Constitutional proposal

Updated 10 November 2025: This proposal has been amended to include an increase in the L2 min base fee from 0.01 gwei to 0.02 gwei. This change is proposed to be executed by an ArbOwner precompile call to the setMinimumL2BaseFee function and will solely be a parameter/configuration change.

Abstract

This AIP proposes to reduce the severity, frequency, and duration of high L2 gas prices during periods when demand exceeds the gas target by introducing a new set of gas targets and new, accompanying adjustment windows for Arbitrum One and Arbitrum Nova. The starting effective (lowest) gas target of the chain is proposed to be 10 Mgas/s with an adjustment period of 86,400 seconds (1 day). These changes are intended to replace the current 7 Mgas/s gas target, which is used to adjust the L2 gas price using an EIP-1559-inspired algorithm relative to the current 102-second adjustment window.

The AIP requests that the ArbitrumDAO grant Offchain Labs the right (for 2-years, measured from this proposal’s mainnet activation) to add up to 10 gas targets and adjustment windows, and to modify them over time—up to 100 Mgas/s and 86,400s, respectively. These changes will be introduced gradually to protect network stability while addressing high gas price volatility. The rollout begins with 6 new gas targets, each paired with its own adjustment window.

Lastly, this AIP is accompanied by an increase in the minimum L2 base fee from 0.01 gwei/gas to 0.02 gwei/gas to help reduce spam and offset any potential decline in the portion of L2 surplus fee-derived transaction fees (during periods of peak demand) to the ArbitrumDAO.

These updates and delegated rights are proposed by Offchain Labs in its role as an Arbitrum Aligned Entity (AAE), as described in A Vision for the Future of Arbitrum. Offchain Labs serves as an AAE for engineering, product, business development, and technical research.

All changes will be gated through smart contracts and DAO votes. Activation will require an on-chain vote, a security audit, and deployment of a new Resource Constraint Manager contract to manage permissions. If approved, only Offchain Labs will be authorized to adjust the parameters within the approved limits.

The proposal also outlines the rationale, risks, tradeoffs, and supporting data behind these changes. It applies solely to ArbitrumDAO-owned chains—Arbitrum One and Arbitrum Nova.

Rationale

How gas costs are priced today

Arbitrum chains determine transaction gas fees using two components:

-

L1 gas costs – the expense of posting data to the parent chain.

-

L2 gas costs – the resources consumed on the child chain (computation and storage).

L1 gas costs depend on the price of calldata or blobs on the parent chain, while L2 gas costs depend on network demand. Today, when demand on Arbitrum One exceeds 7 MGas/s, the L2 base fee increases exponentially — using a mechanism similar to Ethereum’s EIP-1559 — until demand falls back toward the gas target over a 102-second adjustment window. Learn more about Arbitrum’s gas model here.

Negative impacts of elevated demand

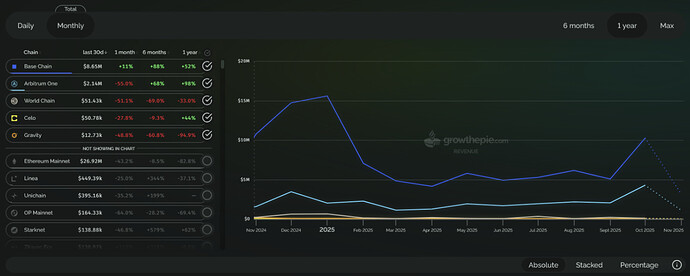

During periods of high activity, L2 gas prices can rise sharply, which significantly increases transaction costs for users and developers. For example, on Oct. 10, 2025, Arbitrum One’s L2 gas price peaked at an average of 41 gwei/gas, resulting in roughly $9.49 in L2 gas costs to transfer an ERC-20 token (source, and assumes 60,000 gas and a price of $3,855 per Ether).

These high L2 gas price spikes are the motivation behind this AIP: to mitigate the frequency and severity of congestion-driven cost increases. Notably, introducing multiple gas targets with overlapping adjustment windows has a greater combined effect on stabilizing prices than raising a single gas target or changing a single adjustment window alone.

Illustrative example

To illustrate this, we analyzed how the L2 gas price would have changed during the demand surge on Oct. 10, 2025 and on Sept 22, 2025, under different gas targets and adjustment windows. The adjustment window is a time-based damping parameter that controls how slowly the L2 gas price responds to changes in demand on the network above the gas target. A larger adjustment window results in slower price adjustments relative to the gas target, while a smaller adjustment window results in faster price adjustments.

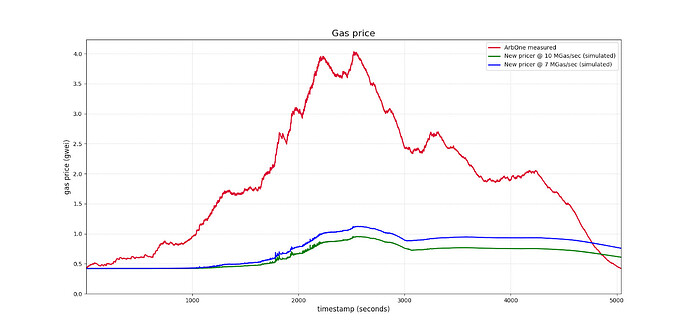

Figure 1: L2 gas prices calculated different pricing algorithms during a period of high congestion on Sept 22, 2025

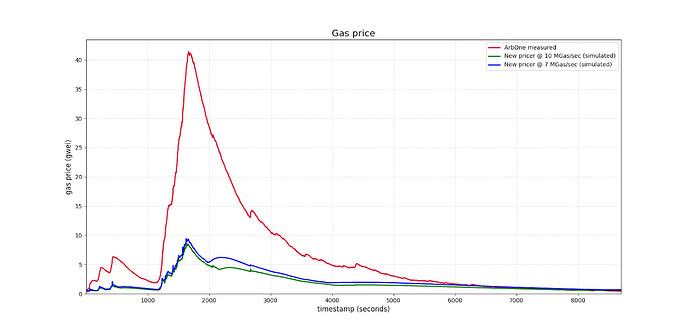

Figure 2: L2 gas prices from different pricing algorithms during a period of high congestion on Oct 10, 2025

Below is a brief description of the colored lines and what they represent in each of the two figures above, while holding the minimum L2 base fee constant

-

Red lines: Actual L2 gas price using today’s parameters (effective gas target of 7 MGas/s over a 102-second adjustment window), peaking near 4 gwei on Sept 22 (Figure 1) and 42 gwei on Oct 10 (Figure 2).

-

Blue lines: L2 prices using the new set of proposed gas targets and adjustment windows, with an effective 7 MGas/s target and 86,400-second window.

-

Green lines: L2 prices using the new set of proposed gas targets and adjustment windows, with an effective 10 MGas/s target and 86,400-second window.

Looking specifically at Figure 2 during the period of peak demand on October 10, 2025, notice how both the green and the blue lines produce a much lower L2 gas price of ~9 gwei during the same demand peak, representing a ~33 gwei difference when compared to the peak of the red line (which uses today’s single 7 Mgas/s gas target and 102-second adjustment window). The difference between the peaks is almost ~33 gwei (129% difference) despite the effective gas targets being very close. Both the green and blue lines show substantially lower peak prices — around 9 gwei — a 33 gwei (≈129%) reduction compared to the current configuration, despite similar effective gas targets.

Summary and the increase in the minimum L2 base fee

This retrospective analysis shows that applying the proposed gas targets and adjustment windows would have significantly reduced L2 gas prices during the periods of peak demand on Sept 22, 2025 and Oct. 10, 2025. While this simulation does not predict future outcomes, it demonstrates that longer and overlapping adjustment windows can meaningfully dampen gas price volatility during periods of high demand.

Naturally, this change will mean that during periods of peak demand, the portion of L2 surplus fee-derived transaction fees collected by the ArbitrumDAO will be lower going forward, compared to before. To offset this potential decline, this proposal is to be accompanied by a slight increase in the minimum L2 base fee from 0.01 gwei/gas to 0.02 gwei/gas. This slight increase in the minimum L2 base fee can also positively contribute to reducing spam on the network as well, since the base fee for all transactions will be slightly larger than before this change.

Specifications

New gas targets and adjustment windows

This proposal replaces the current, singular gas target (7 Mgas/s over a 102-second adjustment window) with multiple gas targets across overlapping adjustment windows, as tabulated in Table 1 below.

| Table 1: Proposed gas targets & accompanying adjustment windows | |

|---|---|

| Gas Target (Mgas/s) | Adjustment window (seconds) |

| 60 | 9 |

| 41 | 52 |

| 29 | 329 |

| 20 | 2105 |

| 14 | 13,485 |

| 10 | 86,400 |

These values were calculated using this model here, with inputs from internal benchmarking on a server hosted by a cloud provider. This model assumes that a node on the reference hardware can sustainably sync at 80 MGas/s and that the chain can tolerate a 20% increase in L2 gas price per second during periods of high demand. Reference hardware used for these tests was: 64 GB RAM, 8 CPUs (x86 architecture), and a locally attached NVMe drive (for AWS, i4i.2xlarge). Note that the lowest gas target of the 6 being introduced is 10 Mgas/s, which will be measured over the longest adjustment window (86,400s). We refer to this proposed 10 Mgas/s gas target as the “long-term gas target” or “effective gas target” of the chain..

Special permissions to gradually adjust gas targets and adjustment windows, over time

Separately, this proposal requests the ArbitrumDAO grant Offchain Labs permission, for 2 years from the mainnet activation of this proposal, to adjust the gas targets and adjustment windows in Table 1, in addition to the right to add up to 10 more gas targets and adjustment values. These rights will allow Offchain Labs to adjust these values over time and help the chain’s stability in a way that security is not negatively impacted as additional capacity is added. The rollout of these changes will be paired with continuous monitoring of how the user behavior, node operators, and the network itself respond to them. Summarized below in Table 1 are the values and ranges that this proposal grants Offchain Labs the right to adjust.

Table 2: Proposed gas targets and adjustment window ranges that can be adjusted over time by Offchain Labs, should the permission be granted by the ArbitrumDAO

| Parameter | Range | Status quo value |

|---|---|---|

| Number of gas targets | 1 to 10, inclusive | 1 |

| Gas targets | 7 Mgas/s to 100 Mgas/s, inclusive | 7 Mgas/s |

| Adjustment windows | 5 seconds to 86,400 seconds, inclusive | 102 seconds |

Resource Constraint Manager Contract

Resource Constraint Manager Contract

Lastly, if approved, there will be a new contract deployed called the ResourceConstraintManager that will give Offchain Labs the appropriate permissions to adjust the above values within the specified ranges in Table 2 over time, should this proposal pass. This new contract will be audited by an independent third party entity (Trail of Bits). A full audit report will be published alongside this proposal when it gets proposed in the eventual on-chain vote.

This new contract will contain an access list. We propose that the ArbitrumDAO use this access to designate Offchain Labs the right to invoke specific functions on the ArbOwner precompile to adjust the above values in Table 2, within certain ArbitrumDAO-approved bounds. Normally, ArbOwner parameter changes and function calls require an ArbitrumDAO vote. Implementing this ResourceConstraintManager contract will allow Offchain Labs to adjust these parameters in Table 2, within the proposed bounds, without the need for additional votes - should the ArbitrumDAO pass this proposal.

Changing the minimum L2 base fee

A change to the minimum L2 base fee is also included in this proposal and will be executed via a call to the ArbOwner setMinimumL2BaseFee function. This will be a one-time adjustment from the current 0.01 gwei value to a new 0.02 gwei value.

Risks & Tradeoffs

The addition of new, higher gas targets to a chain is not without tradeoffs. Below are some of the potential tradeoffs that the ArbitrumDAO and ecosystem should consider in their assessment of this proposal.

Accelerated state growth

A gas target increase translates to an increase to the demand threshold at which EIP-1559-style congestion pricing kicks in, which will invite more demand to the network. After profiling the type of gas used on Arbitrum One over a period of about 3 weeks, the gas rate associated with state growth was observed to remain relatively stable over time. It is believed that if the capacity of the chain increases, then the rate of storage growth is expected to also increase.

While this issue presents a challenge regarding the size of the state database and the costs to maintain it over the long run (e.g., archive node operators), after careful consideration, we believe the below are sufficient justifications that support the current proposed course of action.

-

In September 2025, the Erigon team announced the alpha release of their archive node support for Arbitrum Sepolia. Their team was able to reduce the Arbitrum Sepolia archive node size from 12 TB to 0.732 TB, a 94% reduction. The Erigon team is expected to deliver Arbitrum One mainnet support by Q1 2026. This achievement will mean that node operators can opt to run archive nodes using Erigon, significantly reducing the cost associated with maintaining a larger and faster-growing state database size (when compared to today’s Geth-based Nitro nodes).

-

The majority of professional node operators surveyed run Arbitrum One nodes on bare-metal providers and in RAID0 configurations. This special type of setup grants node operators the flexibility and optionality to expand storage at more predictable (and sometimes lower) costs and in a horizontal fashion. Based on this information, we expect professional node operators to be able to adequately provision and scale up in their disk sizes over time.

-

In September 2025, AWS announced that it raised the limit on EBS GP3 volumes to 64 TB, up from 16 TB. Given that some instance families (e.g., i8g) have an upper bound of 32 EBS volumes, then the theoretical maximum that a node operator could provision on AWS would be 32 x 64 TB = 2048 TB. For NVMe drives, which we recommend for performance and latency today already, some instances offered by AWS go as high as 120 TB (i8g) and 45 TB (i7ie). We expect that cost reductions and other advancements to technology will continue to improve across all cloud providers, making access to these larger drives more affordable as time goes on (i.e., Moore’s Law).

The combination of the above 3 trends leads us to conclude that the risk of accelerated state growth, as a result of increased demand, can be reasonably managed in both the short and long term.

Updated minimum hardware requirements for node operators

As noted in Table 1, the proposed starting gas targets and adjustment windows were computed using test results observed from syncing an Arbitrum node on reference hardware. The reference hardware used in these tests was 64 GB RAM, 8 CPUs (x86), and a locally attached NVMe drive formatted with ext4 (for AWS, i4i.2xlarge). Therefore, this proposal will accompany an increase in the minimum hardware requirements for node operators from the current specification. These requirements will be used as the foundation for future increases to the tech stack’s scaling capabilities.

Table 3: Comparison of current and new minimum hardware requirements for Arbitrum Nitro full nodes, given the new gas targets being proposed

| Arbitrum Nitro full node hardware requirements | Current (source) minimum | Proposed new minimum |

|---|---|---|

| Total RAM (GB) | 16 | 64 |

| Number of CPUs | 4 | 8 |

| Disk type | Local NVMe drive | Local NVMe drive |

Despite the cost increases that come with higher hardware minimums, we believe that this increase is justified because:

-

Surveys conducted with at-home node operators found that the majority of teams are already running Arbitrum Nitro full nodes on servers that have 12+ CPU cores, 64GB+ RAM, and NVMe drives. As such, we believe this change will bring the requirements in line with setups that teams use today.

-

The current minimum CPU and RAM requirements for running an Arbitrum Nitro node were defined over 3 years ago. As technology has improved and costs have decreased, we believe it makes sense to update this requirement to align with what the market can offer today at a similar price.

-

Future chain capacity increases will benefit from better hardware, and so this update will establish a new baseline for how we scale Arbitrum technology in the future

Over the coming weeks, we will perform similar benchmarking tests on various other types of hardware using different workloads to understand the limitations of the Nitro node software. The results of these upcoming tests will help us further improve Arbitrum technology.

Spam, relative to organic traffic, could increase on Arbitrum One

As mentioned above, a gas target increase translates to an increase to the demand threshold at which L2 congestion pricing kicks in. Doing this naturally invites more demand to the network and could, therefore, result in more spam relative to organic traffic and today’s level of spam, since there would be more capacity to transact on the chain. While spam can be monitored, it is difficult to predict exactly how much more spam could take place on the network as a result of this change, relative to organic traffic.

To counteract the potential increase in spam, Entropy Advisors, an Arbitrum Aligned Entity (AAE), has suggested this proposal be accompanied with a change in the minimum L2 base fee from 0.01 gwei to 0.02 gwei. This change is based on the assumption that inorganic demand (generated from bots or spam) are more price sensitive compared to organic demand.

Careful monitoring and subsequent changes to the gas targets and their adjustment windows will be considered over time to better manage spam. We acknowledge that there is no single, one-size-fits-all solution to eliminating or reducing spam, and so this area remains a topic of ongoing research at Offchain Labs.

Slight increase in transaction costs

An increase in the minimum L2 base fee will result in, overall, higher transaction costs for all users during all periods, assuming usage remains the same. However, we believe this change (from 0.01 gwei/gas to 0.02 gwei/gas) is small enough that regular users and applications will largely be unaffected. To illustrate this, a simple ETH transfer consumes 21,000 gas. At $3500 USD per ETH, this increase in the minimum L2 base fee would result in a ~ $0.000735 increase in cost for an end user (0.01 gwei/gas * 21,000 gas * 1e-9 gwei/ETH * $3500 ETH = ~$0.000735).

Steps to Implement & Timelines

If approved, these changes will be deployed with the values in Table 1, accompanied by continuous monitoring of the network and its response to the changes. With permission from the ArbitrumDAO, Offchain Labs may adjust these values over time to help maintain the stability and security of the network as the chain’s capacity increases.

Below are the approximate next steps and timelines for this proposal:

-

Formal submission to the ArbitrumDAO for consideration and assessment (this post)

-

Discussion and productive iteration together with the community (1 week)

-

Development and audit, by Trail of Bits, of the required changes to add multiple gas targets and adjustment windows, alongside the actual proposed starting parameter values (now through mid-November 2025)

-

Temperature check vote on Snapshot (mid-November 2025)

-

Arbitrum Sepolia upgrade to ArbOS 50, should the temperature check vote pass successfully (mid- to late-November 2025)

-

Submission for inclusion in the ArbOS 50 on-chain vote (carried out on Tally) (early December 2025), should the temperature check vote pass successfully, alongside the publication of the audit report from Trail of Bits.

Overall costs

All engineering and research conducted for this proposal was done so by Offchain Labs at no explicit or additional costs to the ArbitrumDAO