A. OVERVIEW

For Investment Professionals Only

A Trusted Partnership Driven by Expertise

Drawing on decades of experience in capital markets and the digital asset ecosystem, the partnership between Sygnum and Fidelity International provides regulated, compliant investment solutions that emphasize security, transparency, and flexibility.

This partnership has led to the creation of the Institutional Liquidity Fund (ILF) – FIUSD Token, a project that combines Sygnum’s multi-chain tokenization solution with traditional investment solutions. By tokenizing investments in Fidelity’s money market fund, Sygnum further strengthens Crypto-TradFi connections and lays the foundations for a fully tokenized ecosystem.

By participating in STEP 2, we are keen to add another successful chapter to this unique partnership.

Institutional Liquidity Fund (ILF) – FIUSD Token

Fidelity International’s Institutional Liquidity Fund (ILF) is a short-term money market fund known for its strong track record of performance.

This on-chain investment solution via the FIUSD Token offers direct access to a well-established multi-billion money market investment fund designed for simplicity and cost-efficiency.

The investment is structured to offer attractive yields, competitive fee models and is safeguarded by the bankruptcy-remoteness of traditional securities and digital assets applicable for assets held in custody with a Swiss bank. Thanks to Sygnum’s ability to act as a collateralized lender against the FIUSD tokens, Sygnum can provide liquidity of up to $25 million outside Swiss banking hours.

FIUSD Token delivers a secure pathway into on-chain representation of the allocated assets. Combining the expertise of Sygnum and Fidelity International, this initiative provides a compliant, regulated approach to on-chain traditional securities investment.

Why Sygnum?

-

Pioneer in Digital Asset Banking: Sygnum is recognized as the world’s first digital asset bank with more than $5 billion in assets under custody and trusted by +2’000 professional and institutional clients globally including leading digital asset foundations, entrepreneurs/founders, family offices, asset managers, brokers as well as more than 20 other banks. Sygnum’s heritage is deeply rooted in Switzerland and Singapore. As a licensed bank in Switzerland, Sygnum ensures the adherence to the highest standards of compliance and security.

-

Institutional-grade Custody Solution: Digital assets are securely stored in Sygnum’s institutional-grade multi-custody platform. The solution is certified and audited in accordance with ISAE 3000 and ISAE 3402 industry standards, protected by FIPS-140.2 Level 3 hardware security modules (HSMs), MPC technology and highest-level security data centres in Switzerland.

-

Proven Tokenization Expertise: Sygnum’s Tokenization platform has been operational for five years, supporting a series of successful and globally recognized tokenization projects across private markets, traditional securities, and art.

-

On-chain Integration: The FIUSD token, integrates Fidelity International’s Institutional Liquidity Fund (ILF) Net Asset Value (NAV) on-chain through Chainlink, delivering greater transparency and operational efficiency.

Why Fidelity International?

-

Global Investment Expertise: Fidelity International has over 50 years of experience in the investment management industry, serving 2.9 million clients worldwide (excludes Fidelity Investments Canada (FIC) clients). With a long-term perspective and a solid track record, Fidelity International is a trusted name in global finance.

-

Comprehensive Financial Services: Managing over $893 billion in assets as of December 2024, Fidelity International provides a wide range of tailored investment solutions for institutions and workplace pensions.

-

All rounded digital assets ecosystem: Fidelity International’s long-term vision is to position itself as a gateway to digital assets investing for investors, relying on Fidelity International’s all rounded digital assets ecosystem to bring in research capabilities and blockchain expertise.

Looking Ahead

Sygnum and Fidelity International are committed to growing their presence in Web3 and blockchain-powered finance. The partnership will continue exploring opportunities in tokenized assets, advancing the development of on-chain investment opportunities that bridge traditional and decentralized finance. Sygnum and Fidelity International would be delighted to explore opportunities with Arbitrum to accelerate this transformative journey, unlocking new possibilities and expanding adoption across the industry.

B. APPLICANT INFORMATION

Name: FIUSD Token – Fidelity Institutional Liquidity Fund (ILF)

Address (Headquarters):

Sygnum Bank AG

Uetlibergstrasse 134A,

8045 Zurich, Switzerland

Fidelity International

4 Cannon Street,

London, EC4M 5AB

United Kingdom

Website:

For comprehensive details regarding the underlying asset of the FIUSD Token—the Fidelity Institutional Liquidity Fund—please visit the fund’s official website at Liquidity Funds.

Primary contact Name:

Name: Martin Burgherr

Title: Chief Clients Officer, Sygnum Bank

Country: Switzerland

Email: Martin.burgherr@sygnum.com

C. KEY INFORMATION

Expected Yield: 4.35%*as of 13 February 2025. The weighted average maturity is expected not to exceed 60 days.

*Please note that the expected yield is not guaranteed and may not be achieved. Various factors can influence actual results, and past performance is not indicative of future outcomes.

Expected Maturity: This is an open-ended investment fund without a final maturity date. The target weighted average maturity of the Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund is between 0 and 60 days. The fund invests in instruments with a maturity up to 397 days.

Underlying asset: The Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund is a short-term money market fund with the investment objective to invest in a diversified range of short-term instruments with the aim of maintaining capital value and liquidity whilst producing a return to the investor in line with money market rates.

The fund is a same day settlement fund and offers multiple cut-off times throughout the day.

The fund is managed according to a strict set of guidelines to qualify as low volatility net asset value Short-Term Money Market Fund under EU Money Market fund regulations. The fund is rated AAAm / Aaa-mf* by S&P and Moody’s respectively, which adds a further strict layer of guidelines to ensure the fund maintains the highest ratings.

*Please note these ratings are not intended to evaluate the prospective performance of the relevant fund with respect to appreciation, volatility of Net Asset Value, or yield. The Fidelity Institutional Liquidity Fund PLC (ILF) has been awarded the highest possible money market rating of Aaa-mf by Moody’s and AAAm by Standards & Poor’s, as of December 2024.

Minimum/Maximum transaction size: Per current prospectus, Class G Shares within the ILF Fund have no minimum initial subscription, holding, or subsequent subscription requirements.

Current AUM

-

Token – FIUSD: $47.5m FIUSD, Fidelity ILF USD Fund Class G Acc (as of 11 March 2025)

- Arbitrum: $5m ArbiScan

- ZKsync: $42.5m ZKsync Explorer, RWA.xyz

-

Underlying Fund: The underlying fund has $8.898 billion of assets under management as of 13 February 2025.

Volume of transactions LTM: The Fidelity Institutional Liquidity Fund – US Dollar Fund, per European money market regulations, is required to have over 10% of its assets in instruments that mature in 1 day and 30% with weekly maturity. This means there is a naturally high level of liquidity in the portfolio at all times, ensuring that large inflows and redemptions can be met with ease. At present, there is more than 25% in assets with a 1-day maturity. Given a fund size of approximately $8.9bn, this means it is trading over $2bn of assets in instruments such as time deposits each day.

Fidelity offers full transparency on the liquid asset percentage (i.e. 1-day maturity of underlying assets). You can find the numbers here: Fidelity Liquidity Funds - Fund Information – ILF Liquid Assets Percentage.

Source of first-loss capital: This question is applicable for the underlying money market fund, because there is no securitisation or tranching of assets. With an investment into a mutual fund, the investor will be exposed to the performance and the risks of the underlying securities.

D. BASICS AND BACKGROUND

1. How will this investment improve Arbitrum’s RWA ecosystem?

Sygnum is driving the growth of Arbitrum’s RWA ecosystem by facilitating institutional adoption and liquidity. We have already enabled $5 million (ARBISCAN) in investments on Arbitrum and will continue to bring new capital to the network.

As a regulated digital asset bank, Sygnum bridges traditional finance with DeFi by providing secure, compliant tokenized asset solutions. Our investment strengthens Arbitrum’s position as a leading RWA hub, enhancing liquidity, yield opportunities, and institutional participation.

By leveraging our expertise in asset tokenization and regulated financial services, we are committed to scaling Arbitrum’s RWA sector and unlocking new opportunities for investors and issuers.

2. Identify key management personnel and individual experience. Also include third parties utilized for managing assets and their qualifications.

Sygnum as banking partner and tokenization provider:

Mathias Imbach, Co-Founder & Group CEO

Prior to co-founding Sygnum, Mathias was General Manager at RNT Associates, Mr. Ratan N. Tata’s personal investment platform, which he joined as the first team member. He led multiple venture capital and private equity investments and participated in blockchain, and DLT-related equity deals globally. Mathias started his career at Bain & Company where he led advisory projects for private equity funds, family offices and technology companies. He holds a PhD from the University of St. Gallen and a Master of Science from the London School of Economics (LSE).

Martin Burgherr, Chief Client Officer

Martin is Chief Clients Officer at Sygnum, responsible for all clients, including DLT, corporate, hedge fund, EAM, family office and private clients, as well as new business and new market development. Prior to joining Sygnum in August 2019, Martin worked as a qualified auditor and advisor for the financial services industry, with KPMG and Deloitte. He started his career in Swiss equity sales with UBS Investment Bank. He is a Swiss Certified Public Accountant (CPA) and a Swiss Licensed Audit Expert. Martin also holds a Master of Arts in Business Administration and a Bachelor of Arts in Banking and Finance from the University of Zurich.

Fatmire Bekiri, Head Tokenization

Fatmire is the Head of Tokenization at Sygnum Bank, where she leads the development of on-chain investment opportunities. Under her leadership, her team has launched multiple pioneering and industry-leading projects across diverse investment verticals. Fatmire is also responsible for overseeing the in-house development of Sygnum’s primary and secondary tokenization platforms. Prior to joining Sygnum in July 2021, Fatmire gained extensive experience in traditional banking in Switzerland and built a successful career at a corporate finance boutique, where she formed a strong foundation in financial advisory and investment structuring. Fatmire holds a Master of Arts in Banking and Finance from the University of Zurich.

Fidelity International as investment manager:

Emma Pecenicic, Head of Digital Propositions and Partnerships, APACxJ

Emma leads the distribution efforts for digital assets globally at Fidelity International, supporting the commercialisation of Fidelity International’s Bitcoin spot strategy as well as fund tokenization. In addition, Emma leads the build out of Fidelity International’s digital product solutions and digital wealth strategy in Asia. Emma joined Fidelity International in 2021, prior to that she was heading the Digital Strategy department at BNP Paribas Asset Management, leading tokenization and blockchain initiatives since 2018. Emma is a board member of the Fintech Association of Hong-Kong and has led its Blockchain committee for multiple years, she is a founding member of W3W a community supporting women in Web3. Emma holds an MSc in Financial Management and a Diplôme des Grandes Écoles with a major in Financial Analysis from EDHEC Business School in France.

Nicolas Lehmann, Sales Associate Director Wholesale

Nicolas joined Fidelity International in 2017 as a Senior Sales Manager, covering the Swiss Wholesale Market in the German and Italian speaking region. In his role, he is responsible to cover key strategic clients, banks and external asset managers in Switzerland. Before joining Fidelity International, Nicolas worked for Credit Suisse Asset Management as a Sales Manager. He started his career in 2008 at Clariden Leu AG as a Sales Support in their Asset Management department. Nicolas holds a Bachelor of Arts in Banking & Finance and a Master of Arts in Business Administration, both from the University of Zurich.

Tim Foster, Portfolio Manager, Lead manager of the Institutional Liquidity Fund

Tim Foster is a Portfolio Manager of Fidelity International’s money market, inflation linked and total return bond disciplines. Tim joined Fidelity International in 2003 as a Quantitative Analyst and became a Portfolio Manager in 2007. Through this time, he has widened his portfolio management responsibility beyond short-dated portfolios, including into corporate and inflation linked bonds. Tim is a key member of both Fidelity International’s Money Market & Short Dated and Total Return & Unconstrained strategy teams. Tim has a Bachelor, MSc in Natural Sciences from Cambridge University and is a CFA charter holder. He also has a Certificate in Quantitative Finance.

Ravin Seeneevassen, Lead Portfolio Manager

Ravin Seeneevassen joined Fidelity in November 2024 and is the Lead Portfolio Manager for Fidelity’s Absolute Return Fixed Income Fund and the Co-PM for Fidelity’s Strategic Bond strategies. In April 2025, he will become the Lead PM for Fidelity’s Inflation-Linked Bond Funds and Co-PM on the Money Market Funds. Ravin will work closely with Mike Riddell and Tim Foster using the well-established team-based investment approach. Ravin joined Fidelity with extensive experience in unconstrained fixed income strategies, having previously been a portfolio manager in Allianz Global Investors’ Macro Unconstrained Fixed Income team. Prior to this, he was a Partner and Portfolio Manager at Linden Grove Capital, Portfolio Manager in the Macro Trading Unit at Noble Resources UK, Vice-President on the Cross-Asset Trading Desk at Nomura International, and an Associate in Inflation Derivates trading at Lehman Brothers. Ravin holds an MSc in Machine Learning from Royal Holloway, University of London and an Meng (Hons) in Engineering, Economics & Management from the University of Oxford.

3. Describe any previous work by the entity or its officers/key contributors similar to that requested. References are encouraged.

In 2024, Sygnum collaborated with Fidelity International to tokenize Matter Labs’ treasury reserves in Fidelity International’s ILF money market fund. In addition, Sygnum and Fidelity International partnered with Chainlink to bring the Net Asset Value (NAV) of the fund on-chain, see article.

Additionally, Sygnum has significant experience in tokenizing financial assets, including traditional securities. The bank has been operating in the digital asset space since 2019 and launched its tokenization platform, Desygnate, in 2020. The platform has facilitated the issuance of tokenized assets across various sectors, including private markets, traditional securities, and arts & collectibles.

Relevant past work includes:

- 2022: Sygnum was selected by a vehicle of Maker under MIP-65 as the lead brokerage and custody partner for its first treasury diversification into traditional assets, see article.

- 2023: Sygnum partnered with Float and Fasanara Capital to tokenize a private debt instrument, see article.

- 2024: In collaboration with Hamilton Lane and Apex Group, Sygnum launched fully regulatory-compliant DLT-registered shares under Luxembourg law for Hamilton Lane’s flagship Global Private Assets fund. This milestone was not only exceptional from a technical blockchain perspective, but also marked a significant step from a legal perspective, see article.

These projects highlight Sygnum’s leadership in regulated tokenization solutions, particularly in institutional-grade financial products like tokenized money market funds as well as private asset funds.

Fidelity has a long heritage in the digital assets space, being at the forefront of innovation and adoption.

Specifically on tokenization, Fidelity International actively explores the real-life applications of asset tokenization, including fund tokenization and security tokenization. Fidelity’s aim is to develop practical approaches that promote capital efficiency and democratize access to financial services.

Fidelity International’s relevant tokenization experience includes:

- 2023: Participation in the HKSAR tokenized green bond, marking the first sovereign tokenized green debt issuance on a global scale.

- 2024: Participation in JP Morgan Kinexys’ Tokenized Collateral Network, tokenizing the ILF money market fund for collateral use.

- 2024: Participation in Monetary Authority of Singapore Project Guardian, partnering with Citi on tokenized swap and tokenized money market fund solution.

- 2025: HBAR Foundation invests in Fidelity International USD Money Market Fund, tokenized by Archax.

Fidelity’s recent focus has been to extend the utility and capabilities of its money market funds by using blockchain technology.

4. Has your entity or its officers/key contributors been subject to an enforcement action, criminal action, or defaulted on legal or financial obligations? Please describe the circumstances if so.

As of the date of submission of this RFP, there are no current, past, or pending material litigation against Sygnum Bank AG, or any of its officers that would be expected to have a material adverse impact on the financial condition of Sygnum or Sygnum’s ability to carry out the services described herein.

To the best of the knowledge and belief of Fidelity International, there is no current, past, or pending material litigation against the entity, or a director or key employee of the entity, for the past 10 years, which has had or is expected to have a material adverse impact on the financial condition of the entity or the entity’s ability to carry out investment management of client assets.

5. Describe any conflicts of interest for your entity and key personnel.

At this time, there is no known (unmitigated) conflict of interest that requires disclosure. Sygnum Bank AG and Fidelity International have appropriate policies and procedures in place to adequately identify and mitigate (potential) conflicts of interests.

6. Insurance coverages, guarantees, and backstops, Name of insurer or guarantor Per incident, coverage, Aggregate coverage

Sygnum’s insurance protection has the following policies in place:

- Professional indemnity insurance (Civil Liability)

- Management liability insurance (Directors and Officers Liability)

- Electronic and computer crime insurance

Fidelity International currently maintains a Global Financial Lines Policy that includes blended cover for the following categories:

- Financial institutions bond

- Electronic and computer crime insurance

- Professional indemnity insurance (Civil Liability)

- Management liability insurance (Directors and Officers Liability)

Additional information has been emailed for committee review.

7. Historical tracking error in your proposed product, or similar to that being proposed Product 2024 2023 2022 2021

This Fund does not track a benchmark, and as such we typically do not provide tracking error information. However, in this instance, we have provided you with the tracking error information for the Fund against the ICE Bank of America (BofA) SOFR Overnight Rate Index (L0US Index).

Table 1: Tracking error for the G Acc Share Class of the Fidelity Institutional Liquidity Fund The United States Dollar Fund in USD, net of fees.

| Date | 1-year Tracking Error* (in %) |

|---|---|

| 31/12/2022 | 0.01 |

| 31/12/2023 | 0.02 |

| 31/12/2024 | 0.02 |

*Calculated daily.

Source: Fidelity International, as of 31 December 2024. Past performance is not indicative of future performance.

Please note that Fidelity’s Institutional Liquidity Fund range is managed according to a strict set of guidelines in order to qualify as low volatility net asset value Short-Term Money Market Funds under EU Money Market fund regulations. The funds are rated AAAm / Aaa-mf^ by S&P and Moody’s respectively, which adds a further strict layer of guidelines to ensure the funds maintain the highest ratings.

8. Brief reason for above tracking error

N/A, please see above answer to question 7.

9. Please describe any experience your firm has in working with decentralized organizational structures

Sygnum has significant experience working with DAOs, demonstrating a proven ability to integrate traditional financial solutions with blockchain technology in a highly secure and compliant environment.

Sygnum’s track record includes pioneering work in RWA, such as its role in the diversification of $500 million in collateral assets for the Sky community (formerly MakerDAO) into liquid bond strategies structured as Exchange Traded Funds (ETFs). This collaboration was a landmark achievement in the adoption of RWAs within the blockchain space, see article.

Sygnum’s extensive expertise in bridging traditional finance and the digital asset ecosystem is grounded in its unique regulatory status as a bank and a securities firm, which provides additional assurances to Arbitrum such as:

- Robust Liquidity Solutions – Sygnum’s dual role as a lender and professional broker grants access to an extensive network of institutional liquidity providers, developed and refined over the past five years.

- Bankruptcy remoteness – traditional securities and digital assets held in custody with Sygnum benefit from enhanced asset protection, rooted in the Swiss Banking Act (Articles 16 and 37d).

- Strategic Industry Presence – Sygnum has strong partnerships with key players in the blockchain ecosystem, including ZKsync and Chainlink, having tokenized $50 million of Matter Labs’ treasury reserves on the ZKsync blockchain, see article. Additionally, Sygnum’s multi-chain tokenization stack has supported Hamilton Lane, a leading private markets investment manager with over $900 billion in assets, in launching DLT-registered shares on Polygon blockchain for a flagship product, see article.

10. What is your entity’s current assets under management, assets held in trust, total value locked, or equivalent metric for your legal structuring?

Sygnum is recognized as the world’s first digital asset bank with more than $5 billion in assets under custody and trusted by +2’000 professional and institutional clients globally including 70% of the top 50 digital asset foundations/projects, entrepreneurs/founders, family offices, asset managers, brokers as well as more than 20 other banks, deeply rooted in Switzerland and Singapore.

Fidelity International has over 50 years of experience in the investment industry, serving 2.9 million clients worldwide (excludes Fidelity Investments Canada (FIC) clients). With a long-term perspective and a solid track record, Fidelity International is a trusted name in global finance. Managing over $893 billion in assets as of December 2024, Fidelity International provides a wide range of tailored investment solutions for institutions and workplace pensions.

11. How many of these assets held are present on Arbitrum One, if any?

Currently, $5 million from the ILF Fund is strategically allocated to Arbitrum, with strong growth potential not only from this position but also from other existing and newly issued tokens within the ecosystem.

E. PLAN DESIGN

1. Please describe your proposed product, including a description of the underlying assets and, if more than one asset, the proposed allocation among assets and general investment guidelines. Where appropriate, include targeted maturity mix and credit quality. Attach supplementary documents as appropriate.

Each FISUD token represents one fund unit of the Fidelity Institutional Liquidity Fund (ILF).

The Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund is a short-term money market fund with the investment objective to invest in a diversified range of short-term instruments with the aim of maintaining capital value and liquidity whilst producing a return to the investor in line with money market rates. This is an open-ended investment fund without a final maturity date. The target weighted average maturity of the Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund is between 0 and 60 days. The fund invests in instruments with a maturity up to 397 days.

The fund is a same day settlement fund and offers multiple cut-off times throughout the day.

The fund is managed according to a strict set of guidelines to qualify as low volatility net asset value Short-Term Money Market Fund under EU Money Market fund regulations. The fund is rated AAAm / Aaa-mf* by S&P and Moody’s respectively, which adds a further strict layer of guidelines to ensure the fund maintains the highest ratings.

The Yield of the fund as of 13th of February 2025, was 4.35%*.

*Disclaimer: Please note these ratings are not intended to evaluate the prospective performance of the relevant fund with respect to appreciation, volatility of Net Asset Value, or yield. The Fidelity Institutional Liquidity Fund PLC (ILF) has been awarded the highest possible money market rating of Aaa-mf by Moody’s and AAAm by Standards & Poor’s, as of December 2024.

The net income generated by the fund is allocated to tokenholders through daily price adjustments, directly integrating the earned net income into the value of the FIUSD token. This daily accumulation ensures that the token price accurately represents the net income generated by the underlying assets.

As per the prospectus, the Fidelity Institutional Liquidity Fund - US Dollar Fund’s (“the Fund”) objective is to invest in a diversified range of short-term instruments with the aim of maintaining capital value and liquidity whilst producing a return to the investor in line with money market rates. The Investment Manager believes that its investment practices will enable the Fund to achieve its stated policy although this cannot be guaranteed. The Fund shall invest in accordance with the policies outlined in the section below entitled “Permitted Investments”.

The Fund promotes environmental and social characteristics by aiming to achieve an ESG score in its portfolio greater than that of its investment universe. In addition, through the investment management process, the investment manager aims to ensure that invested companies follow good governance practices. For more information, please see the section of the Prospectus entitled “Sustainable Investing and ESG Integration” and the Sustainability Annex. The Fund is subject to the disclosure requirements of article 8 of the SFDR (i.e., it promotes environmental and/or social characteristics).

Permitted Investments: The Fund will invest in the High-Quality instruments indicated below (and described in detail under “Asset Classes” in the “Investment Objective and Policies” section of the Prospectus), provided they are payable in United States Dollar:

Table 2: Permitted Investments (ILF)

| Security/Instrument | Eligibility |

|---|---|

| Money market instruments (government) | Yes |

| Money market instruments (non-government) | Yes |

| Securitisations and ABCP | Yes |

| Deposits | Yes |

| Repurchase agreements | Yes |

| Reverse repurchase agreements | Yes |

| Money market funds | Yes |

Source: Fidelity International, 2025

Liquidity and preservation of capital are key objectives of Fidelity International’s money market funds. In accordance with the Institutional Money Market Funds Association’s (IMMFA) money market fund criteria, the fund maintains at least 10% of its assets in securities maturing the next business day and at least 30% in securities maturing within five business days. Liquidity in the market is monitored by its dedicated fixed income Trading Team and an independent risk oversight function. Portfolio Managers maintain conservative liquidity buffers to facilitate any client redemptions with ease. Furthermore, the Fund is subject to liquidity criteria in order to maintain its Aaa-mf rating from Moody’s.

Below are the key criteria followed by the fund across the three major bodies responsible for the Fund’s guidelines:

Figure 1: Key criteria across three major bodies

Source: Fidelity International, 2025.

2. Do investors have any shareholder, investor, creditor or similar rights?

Holders of the FIUSD token have the right to demand the delivery of the underlying assets – i.e. the ILF fund units – held by Sygnum on behalf of Arbitrum (see answer to E.3 and E.4 for more information on the fiduciary setup). The Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund (the underlying custody asset) is an open-ended investment company with variable capital organized under the laws of Ireland as a public limited company pursuant to the Irish Companies Act 2014. As such the Fund provides its shareholders with the shareholder rights granted by the applicable law, articles of association and the prospectus.

3. Describe the legal and contractual structuring for your product including regulatory bodies overseeing your business and the product and identifying all legal jurisdictions interacting with your product. Attach supplementary documents as appropriate.

Structuring: One token represents one fund unit of the Fidelity Institutional Liquidity Fund (ILF). A new FIUSD token is issued for each new fund unit that is subscribed. If a fund unit is sold or redeemed, the corresponding FIUSD token is burnt. The FIUSD tokens therefore always represent the exact number of fund units invested via Sygnum.

The FIUSD tokens are issued as a ledger-based security under Swiss law in accordance with art. 973d et seqq. of the Swiss Code of Obligations. With ledger-based securities, Swiss law explicitly provides for the legal possibility of representing a value or right on-chain. Together with the well-established legal system in Switzerland, this provides legal certainty in a renowned jurisdiction.

The proposed setup is structured in such a way that Sygnum will hold the assets in its own name but on behalf of Arbitrum (i.e., a fiduciary setup in accordance with art. 16 para. 2 of the Swiss Banking Act to ensure that the assets are segregated in the unlikely event of Sygnum’s bankruptcy).

Oversight on Sygnum’s level (token issuer): Sygnum Bank AG is an authorized Swiss bank and securities firm supervised by the Swiss Financial Market Supervisory Authority (FINMA) and is authorized to operate as a portfolio manager.

Regarding the FIUSD token as such, there is no direct product supervisory body. However, as a regulated Swiss bank, Sygnum is prudentially supervised by FINMA. This supervision aims at protecting creditors and maintaining the stability of the financial system (see Banking supervision | FINMA).

Oversight on underlying asset level: The Fidelity Institutional Liquidity Fund PLC – The United States Dollar Fund is an Irish domiciled fund which is authorised by the Central Bank of Ireland (the “Central Bank”) as an UCITS under the European Communities (Undertakings for Collective Investments in Transferable Securities) Regulations 2011.

4. Would Arbitrum’s assets be bankruptcy remote from your own entity and its officers/key contributors? If so, please explain the legal and contractual basis. On a confidential, non-reliance basis, provide any third-party legal opinions to support the conclusions.

The chosen setup, in which Sygnum will hold the underlying assets in its own name but on behalf of Arbitrum, is a fiduciary setup.

According to art. 16 para. 2 of the Swiss Banking Act, tangible assets, securities and claims which a bank safekeeps on behalf of the depositor (i.e., Arbitrum) are considered to be deposits (“Depotwerte”; custody account assets) as per art. 37d of the Swiss Banking Act and are therefore segregated by law in case of an unlikely event of bankruptcy of Sygnum. In other words, the underlying assets held by Sygnum on behalf of Arbitrum are bankruptcy remote.

With art. 16 and art. 37d of the Swiss Banking Act, the segregation of custody account assets (Depotwerte) is based on a clear legal basis and has an established practice (see, for example, the answer to the FAQ question “What happens to securities in the event of a bank’s bankruptcy?”: Questions and Answers (FAQ) | esisuisse).

5. How are Arbitrum’s assets protected vis-a-vis the bankruptcy of the brokerage or applicable financial institution (e.g., bank deposit insurance, securities insurance, etc.)?

Reference is made to the answer to the previous question (see E.4). Custody account assets (Depotwerte) such as the Fidelity Institutional Liquidity Fund PLC fund units held on behalf of Arbitrum are segregated by law in case of an unlikely event of bankruptcy of Sygnum and are thus bankruptcy remote. The same would apply to any crypto-based assets (such as ARB) that Arbitrum might hold with Sygnum and which qualify as custody account assets (Depotwert).

6. Does the Issuer issue more than one asset? If so, what is the priority relationship between different asset classes?

The FIUSD Token represents the token holder’s right to demand the delivery of the ILF unit, which is held on behalf of Arbitrum. This means that neither existing tokens nor future tokens compete with the FIUSD Token. Fidelity International offers a broad range of innovative solutions and services across asset classes to meet their clients varied and evolving needs. These include equities, fixed income, multi asset and real estate - covering active, passive, systematic and factor-based investment styles, as well as specific sustainable strategies and digital assets solutions. There is no priority relationship between the different asset classes.

7. Provide a detailed cash flow diagram that shows the flow of funds from ARB/Fiat conversion, investment in underlying asset, payment of expenses, sale of underlying asset, and repayment (Fiat/ARB conversion), including the counterparties and legal jurisdictions involved.

Subscription requests can be made during standard Swiss banking hours and are subject to applicable cut-off times.

Subscription flow:

- Arbitrum has the option to deposit either Arbitrum tokens (ARB), other cryptocurrency or fiat into their account at Sygnum.

- Arbitrum initiates the investment by placing a subscription order at Sygnum. Subscription can be placed in Arbitrum tokens (ARB), other cryptocurrency or fiat. Subscriptions are generally made in the currency of the underlying asset, which in this case is USD. If a subscription is requested in ARB, other cryptocurrency/stablecoins or fiat other than USD, Sygnum executes respective conversion to USD free of charge and settles the order in the corresponding currency/token. See question G.2 for the list of fees.

- Following Arbitrum’s order, Sygnum invests in the fund via J.P. Morgan, the fund administrator.

- After the trade is successfully completed, Sygnum mints FIUSD tokens representing the purchased fund units to Arbitrum’s wallet, which is securely held in Sygnum custody.

Figure 2: Subscription Flow (1. – 4.)

Source: Sygnum Bank, 2025

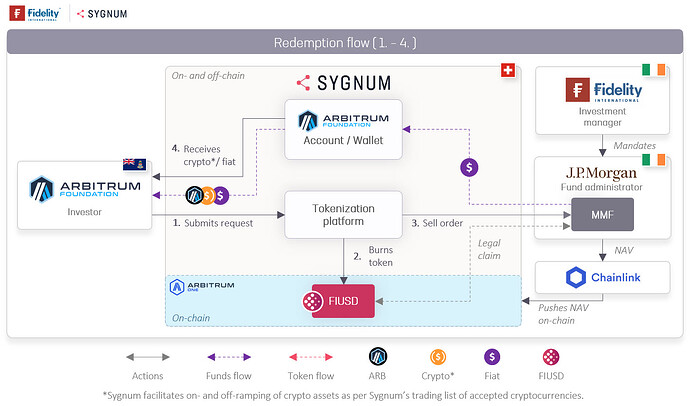

Redemption flow:

- To initiate the redemption process, Arbitrum submits a redemption request to Sygnum.

- Upon receiving the request, Sygnum burns the tokens.

- A sell order is then executed via J.P. Morgan.

- Once the sale is executed, the proceeds from the sale, either in ARB, other cryptocurrency/stablecoins or fiat, are credited to Arbitrum’s account at Sygnum. See question G.2 for the list of fees.

Following both subscription and redemption processes, J.P. Morgan takes on the role of the calculation agent, tasked with determining the NAV of the tokens. J.P. Morgan then communicates the NAV to Chainlink. In return, Chainlink pushes the updated asset price on-chain.

Figure 3: Redemption Flow (1. – 4.)

Source: Sygnum Bank, 2025

8. Describe anticipated tax consequences (if any) in transacting on the underlying and/or receipt of yield.

Tax obligations may arise from the underlying assets themselves. The tokenization is not expected to have any additional tax implications in Switzerland.

Disclaimer: Sygnum is not entitled to provide any tax advice, hence the above information is for general information purposes only and does not constitute tax, legal or financial advice. It is recommended to consult a qualified tax, legal and/or financial advisor for specific tax questions or matters. Sygnum assumes no liability for decisions made based on the information contained in this publication.

9. Describe the process and expected timeline for liquidation of assets, if given instructions to do so by Arbitrum governance.

Sygnum with its direct access to state-of-the-art fiat and cryptocurrency/stablecoin capabilities, as well as its ability as a bank to provide collateralized lending facilities is uniquely positioned to provide maximum redemption and subscription efficiency.

Sygnum, as a lender against the FIUSD token, has designed a liquidity facility concept which increases the liquidity efficiency significantly above current industry benchmarks. The designed process increases the 24/7/365 redemption to about $25m outside of Swiss banking hours.

The underlying fund is daily liquid during business days and provides ample liquidity. Please see question E.11. for further information.

10. What amount of first-loss equity will Sponsor provide to ensure over-collateralization, how is the first-loss equity denominated, and what is the source of capital?

This question is not applicable for the underlying money market fund, because there is no securitisation or tranching of assets. With an investment into a mutual fund, the investor will be exposed to the performance and risks of the underlying securities.

11. Describe the liquidity and stability of the proposed underlying assets, including anticipated settlement times from the sale of the underlying to the repayment of ARB.

The money market fund is a same day settlement fund and offers multiple cut-off times throughout the day. Further details on dealing cut-off times for the fund can be obtained in the prospectus and in the cut-off times grid.

Table 3: Trading Deadlines

| PDCNAV (New York Time) | LVNAV (Irish Time) | ||

|---|---|---|---|

| ILF USD Treasury | ILF USD | ILF EUR | ILF GBP |

| *08:00 | *07:00 | *07:00 | *07:00 |

| **12:00 | **11:00 | **11:00 | **11:00 |

| ***15:00 | **15:00 | ***13:30 | ***13:30 |

| **18:00 | |||

| ***21:00 |

Source: Fidelity International, 2025

*Interim cut off for in good order automated trades

**Interim cut off

***Final cut off

The Fidelity Institutional Liquidity Fund - US Dollar Fund, per European money market regulations, is required to have over 10% of its assets in instruments that mature in 1 day and 30% with weekly maturity. This means there is a naturally high level of liquidity in the portfolio at all times, ensuring that large inflows and redemptions can be met with ease. At present, there is around 25% in assets with a 1-day maturity. Given a fund size of approximately $8.9bn, this means it is trading over $2bn of assets in instruments such as time deposits each day.

Fidelity offers full transparency on the fund’s “Liquid Asset Percentage” (i.e. 1-day maturity of underlying assets). You can find the numbers here: Fidelity Liquidity Funds - Fund Information – ILF Liquid Assets Percentage.

12. If relying on the blockchain for any of the transactional flows, please describe any blockchain derived risks and mitigations.

For any transaction flows relying on the blockchain, Sygnum introduced the following risk mitigations:

- Extended block confirmations: These confirmations take place before setting the final state of a transaction: this helps Sygnum mitigate risk from the chain being forked while a transaction in pending.

- Daily risk report: Sygnum also maintains a comprehensive risk (and reconciliation) report that consolidates data from its Core Banking System (CBS), database, and blockchain to ensure consistency and reliability.

- Smart contract functions: Sygnum’s smart contracts include functions that allow specific users to make necessary corrections in a fully auditable manner.

- Roles and authorizations: To maintain security and integrity, Sygnum’s applications and smart contracts enforce strict role-based permissions, ensuring that only authorized entities can process blockchain transactions, with all actions recorded for transparency and accountability.

13. Does the product rely on any derivative product (swaps, OTC agreements)?

The Fund does not engage in the use of financial derivative instruments and, for the avoidance of doubt, shall not invest in equity or equity-related securities.

14. List all the third-party counterparties linked to your assets including and not restricted to prime broker if any, custodian, reporting agent, banks for derivatives or loans and provide primary contact details for the third-party counterparties.

Figure 4: Roles of involved counterparties and their jurisdictions

Source: Sygnum Bank, 2025

Table 4: List of off-chain counterparties

| Role | Counterparty |

|---|---|

| Custodian | J.P. Morgan SE, Dublin Branch (200 Capital Dock, 79 Sir John Rogerson’s Quay Dublin 2, Dublin 2) |

| Administrator | J.P. Morgan Administration Services (Ireland) Limited (200 Capital Dock, 79 Sir John Rogerson’s Quay Dublin 2, Ireland) |

| Sponsoring broker | J & E Davy (Davy House, 49 Dawson Street, Dublin 2, Ireland) |

| Legal advisor | Dillon Eustace Solicitors (33 Sir John Rogerson’s Quay, Dublin 2, Ireland) |

| Auditors | Deloitte Ireland LLP (Deloitte & Touche House, 29 Earlsfort Terrace, Dublin 2, D02 AY28, Ireland) |

| Distributor | Sygnum Bank AG (Uetlibergstrasse 134a, 8045 Zurich, Switzerland) |

Source: Fidelity International, 2025.

For further details, please see the fund’s prospectus: Prospectus Fidelity ILF.

15. Can you explain how is risk management (inv and operational) being done? Can you provide a copy of your risk management policy?

Sygnum’s risk policy, approved by the Group Board of Directors, along with other risk directives sets forth Sygnum’s risk management framework and principles. The risk governance of Sygnum has been established by the Group Board of Directors who nominates and dismisses the members of the Audit and Risk Committee (ARC), the members and chairs of the Group Executive Board (including Chief Risk Officer) and the responsible Head of Group Internal Audit. The ARC monitors and assesses the institution wide risk management framework, the integrity of financial statements, the Internal Control System, and the effectiveness of the internal and the external Audit firm. The ARC receives monthly consolidated risk reports for the attention of the BoD.

With the aim of fulfilling its responsibilities and conducting its monitoring function, the Group Board of Directors defines risk appetite statements including escalation and remediation processes in case of limit breaches. The risk appetite defines the amount of risk Sygnum is willing to consume to achieve its strategic pursuits. The Group Executive Board is responsible for the Group-wide management of risks and risk-taking within the risk appetite of all Sygnum entities and all business activities. As such, it fosters a prudent and conscious risk culture and is responsible for the implementation of the risk management framework as well as for compliance with applicable law, internal and external regulations.

The identification, assessment, measurement, monitoring, and reporting of risks are crucial processes for Sygnum. Sygnum’s Risk Management framework is designed to protect its capital base and shareholder value; minimize operational losses and damage to Sygnum’s reputation; and support its strategy by providing risk-relevant factors for decision-making.

Sygnum has established two control functions, Risk Management (including IT Security) and Compliance. These functions, represented by their respective heads at the Group Executive Board level, are independent from the revenue-generating units.

Overall, the risks that arise from Sygnum’s business activities are the following: credit risk, operational risk, market risk, liquidity risk and reputational risk (arising as a consequential risk from the first ones).

Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. Sygnum identifies and assesses operational risk along with well-established methods, and addresses risks based on cost-benefit considerations and the defined risk appetite. The operational risk appetite is spread across a number of key risk indicators (KRIs) and in case of breaches to the limits, risk mitigating measures are defined.

Core components of the operational risk management framework are the institution-wide identification of risks and controls in processes and systems at Group level. Furthermore, Sygnum conducts annual risk and controls self-assessment of key risks (e.g. IT risks, BCM risks, Cyber risks) by category.

As far as Sygnum’s Internal Control System is concerned, an annual assessment of design of controls and effectiveness tests is performed. This is all documented in Sygnum’s Group Governance, Risk and Compliance (GRC) platform. Moreover, the timely identification of any operational events is also core to the operational risk management framework.

Particular attention is given to the following topics:

- Technology-related risks, especially information security risks

- Compliance-related risks, especially Know-Your-Client (KYC), Anti-Money Laundering (AML) and cross-border business conduct

Additional information has been emailed for committee review.

Fidelity International’s portfolio risks and positions are monitored and reviewed daily primarily via its proprietary Fund Manager Workbench (FMW) tool. The system breaks down interest rate exposures and measures of credit risk including DTS (duration times spread) and spread duration at the bond, issuer, sector and rating level. New strategies can be tested prior to implementation.

Further to risk controls carried out by the investment teams, there are independent governance and oversight reviews. These include daily monitoring of portfolio constraints and regulatory requirements by the Investment Compliance function, and monthly Investment Risk Committees’ (IRCs) evaluations of risk exposures versus expectations. The portfolio managers participate in formal Quarterly Fund Reviews (QFR) chaired by the fixed income Chief Investment Officer (CIO) and attended by the Investment Risk Team.

Fidelity’s risk processes follow three lines of defense model in adherence with a robust risk management framework.

Figure 5: Risk management: Lines of defense

Source: Fidelity International, 2024.

*Joint first / second line committee.

Additional information has been emailed for committee review.

F. PERFORMANCE REPORTING

1. What are your proposed performance benchmarks? If this is substantially different from the underlying assets, please explain why.

Fidelity Institutional Liquidity Fund is actively managed without a reference benchmark, therefore only the return is presented below.

Figure 6: ILF Fund performance

Source: Fidelity International, 2025

Please note that past performance is not a reliable indication of future performance.

The fund’s returns may increase or decrease as a result of currency fluctuations. The investment in question concerns the acquisition of units or shares in a fund, and not in a given underlying asset owned by the fund. Further information about the fund can be found on the factsheet: Factsheet Fidelity ILF Fund.

Prospectus and KID (key information document) are available in English along with the current annual and semi-annual reports at Fidelity Liquidity Funds.

An investment in a money market fund is different from an investment in deposits, as the principal invested in a money market fund is capable of fluctuation. Fidelity International’s money market funds do not rely on external support for guaranteeing the liquidity of the money market funds or stabilising the NAV per unit or share. An investment in a money market fund does not guarantee a certain yield level. Complete information on risks can be found in the Prospectus.

Figure 7: Performance to 31.12.24. Data shown for the G Acc Share Class of the Fidelity Institutional Liquidity Fund The United States Dollar Fund. Basis: Total Return.

Source: Fidelity International, as of 31 December 2024.

*After the deduction of the applied Ongoing Charges Figure of 0.2% p.a.

Past performance is not a guide to the future performance and may not be repeated .

As previously mentioned, this Fund does not track a benchmark, however we have included the performance of the ICE BofA SOFR Overnight Rate Index (L0US Index) for your comparison.

Table 5: Performance of the ICE BofA SOFR Overnight Rate Index (L0US Index)

| 1m | 3m | YTD | 1yr | 3yr | 5yr | |

|---|---|---|---|---|---|---|

| Cumulative Growth | 0.39% | 1.20% | 5.37% | 5.37% | 12.69% | 13.17% |

| Annualised Growth | - | - | - | 5.37% | 4.06% | 2.50% |

Source: Fidelity International, as of 31 December 2024.

Table 6: Monthly Performance (%)

| Dec 2023 | Jan 2024 | Feb 2024 | Mar 2024 | Apr 2024 | May 2024 | June 2024 | Jul 2024 | Aug 2024 | Sept 2024 | Oct 2024 | Nov 2024 | Dec 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.46% | 0.46% | 0.43% | 0.46% | 0.44% | 0.46% | 0.44% | 0.46% | 0.46% | 0.43% | 0.42% | 0.39% | 0.39% |

Source: Fidelity International, as of 31 December 2024.

Data shown for the ICE BofA SOFR Overnight Rate Index (L0US Index) in USD.

2. Describe the content, format, preparation process, and cadence of performance reports. This should include proof of reserves, if appropriate. Please include a sample report.

Sygnum provides monthly asset statements, along with real-time asset overviews available through e-banking. Additionally, you can generate and download ad hoc reports detailing their current positions as needed.

The following table highlights the types of client reporting and frequency provided by Fidelity International’s client service and investment teams:

Table 7: Reporting summary, Fidelity International

| Client reporting | Frequency |

|---|---|

| Factsheets: Overview of a fund including the fund’s investment objective, risk level, costs, past performance and holdings details. Fund factsheets are available for all relevant share classes. You can access the factsheet here: Factsheet Fidelity ILF Fund | Monthly |

| Fund Full Holdings: the full holdings / list of underlyings can be found here: Fund Holdings Fidelity ILF Fund | Monthly |

| Liquid Asset Percentage: this report will show you how liquid the underlying portfolio is. It shows the percentage of the portfolio that can be liquidated in one day or one week: Fidelity Liquidity Funds (under Fund Information) | Daily |

| Daily NAV: this report will provide the daily NAVs of the underlying fund: Fidelity Liquidity Funds (under Fund Information) | Daily |

Source: Fidelity International, 2025

Additionally, clients may access Fidelity International’s website for detailed information on key statistics, performance, charges, composition, and asset allocation. Please visit Fidelity International’s website at: Fidelity Liquidity Funds.

3. Who provides the performance reports in respect of the underlying assets?

Fidelity International’s investment teams include investment directors, whose role is to provide clients with timely information about past performance, as well as current views and positioning. They are also available to help potential clients learn more about applicable strategies. Please refer to your Relationship Manager at Sygnum regarding meeting opportunities and details of video/ teleconferences and events.

4. Describe any formal audit process and timing of such audits.

Fidelity International has appointed Deloitte Ireland LLP as auditor for the global fund range and related services. The fund auditor provides independent review of the financial statements of the SICAV and all funds once a year. The auditor also verifies all performance fee calculations. The appointment is subject to shareholder’s approval at each annual general meeting.

In addition, Fidelity undertakes an annual Audit and Assurance Faculty (AAF) Report to review its internal controls in conjunction with the FIL Limited Group’s auditor PricewaterhouseCoopers (PwC). Fidelity’s intention in producing this report is to explain the procedures and controls Fidelity operates within its business. Fidelity is committed to having strong control environment through its organisation. It is PwC’s responsibility to arrive at an independent conclusion based on their review of Fidelity’s controls. In summary, the control procedures are tested in relation to fund administration to confirm that it is operating with sufficient effectiveness.

Finally, Fidelity’s Internal Audit department is responsible for providing internal control and risk assessments to the FIL Limited Group. Internal Audit assess the internal controls within the FIL Limited Group to ensure that departments, including the administration group, have efficient and effective business processes with sufficient controls. They perform operational, systems audits at a team level and report on their strengths/weaknesses, and where appropriate, recommend improvements and monitor the implementation of actions for a successful and timely conclusion.

G. PRICING

1. Provide a copy of your standard contract, or one similar to what is being proposed here.

All details in relation to the underlying fund, can be found in the Prospectus Fidelity ILF and/or the SSRS_KID_FIL_PRIIP_EU.

Additional information has been emailed for committee review.

2. Fee summary: Inclusive of the full scope of services requested. Product Fee schedule If asset based Fee calculation for our plan if asset based Annual fee if flat fee Any other fees (including redemption or minting fees)

Subscription fees: 20bps

Redemption fees: 40bps

Fund Management fees: 25bps p.a.

Additional fees for banking services may apply. All prices refer to the time of the publication. Prices may be subject to change at any time and will be announced in an appropriate manner.

Additional information has been emailed for committee review.

3. Describe frequency of fee payment and its position vis-a-vis payment priority compared with other expenses (i.e., cash waterfall)

Subscription fees: once at subscription.

Redemption fees: once at redemption.

Fund Management fees: taken from the NAV daily.

H. SMART CONTRACT / ARCHITECTURE

1. How many audits have you had and name of auditors? Please provide a copy of reports.

Quantstamp conducted an audit of the smart contracts in November 2020. Sygnum’s smart contracts are currently undergoing a periodic review, with a new audit anticipated in the coming months.

Additional information has been emailed for committee review.

2. Is the project permissioned? If so, how are you managing user identities? Any blacklisting/whitelisting features?

The project combines the use of a permissionless blockchain network with a set of application and smart contract permissions to ensure security and conformity.

If enabled, token transfers are exclusively available to professional investors fully onboarded with Sygnum, according to Swiss Law. These investors undergo thorough KYC and AML verification as part of the onboarding process, ensuring alignment with all applicable regulatory standards. Upon successful completion of these due diligence procedures, their custodial wallets are added to the whitelist.

For every transaction, a smart contract is automatically activated to verify the blockchain address. If the address matches an approved one from the whitelist, the transaction is promptly authorized and completed. This process guarantees that only verified investors can engage in token transfers, creating a secure and compliant ecosystem for all participants.

3. Is the product present on several chains? Are there any cross-chain interactions?

FIUSD, Fidelity ILF USD Fund Class G Acc - $47.5m (as of 11 March 2025) is present on the following chains:

- Arbitrum: $5m ArbiScan

- ZKsync: $42.5m ZKsync Explorer, RWA.xyz

Additionally, the price of the token (Net Asset Value) is propagated on-chain using Chainlink oracle. Sygnum’s solutions enable seamless and efficient cross-chain interactions, enhancing interoperability and connectivity across blockchain networks.

4. Are the RWA tokens being used in any other protocols? Please describe the various components of the ecosystem.

The FIUSD tokens are currently not used in any additional protocols as the current needs of Sygnum’s clients are effectively met by the existing solution. Sygnum continuously evaluates client needs and analyzes the ecosystem to expand the use of its products into other protocols.

5. How are trusted roles/admins managed in the system? Which aspects of the solution require trust from users?

Trusted roles and admin access within the system are strictly managed through multiple security layers and periodic reviews.

For the Tokenization application, Sygnum assigns different access levels to internal users such as administrators, operators, etc. Following the high standards as a regulated bank, these access rights are periodically reviewed and secured through multi-factor authentication, including password renewal every three months, an internal VPN connection, and mandatory wallet linkage. Each wallet is personal, whitelisted, and exclusively accessible by its respective user, ensuring that only authorized personnel can interact with the system.

External users, such as Sygnum’s bank clients, access the tokenization platform through Sygnum’s e-banking solution, which enforces standard two-factor authentication.

In the AWS environment, access is governed by a strict entitlement framework, with role-based permissions reviewed monthly and approved using the four-eye principle. AWS itself does not have direct access to Sygnum’s environments unless explicitly requested by Sygnum or required to prevent fraud, abuse, or comply with legal obligations.

Overall, while aspects like user authentication and administrative controls require trust in Sygnum’s security framework, its layered access management and audit processes minimize risks and ensure a high level of operational integrity.

6. Is there any custom logic required for your RWA token? If so, please give any details.

The FIUSD token is permissioned with address whitelisting, and it contains operator roles.

I. SUPPLEMENTARY

1. Please attach any further information or documents you feel would help the screening committee or ARB tokenholders make an informed decision. If you prefer this not to be made public, it can be emailed to rwa@dao.arbitrum.foundation. Please mention in your application that documents have been emailed for committee review.

Additional information in relation to the questions listed below has been emailed for committee review:

- Question D.6: Insurance coverages, guarantees, and backstops, Name of insurer or guarantor Per incident, coverage, Aggregate coverage.

- Question E.15: Can you explain how is risk management (inv and operational) being done? Can you provide a copy of your risk management policy?

- Question G.1: Provide a copy of your standard contract, or one similar to what is being proposed here.

- Question H.1: How many audits have you had and name of auditors? Please provide a copy of reports.

Disclaimer: The information in this document pertaining to Sygnum Bank AG (“Sygnum”) or its partners mentioned herein is for general information purposes only, as per date of publication, and should not be considered exhaustive. This document does not consider the financial situation of any natural or legal person, nor does it provide any tax, legal or investment advice. The information herein does not constitute any advice or recommendation, an offer or invitation by or on behalf of Sygnum or its partners to purchase or sell any assets. No elements of precontractual or contractual relationship are intended. While the information is believed to be from accurate and reliable sources, Sygnum makes no representation or warranties, expressed or implied, as to the accuracy of the information. Sygnum expressly disclaims any and all liability that may be based on such information, omissions, or errors thereof. Any statements contained in this publication attributed to a third party represent Sygnum‘s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. Sygnum and its partners reserve the right to amend or replace the information, in part or entirely, at any time, and without any obligation to notify the recipient of such amendment / replacement or to provide the recipient with access to the information. Simultaneously, there is no obligation of Sygnum to inform recipients of information, if before provided information later becomes outdated, inaccurate or obsolete, unless otherwise provided by applicable law. The assets mentioned herein might face an uncertain regulatory landscape in certain jurisdictions, legal and regulatory risks shall therefore be assessed on an individual basis.

These materials may include statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements include, for example, the terms “believes”, “estimates”, “plans”, “projects”, “anticipates”, “expects”, “intends”, “may”, “will” or “should” or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. Forward-looking statements may and often do differ materially from actual results. Forward-looking statements speak only as of the date they are made. Without prejudice to any requirements under applicable laws and regulations, Sygnum and each of the participating authorized participants expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in these materials to reflect any change in expectations thereof or any change in events, conditions or circumstances on which any such forward-looking statement is based, whether as a result of new information, future developments or otherwise. In any case, these materials are not a complete statement of the markets and developments referred to herein. Where applicable, some figures may refer to past performances or simulated past performances and past performance is not a reliable indicator of future results. Some figures may be forecasts only and forecasts are not a reliable indicator of future performance. Investment decisions should always be taken in a portfolio context and make allowance for your personal situation and consequent risk appetite and risk tolerance. No reliance may be placed for any purpose on the information contained in these materials or its accuracy or completeness.

The information provided is not intended for use by or distributed to any individual or legal entity in any jurisdiction or country where such distribution, publication or use would be contrary to the law or regulatory provisions or in which Sygnum does not hold the necessary registration, approval authorization or licence. Except as otherwise provided by Sygnum, it is not allowed to modify, copy, distribute or reproduce, display, licence, or otherwise use any content for commercial purposes.

Important Information: This information must not be reproduced or circulated without prior permission. This information does not constitute investment advice unless specifically agreed in a formal communication. Fidelity International refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited. FIL Limited assets and resources as at 31/ 12/2024 - data is unaudited. No statements or representations made in this document are legally binding on Fidelity or the recipient. Any proposal is subject to contract terms being agreed. Fidelity Institutional Liquidity Fund plc is an open-ended investment company with variable capital organised under the laws of Ireland and is authorised by the Central Bank of Ireland as a UCITS fund under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (as amended). FIL investment Management (Luxembourg) S.A. reserves the right to terminate the arrangements made for the marketing of the sub-fund and/ or its shares in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU. Prior notice of this cessation will be made in Ireland.

Switzerland: Prospectus and KID in English/German/French and Complaints policy in German/English on www.fidelity.ch and from the representative and paying agent in Switzerland, BNP Paribas, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Fidelity undertakes the financial services of purchasing and/or selling financial instruments within the meaning of the Financial Services Act (FinSA). Fidelity is not required to assess the appropriateness and suitability under FinSA. The information provided constitutes an advertisement. Issued by FIL Investment Switzerland AG. RFP2025CN0009543.