Thank you @GFXlabs @SEEDGov @TodayInDeFi for your engagement with the proposal.

We’d like to begin by clarifying a few key points based on the ongoing discussion. Further below, you’ll also find some backtesting for both the stablecoin and ARB-only strategy, as well as answers to GFX’s remaining questions further below (which we’ve coordinated together with @karpatkey), and lastly clarification on the incentive alignment of having a performance fee for the ARB strategy.

-

Meaningful Yield Targets: We recognize the concerns about “low yield projections” for the ARB-only strategy, but covered calls offer a compelling yield opportunity that would surpass current lending returns. More importantly, the yield potential is not set in stone—parameters such as strike prices and expiries which determine the final APY can be adjusted to align with the TMC’s or community’s preferences. In our proposal, we conservatively estimated target yields in the range of 5-12% APY, factoring in current market conditions and a low probability of conversion. However, depending on market conditions the strategy has the potential to generate even higher yields.

-

Balancing Yield and Conversion Risk: Our approach to structuring the ARB-only strategy using covered calls was not arbitrary—it was designed to balance yield generation with minimal conversion probability into stablecoins. We derived suitable strike prices and expiries using historical ARB returns to help the treasury optimize for a favorable risk/reward balance.

-

Tradeoff Between Yield and Conversion Risk: Higher target yields require either lower strike prices or longer durations, which increases the probability of ARB being converted into stablecoins. Conversely, more conservative parameters reduce the yield but also decrease conversion risk. This is a fundamental tradeoff in covered call strategies.

-

Conversion Does Not Necessarily Mean Underperformance: Importantly, converting into stablecoins does not necessarily mean that a covered call strategy will underperform relative to a benchmark like lending. In fact, backtesting covered calls versus lending over the longest available time frame, as suggested by GFX Labs, shows that the final NAV from writing calls would have outperformed lending—even in cases where a conversion occurred (see details further below).

-

Handling Conversions (if at all): In the event of a conversion, the stablecoin proceeds can be strategically deployed to reacquire ARB through direct spot purchases or by using cash-secured puts. The latter approach enables the treasury to execute an “option wheel” strategy, where calls are initially sold on ARB, as mentioned in our original proposal. Should ARB’s price decline below a designated strike price, the treasury would reacquire ARB at lower prices, effectively defending ARB’s price while maintaining yield generation.

-

Customizable Strategy for the Community: This tradeoff is not set in stone—the parameters can be tailored to the community’s preferences. If the community prefers a more conservative approach with lower conversion risk, strikes and expiries can be adjusted accordingly. Similarly, if the goal is to prioritize higher yield, a different balance can be chosen.

-

Comparing Covered Calls to Single-Sided Liquidity Provision: AMM/DEX liquidity provisioning has also been suggested as an alternative strategy for generating yield on ARB. However, it is important to recognize that this strategy can also lead to conversion.I.e., in single-sided liquidity provisioning using ARB, if ARB prices increase, the LP position will gradually convert into stablecoins as ARB is sold at higher prices. While this process is typically referred to as “impermanent loss” in the context of liquidity provisioning, it is functionally similar to the conversion mechanics of covered calls. Nonetheless it seems that covered calls have been perceived as riskier or misaligned, even though both strategies share the same potential for conversions. It is worth highlighting this parallel to ensure a fair evaluation of covered calls as a yield-generating mechanism for ARB.

Stablecoin Strategy

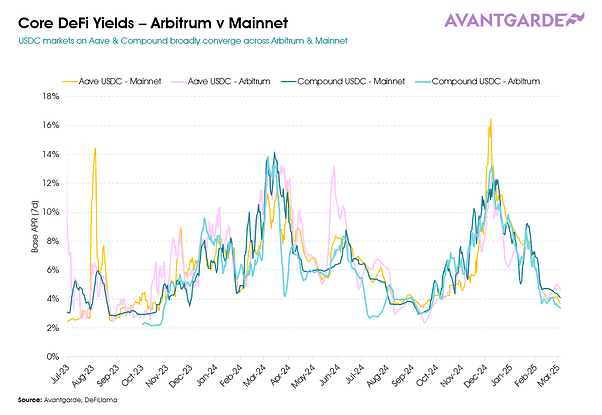

Lending protocols on Arbitrum has not existed in a meaningful sense before 2023. As a reference, USDC markets on Aave v3 & Compound v3 have seen an average of 6% since July 2023.

Base APR (excluding rewards) on these markets have broadly converged across Mainnet and Arbitrum so one method to bootstrap a historical backtest is to use longer term historical lending rates from Mainnet.

Extending the history to include USDC, USDT, and DAI markets across Aave, Compound, and Maker shows that rates have oscillated from lows of 2% (during the depths of the bear market and zero interest rate regime in 2022) to highs of 15%+. Given the fast moving nature of the lending ecosystem, we would caution against attempts to forecast with precision the exact level of rates that will prevail over the course of the future holding period. However, this historical range can help give some context with which to frame expected returns. One significant development since the start of the historical data in the chart below is the the interest rate environment and the growing number of channels through weak t-bill yields are transmitted on-chain - this may provide a floor to DeFi lending yields going forward where they may have previously fallen below the fed funds rate when the market was fully decoupled.

For some comparison, you can see the chart below which shows the aggregate APR on the portfolio holdings of our DeFi Yield Fund (which utilises similar assets/protocols as those included in our proposal) versus that on Aave USDC (Mainnet).

ARB-only Strategy

Note that the ARB TGE took place on April 23, 2023. As of today (March 3, 2025), the maximum available time frame for backtesting is 713 days (~1.9 years). Therefore, we conducted a backtest spanning this period, simulating one of the previously discussed example parameterizations: continuously writing call options with 23 days to expiry, a 128% strike price, and a minimum option premium of 0.8% per period (equivalent to a 12.7% APY).

The initial position was set at 5M ARB (roughly $2,000,000 as of March 5th), and we compared the strategy’s performance to a benchmark of lending 5M ARB at an average market yield of 0.3% APY.

The final NAVs are as follows:

| Strategy | Final NAV |

|---|---|

| Covered Call | $5,603,942 |

| Lending | $2,551,499 |

Below, we illustrate the strategy’s performance, including strike prices, conversions over time, and the NAV evolution of both the strategy and the benchmark. A Google spreadsheet with the associated results is also available here.

For the ARB-only strategy, as requested, we used ARB DeFi lending with an average rate of 0.3% APY as the benchmark.

As for the stablecoin part, we are open to using the Aave or Compound rate as a purely notional comparison and for estimating a range of expected returns. However, we would caution against codifying them as formal benchmarks since the prevailing Aave & Compound rates do not in themselves represent the return of a “default investment” - supply rates represent the return at the current level of utilization of the lending market, but they fall in a deterministic fashion as more capital is lent (and the utilization is decreased). The ex ante rate is not achievable when actually deploying a large amount of stablecoins into a market.

| Risk | Covered Call | Lending |

|---|---|---|

| Liquidity Risk | Funds can be withdrawn early via the early exit mechanism (as outlined in a previous post). | Funds can be withdrawn immediately; however, there is potentially bad debt risk. |

| Multisig Risk | Same | Same |

| Credit / Counterparty Risk | None, as no tokens are loaned, and the option premium is received upfront. | The risk is low; however, there is potentially bad debt risk. |

We are happy to explore insurance solutions if desired. However, please note that obtaining insurance would incur additional costs and require additional time for planning and implementation. Furthermore, as far as we know no traditional insurers offer any cover for crypto-related financial services. There might be DeFi-native or tier 3/4 insurers that can provide some cover, but this would require further evaluation in terms of quality/credibility of the cover and the size of the premium required.

We see the risk of underperformance as very minimal, and don’t believe waiving fee is remotely close to an industry standard nor a reasonable expectation. Even if we were to waive fees given how extremely unlikely it is for the ARB-strategy to underperform the 0.3% lending benchmark, this benchmark may come to change at a later date, which we believe would put us in an unfair position.

On stablecoins, we echo the points made in the section on proposed benchmarks that the ex ante rate is not achievable when actually deploying a large amount of stablecoins into a market and therefore should not be used as a formal benchmark from a contractual perspective.

Since the performance fee is based on premiums earned rather than ARB conversions, there is a clear incentive alignment to set strikes and expiries in a way that minimizes conversions and allows the strategy to continue over a longer period through rolling covered calls. This aligns the treasury’s interest in maximizing covered call yields with maintaining as much upside as possible, as opposed to a one-time conversion, which would immediately halt fee generation.