ABSTRACT

Vaultka is applying for a grant of 1,000,000 $ARB from the Arbitrum Foundation to significantly augment capital flow into Perp DEX LP. The initiative aims to boost Vaultka’s TVL in lending pools and strategic vaults to $75 million and $46 million, respectively. This objective will be achieved through allocationg ARB tokens as incentives, targeting to boost APR of approximately 10% across the board.

Pain Points

Vaultka has consistently witnessed high demand for its strategic vaults, as evidenced by the persistently high utilization rates within its lending pools. However, the limited size of these lending pools has increasingly become a bottleneck, hindering Vaultka’s development and its capacity to channel greater liquidity into the Perp DEX ecosystem.

Impact on the Arbitrum Ecosystem

Vaultka stands to significantly benefit the Arbitrum ecosystem by:

- Enhancing the connection between lending capital and Perp DEX liquidity, thereby improving liquidity utilization across the board.

- Introducing market-first innovations through Vaultka’s unique offerings, such as the GLM strategy and the leverage launchpad, which inject fresh innovation into the ecosystem.

Justification for the Grant Size

The request for this grant is grounded in several key considerations:

- Drawing from the historical success of lending and yield protocols during the STIP, Vaultka is looking to bring 3x growth to its TVL a targeted ~10% additional APR. A calculated request of 1M ARB is aligned with achieving this ambitious yet attainable growth objective.

- Vaultka’s proven track record in generating substantial yields, evidencing the platform’s capacity to foster significant growth with the proposed incentives.

SECTION 1: APPLICANT INFORMATION

Applicant Name: Vaultka

Project Name: Vaultka

Project Description:

Vaultka is a yield optimizing protocol on Arbitrum that focuses on strategies for Perp DEX LP. The protocol offers a variety of strategies, including LP Leveraging, Delta Neutral strategies, Indexing strategies, and Lending pools, where these strategies enhance users’ earnings while managing risk according to their preferences. In just one year, Vaultka has injected over $30 million into the ecosystem, driving up Total Value Locked (TVL) by 180% for some partnering Perp DEX. It serves as a conduit, connecting those seeking steady returns with the dynamic world of Perpetual DEXs, benefiting both sides of the market.

Team Members and Roles:

Business Development Lead: micheung

Project Manager: matt.arb

Product Manager: Ron

Marketing Lead: Mr. Gorilla

Research Lead: Tai

Developer: Jjjjj, Cale, Raymond, Vincent, Steve, Paul

UI/UX Designer: Renee

**Excluding Contractors and Freelancers

Project Links:

| Website | https://www.vaultka.com/ |

|---|---|

| https://twitter.com/Vaultkaofficial | |

| Chinese Twitter | https://twitter.com/VaultkaCN |

| Discord | Vaultka🍾 |

| Telegram | Telegram: View @vaultkaofficial |

| Medium | https://medium.com/@Vaultka |

| GitHub | Vaultka-Project · GitHub |

| Youtube | https://www.youtube.com/@Vaultka_official |

| DefiLlama | https://defillama.com/protocol/vaultka |

| Zealy | https://zealy.io/c/vaultka/questboard |

| Spotify | 2023-05-22 Fireside Chat - The Emergence of Decentralized Perpetual Exchange by Vaultka |

Contact Information:

Point of Contact: @Tai_Vaultka

Point of Contact’s TG handle: @tky0301

Twitter: @Vaultkaofficial

Email: info@vaultka.com

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Team experience:

Vaultka has been developed and live on Arbitrum for more than 1 year, with over 17 strategies deployed, with each strategy averaging in less than 1 month developing time. This shows the strong ability of Vaultka to develop and contribute to the Arbitrum ecosystem.

Development Team:

Composed of six full-time developers proficient in front-end, back-end, and smart contract development, with expertise in general-purpose programming languages and over three years of proficiency in Solidity. Our members possess diverse development experience, spanning projects such as inflation-pegged collateralized currency, perpetual decentralized exchange, and smart contract auditing.

What novelty or innovation does your product bring to Arbitrum?

- Bridge between Lending capital and Perp DEX Liquidity

Vaultka connects lending capital with Perp DEX LP by offering lending yields above market rates. This allows lenders to yield more while giving leverage Perp DEX LP users to borrow at favorable terms, channeling lending capital into Perp DEX LP. Our reward split mechanism benefits lenders with a share of the profits from leverage users, ensuring lenders gain from the Perp DEX market’s performance. In case of liquidations, lenders’ capital is protected first, maintaining security for their investment. This setup enhances the liquidity flow into Perp DEX LP, benefiting both lenders and leverage users by providing high returns and access to capital.

- Leveraged Strategies with Enhanced Real Yield

Vaultka enables users to amplify their earnings from Perp DEX LP real yields by offering up to 10x leverage. This approach not only maximizes rewards from protocol fees but also maintains low liquidation risk due to the stable nature of Perp DEX LPs.

- Basket-Structured Strategies on Perp DEX LP

Vaultka introduces a GLP-like structured GM index token on-chain, providing a diversified portfolio for users to deposit in GMX V2 GM tokens without a single asset exposure. This provide the perfect solution for veterans who invested in GLP during GMX V1, and may not be comfortable to invest in GMX V2 GM token due to the single asset price exposure. This also only marks as the first step of Perp DEX LP index token. In the near future, more index tokens will be developed for users who are optimistic on the overall development of Perp DEX on Arbitrum, and would rather to invest on the overall market, rather than a single protocol.

- Leveraged Delta-Neutral Strategy

Vaultka’s leverage delta-neutral strategy on GM tokens allow users to earn GMX protocol fee sharing without the risk of price fluctuation. By eliminating the price exposure of each GM tokens, the risk of liquidation from high leverage size can be minimized, and users are able to earn up to 10x protocol fee shares from the prominent Perp DEX on Arbitrum.

- Leverage Launchpad:

Vaultka is also developing its leverage launchpad to help users to participate in early-stage projects without the fear of huge dilutions from whales influx, diversifying the token holdings of early projects and enhance decentralization. It also encourage early stage projects to deploy on Arbitrum, by lowering the hurdle in meeting fund raising targets with leverage launchpads. This further enhances the diversity of the Arbitrum ecosystem, and provide more opportunity for new projects to get its exposure by leveraging on Vaultka’s connection.

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes, Vaultka is composable with other projects.

- Integration with Perp DEXs

Vaultka exemplifies high composability within the Arbitrum ecosystem through its extensive integration with various Perp DEXs. Currently, Vaultka features 17 strategic vaults across 6 different Perp DEXs on Arbitrum, including GMX, Gains Network, HMX, Vela, ApolloX, and KTX, encompassing a range of strategies from leveraging and delta neutral to indexing. Plans are underway to expand these offerings, with additional vaults for Hyperliquid, AARK, and EquationDAO in the final stages of testing, underscoring Vaultka’s commitment to broad ecosystem engagement.

- Voting and Bribery Mechanism for protocols to offer bribes

Vaultka also implements a unique voting and bribery mechanism. Through this, $VKA and $esVKA stakers can direct weekly emission allocations to their preferred strategic and lending vaults, enhancing control over resource distribution. This system is further enriched by the opportunity for protocols and partners to offer bribes, incentivizing votes towards their vaults to increase TVL. Such dynamics have already attracted a series of partners, including HMX, Vela, and ApolloX, to engage in Vaultka’s incentive ecosystem, promoting a vibrant and collaborative environment across Arbitrum.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

Vaultka aligns with two primary categories: Yield optimizing protocols and lending protocols.

- Yield Optimizing Protocols:

Vaultka shares similarities with Pendle and JonesDAO in the yield optimization space. Pendle specializes in tokenizing yield, creating pools for LPs or yield-bearing tokens that enable users to speculate on yield changes. They also offer products related to GLP and GM, which overlap with Vaultka’s offerings. However, Vaultka distinguishes itself by providing a broader spectrum of strategies beyond yield speculation, including leveraging, delta neutral, and indexing strategies tailored to various risk and reward preferences, catering to users across 6 different Perp DEX on Arbitrum.

JonesDAO focuses on generating additional yield through products like jGLP, jUSDC, and jAURA, employing leverage and neutral strategies similar to Vaultka. Yet, Vaultka’s diverse range of products and strategies, covering multiple Perp DEX platforms, sets it apart by addressing a wider array of user needs.

- Lending Protocols:

Radiant Capital operates as a lending protocol offering overcollateralized loans, where interest rates are determined by the utilization rate of lending pools. Vaultka, while also providing lending services, ventures into under-collateralized loans, offering lenders above-market rewards. Vaultka’s unique reward distribution mechanism ensures a balanced return for lenders, differentiating it through a novel approach to managing the relationship between leverage users and lenders.

How do you measure and think about retention internally? (metrics, target KPIs)

| Category | Relevant Metrics |

|---|---|

| General | All general metrics in the OBL relevant metrics chart are relevant. These metrics include: Daily Active Users, Daily User Growth, Daily Transaction Count, Daily Protocol Fee, Daily Transaction Fees, Daily ARB expenditure & User Claims and Incentivised User List & Gini Coefficient. |

| Yield / Yield Aggregator | All metrics for Yield in OBL relevant metrics are relevant. The metrics include the TVL of the incentivized pool, and the list of depositors. The list of depositors will containt information like LP addresses, their current liquidity in USD, time-weighted liquidity in USD, and the duration of liquidity provision. |

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal?

No

SECTION 2b: PROTOCOL DETAILS

Is the protocol native to Arbitrum?:

Yes, Vaultka is native an only deployed on Arbitrum.

On what other networks is the protocol deployed?:

No. Vaultka is only deployed on Arbitrum.

What date did you deploy on Arbitrum mainnet?:

Yes. First Vault in Vaultka is deployed on Feb-08-2023.

Transaction ID: 0x8823561497e45d98e7cdfaccb1a28081cb2cc2d9b6a4ebece9476e8872ee940a

Do you have a native token?:

Yes. $VKA Tokenomics: https://docs.vaultka.com/tokenomics/vka-tokenomics

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

Liquidity Bootstrapping Program:

Launched on October 20, 2023, Vaultka’s liquidity bootstrapping rewarded depositors with $esVKA, Vaultka’s escrowed native token, proportionate to their deposits. The program required a three-month lock-up period to receive the full amount of rewards, encouraging long-term commitment. The overwhelming response was evident as the $8 million deposit cap was reached within a day, demonstrating the market’s confidence in Vaultka.

With the help of the program, Vaultka’s TVL grew by 103% with 3 days. The sustained growth in TVL post-program suggests a lasting user engagement, indicating that the initial incentives served not only as an attraction to new depositors but also cultivated stickiness to the platform. This underscores the Liquidity Bootstrapping Program’s role as a catalyst for Vaultka’s continued expansion and user retention.

Current Incentivization: How are you currently incentivizing your protocol?

Vaultka continues to engage users through comprehensive incentivization models focusing on real yields and strategic engagement:

- Real Yield for Strategic Vault Users:

Users actively participating in strategic vaults benefit from real yields generated from protocol fees of underlying Perp DEX LPs. This approach encourages users to engage more deeply with Perp DEXes, offering them an opportunity to significantly increase their earnings by taking on calculated risks.

- Real Yield Reward Split for Lenders:

Lenders are allocated a portion of the real yield, sourced from the earnings of leverage users. This model allows lenders enjoy above-market rewards and share in the success of Perp DEXes without assuming their associated risks.

- $esVKA Emission:

Both strategic vault users and lenders are eligible for $esVKA emissions. The distribution is determined weekly through the voting process by $VKA and $esVKA stakers, with the option for users to boost their $esVKA emissions by up to 2.5 times by staking $VKA or $esVKA.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

Yes. In November 2023, Vaultka received a 100,000 ARB grant from GMX to expand our USDC lending pool, aiming to boost it by $4 million and contribute over $5 million in TVL to the GMX V2 ecosystem within 12 weeks. Surpassing our goals, we achieved over $10 million TVL in the USDC lending pool and over $11 million TVL in GMX V2, reflecting a 5500% return on investment from the grant. The grant has ended on February 21, lasted for 12 weeks.

Bi-weekly Updates: Vaultka Grant Bi-Weekly Update - GMX Grants Reports - GMX

Dune Dashboards for GMX Grant: https://dune.com/matthewtaiposley/vaultka-gmx-grant

Final Report: Vaultka Grant Final Update - GMX Grants Reports - GMX

Protocol Performance:

Vaultka TVL: $35.7m

TVL Growth Rate:

Vaultka’s TVL grows steadily since the protocol deployment in February 2023. Since Septemeber 2023, Vaultka’s TVL start to grow rapidly due to the launch of Market-first GMX V2 Leverage Vault. After that, Vaultka’s TVL increases in a rate of average over 100% every month, with the deployment of new products and strategies every month.

Product Coverage:

Total of 17 Strategies, covering Perp DEX LP Compounding, Delta Neutral, Leverage, Index Strategies

Protocols (LP) Coverage:

GMX V1 (GLP), GMX V2 (GM [WBTC-USDC], [ETH-USDC], [ARB-USDC], [LINK-USDC]), GNS (gDAI), Vela Exchange (VLP), HMX (HLP), ApolloX (ALP), KTX (KLP)

Lending Pools size and Average Utilization Rate:

| Lending Pools | TVL | Average UR (past 90 days) |

|---|---|---|

| USDC.e Lending Pool | $6,082,481 | 86.2% |

| USDC Lending Pool | $5,956,244 | 82.3% |

| ARB Lending Pool | $4,374,202 | 89.7% |

| ETH Lending Pool | $2,827,274 | 88.6% |

| WBTC Lending Pool | $2,447,943 | 85.3% |

| LINK Lending Pool | $448,140 | 53.7% |

**When the Utilization Rate (UR) reaches 95%, positions opening will be disabled to provide a buffer for lenders to withdraw.

The provided scatter plot illustrates the daily utilization rates for different lending pools on Vaultka. The data points consistently above the 80% threshold underscore the persistent high demand from users engaging with strategic vaults. Notably, the frequency of utilization rates exceeding 90% is a clear indicator that the lending pool capacity is currently a limiting factor, unable to fully meet the demand from strategic vaults. This bottleneck highlights the need for an expansion of lending capacity to ensure that Vaultka can continue to satisfy user demand and maintain healthy liquidity levels within its ecosystem.

Strategic Vault User Unrealized and Realized Gains

Vaultka has demonstrated a strong capacity to generate significant yield and rewards for its users, as evidenced by both unrealized and realized gains within strategic vault positions:

- Unrealized Gains:

- As of February 29, 2024, users have accumulated unrealized gains totaling ~$2 million in their strategic vault positions. This figure underscores Vaultka’s effectiveness in creating value for its users through its innovative strategies and market positioning.

- Realized Gains:

- Over the past 30 days, Vaultka users have realized total gains amounting to ~$1 million. This achievement highlights Vaultka’s success in delivering sizeable yields to its community, reinforcing the platform’s role as a leading yield-generating protocol within the DeFi space.

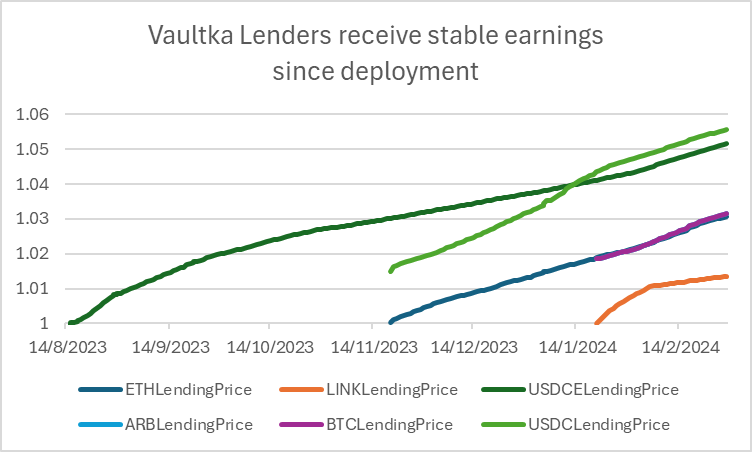

Lenders Earnings:

Vaultka lenders receive stable earnings on their deposits since pool deployment. Lenders get an average of 8% APR on their deposits, which is above the market lending rate. This shows the effectiveness of Vaultka’s reward split mechanism in bringing a win-win situation to lenders and leverage farmers.

Dune Dashboard to track performance of Vaultka:

https://dune.com/gooddata_badguy/vaultka-vault-info

Protocol Roadmap:

- Launching the Leverage Launchpad (Expected in April):

Vaultka is set to introduce a Leverage Launchpad, aiming to democratize access to early-stage investments, reducing the dominance of large investors and providing a balanced platform for all users.

- Expansion to More Arbitrum Perp DEX LP (Ongoing):

Committed to broadening its Perp DEX LP coverage on Arbitrum, Vaultka is actively working to integrate additional protocols such as Hyperliquid, AARK, and EquationDAO, in which the development is already in final testing phase.

- Boosting GLM:

Vaultka introduced the GLM strategy, a GLP-like structured GM token basket, diversifying investment risks while capturing fees from top Perp DEXs.

- Launching Perp DEX LP Index Products:

Building on the success of the GLM strategy, Vaultka plans to develop additional index-like products to cater to a broader investor base. Upcoming strategies include Mega Perp DEX LP and Gov tokens, allowing investment across a spectrum of Perp DEX tokens and leveraging the collective strength of Arbitrum’s Perp DEX ecosystem.

Audit History & Security Vendors:

Audit History:

- Zokyo Audit 1 (for general Leverage Vault logics)

- Zokyo Audit 2 (for GM Leverage Vault Smart Contract audit)

- Zokyo Audit 3 (for GLM Strategy)

- Hacken Audit 1 (Tokenomics)

Bug Bounty for webpage and Smart contract:

Other Security Implementation:

- Hypernative:

Vaultka utilizes Hypernative technology, which triggers automatic alerts for the team in the event of detecting a potentially harmful deployment or fork.

- Chainalysis:

Vaultka uses Chainalysis to manage and reduce protocol-related risks. We ensure strict adherence to regulations and sanctions to safeguard users from malicious individuals.

- Multisig Wallets:

Vaultka’s contract owner is controlled by a multisig wallet. To further reduce the centralization risk, Vaultka has added Vela’s core team as one of the multisigg holder.

Security Incidents:

No, Vaultka has not been exploited.

SECTION 3: GRANT INFORMATION

Requested Grant Size:

1,000,000 ARB

** Protocols that successfully applied for LTIPP will NOT be incentivized (e.g. KTX, APX and HMX etc. if they successfully applied LTIPP), in order to prevent double counting

Justification for the size of the grant:

Objective 1: Triple Lending Capacity to Increase TVL by $50M

With a current lending pool size of $26M and an average utilization rate above 85%, Vaultka aims to triple its lending capacity. This expansion will accommodate the growing demand for strategic vaults and the upcoming leverage launchpad, projecting to channel an additional $50M TVL into Perp DEX LP.

Drawing parallels from the STIP, lending protocols such as Dolomite and Silo have demonstrated the feasibility of achieving a 3x increase in TVL. Their successes serve as a benchmark for Vaultka, providing a solid foundation for our target.

OpenBlock Source for Dolomite: https://www.openblocklabs.com/app/arbitrum/grantees/Dolomite

OpenBlock Source for Silo: https://www.openblocklabs.com/app/arbitrum/grantees/Silo

Objective 2: Boost Perp DEX LP Attractiveness

The STIP saw Perp DEXs receiving grants from the Arbitrum DAO elevate their LP APRs to about 35%. Post-STIP, these APRs are anticipated to decrease by approximately 10%. Vaultka intends to leverage the grant to counteract this expected drop by augmenting APRs within its strategic vaults.

Our goal is to sustain and even accelerate the growth of Arbitrum’s Perp DEX sector by ensuring competitive APRs. This effort is designed not just to draw more capital but to triple the growth within strategic vaults, maintaining an attractive investment landscape within the Arbitrum Perp DEX ecosystem.

**Protocols that successfully applied for LTIPP will NOT be incentivized (e.g. KTX, APX and HMX if they successfully applied LTIPP), in order to prevent double counting

To achieve this, Vaultka will be incentivizing users in 2 ways:

- 65% of the funds will be used to deepen the liquidity for lending pools

- 35% of the funds will be used to enhance TVL of strategic vaults that is not included in the LTIPP program

Lending Pools Incentives Calculations:

Vaultka’s strategy for lending pool incentives is informed by STIP outcomes, where lending protocols typically achieve a ~7% additional ARB APR in their mature phase (based on obseravations from Silo Finance, Dilomite and Radiant). To facilitate a 3x growth in TVL, and assuming ARB tokens are valued at $2, the below calculations were made to estimate the ARB required. The detailed distribution plan, accessible via the linked spreadsheet, is an initial forecast, designed to be revisited and potentially adjusted bi-weekly to align with the latest market conditions and strategic objectives.

Calculation on the incentives required to reach target APR for Lending Pools

Vaulka Strategic Vault Incentive Calculations:

Reflecting on STIP’s insights, Perp DEX LPs typically offer around 10% APR additionally with ARB enhancement. Our goal is to sustain this level of attractiveness, and ensuring strategic vaults achieve approximately 3x growth. This section outlines the calculated estimated ARB needs, which is also subject to bi-weekly changes based on market conditions and demands.

Calculation on the incentives required to reach target APR for Strategic Vaults

Why is the above expectations justifiable and achievable?

- Historical Success of STIP Initiatives:

- Analysis of STIP outcomes reveals that Yield and Yield Aggregator Protocols stand out as the most effective categories in leveraging grants to significantly augment TVL.

- Post-STIP, the average TVL increase for yield protocols was 191%, translating to an average 2.9x growth in protocol size.

- The table below presents a snapshot of the transformative impact of STIP on both Yield and Yield Aggregator categories, highlighting the substantial TVL increases and showcasing the potential for similar success with Vaultka’s strategic initiatives.

| Type | TVL Pre-Incentive | Current TVL | TVL Change | % TVL Change |

|---|---|---|---|---|

| Yield & Yield Aggregator | 80,403,663 | 234,162,824 | 153,759,162 | 191.23% |

| Others | 1,004,742,510 | 1,297,356,613 | 292,614,103 | 29.12% |

** Source from OpenBlock STIP Summary: https://www.openblocklabs.com/app/arbitrum/overview

Below, it shows which protocols have had the highest growth in TVL and volume per claimed ARB in STIP, showing that Lending and Yield related protocols are the best performing sector among the recipients.

** Source from OpenBlock STIP Efficacy Update: OpenBlock Labs Bi-Weekly STIP Efficacy Update (1/19)

Vaultka’s Targeted Growth:

- Inspired by the STIP’s success, Vaultka’s objectives are to boost its current lending pool size by 200% to $75 million and to expand its strategic vault TVL to $46 million.

- The projected 200% boost for both lending pools and strategic vaults aligns with the historical data from STIP, reinforcing the feasibility and attainability of Vaultka’s goals.

- Proven Yield Generation and User Rewards

- Vaultka has demonstrated its capability in generating substantial real yield income for its users, with both unrealized and realized gains amounting to significant figures.

- This track record not only underscores the effectiveness of Vaultka’s strategies in delivering tangible financial benefits to its participants and serves as a testament to the potential impact of deploying additional incentives within Vaultka’s ecosystem.

Grant Matching:

Throughout the ARB incentive period, Vaultka will maintain its regular $esVKA emissions, providing an extra layer of rewards for depositors.

For a comprehensive understanding of the $esVKA emission strategy and schedule, please refer to our detailed documentation available here.

Grant Breakdown:

- 65% (650,000 ARB) for incentivizing Vaultka lending pools:

This portion of the grant, amounting to 650,000 ARB, is reserved for the enhancement of six designated lending pools within Vaultka. The strategy involves a linear distribution of ARB incentives, anticipated to drive significant initial growth in lending pool sizes due to attractive starting APRs. As TVL in these pools expands, the APR is planned to adjust downward correspondingly, balancing the incentive impact with sustainable growth. The below table shows the initial ARB allocation to each pool for the first two weeks. The distribution allocation schedule will be reviewed bi-weekly to meet market demands.

| Lending Pool | Initial Bi-weekly ARB distribution |

|---|---|

| USDC.e | 36,208 |

| USDC | 36,208 |

| ETH | 14,583 |

| ARB | 10,000 |

| WBTC | 10,000 |

| LINK | 1,333 |

Distribution Schedule for Lending Pools

Association Between Lending Pools and Strategic Vaults:

The following table illustrates the connection between specific lending pools and their respective strategic vaults within Vaultka, highlighting how each pool supports various leveraging strategies:

| Lending Pool | Corresponding Strategic Vault |

|---|---|

| USDC.e | VLP Leverage (Vela Exchange), HLP Leverage (HMX), ALP Leverage (ApolloX), KLP Leverage (KTX) |

| USDC, ETH, ARB, WBTC, LINK | GM Leverage, GM Leverage (Neutral) Vault |

- 35% Allocation (350,000 ARB) to Enhance Vaultka Strategic Vaults:

Another 35% of the grant, totaling 350,000 ARB, is dedicated to boosting 10 strategic leverage pools across Vaultka. The incentive distribution is planned to occur weekly, with an expectation of rapid initial growth in pool sizes driven by attractive APR offerings. As these pools expand in TVL, the APR will be adjusted downwards to ensure sustainable growth and value for participants. The below table shows the initial ARB allocation to each pool for the first two weeks. The distribution allocation schedule will be reviewed bi-weekly to meet market demands.

| Strategic Vault | Initial Bi-weekly ARB distribution |

|---|---|

| VLP Leverage | 14,167 |

| GM Leverage - BTC Pool | 4,083 |

| GM Leverage - ETH Pool | 8,229 |

| GM Leverage - ARB Pool | 2,333 |

| GM Leverage - LINK Pool | 21 |

| GM Leverage (Neutral) - BTC Pool | 8,333 |

| GM Leverage (Neutral) - ETH Pool | 8,333 |

| GM Leverage (Neutral) - ARB Pool | 8,333 |

| GM Leverage (Neutral) - LINK Pool | 2,500 |

| GLM | 2,000 |

**Strategic Vaults like HLP Leverage, ALP Leverage and KTX Leverage is not included in the estimation, assuming their application on LTIPP is successful. This is to prevent double spending on ARB incentives.

***Budget for new integrations are subject to changes due to market conditions and demand in the future, where numbers might change and be re-evaluated due to LTIP voting results that can not be known before hand

Distribution Schedule for Strategic Vaults

Funding Address:

0x6CF1974e1f2C36bdE9F63071b0D5503194F0Da37

Funding Address Characteristics:

The address above is a 2/3 Gnosis Multisignature wallet. The private keys are securely stored.

The multisig wallet is able to accept and interact with ERC-721s.

Treasury Address:

Vaultka Treasury Address: 0x9bb5020EC1e42E4eF32d634F595734F7cA9F0EA4

Contract Address:

VLP Leverage: 0xc53A53552191BeE184557A15f114a87a757e5b6F

HLP Leverage: 0x739fe1BE8CbBeaeA96fEA55c4052Cd87796c0a89

GM Leverage: 0x9198989a85E35adeC46309E06684dCA444c9cF27

ALP Leverage: 0x482368a8E701a913Aa53CB2ECe40F370C074fC7b

GM Leverage (Neutral): 0x316142C166AdA230D0aFAD9493ef4bF053289269

KLP Leverage: 0x9ef87C85592a6722E2A3b314AEc722365f3FbF4D

USDC.e Lending Pool: 0x806e8538FC05774Ea83d9428F778E423F6492475

USDC Lending Pool: 0x9045ae36f963b7184861BDce205ea8B08913B48c

ETH Lending Pool: 0x8A98929750e6709Af765F976c6bddb5BfFE6C06c

ARB Lending Pool: 0x175995159ca4F833794C88f7873B3e7fB12Bb1b6

WBTC Lending Pool: 0x4e9e41Bbf099fE0ef960017861d181a9aF6DDa07

GLM: 0xB455f2ab7905785e90ED09fF542290a722b3FBb5

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives:

- Enhance Capital Flow to Perp DEX LP through Lending Pool and Strategic Vault Expansion

- Recent months have seen a surge in product demand, pushing the utilization rate of lending pools beyond 90%. This high utilization has occasionally prevented new leverage activities due to the full allocation of available liquidity, posing challenges to Vaultka’s growth and the broader Perp DEX ecosystem.

- The grant will enable Vaultka to significantly deepen each lending pool, aiming to double their depth and offer an attractive APR of approximately 7% additional yield through ARB token incentives at targeted pool sizes. The objective is to achieve an optimal utilization rate average of 70%, carefully balancing the redirection of lending capital with the attraction of new leverage users and lenders.

- Expanding Vaultka’s User Base

- Vaultka is set to leverage the ARB grant to significantly expand its user base, aiming for a 50% increase to reach approximately 6000 cumulative users.

- The basis for this objective draws on comparative analysis with JonesDAO’s performance during the STIP period, which successfully attracted 1487 new users (quoted from dune dashboard) with a 2,000,000 ARB grant. With a grant request of 1,000,000 ARB, Vaultka projects to onboard an additional 2000 users.

- It’s important to note that Daily Active Users (DAU) may not serve as an accurate KPI for yield protocols, which inherently exhibit lower daily transaction and login rates. Instead, the effectiveness of the grant will be evaluated based on the number of unique deposits and addresses, offering a more relevant measure of user engagement and protocol growth.

Dune Dashboard for JonesDAO STIP result:

- Enhancing User Engagement and Decentralization

- As Vaultka expands its user base, a key objective is to cultivate a more equitable distribution of deposits among users. This strategy is not only aimed at bolstering the protocol’s decentralization but also at mitigating the potential dominance and influence of large-scale investors on the platform’s operations and governance.

- To objectively measure and track progress towards a more balanced user deposit landscape, Vaultka will employ the Gini Coefficient as a KPI. This statistical measure will be pivotal in assessing the equality of TVL distribution across users, providing a clear metric to evaluate changes in decentralization before and after the grant period.

- Through targeted initiatives funded by the grant, Vaultka is committed to achieving a Gini Coefficient of less than 0.3. Attaining this threshold would signify a substantial improvement in the decentralization of deposits, demonstrating a more evenly distributed and participatory ecosystem.

Execution Strategy:

Incentives for Lending Pools and Strategic Vaults:

- Incentives will be distributed linearly over a 12-week period, adhering to the schedules outlined in the provided excel sheets. This approach ensures a consistent and fair allocation of rewards to participants.

- To calculate each user’s eligible claim on a weekly basis, a time-weighted methodology will be employed:

- Lending Pools: Participants’ shares in the lending pools will be represented by ERC-4626 tokens, indicating each depositor’s proportional ownership.

- Strategic Vaults: Users will receive a proof of deposit token upon initiating a position, serving as the basis for calculating their time-weighted stake and corresponding ARB claims.

- Eligible ARB rewards can be claimed every Thursday via Vaultka’s Airdrop page, facilitating regular and accessible distribution to users.

- The distribution schedule shown below are only showing the distribution planned for the first two weeks. Distribution allocation will be subject to changes, according to market demands and changes. New distribution allocation will be posted in the bi-weekly report.

- The utilization and distribution of incentives for new strategies and integrations will be meticulously documented and shared in Vaultka’s bi-weekly reports. These reports will detail the schedule, allocation, and usage of funds, ensuring transparency and accountability throughout the execution process.

Distribution Schedule for Lending Pools

Distribution Schedule for Strategic Vaults

Attracting New Users and Preventing Concentration of Rewards:

- It was noted by the DAO that certain protocols had their rewards disproportionately concentrated among a few users in STIP. This pattern of distribution was counterproductive to the intended goal of expanding the user base within the Arbitrum ecosystem.

1. Concentration of Rewards:

A handful of protocols have dispersed the majority of their rewards (50-70% or more) to a small group of users (less than 10). In such cases, the DAO is essentially committing millions of dollars to highly concentrated bets on user acquisition. Frequently, these major stakeholders have vested interests in the protocol, resulting in rewards flowing toward rent-seeking participants. The underlying data is available in the “User Claim Activity” section here.

- To address these concerns and ensure a more equitable reward distribution, Vaultka actively collaborates with cross-chain Perp DEX partners to attract fresh capital from various chains into Arbitrum. Our partners, who have a strong presence on multiple chains, provide a robust network to diversify and bring new liquidity into Vaultka and Arbitrum, benefiting the entire ecosystem:

| Protocols integrated with Vaultka | Chains Coverage |

|---|---|

| GMX | Arbitrum, Avalanche |

| HMX | Arbitrum, Blast |

| Vela | Arbitrum, Base |

| ApolloX | Arbitrum, BNB Chain, Base |

| KTX | Arbitrum, Mantle, BNB Chain |

- To incentivize and attract new depositors, Vaultka will implement an additional multiplier on the weight of their deposits, effectively increasing their share of rewards. This approach ensures that new users are given precedence in the allocation of incentives, aligning with the Arbitrum grants’ primary aim to attract new capital and participants.

- The identification process will include monitoring deposited addresses for activity and cross-referencing with behaviors across other chains to mitigate the risk of Sybil attacks. The criteria for new users will extend beyond just being new to Arbitrum, incorporating a comprehensive analysis to ensure genuine engagement.

- By establishing these measures, Vaultka upholds the essence of the Arbitrum grant incentives, fostering growth and inclusivity while expanding the ecosystem

| Criteria | Initial Multiplier applied to weights |

|---|---|

| Wallets that do not have any transaction on Arbitrum, but have at least 10 transactions on other chains on or before 31 Dec 2023 | 1.2x |

| Wallets that have neither interacted with Vaultka nor integrated protocols, but had transactions on Arbitrum before. | 1.15x |

| Wallets that have deposited LP into integrated protocols (on non-Arbitrum chains), and have never interacted with Vaultka | 1.1x |

| Wallets that have deposited LP into integrated protocols (on Arbitrum), but have never interacted with Vaultka | 1.05x |

| Totally New Wallet without any transactions across different chains | No multiplier applied, to prevent Sybil attacks with new wallets |

*Multipliers and Critierias are subject to modifications bi-weekly based on market reactions and demands, where it will be reported on the bi-weekly updates provided to the DAO forum. The above multiplier is only a reference for the first two weeks.

**For cross chain records, Vaultka will be accessing the wallets interaction in EVM chains including Ethereum, BSC, Avalaunche, Blast, Base, Optimism, and Mantle

***The initial multiplier for rewards is set with reference to the existing liquidity levels of Perp DEXs operating outside of Arbitrum, with the objective to draw in and consolidate both capital and users to the Arbitrum network.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

Enhanced Vaultka NFT Rewards

In December of the previous year, Vaultka introduced an exclusive NFT series, aimed at rewarding our dedicated user base with potential benefits and privileges. For our loyal users who already possess these NFTs and participate during the LTIPP, there will be an opportunity to upgrade their NFTs, symbolizing their status as early supporters and contributors to Vaultka’s growth during the LTIPP.

Additionally, new users engaging with Vaultka during the LTIPP will be eligible to receive NFTs from a distinct series, serving as a testament to their active involvement. The introduction of these NFTs is more than a symbolic gesture; it unlocks tangible advantages for holders, such as access to increased leverage options and enhanced borrowing capacities, thereby enriching their Vaultka experience.

Creating a Flywheel Effect

The vitality of Vaultka’s ecosystem is closely tied to its TVL, with higher TVL translating into increased protocol fees. These fees are then redistributed to $VKA and $esVKA stakers, encouraging users to earn and stake $esVKA emissions. Specifically, lenders participating in the LTIPP will be rewarded with $esVKA emission. This strategy establishes a positive feedback loop, where the benefits to users are directly aligned with their contributions to Vaultka, ensuring a mutually beneficial relationship and fostering long-term “stickiness” within the ecosystem.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

| Objective | KPI | Definition |

|---|---|---|

| Channeling Liquidity to Perp DEX LP | Each Vault TVL | The TVL in each Perp DEX vault, reflecting the liquidity directed towards each specific Perp DEX. |

| Each Lending Pool Size | Growth in liquidity within each lending pool as a result of the incentivization, showcasing the impact of additional incentives. | |

| Average Utilization Rate for Each Lending Pool | The efficiency of fund usage within lending pools, with an optimal target to maintain an average utilization rate above 70% to ensure a healthy liquidity ratio. | |

| TVL After 90 Days | The sustained liquidity level 90 days post-incentive program, indicating the long-term retention of channeled funds. | |

| Attracting New Depositors | Daily User Growth | The rate of new user acquisition, demonstrating Vaultka’s effectiveness in drawing new participants. |

| Daily Transaction Count | The volume of deposit and withdrawal transactions, providing insights into active engagement and the balance of inflow versus outflow, potentially reflecting the diversity of user activity. | |

| Total User Growth | The aggregate increase in Vaultka users by the conclusion of the LTIPP, quantifying overall success in expanding the user base. | |

| New Deposits Average Deposit Period | The average duration new deposits remain in Vaultka post-incentives, gauging the stickiness and retention of new users. | |

| Striving for Uniform Engagement | Gini Coefficient | The equality measure of deposit distribution among users, a lower Gini Coefficient indicating a more equitable distribution and enhanced protocol decentralization. |

| User Deposits Distribution | A detailed breakdown of deposits across different user segments, highlighting the diversity and spread of user investments within Vaultka. |

Grant Timeline and Milestones:

The incentive program is structured to commence 7 days following the receipt of the ARB funds. The distribution of these funds will follow a linear schedule across both strategic vaults and lending pools, evenly spread over 12 weeks. Initially, due to the anticipated lower TVL, the APR is expected to be significantly high, attracting early participation.

Vaultka will implement a systematic approach to reward distribution:

- Weekly collection of user deposit data will allow for the calculation of time-weighted averages, determining each user’s eligibility for ARB rewards.

- The ARB rewards will be distributed every Thursday, with users able to claim their rewards via the Vaultka Airdrop page.

Milestones:

| Weeks | KPI | Details |

|---|---|---|

| 1-3 Weeks | Lending Pools TVL | Anticipate a 100% growth in TVL driven by high initial APRs. |

| Strategic Vault TVL | Expect parabolic growth in strategic vaults’ TVL, with an anticipated increase of 100%. | |

| User Growth | Project a significant spike in user acquisition, aiming for an increase of 2000 new users, fueled by the high APRs and LTIPP marketing initiatives. | |

| 3-6 Weeks | Lending Pools TVL | Growth rate expected to moderate as APR decreases, with a 50% increase in TVL anticipated. |

| Strategic Vault TVL | As APR stabilizes, strategic vault TVL growth is projected to slow, targeting a 50% increase. | |

| User Growth | The pace of new user acquisition is expected to decelerate, with a goal of adding 1000 new users in this phase. | |

| 6-12 Weeks | Lending Pools TVL | As the program progresses, TVL growth is expected to stabilize, distributing the remaining 50% growth evenly across this period to triple the initial liquidity. |

| Strategic Vault TVL | Strategic vault TVL growth to further decelerate, aiming for an additional 50% increase as it reaches a stable state. | |

| User Growth | The influx of new users is anticipated to slow further, with an additional 1000 users expected over the last 6 weeks, marking a steady approach to the program’s conclusion. |

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

- Amplifying the Flywheel Effect through Enhanced Liquidity

The incentivization of lending pools and strategic vaults can significantly increase both the volume and TVL within Vaultka. This surge in liquidity directly benefits the Perp DEX ecosystem on Arbitrum by providing deeper liquidity pools for various trading strategies. This enhancement in trading conditions is expected to attract more users, resulting in increased trading fees and yields, which are then redistributed to liquidity providers. The resultant flywheel effect amplifies with each cycle, driving more liquidity, enhancing trader experience, and attracting further participation.

- Encouraging Diversity and Innovation Among Early-Stage Perp DEXs

Vaultka offers a platform for early-stage Perp DEXs, such as ApolloX and KTX, to develop and showcase their strategies, leveraging Vaultka’s established user base to enhance their visibility and liquidity. This collaboration has proven to be effective, as evidenced by ApolloX’s TVL increase by 180% following its partnership with Vaultka.

- Promoting Innovation with Index Solutions

The incentivization of innovative pools like GLM, which offers exposure to a basket of assets akin to GLP-structured GM tokens, highlights Vaultka’s role in introducing novel financial products to the Arbitrum market. This strategy not only attracts users seeking diversified asset exposure but also paves the way for the introduction of more index-like solutions, addressing a market need for such products on Arbitrum and encouraging further innovation.

- Supporting Early-Stage Projects through the Leverage Launchpad

Vaultka’s leverage launchpad is an innovative feature that lowers fundraising barriers for early-stage projects by enhancing the efficiency of lending capital utilization. It allows these projects to capitalize on Vaultka’s visibility and user base, facilitating their fundraising efforts and enabling them to reach their financial goals more effectively.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes

SECTION 5: Data and Reporting

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, We are prepared to comply.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard?

Yes, we agree. A bi-weekly update will be posted on Arbitrum Forum, together with a dune dashboard that illustrates each of the KPIs and the progress of Vaultka.

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes. We agree

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?:

Y