SECTION 1: APPLICANT INFORMATION

Applicant Name: Threshold Foundation

Project Name: tBTC

Project Description: tBTC is a decentralized gateway between Bitcoin and DeFi. tBTC provides Bitcoin holders open access to the thriving DeFi ecosystems available cross-chain whilst maintaining its decentralized ethos.

tBTC was created by a decentralized effort of contributors at the Threshold Network DAO, and utilizes the Threshold Network’s threshold cryptography to create a secure BTC asset. tBTC v2 was launched in Jan23.

Team Members and Roles: Threshold Network DAO was born out of the first on-chain merger between two decentralized protocols, Keep Network and NuCypher early in 2022. The DAO has successfully operated since that time, and supports an active community of contributors that work towards building tBTC liquidity and usability.

Threshold Network flagship services are tBTC, a bitcoin asset bridge, TACo, an access control plugin, and is about to announce the launch of a stablecoin, thUSD. Traditionally, critical operations such as signing, randomness generation, and access control require trust in a single entity. However, on the Threshold Network, these functionalities are decentralized and trust-minimized, ensuring robust security and integrity.

Project Links:

Project: https://www.threshold.network/

Minting dashboard: Threshold - tBTC

GitHub: GitHub - threshold-network/tbtc-v2: Trust-minimized tokenized Bitcoin everywhere, version 2

Threshold · GitHub

Docs: tBTC Bitcoin Bridge | Threshold Docs

Audit: Threshold Network: Building the Bitcoin Economy

Immunfi Bug Bounty: Threshold Network Bug Bounties | Immunefi

Llama Risk Report: Collateral Risk Assessment: Threshold BTC (tBTC) - HackMD

Twitter: https://twitter.com/thetnetwork

Discord: Threshold Network ✜

Dune dashboards:

https://dune.com/threshold/tbtc

https://dune.com/sensecapital/tbtc-liquidity

Contact Information

Points of Contact:

Eddie Noyons - Threshold Foundation director (@eddienoyons)

John Packel (@john_packel ; tg: john_packel), treasury guild

East (@East, tg: notwest), treasury guild

Ethan (@getmorebullish; tg: getmorebullish) , growth coordinator

Twitter: @ TheTNetwork

Email: hello@threshold.network

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Team experience :

- Threshold Network’s flagship services are tBTC, a bitcoin asset bridge, TACo, an access control plugin, and is about to announce the launch of a stablecoin, thUSD. Traditionally, critical operations such as signing, randomness generation, and access control require trust in a single entity. However, on the Threshold Network, these functionalities are decentralized and trust-minimized, ensuring robust security and integrity.

- tBTC v2 is the result of years of iteration from the tBTC v1 model, originally created by Keep Network. The Keep Network team are contributors to Threshold DAO and have extensive technical expertise related to tBTC v2.

- The Threshold Treasury Guild (TTG) are an elected committee of DAO contributors that meet weekly to discuss treasury and liquidity management requirements. It has been operational since Feb 23 and has managed the tBTC’s multi-chain liquidity expansion and incentives program. This committee will manage the execution of this proposal.

- tBTC currently features an over 95% utilization rate on Arbitrum, where the majority of tBTC is used to enhance BTC DEX liquidity.

- Threshold DAO was the recent recipient of a grant from the Optimism Foundation, which is currently being used to deepen tBTC liquidity on Optimism via Merkl. This is mentioned to demonstrate familiarity with similar programs.

What novelty or innovation does your product bring to Arbitrum?

tBTC is currently the most liquid EVM-based BTC product that also supports fully permissionless mint and redemption functionality. It allows users to deposit and withdraw BTC between Ethereum and Bitcoin, without trust in a centralized counterparty. As a result, tBTC offers a superior user experience to bridge BTC to Ethereum, as it eliminates the friction of creating an account with a centralized third party.

Centralized models are susceptible to censorship and intermediary risk, which threatens the premise of Bitcoin as a sovereign, secure, permissionless digital asset.

These differences set tBTC apart as an asset, and unlocks a new demographic of BTC holders interested in DeFi, but maintain concerns around centralization risk.

tBTC achieves its decentralized nature via a probablistic cryptographic mechanism that utilizes a randomly selected group of Threshold node operators to secure deposited Bitcoin with threshold cryptography. All tBTC mint and redemption actions require a threshold majority agreement from nodes prior to execution, which in turn provides Bitcoin users secure and open access to the broader DeFi ecosystem.

An Arbitrum grant will increase the market share of a decentralized wrapped Bitcoin within the Arbitrum ecosystem, and attract a new class of BTC users and liquidity to Arbitrum, while offering a decentralized alternative to WBTC

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes! tBTC is an ERC20 token so it allows users to unlock your Bitcoin’s value to borrow and lend, mint stablecoins, provide liquidity, and much more. tBTC is completely permissionless so if any dApps wish to use it, they can!**

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

WBTC is most comparable from a product perspective, but is a centralized protocol. Current WBTC adoption illustrates the demand for BTC assets that currently exists in the Arbitrum user base.

How do you measure and think about retention internally? (metrics, target KPIs)

We consider retention to be a user that adopts tBTC for use in DeFi. This can be measured by the increase of tBTC TVL, trade volume and unique wallets that hold tBTC. These are long-term believers in the tenants of decentralization, but also want the convenience of a permissionless user experience for mint and redemption.

Retention heuristics measured are the average of the following metrics:

- tBTC circulating supply.

- tBTC volume.

- Unique active wallets that hold tBTC.

- tBTC bridge users.

We track these metrics via a Dune dashboard that can be found here and here. Growth in any of these metrics indicate retention.

Relevant usage metrics :

- DeFi Utilization - the amount of tBTC allocated in LPs or DeFi protocols.

- Transaction volume

- Bridge volume - number of tBTC bridged to Arbitrum

- tBTC bridge users - the number of unique accounts that use the tBTC bridge for mints or redemptions.

- tBTC market share

- Unique addresses that interact with tBTC

- Number of tBTC holders on Arbitrum (MoM change)

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? :

No

SECTION 2b: PROTOCOL DETAILS

Is the protocol native to Arbitrum?:

No - tBTC is native on Ethereum and bridged to Arbitrum. Although tBTC contracts deployed on Arbitrum are native/canonical contracts, not wrapped variants.

However, Threshold is working towards supporting native mint and redeem on L2s so that users can bridge directly between Arbitrum and the Bitcoin blockchain.

On what other networks is the protocol deployed?:

Ethereum, Optimism, Base, Polygon and Solana.

What date did you deploy on Arbitrum mainnet?:

March 31, 2023 arbiscan.io/tx/0x34004f22f4d206717368f941ddb7d389898240d86568f5bc71131136fd13f4a

**Do you have a native token?: **

Yes, the T token : https://www.coingecko.com/en/coins/threshold-network-token

Tokenomics/inflation mechanism: TIP-003: Threshold Network Reward Mechanisms Proposal I – Stable Yield for Non-Institutional Staker Welfare - Proposals - Threshold Network

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

Since tBTC’s launch Threshold Network has run an extensive multi-chain incentives program, distributing a monthly budget of $70k USD (denominated in T) to Threshold pools.

The monthly budget and allocation can be viewed here: Incentives Allocation Plan - Google Sheets

Liquidity success has been tracked in a number of forms, primarily by a dune dashboard and manual snapshots: https://dune.com/sensecapital/tbtc-liquidity, some key achievements include attaining 75% of all tBTC TVL providing liquidity in AMMs and DeFi volume aggregate increasing significantly since incentive inception.

Threshold DAO has incentivised tBTC liquidity on Arbitrum since June 2023.

Current Incentivization: How are you currently incentivizing your protocol?

Incentives on Arbitrum have primarily been made through vote market participation on Curve and Balancer. Vote market’s are incentivised via $T distributions on Paladin’s Warden platform: Quest. $T is paid to veCRV and veBAL holders to direct their votes to the appropriate pool. This has historically been more efficient than a Uni V2 style liquidity mining program.

Another distribution method utilized is Angle’s Merkl platform, which allows direct incentivisation of UniV3 concentrated liquidity pools. There has been significant success of this program on Arbitrum already, where other grant recipients have boosted the tBTC/WBTC Uni V3 pool to great success.

Finally, incentives have also been distributed via Solidly platforms, directly.

As of February 2024, Threshold Network incentivizes $10,000 a month on Arbitrum across 5 pools, on Curve and Balancer.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

No

Protocol Performance:

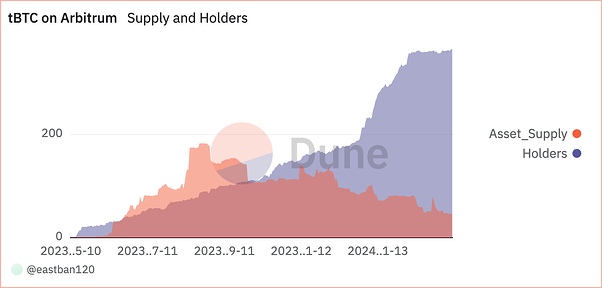

tBTC performance on Arbitrum

Asset Supply : There are currently 46 tBTC tokens in circulation on Arbitrum.

Holders : There are 363 unique wallets or addresses that hold tBTC on Arbitrum. This reflects the number of participants in the network who own some amount of tBTC.

The graph shows how these two metrics have changed over time. Starting with a lower supply and fewer holders, both numbers increased over the period from May 2023 to March 2024. The supply had periods of both rapid growth and leveling off, while the number of holders grew at a more consistent rate. The data suggests that tBTC became more widespread and more distributed among users on the Arbitrum network during this period.

Total Value Locked (TVL) in tBTC on the Arbitrum network: the data shows that the amount of money in tBTC within the Arbitrum network increased significantly over the year, from 0 to 6.3 million with peaks of almost $9 million.

TVL on Uniswap, Balancer and Curve pools show different behaviour

TVL on Balancer : the graph has two colored areas, orange and blue, representing the ARB_tBTC_WBTC pair and the ARB_tBTC_WETH pair.

From the graph, we can observe the following points:

- The value locked in both pairs started relatively low in June 2023.

- It then rose, reaching its peak around September for the ARB_tBTC_WETH pair, with the ARB_tBTC_WBTC pair peaking shortly afterward.

- After the peak, the TVL declined significantly over the next few months.

- By March 2024, the TVL appears to have stabilized somewhat but remains much lower than the peak values.

TVL on Uniswap :

This graph shows the Total Value Locked (TVL) for tBTC on the Arbitrum network using the Uniswap platform over time, from January 2023 to March 2024.

We can see that TVL has increased significantly from Arbitrum incentives inception.

Daily mint and burns show how tBTC inflows and outflows behaved since its inception back in May23 :

More specific information on Uniswap, Balancer and Curve Finance tBTC TVL on Arbitrum can be found at: https://dune.com/eastban120/tbtc-on-arbitrum

General tBTC metrics: dune.com/threshold/tbtc

Volume metrics: dune.com/sensecapital/tbtc-liquidity

Bridge activity: tbtcscan.com

Protocol Roadmap:

Threshold Network core contributor Keep team is working over the next 12 months on:

-

tBTC/USD Chainlink pricefeed to launch on Arbitrum by the end of March. This will significantly unlock tBTC’s compatibility with a number of lending and leverage protocols. We expect to see significant growth of tBTC with the unlocking of new DeFi protocols.

-

tBTC SDK integration featuring gasless minting and redemptions. This feature will greatly improve the user experience for tBTC L2 users, since it technically enables a seamless minting experience directly to the L2. Users simply select their desired destination chain and tBTC arrives in a single transaction. This improvement also supports wallet integrations, such as Xverse, OKX Wallet, and other Bitcoin wallets.

-

Signing scheme upgrade. The new signing scheme will utilize ROAST/Schnorr signatures which increases system security by upgrading signer sets from 51-of-100 to 501-of-1000. It also introduces advanced attributability to signing participants, to disincentivize malicious actors. Signing upgrade expected Q4 2024.

-

BRC-20 and ordinals bridge. This upgrade will enable Bitcoin-based tokens and NFTs to permissionlessly bridge to Ethereum and Arbitrum. BRC-20 bridge expected Q3 2024.

-

Native L2 tBTC mints, will enable a user flow so any BTC holder can directly onboard to Arbitrum, including covering gas. Native & gasless L2 mint expected Q2 2024.

-

Native redemptions, will mean tBTC holders on Arbitrum can bridge directly back to BTC, skipping Ethereum or other chains in the middle. Native & gasless L2 redemption expected Q3 2024.

Audit History & Security Vendors:

Audits: List of audits

Immunfi Bug Bounty: Threshold Network Bug Bounties | Immunefi

Llama Risk Report: Collateral Risk Assessment: Threshold BTC (tBTC) - HackMD

Security Incidents: No

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 300,000 ARB

Justification for the size of the grant :

Summary

Threshold DAO will launch a “Bitcoin on Arbitrum Season” campaign with the launch of grant incentives deployment. The campaign will have 4 parts :

-

Liquidity incentives with the grant for liquidity providers and tBTC users (as explained in next subsections 1a) & 1c))

-

Direct tBTC Minting: Bitcoin to Arbitrum (as explained in the next subsection 2))

-

Liquidity incentives provided through a continued incentives program by the Threshold DAO after the initial grant program concludes. It will continue with this bribe program for the next 12 months, meaning that T incentives persist after ARB is fully distributed. The goal is to provide long-term rewards for all tBTC users on Arbitrum.

-

A tiered loyalty program to incentivize both long-term participation and substantial liquidity contribution (as explained in next subsection 1b)

Breakdown overview:

-

Liquidity Incentives - 270,000 ARB

a. 200,000 ARB for liquidity incentives for tBTC lps

b. 50,000 ARB for liquidity stickiness - Tiered Loyalty Program

c. 20,000 ARB for tBTC users on lending platforms

-

30,000 ARB for Direct minting dApp: Bitcoin on Arbitrum

Detailed Breakdown :

1. Liquidity Incentives - 270,000 ARB

This proposal aims to increase the total tBTC TVL on Arbitrum to $25M of tBTC through a progressive liquidity incentives program over a three month period plus a stickiness program for the rest of a year.

a) We aim to incentivize four pools during the 12 week with 200,000 ARB and 25% of co-incentives provided by the Threshold DAO :

- 2BTC (tBTC/WBTC) on Curve

- tBTC/WBTC (50/50) on Balancer

- tBTC/ETH (50/50) on Balancer

- tBTC/WBTC on Uniswap V3

Currently (Feb 29 snapshot), the total value locked (TVL) in these pools is $5 million. Our goal is to achieve a fivefold increase during the 12 week program, bringing the TVL to $25 million.

By progressively increasing the incentives, including both ARB direct incentives and CRV/BAL or T emissions, we will consistently offer highly attractive APRs on these pools to attract liquidity.

The increase in liquidity as a response to these incentives is achievable because of several key factors:

1. Financial Incentives → Direct Rewards: By offering ARB tokens plus CRV, BAL or T as rewards for liquidity provision, we’re directly increasing the financial benefit for users who participate in these liquidity pools.

2. Lowered Barrier to Entry → Risk Mitigation: The additional incentives can help mitigate some of the risks associated with providing liquidity, such as impermanent loss for the tBTC/WETH pool.

3. Enhanced Yield Opportunities → Competitive Yields: In the DeFi space, liquidity tends to flow to where it can earn the highest returns. By enhancing the yield through ARB rewards, these tBTC pools on Balancer, Uniswap, or Curve become more competitive compared to other opportunities outside Arbitrum ecosystem.

4. Positive Liquidity Feedback Loop → Increased Liquidity and Trading Volume: More liquidity in a pool leads to reduced slippage and lower trading expenses, making these pools more attractive for traders. An increase in trading volume further benefits liquidity providers through higher fee earnings, creating a positive feedback loop that attracts even more liquidity.

5. Network Effects → Broader Ecosystem Engagement: Incentivizing liquidity on these key protocols not only benefits those specific pools but also the broader Arbitrum ecosystem. Increased liquidity and activity will lead to more users migrating to Arbitrum for its DeFi offerings, enhancing the network effect and attracting even more liquidity and participation across the platform.

6. Market Sentiment and Visibility → Increased Awareness: The announcement and implementation of such an incentives program will generate buzz and increase visibility for tBTC liquidity pools.

7. Long-Term Ecosystem Growth → Foundation for Sustainable Growth: By incentivizing liquidity provision in the short term, you’re also laying the groundwork for long-term growth. A robust, liquid market for tBTC enhances its utility and integration within the DeFi ecosystem, leading to sustained interest and participation beyond the incentive period.

Rolling out progressively increasing incentives:

Incentives will be incrementally increased on four of tBTC pools to encourage new liquidity and growth on Arbitrum.

An APR of 15% is targeted for stable pools (tBTC/WBTC).

An APR of 25% is targeted for volatile pools (tBTC/WETH).

Every two weeks, we will introduce a new set of ARB + CRV/BAL or T incentives for each pool. These incentives aim to achieve the desired APR for the target TVL of each pool during that period. Any unused ARB will be returned to Arbitrum.

[details="Execution for period “Week 1&2"”]

For the period labelled “Week 1 & 2,” the target Total Value Locked (TVL) for the 2BTC pool on Curve will be $1.607 million. We aim to achieve this by offering a 15% Annual Percentage Rate (APR) during that period. The rewards for that pool over these two weeks should amount to $8966. This sum is calculated as follows: ((8966*26)/1.607m=15%), with $6725 in ARB and $2242 through Threshold T token incentives.

The existing liquidity of $1.229 million will rapidly increase with new funds drawn in by the high Annual Percentage Rate (APR), based on the factors mentioned earlier.

[/details]

Execution for remaining periods

For the following period, “Week 3 & 4”, a new TVL target is set for each pool, with incentives recalculated based on the same target APR. This process is repeated throughout the entire duration of the program and for the four targeted pools:

b) 50,000 ARB for liquidity stickiness

To maintain and enhance the stickiness of users and liquidity providers after the initial grant program concludes, it’s crucial to design a suite of mechanisms that offer long-term value, the “Bitcoin on Arbitrum Season” campaign.

Part of it will be a Tiered Loyalty Program to incentivize both long-term participation and substantial liquidity contribution and that will use 50,000 ARB plus 25% in T tokens provided by the Threshold DAO :

Tiered Loyalty Program

We will create a tiered loyalty program where LPs can achieve different status levels based on the duration of their liquidity provision.

A tiered loyalty program with three levels—30 weeks, 40 weeks, and 52 weeks—and with a total of 50,000 ARB plus 25% in T tokens to distribute (total $125000 with actual prices). We will structure the rewards to heavily favor the longest-term liquidity providers.

Reward Structure:

- Tier 1 (30 weeks): 10,000 ARB tokens + 25% in T tokens

- Tier 2 (40 weeks): 15,000 ARB tokens + 25% in T tokens

- Tier 3 (52 weeks): 25,000 ARB tokens + 25% in T tokens

By using this method, we reward the liquidity providers not only for the time they commit but also for the amount of liquidity they provide, with those committing for longer periods receiving a larger share of the rewards, incentivizing both long-term participation and substantial liquidity contribution.

c) 20,000 ARB for tBTC users on lending platforms

Threshold DAO is currently in the process of targeting other (non-Decentralised Exchange) protocols on Arbitrum, to enable a broader use case for tBTC users. We are looking to deploy on the following protocols before Arbitrum Grants are rolled out:

- Synonym Finance (https://www.synonym.finance/)

- Silo Finance (https://www.silo.finance/)

- Timeswap (https://timeswap.io/)

Post-launch of tBTC’s Chainlink oracle (estimated to be within March), Threshold Network looks to target other, Chainlink secured protocols on Arbitrum, to which the DAO will incentivize usage with its own funds.

Currently there is no tBTC supply total value locked (TVL) in these protocols. Our goal is to achieve a substantial deployment and increase during the 12 week program bringing the supply TVL to $1.8 million.

By progressively increasing the incentives, including both ARB and T direct incentives we will consistently offer highly attractive APRs on these pools to attract liquidity.

2. Arbitrum tBTC Direct minting dapp: Bitcoin on Arbitrum - 30,000 ARB

30,000 ARB will be used to fund the development of an Arbitrum integration with the tBTC SDK and the development of a native tBTC minting DApp built specifically for Arbitrum. The DApp will enable BTC holders to mint tBTC directly to Arbitrum, using gasless mint functionality, to encourage tBTC use cases on Arbitrum.

The cost for the Arbitrum tBTC SDK integration was estimated by the Keep development team and includes engineering, design, and pm/content (support), for a duration of 6 weeks from commencement. Any excess ARB will be distributed to dApp users.

To support the reach and utilization of the Arbitrum minting DApp, Threshold DAO will distribute 50% of development cost in T to encourage new BTC mints directly to Arbitrum.

How tBTC native minting helps the Abritrum Ecosystem:

We know from the size of wBTC that there is a huge demand for Bitcoin in Decentralized Finance, but wBTC is only a fraction of all BTC minted. By improving the user experience for Bitcoin holders, getting yield on their BTC on the most exciting DeFi opportunities on Arbitrum becomes even more attractive:

How the grant will accelerate the native minting development and lead to greater efficacy of LTIPP grant:

The development roadmap that the Keep contributor team has is constrained via time and budget. What this section of the grant does, is allow for reallocation and incorporation of resources to accelerate this specific development.

With expediting the Arbitrum Native minting upgrade, the actions outlined in this proposal become more effective (along with marginally decreased risk and cost to bridging tBTC to Arbitrum), with a proposed completion within Q2, Bitcoin users will be able to directly mint tBTC on Arbitrum, rather than to Ethereum, then to Arbitrum, reducing the obstacles to using Bitcoin in Arbitrum DeFi.

We believe that this Native Minting will wholly increase the efficacy this grant, that the cost incurred to bring native minting to Arbitrum outweighs the benefit of 30,000 ARB being used solely for incentives instead.

We can expect to see a better inflow of liquidity providers, increasing the depth of liquidity on Arbitrum, an increase in the number of users engaging in our “Bitcoin to Arbitrum Season” campaign, an increase in the value of decentralized bridged Bitcoin in new opportunities unlocked by tBTC’s Chainlink oracle and a strong, sustained tBTC presence on Arbitrum with our proposed rewards for long term liquidity providers.

Grant Matching:

- The Threshold DAO commits to matching 25% of the liquidity incentive budget with T incentives, to be deployed at the same cadence over an identical period.

- Furthermore, the Threshold DAO will match 50% of the ARB SDK grant with T incentives, to reward users for bridging BTC to Arbitrum.

- Additionally, the Threshold DAO commits to a continued liquidity incentives program for the pools once the grant program finishes, and will provide funds in T for the Tiered Loyalty Program, 25% of the ARB grant for stickiness.

Grant Breakdown:

- Liquidity Incentivisation - 270,000 ARB

- 200,000 ARB for liquidity incentives

- 50,000 ARB for stickiness - Tiered loyalty program

- 20,000 ARB for tBTC users on lending platforms

- Arbitrum Minting DApp - 30,000 ARB

Funding Address:

Threshold Treasury Guild Multisig:

Arbitrum: 0x6c2bd894bd166dcf053045a4883db49eae3fc01c

Funding Address Characteristics:

Funding Address is a 5/9 Gnosis Safe multisig created in June 2023 with 9 unique signers that conform the Threshold Treasury Guild.

Treasury Addresses:

Governor Bravo Threshold Treasury: 0x87F005317692D05BAA4193AB0c961c69e175f45f

Threshold Council Multisigs :

Ethereum: 0x9f6e831c8f8939dc0c830c6e492e7cef4f9c2f5f

Optimism: :0x7fB50BBabeDEE52b8760Ba15c0c199aF33Fc2EfA

Threshold Treasury Guild Multisigs:

Ethereum: 0x71e47a4429d35827e0312aa13162197c23287546

Arbitrum: 0x6c2bd894bd166dcf053045a4883db49eae3fc01c

Optimism: 0x126940ea97b328e57e9e2285d546a677b2f38300

Base: 0x3b8f79458b6d303b47d56734b00cc6941443bd95

Solana: 8ny33m9UNQ2Fz4Lducb9Zf4soEZHeXMrCkFmFMjorL7M

Threshold Integrations Guild Multisigs:

Ethereum: 0x2ff7ab212cd6feae21bac5300465e149fb6b85a9

Threshold Marketing Guild Multisigs:

Ethereum: 0xd55c4261145EA1752662faA0485AfBC8C431b0Ca

Contract Address: [Enter any specific address that will be used to disburse funds for grant recipients]

Threshold Treasury Guild Multisig:

Arbitrum: 0x6c2bd894bd166dcf053045a4883db49eae3fc01c

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives:

Aggressively grow the TVL of decentralized Bitcoin on Arbitrum to 25 million USD.

We want Arbitrum to be the primary destination for Bitcoin capital crossing over to DeFi.

For this we want to :

A) provide compelling rewards for liquidity provisioning

B) enable other uses of tBTC (e.g. as collateral for lending and derivative protocols)

C) implement a tiered loyalty program for long-term stickiness for liquidity

D) Integrate Arbitrum with the tBTC SDK to support direct BTC->Arbitrum inflows.

Execution Strategy:

A. Liquidity provisioning incentives

Farming of Direct Rewards:

- Curve pool will be incentivized with grant assets through Curve/Convex UI (direct disbursement of ARB for staked liquidity).

- Balancer pools will be incentivized with grant assets through Aura UI (direct disbursement for staked liquidity)

- Uniswap liquidity will be incentivized through disbursement of ARB on Merkl (Angle Protocol)

Execution for each pool

Taking this plan as a guide at the start of every two-week period we have to perform several steps:

- Analyze and report on previous period

- Calculate target TVL (previous period TVL * r growth (1.383))

- Based on target TVL calculate APR, needed ARB and CRV, BAL or T depending on pool

- Deploy ARB to Curve, Aura and Merkl to directly distribute on Arbitrum. T incentives will be bridged to Arbitrum and used to bribe Curve and Aura votes via Paladin’s Warden app. Uniswap will be incentivised via Angle’s Merkl app, where ARB and T will be directly distributed.

Detailed execution is covered in the previous section 3 - Detailed Breakdown.

B. Other uses of tBTC

Threshold DAO is currently in the process of targeting other (non-Decentralised Exchange) protocols on Arbitrum, to enable a broader use case for tBTC users. We are looking to deploy on the following protocols before Arbitrum Grants are rolled out:

- Synonym Finance (https://www.synonym.finance/)

- Silo Finance (https://www.silo.finance/)

- Timeswap (https://timeswap.io/)

Post-launch of tBTC’s Chainlink oracle (estimated to be within the month), Threshold Network looks to target other, Chainlink secured protocols on Arbitrum, to which the DAO will incentivise usage with its own funds.

C. Stickiness - Tiered loyalty program

As explained in the previous section 3 - Detailed Breakdown we will create a tiered loyalty program where LPs can achieve different status levels based on the duration of their liquidity provision.

Implementation

Implementation

After 52 weeks we would distribute the rewards within each tier based on the proportion of liquidity each provider contributes, relative to the total amount of liquidity in that tier :

-

Determine the Proportional Share Within Each Tier:

Calculate each LP’s share of the total liquidity for each tier at the end of the 52-week period. Their share is the average amount of liquidity they provided during the duration of the tier, divided by the total average liquidity in that tier during the same period. -

Allocate Tokens to Each Tier:

Assign a portion of the 50,000 ARB tokens (plus 25% proportion of T tokens) to each tier:- Tier 1 (30 weeks): 10,000 ARB tokens (plus 25%proportion of T tokens)

- For liquidity providers that hold liquidity for 30-39 weeks on any pool

- Tier 2 (40 weeks): 15,000 ARB tokens (plus 25%proportion of T tokens)

- For liquidity providers that hold liquidity for 40-51 weeks on any pool

- Tier 3 (52 weeks): 25,000 ARB tokens (plus 25%proportion of T tokens)

- Tier 1 (30 weeks): 10,000 ARB tokens (plus 25%proportion of T tokens)

-

Calculate Individual Rewards Within Tiers:

For each tier, distribute the assigned ARB tokens proportionally, based on each LP’s share of liquidity. For instance, if an LP provided 10% of the total average liquidity in Tier 1, they would receive 10% of the 10,000 ARB tokens allocated to Tier 1, which is 1,000 ARB tokens. -

Example Calculation:

Let’s say you have three liquidity providers in Tier 3, with the following proportions of the total liquidity in that tier:- LP1: 50%

- LP2: 30%

- LP3: 20%

The 25,000 ARB tokens for Tier 3 would be distributed as follows:

- LP1: 50% of 25,000 = 12,500 ARB tokens (plus 25%proportion of T tokens)

- LP2: 30% of 25,000 = 7,500 ARB tokens (plus 25%proportion of T tokens)

- LP3: 20% of 25,000 = 5,000 ARB tokens (plus 25%proportion of T tokens)

-

Maintain Flexibility for Adjustments:

Be prepared to adjust the reward structure if the proportion of liquidity in the pools changes significantly during the program. -

Minimum threshold of liquidity

We need to set minimum thresholds of liquidity for eligibility to avoid manipulation or gaming of the system.

Continued Liquidity incentives provided by the Threshold DAO after grant

Liquidity incentives provided through a continued incentives program by the Threshold DAO after the initial grant program concludes.

Threshold DAO incentivizes these Arbitrum pools with bribes via Warden protocol since 1H23. It will continue with this bribe program for the next 12 months meaning that T incentives persist after ARB is fully distributed. The goal is to provide long-term rewards for all tBTC users on Arbitrum.

D. Direct minting for Bitcoin on Arbitrum

Threshold will integrate Arbitrum into the tBTC SDK and develop a direct to Arbitrum minting DApp, for use in Arbitrum protocols.

Total development time of 6 weeks. Milestones:

- Design - week 2

- Test - week 4

- Production - week 6

T incentives equivalent to 50% of the 30K ARB will be distributed over the same period as the rest of the program.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

The increased liquidity and user experience for tBTC on Arbitrum should lay the groundwork to enable easy access to the variety of protocols that tBTC wishes to integrate with over the coming months.

As already mentioned in previous section 3 - Justification for the size of the Grant Threshold DAO will launch a “Bitcoin on Arbitrum Season” campaign to acquire, maintain and enhance the stickiness of users and liquidity providers.

We can expect to see increased conversion of Bitcoin holders to Bitcoin in DeFi users, a better inflow of liquidity providers, increasing the depth of liquidity on Arbitrum, an increase in the value of decentralized bridged Bitcoin in new opportunities unlocked by tBTC’s Chainlink oracle and a strong, sustained tBTC presence on Arbitrum with our proposed rewards for long-term liquidity providers.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

A- Liquidity provisioning incentives

Success will be measured by TVL on each incentivized pool (Curve, Balancer and Uniswap) :

Source; https://dune.com/eastban120/tbtc-on-arbitrum

tBTC on Arbitrum supply and holders will also be measured:

B- Stickiness - Tiered loyalty program

Success will be measured by

- TVL on each incentivized pool (Curve, Balancer and Uniswap)

- List of liquidity providers indicating total value and time each lp’s liquidity is locked (this KPI will be incorporated in the Dune Dashboard)

C- tBTC users on lending platforms

- tBTC liquidity supplied and borrowed

- Unique tBTC users on each the lending platform

- These KPI will be incorporated in the Dune Dashboard

- New tBTC mints

D- Direct minting dapp for Bitcoin on Arbitrum

- Total tBTC minted through the Bitcoin on Arbitrum dApp

- Unique users and tBTC per users on the Bitcoin on Arbitrum dApp

- These KPIs will be measured and reported on a dashboard (similar to tbtcscan.com).

Grant Timeline and Milestones:

For A) and C) we prepared a Arbitrum Grant Planning and Execution sheet where we stated TVL both in assets units and nominal value.

- Liquidity Incentivisation - 270,000 ARB :

- 200,000 ARB for liquidity incentives

- 50,000 ARB for stickiness - Tiered loyalty program

Required after week 12

- 20,000 ARB for tBTC users on lending platforms

- Arbitrum Minting DApp - 30,000 ARB

Total development time of 6 weeks. Required 10,000 ARB for each milestone:

- 1 Design - week 2

- 2 Test - week 4

- 3 Production - week 6

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

The goal:

- Grow the breadth of a decentralized and permissionless Bitcoin on Arbitrum.

Why tBTC is the only unique asset to be able to do this:

-

Decentralization and Security: tBTC maintains a strong emphasis on decentralization and security, mirroring Bitcoin’s foundational principles. This approach ensures that Bitcoin’s value can be utilized within the Arbitrum ecosystem without compromising on the very qualities that make Bitcoin valuable.

-

Seamless Integration: By facilitating a bridge between Bitcoin and Arbitrum, tBTC allows for seamless asset transfer, expanding the use cases for Bitcoin holders and introducing BTC’s liquidity to the DeFi ecosystem on Arbitrum.

How this will be achieved with an Arbitrum Grant:

-

Enhanced Liquidity: With greater liquidity incentives, this increases the yield on tBTC pairs, making providing liquidity more attractive, this then increases tBTC depth of liquidity.

-

New tBTC DeFi opportunities: By acquiring a Chainlink oracle (Arbitrum is prioritized), a variety of new tBTC usecases can be unlocked.

-

Native Minting: Sleek user experience for Bitcoin users to deploy tBTC on Arbitrum.

-

Attracting Bitcoin Holders: With enhanced liquidity, great UX and new incentivised usecase, it gives Bitcoin holders a strong risk/return ratio for them to engage in Bitcoin DeFi.

The Second order benefits to the Arbitrum Ecosystem:

- Boosting DeFi Applications: tBTC’s integration enables new DeFi products and services that cater to Bitcoin holders, such as Bitcoin-backed loans, yield farming and Bitcoin margin trading. This diversification of services can attract a broader audience to the Arbitrum ecosystem.

- Network Effects: As tBTC brings more users and liquidity into Arbitrum, adjacent protocols benefit from the increased activity. This can lead to higher fees generated for liquidity providers and protocols, and a more vibrant ecosystem attracting further innovations and investments.

- Enhanced Security and Stability: The increased dominance of a decentralized bridged Bitcoin will contribute to the overall security and stability of the Arbitrum network.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL . Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard?

We have a capable and experienced team in the DAO, the Threshold Treasury Guild, that will provide these updates.

First Offense: *In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?: [Y/N]

Yes