USDC (ARB) in the SafePal banking gateway.

- Incentive: $10 USD per user

- Target: 21,000 transactions (3 transactions per user)

- Total estimated cost of 21,000 transactions incentives: $10 USD per user * 7,000 users * 3 transactions per user = $70,000 USD

- ARB amount = $70,000 / $2 = 35,000 ARB (assume ARB price is $2)

3. 35,000 ARB to incentivize users to continue using SafePal banking gateway after account opening on Arbitrum

- We aim to generate 21,000 transactions on Arbitrum from 7,000 new users to continue using the SafePal banking gateway within a 12-week period for post-onboarding retention

- Users are expected to complete a second deposit and 2-3 additional online/offline transactions within 12 weeks, totaling at least 3 transactions per user after onboarding.

- Incentive: $10 USD per user

- Target: 21,000 transactions (3 transactions per user)

- Total estimated cost of 21,000 transactions incentives: $10 USD per user * 7,000 users * 3 transactions per user = $70,000 USD

- ARB amount = $70,000 / $2 = 35,000 ARB (assume ARB price is $2)

The grants mentioned above will be all allocated to reward our users. We plan to tailor-make specific tasks aimed at boosting on-chain activity. Users will be able to automatically receive corresponding ARB rewards upon successfully completing these tasks, ensuring a smooth and enjoyable user experience.

The overarching objective of the proposed 140,000 ARB grant is to

- Target 7,000 ARB NFT holders (new accounts)

- Target 42,000 on-chain transactions.

Funding Address:

0x14F28D0F1408dE84F8A196aE47086C6002f317DF

Funding Address Characteristics:

This is an 2/3, 3/5 setup multisig wallet address

Treasury Address: [Please list out ALL DAO wallets that hold ANY DAO funds]

Not applicable

Contract Address:

0x41bD8AA9e4C6465160Df63a3948ec09350B897d9

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives:

Based on SafePal’s recently launched banking gateway product on the Arbitrum chain, we aim to boost Arbitrum on-chain activities with our 10 million users around the following two scenarios:

Objective 1: Incentivize 7,000 users to open a bank account through the SafePal banking gateway and mint NFT on Arbitrum. After creating the bank accounts in the SafePal mobile wallet, the credentials are minted as NFTs on Arbitrum, ensuring all related transactions are securely and transparently recorded on-chain.

Objective 2:Incentivize 7,000 users to deposit and use SafePal banking gateway regularly, which contributes to 42,000 transactions on Arbitrum with 12 weeks processing time.

Execution Strategy:

We will be using 3 types of incentivization:

- 70,000 ARB to incentivize users who open a bank account through SafePal banking gateway and mint NFT on Arbitrum.

- We target 7,000 new users who open bank accounts and mint NFT on Arbitrum

- Each user opens a bank account and pass KYC will get a $20 rebate

- Each user ARB amount = $20/$2=10 ARB (assume ARB price is $2)

- Total ARB amount = 10 ARB rebate to each user x 7,000 users = 70,000 ARB

- 35,000 ARB to incentivize users who deposit for first time on Arbitrum.

USDC on Arbitrum is the default deposit cryptocurrency. Users can swap their crypto with SafePal across 40+ blockchains into USDC on Arbitrum, which is deposited into their bank accounts in the mobile wallet and stored as $USD, $EUR, and $CHF for various transactions and expenses. Transactions will be broadcast on-chain with Fiat24 tokens (CHF24, EUR24, and USD24) for recording transactions and balances on Arbitrum. Each CHF24, EUR24, and USD24 token represents an equal amount of fiat currency in Fiat24’s corresponding bank.

- We target 7,000 new users who will open bank accounts and make 21,000 transactions during onboarding process.

- Each user who deposits 10 USDC on Arbitrum for the first time will receive a $10 rebate.

- To make the first deposit, users must complete 3 transactions:

- Mint NFT to open a bank account

- Activate and authorize the card consumption limit

- Sign the deposit transaction

- Each user ARB amount = $10/$2=5 ARB (assume ARB price is $2)

- Total ARB amount = 5 ARB rebate to each user x 7,000 users = 35,000 ARB

- 35,000 ARB to incentivize users who use the card continuously

Incentivize users to continue using the SafePal banking gateway after opening an account. To qualify for a $10 rebate, users must link their account to Apple Pay, Google Pay, Samsung Pay or PayPal. They must make their first online or offline purchase through these platform of more than $10 USD/EUR within one month of opening their account.

As the mentioned platforms are commonly used for daily transactions, linking them to SafePal banking gateway Visa card increases the possibilities of repeated use. This enhances user retention and boosts transactions.

-

We target 7,000 new users who opened bank accounts and make 21,000 transactions after onboarding.

-

Each user who links their account to Apple Pay, Google Pay, Samsung Pay, or PayPal and makes their first online or offline purchase through these platforms of more than $10 USD/EUR within one month of opening their account will receive a $10/5 ARB rebate.

-

To make the online or offline purchase, users must complete 3 steps including Arbitrum on-chain transactions:

- Activate and authorize the card consumption limit

- Link their bank account to Apple Pay, Google Pay, Samsung Pay or PayPal

- Check out with SafePal bank gateway Visa card

-

Each user ARB amount = $10/$2=5 ARB (assume ARB price is $2)

-

Total ARB amount = 5 ARB rebate to each user x 7,000 users = 35,000 ARB

As we are targeting 7,000 ARB NFT holders (new accounts) and 21,000 onboarding on-chain transactions and 21,000 retention on-chain transactions, it would require:

- USD equivalent = 7,000 new accounts with the transaction behavior * $40 = $280,000

- ARB amount = $280,000/$2 = 140,000 ARB

Execution support and communication channels:

We are incentivizing users to open new accounts for the designated service built on Arbitrum and complete frequent transfers on the chain. Qualified users will receive ARB incentives.

To achieve it, there will be dedicated development resources invested into the core feature development surrounding the incentives program, including the UX of the quest user flow, backend and server preparation for the program, implementation of the anti-spamming mechanism, verification of the quest tasks, auto-distribution of the rewards, etc.

Once live, the program will last for 3 months, promoted across all these available resources and channels:

- Twitter: 555.5K followers

- Instagram: 6.69K followers

- Facebook: 2.6K followers

- LinkedIn: 1.2K followers

- Discord: 60.2K members

- Telegram: 70K+ members in combined

- App notification push: 10M+ wallet accounts

- DApp store banner: Estimated monthly exposed impression 3M+

- HelpCenter tutorials

- Dedicated inforgraphic posted across all social media

- KOL and organic media outreach

Risk-control:

Since every step of the user behavior is verifiable, the main risks of such an incentive program would be to scientifically design the quest task to stimulate genuine user behavior instead of fake ones.

There are several risk-control points that we’ll implement the verification mechanisms to address accordingly:

- Bulk created accounts: Each new account will have to complete a compliant KYC onboarding process, which will effectively eliminate the bulk created accounts, bots, sybils, spoofing, etc.

- Wash transactions: An algorithm will be applied to identity wash transaction behavior and thus behavior will be void should it be detected by the system

- Collapse of service: we will provide a dedicated email service to provide timely support to all the users who encounter usage issues. Meanwhile, we’ll set up an emergency public communication plan and IT system back-up should the system break down due to overwhelming transaction load.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity, or some other targeted metric?

The three major user behaviors that we aim to incentivize are

- Opening new accounts on Arbitrum

- Conducting on-chain transactions.

- Migrating cross-chain assets from other chains to Arbitrum.

The onboarding process of such a service will require additional user behavior such as KYC, submission of the application, pairing with the service, etc. The sinking cost of such per onboarding case will lead to a higher retention rate if a new user successfully passes and completes the onboarding process. Additionally this new service is extremely crypto-friendly and aim to solve the pain points of normal users onboarding to web3. While the smooth and comprehensive SafePal service offerings will guarantee a more ideal retention rate compared to other wallet providers.

With the ARB incentives acting as fee rebates and incentives, users will generate more on-chain transactions throughout the program. With the behavior strengthened repeatedly, the stickiness in using the service will be much higher in the long-term future, even after the program is finished.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

With the launch of the SafePal banking gateway, built natively on Arbitrum launched on March 7, 2024, our grant application is designed to boost this project. As such, our KPI targets align with the data from the new SafePal banking gateway, following a three-month incentive plan.

- New wallet accounts that mint and hold the specific Arbitrum NFT (Each NFT represents the ownership of each legitimate account)

- Currently at 336 NFT holders

- Targeting 7,000 ARB NFT holders with newly opened bank accounts

- The on-chain transaction count

- Currently at 650 Arbitrum on-chain transactions.

- Targeting 42,000 on-chain transactions for 3 month period

Grant Timeline and Milestones:

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

SafePal has recently invested in Swiss bank Fiat24, launched an in-app banking gateway, and linked a virtual crypto Visa card built on Arbitrum. This is the first crypto-friendly banking gateway and visa card. It exclusively brings utility to Arbitrum. The grant we are applying for is to incentivize the SafePal banking gateway.

As the entire SafePal banking gateway is built on the Arbitrum chain, all daily expenses, bank transfers, deposits, and top-ups of SafePal banking gateway users are transactions on Arbitrum. This could draw in many new users who are experiencing the Arbitrum chain for the first time.

After launching the SafePal banking gateway, SafePal has established a complete cycle of Arbitrum user journey, including:

User Onboarding → Fiat on-ramp and off-ramp → Explore on-chain DApps → Cross-chain Swaps/Bridge → DeFi Yield Farming → Secure Assets-> Daily Expenses & Utility.

The latest service that is to be launched in the upcoming weeks will be the final piece completing this big picture, which is to stimulate expenses and real-world utilities and boost the adoption and penetration of the Arbitrum ecosystem. With the grant, we can effecitvely stimulate the user behavior surrounding account opening and daily transactions, and thus increase the stickiness of the ecosystem.

Meanwhile, such a program will also bring Arbitrum to the attention spotlight from 10M+ user base in SafePal. This will enhance the brand image and awareness of Arbitrum and greatly boost other wallet behaviors related to Arbitrum, such as:

- Bridging assets to the Arbitrum chain

- Swapping assets to Arbitrum in SafePal swap, particularly swapping to USDC Arbitrum to top-up the SafePal banking gateway

- Topping up

- Exchanging currencies

- Making intra-transfers

- Making online and offline purchases

- Exploring Arbitrum DApps

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Not applicable

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 30. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, we are prepared to comply with the OBL’s data requirements for the entire life of the program and three months following. Please note that the program might not be able to be handoff to the Arbitrum DAO as it’s built into the wallet user experience and cannot be separated from the product for a single handoff.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting]

Yes, we agree. We plan to build a data dashboard on our own and feed the data into the dashboard via API from our wallet services.

First Offense: In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes, we agree.

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?

Yes, we acknowledge that.