TMC Clarification on ARB Strategy Decision

Hello everyone,

First, we want to sincerely thank the teams at @avantgarde, @karpatkey, and Myso for taking the time to discuss their proposals in greater detail with us. We appreciate your proactive approach and the thoughtful contributions you have made, both privately and in the forum.

Below, we provide additional context on our recommendation to defer active deployment of the ARB allocation at this time, along with feedback on each proposal’s approach and risk management.

Overall Rationale for the “Hold ARB” Recommendation

Risk and Transparency

While both teams have made significant efforts, the operational details for the ARB strategies, such as liquidity for options, counterparty arrangements, and daily/weekly execution, remain unclear. Given the large ARB allocation, this uncertainty makes us cautious.

Yield versus Complexity

The proposed yields for ARB strategies vary widely, ranging from near zero (for example, simple lending) to around 30% (for example, covered calls). However, the higher-yield strategies depend on liquidity or counterparties that may not be scalable, and the lower-yield approaches (for example, 0.16% on Aave) do not justify the additional complexity and risk.

Asset Manager Selection Considerations

It’s important to note that selecting an asset manager for alpha generation typically requires a multi-year to decade-long track record across multiple market regimes, a challenging standard, even in traditional finance. Therefore, if the core ARB strategy cannot stand on its own merits, claims of expertise should not serve as the primary selection criteria.

Prudent Governance

Our mandate is to protect the DAO’s treasury. Rather than forcing a strategy with an uncertain risk and reward profile, we prefer to hold ARB until more robust proposals/strategies emerge. This is a postponement rather than a permanent refusal, and we remain open to future improvements.

Feedback on Karpatkey’s Proposal

Stablecoin Strategy

We appreciate Karpatkey’s detailed Risk Management Plan, which includes non-custodial architecture (Safe + Zodiac Roles Modifier), protocol whitelisting (Aave, Compound, Dolomite, Fluid, etc.), and clear maximum exposure thresholds (e.g., no more than 20–25% per protocol).

The yield estimates of ~8–12% for stablecoins appear realistic, and Karpatkey’s track record in managing other DAO treasuries (Gnosis, ENS, etc.) is well-documented.

ARB-Only Strategy

Karpatkey proposes covered calls (via Myso) and deposit/borrow loops. While these ideas are valid in principle, the TMC remains concerned about the practical scalability of the options component (liquidity, strike selection, and counterparty discovery at large ARB notional sizes).

The lending-based approach offers minimal yield (~0.16% to ~4%), which does not justify the operational overhead or the added smart contract risk compared to simply holding ARB in a wallet. The covered-call approach is also sensitive to ARB price and carries risk in case of price appreciation as the cost of reimbursing the loan could exceed the value of the stablecoins used for farming. The backtest is based on a period of constant ARB price depreciation and therefore may not fully reflect this risk.

Although Karpatkey mentions having advanced monitoring systems to respond promptly to adverse market conditions, we lack sufficient visibility into these tools to confidently recommend this approach to the DAO.

Feedback on Avantgarde’s Proposal

Stablecoin Strategy

The Risk Management section shared by Avantgarde (and MYSO) highlights position-sizing constraints, lockup safeguards, and a diversified stablecoin approach. We especially appreciate the plan’s clarity on monitoring liquidity needs and the ability for the DAO to recall funds if necessary.

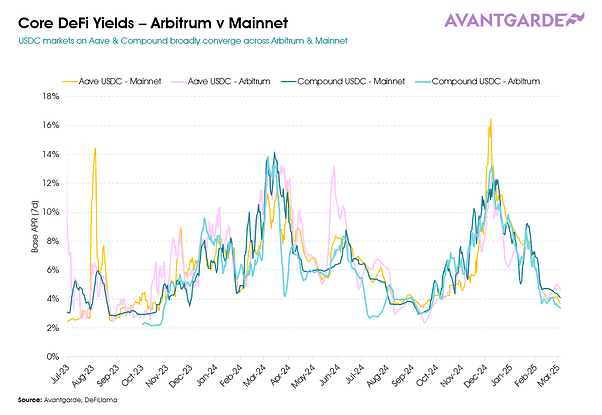

Expected returns of 5–15% are in line with typical DeFi yields, and the approach includes established protocols such as Aave, Compound, and Uniswap.

ARB-Only Strategy

Similar to Karpatkey, Avantgarde’s ARB strategy also leans heavily on covered calls (via Myso) for yield generation. Although the theoretical upside is attractive, we lack sufficient real-world liquidity data for large ARB notional amounts. In addition to the conversion risk, the strategy presents a risk in case of a sharp ARB price increase (which again may not be accurately accounted for in backtests done over a period of relatively constant price depreciation). For instance, vaults on Ribbon and Premia also rely on selling covered calls and have recently incurred losses despite both vaults having widely different strategies, following sharp increases in the price of the underlying assets:

We value the team’s willingness to iterate on strike selection and maturity dates, but given current market conditions, we do not see a clear, low-risk path to consistent yields above simple “hold” alternatives.

Next Steps — DAO VOTING

Stablecoin Allocation 15M

-

Yes: Proceed with converting 15M ARB into stablecoins and manage them via a 33/33/33 split among Karpatkey, Avantgarde & Myso, and Gauntlet. Therefore 5M ARB is allocated to each provider.

-

No: Do not execute the stablecoin strategy; retain current ARB holdings without conversion.

ARB Allocation

-

Yes: Proceed with deploying 10M ARB into on-chain strategies, managed in a 50/50 split between Karpatkey and Avantgarde & Myso. Therefore 5M ARB is allocated to each provider.

-

No: Do not execute the on-chain strategy; hold the ARB tokens.

Paths Based on DAO Voting Outcomes

The four possible combined outcomes are:

#1 YES, deploy the Stable Strategy /// YES deploy the ARB Strategy.

#2 NO, do not deploy the Stable Strategy /// YES, deploy the ARB Strategy.

#3 YES, deploy the Stable Strategy /// NO, do not deploy the ARB Strategy

#4 NO, deploy the Stable Strategy /// NO, do not deploy the ARB Strategy

We recommend that the DAO votes for #3 YES, deploy the Stable Strategy /// NO, do not deploy the ARB Strategy.

Although Avantgarde, Karpatkey, and Myso present compelling reasons to consider deploying the ARB strategy we still stand by our recommendation. If the DAO votes in favor of deploying the ARB strategy. We commit to working with providers to establish a set of safe parameters for running the strategy.

If the DAO votes against ARB, we will re-run the RFP process 3-months after the end of this Snapshot and commit to finding a balance that makes us comfortable with the proposals.

Ongoing Communication

We will continue to publish regular updates and remain open to further discussions with the DAO and the providers.