As the Research Member of the ARDC V2, Castle Labs (@CastleCapital) and @DefiLlama_Research were tasked with identifying the most strategic opportunities to drive adoption, liquidity, and innovation within the Arbitrum ecosystem.

This report presents a structured, data-driven cross-vertical analysis of the broader DeFi and crypto ecosystem, identifying protocol-level gaps, chain-level go-to-market (GTM) differentiators, and asset-level incentive pathways that Arbitrum can target to expand its market share and enhance ecosystem maturity. It identifies where Arbitrum holds latent or underdeveloped potential and proposes a prioritised map of verticals, products, and protocols where DAO-aligned action could unlock meaningful growth.

The objective is twofold:

- Assess Arbitrum’s current market presence across key verticals using consistent, comparable KPIs and qualitative maturity labels that reflect growth potential, market share, and ecosystem depth.

- Benchmark leading chains and protocols within each vertical to understand what features, deployment strategies, or GTM tactics are driving their traction, why similar outcomes have not yet materialised on Arbitrum, and where the clearest growth opportunities lie.

Designed as a strategy tool for DAO delegates, core contributors, and external partners, the report bridges high-level ecosystem data with actionable insights to guide incentive design, business development, and long-term contributor focus, ensuring capital and effort are aligned with the most impactful areas of opportunity.

We have documented our entire research in this Google Doc — Navigate through the document using the Tabs on the left-hand side to jump to specific sections.

Below is a guide to the sections of the document:

- Introduction: You’re here now. This section outlines the report’s goals, its intended audience, and provides guidance on navigating the findings.

- Executive Summary: Get the key information and takeaways from the report in just 10 minutes.

- Ecosystem Overview: A high-level summary of verticals across chains, supported by topline metric comparisons. This section sets the context for the shortlisting work that follows.

- Shortlisting Output: Presents the dual-track shortlisting from both DL and Castle, along with the filters, assumptions, and prioritisation logic used to identify high-potential protocols and assets.

- Feature Mapping & GTM Analysis: Investigates why leading protocols succeed in high-growth verticals and compares their product, UX, composability, and incentive approaches to those currently live or missing on Arbitrum.

- Recommendations: Summarises findings from vertical to vertical into actionable priorities. Identifies key areas where Arbitrum is underweight and offers targeted guidance on where the DAO might deploy capital or resources.

- Appendices:

- Project Methodology: A walkthrough of the research approach, data acquisition, vertical and protocol shortlisting logic, and the scoring and prioritisation frameworks used throughout.

- DL Shortlisting: Raw output and method from the DefiLlama-driven shortlisting

- CL Shortlisting: Castle-led shortlisting track using Arbitrum market share delta and growth analysis

- Shortlisting Feasibility Framework: An overview of the opportunity scoring criteria used to rank potential areas of action

In this forum post, we have onyl included the Executive Summary and Recommendations as collapsible sections. For access to the full report, visit the Google Doc.

Executive Summary

Executive Summary

Report Goals and Structure

The report’s primary objective is twofold: first, to assess Arbitrum’s current market presence across key verticals using consistent KPIs and qualitative labels for growth potential, market share, and maturity; and second, to benchmark leading chains and protocols to understand their traction-driving features, deployment strategies, and go-to-market (GTM) tactics, explaining why similar outcomes haven’t materialized on Arbitrum. It is structured into an Introduction, Ecosystem Overview, Shortlisting Output & Method, Feature Mapping & GTM Analysis, Recommendations, and Appendices. The “Ecosystem Overview” section sets the strategic backdrop by mapping the broader crypto ecosystem to identify areas of market activity, evolving use cases, and structural maturity. It informs where Arbitrum may have high-potential entry points or opportunities for targeted growth.

Ecosystem Overview by Vertical

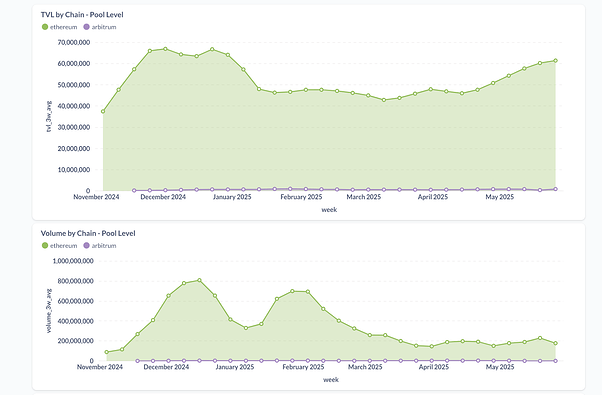

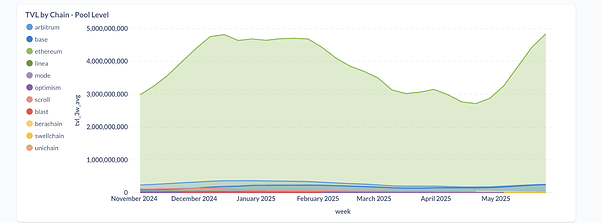

- DEXs: The DEX market has significantly grown, with volume doubling over the past year, primarily concentrated on Solana, Ethereum mainnet, and BSC (which leads with ~50% of current DEX volume, driven by PancakeSwap’s growth). While Aptos (+330%) and Hyperliquid-Spot (+54%) have seen high growth in the last six months, Arbitrum’s volume saw a 5% decline, performing better than Solana (-61%) and Optimism (-52%) but indicating a plateau in activity. On Arbitrum, Uniswap dominates with 63% of DEX volume, followed by PancakeSwap (10%), Fluid (9%), and Camelot (7%), suggesting a dependency on Uniswap and a lack of a single Arbitrum-specific DEX achieving significant dominance.

- Derivatives: The perpetual futures market has tripled its trading volumes since 2021, consistently exceeding $300 billion monthly since early 2025. Hyperliquid leads globally with 48% of on-chain perpetual activity, while Arbitrum holds the highest L2 market share at around 4%. GMX, Arbitrum’s leading protocol, ranks eighth globally with a 2% market share. Arbitrum has seen a 50% decline in perpetual trading activity over the past year, largely due to Hyperliquid attracting liquidity. Despite this, Arbitrum’s derivatives market is healthy with diversified platforms, making it less dependent on a single protocol.

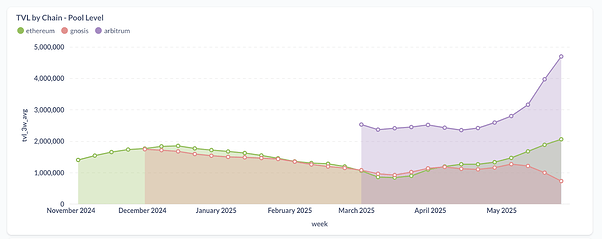

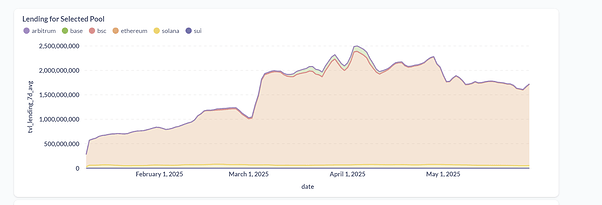

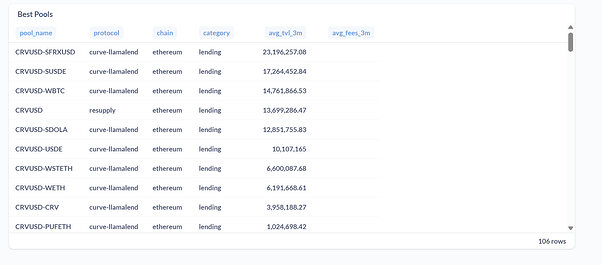

- Lending: Tron dominates lending supply (51%), but Ethereum leads in borrow demand (35.6%), showing higher utilization. Excluding Ethereum and Tron, Arbitrum ranks third in lending TVL (14%) among L1 and L2 networks, behind BSC (22%) and Solana (18%), and leads other L2s like Base (10%) and Optimism (3%). Arbitrum shows a higher utilization rate compared to many competitors, reflecting healthy lending dynamics. On Aave, Arbitrum is a core venue outside Ethereum, holding 19% of supply and generating 24% of borrow volume, with a 46% utilization ratio. The main challenge for Arbitrum is to grow supply while maintaining high utilization against emerging competitors like Base (54% utilization on Aave).

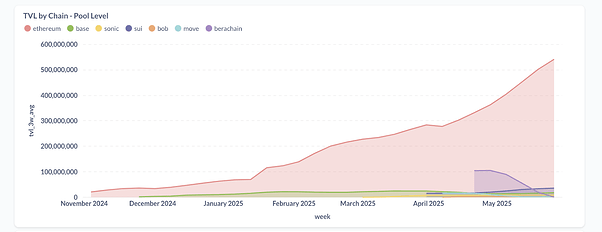

- Yield: The yield market grew 30% in six months to $6.2 billion TVL, with Ethereum maintaining 80% dominance. Arbitrum holds 2% of total TVL, behind BSC (5%) and Base (3%). Pendle (45%), Merkl (25%), and Convex (18%) dominate the protocol landscape. Among L2s, Arbitrum has maintained a stable 20-25% market share, though Base initially led before Sonic’s surge. Pendle and Merkl are deployed on Arbitrum, but Convex is not, with Aura taking the third spot. Arbitrum’s TVL in this sector grew from $76 million to $176 million in six months, indicating resilience but a lack of significant relative gains.

- CDP (Collateralized Debt Positions): The CDP market has stabilized around $10 billion TVL since late 2022, with over 90% of activity on Ethereum. Sky Lending dominates protocols (80% of TVL). Arbitrum’s CDP TVL declined from $50 million to $35 million this year, largely driven by Abracadabra Money (over 90% of Arbitrum’s CDP TVL), and impacted by a $13 million hack in March. While Arbitrum has limited presence, it could benefit by attracting leading collateral assets like USDS (which it and Base natively support).

- Basis Trading: This sector grew significantly, doubling TVL to $8 billion by late 2024, but has stabilized in 2025. Ethena leads with 75% market dominance. Ethereum is the primary hub (77% of TVL), followed by BSC (10%). Arbitrum captures 1-2% of TVL, hosting Ethena, Solv, and Stables Labs, with Stables Labs representing 98% of Arbitrum’s basis trading TVL.

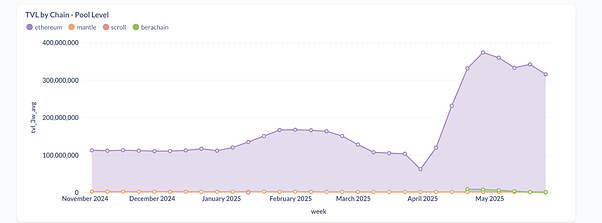

- Liquid Staking: This market is highly concentrated, with Ethereum (over 75%) and Solana (16%) accounting for 90% of total TVL. Lido dominates protocols with 51% share. When excluding Ethereum, BSC leads with 42.5% of liquid staked ETH supply, and Arbitrum is a strong contender with 17.4%. For Lido specifically (stETH/wstETH), Arbitrum holds a significant lead among non-Ethereum chains at 40.6%. Competition is intensifying among L2s to capture this liquidity.

- Restaking: This sector is highly concentrated on Ethereum (65% of TVL) and Bitcoin (29%), with EigenLayer (58%) and Babylon (26%) dominating protocols. Restaking activity must occur on the settlement layer, meaning Arbitrum cannot directly host restaking protocols like EigenLayer. L2s can benefit indirectly through Liquid Restaking Tokens (LRTs).

- Liquid Restaking: This sector has seen significant growth, with ~3.5 million ETH restaked in liquid form and over $10 billion in global TVL. eETH (Ether.Fi) dominates ETH LRT supply (77%). Arbitrum and Base clearly dominate ETH LRT activity on L2s, each capturing 40-45% of the market share for eETH and rsETH, with no decisive lead established. BTC LRTs, however, have seen declining interest due to lack of robust DeFi ecosystems around them. Arbitrum has limited presence in the BTC LRT space, presenting a growth opportunity.

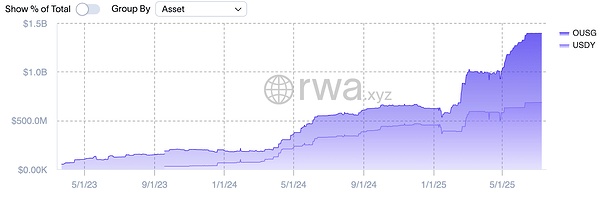

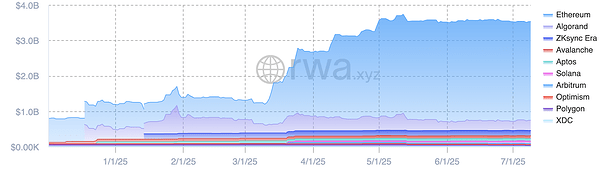

- RWA (Real World Assets): The RWA sector exceeds $20 billion, primarily driven by private credit and US Treasury debt. Ethereum is the primary settlement layer, while zkSync Era has emerged as a leading L2 due to Tradable, though its growth is nuanced due to a small number of large holders. Arbitrum has grown remarkably from $200,000 to $300 million in tokenized assets (around 2% of the total market). Excluding Ethereum and zkSync, Arbitrum holds 8.5% of market share, rivaling L1s like Stellar and Solana. Growth on Arbitrum is driven by government debt (US Treasuries and non-US government debt) and concentrated in a few players like Spiko and Franklin Templeton (over 70% market share).

Shortlisting and Analytical Methodologies

The report employs a dual-phase shortlisting methodology to identify high-potential protocols and assets:

- Market Share Analysis: Identifies winning chains outperforming Arbitrum in key KPIs (TVL, fees, revenue), then determines dominant protocols and assets within those chains.

- Growth Metrics Analysis: Compares all protocols and assets across all chains based on Month-over-Month (MoM) growth of KPIs, regardless of their current chain. Assets or protocols showing positive 2-month MoM growth (+20%) or a spike (>30%) are prioritized, generally avoiding small pools (<$50M in TVL) unless exceptional growth is observed.

The shortlisted protocols and assets undergo Feasibility Scoring (0-5 points) based on EVM compatibility, cross-chain presence, DeFi integration, legal restrictions, governance neutrality (for assets), and chain-agnostic strategy, competing L2s, rollup experience, external collaboration, and architecture support for integrations (for protocols).

Feature Mapping and GTM Analysis

This section investigates why leading protocols succeed, comparing their product, UX, composability, and incentive approaches to those on Arbitrum. This analysis is conducted at both the Chain Level (Arbitrum, Ethereum, BSC, Base, Tron, Solana, Sui) and Vertical Level (exploring shortlisted protocols).

Key Insights from Chain Level Analysis (Arbitrum vs. Competitors)

- Arbitrum relies on its significant liquidity ($2.5B TVL), security inherited from Ethereum, strong developer ecosystem, and innovative features like Arbitrum Orbit (41 chains live) and Stylus (multi-language smart contracts). Its GTM has evolved from broad airdrops and experimental incentives (STIP, LTIPP) to targeted strategic incentives (DRIP) and direct investments via venture studios. Partnerships with entities like Converge and Robinhood are expanding its user acquisition. UX improvements include low gas fees (due to Ethereum upgrades), Timeboost for MEV capture, and protocol-level gasless/one-click transactions.

- Ethereum maintains its dominance through liquidity depth ($62.7B TVL), robust security (1M+ validators), mature developer tooling, and network effects from its L2s. Ethereum’s shift to PoS and EIP-4844 have made L2 operations cheaper, positioning it as a cheaper Data Availability Layer. Grants from the Ethereum Foundation ($32.6M in Q1 2025) and direct liquidity provisioning support ecosystem growth.

- BSC (Binance Smart Chain) is an EVM-compatible L1 with $6.01B DeFi TVL, benefiting from cross-chain deployments and a growing developer ecosystem. Its PoSA consensus mechanism supports staking, liquid staking, and restaking protocols. BSC launched a $100 million incentive program and an RWA incentive program.

- Base (Coinbase-incubated optimistic rollup) has a TVL of ~$3.4B. It boasts deep liquidity, Ethereum-inherited security, and strong developer tooling, ranking second in EVM developer count. Features include cheaper transactions (blobs), Flashblocks (200ms confirmations on testnet), and CDP AgentKit for AI agents. Base also provides builder rewards and eligibility for Optimism RPGF.

- Tron offers a high-throughput, low-fee environment using Delegated Proof of Stake, with TRX freezing for near-zero transaction costs. It has $4.8B DeFi TVL and $80.9B in stablecoins, leading in USDT liquidity due to early focus on low fees and exchange integrations. Arbitrum cannot adopt Tron’s DPoS but can explore fee abstraction.

- Solana provides a high-throughput, low-latency L1 with Proof of History and a single global state, enabling composability without fragmentation. It has $8B DeFi TVL, driven by low fees and speed. Solana’s success is defined by its technical performance and highly centralized operational execution. It secures partnerships with major payment platforms and offers advanced UX features like passkey-based onboarding. Arbitrum can learn from Solana’s user-facing simplicity and cohesive ecosystems.

- Sui is a high-performance L1 with an object-centric data model and Move language, allowing parallel transaction execution for high throughput and low latency. Its DeFi TVL grew to $1.8B. Sui uses a multi-layered incentive structure including developer grants and targeted DeFi incentives through OpenBlock. It also offers sponsored transactions (gasless) and zkLogin for social login onboarding.

Key Insights from Vertical Level Analysis (Selected Protocols & their features/GTM)

The report delves into specific protocols within each vertical, detailing their unique selling propositions (USPs) and Go-to-Market (GTM) strategies.

- DEXs: Arbitrum’s DEX TVL is $524M. Protocols like Uniswap (dominant on Arbitrum, uses concentrated liquidity, relies on ARB airdrop incentives), Camelot (Arbitrum’s native DEX, dual-token model, uses Nitro pools and launchpad), Curve (optimised for low-slippage stablecoin swaps, uses veCRV model and bribes), and Balancer (multi-asset pools, veBAL design, LP profitability through BPTs) are analyzed.

- Derivatives: Arbitrum’s derivatives TVL is $648M. Key protocols include GMX (leading protocol on Arbitrum, uses GM Pools and GLV for liquidity, “real yield” model), Ostium (second largest, offers perpetuals on RWA like gold and global indices), Vertex (hybrid off-chain orderbook with on-chain AMM, cross-chain liquidity via Vertex Edge), and Gains Network (leveraged perpetuals on 280+ markets, synthetic architecture with gDAI vault). Protocols like Lighter (zk-rollup, verifiable order matching, high-frequency trading focus) and Paradex (appchain-native, unified derivatives/spot trading, CLOB on CairoVM, includes $XUSD synthetic dollar) are highlighted as highly performant off-Arbitrum.

- Lending: Arbitrum’s lending TVL is $1.2B. Protocols examined include Aave (largest L2 by TVL on Arbitrum, wide asset support, E-mode, Portals for cross-chain), Compound (incentivized through COMP tokens, expanding with Compound Blue vaults), Fluid (combines DEX and Lending, Smart Debt/Collateral, high LTVs), Morpho (permissionless, isolated risk markets, Morpho Vaults, upcoming V2 features like intent-based lending and cross-chain lending), and Euler (permissionless vault creation, hooks, reward streams, batch transactions).

- Yield: Arbitrum’s Yield TVL is $141M. Protocols like Pendle (leading fixed income platform, yield tokenization, permissionless market creation, custom AMM, highly successful on Arbitrum due to STIP incentives on LRTs), Magpie (yield optimizer and governance aggregator, leverages veTokenomics), Toros (structured products, leveraged yield vaults, delta-neutral strategies), and Aura (yield/governance aggregator on Balancer) are analyzed. Convex (yield optimizer for Curve, Frax, f(x), uses CVX token for governance and reward boosting) is also detailed, though its direct governance aggregation is Ethereum-centric.

- CDP: Arbitrum’s CDP TVL is $29M. Protocols discussed are Sky Lending (largest CDP protocol, mints USDS, relies on fiat bridges), CrvUSD (Curve’s stablecoin, LLAMMA liquidation, deep Curve integration, limited native Arbitrum deployment), and Liquity (immutable, governance-free, mints BOLD, high capital efficiency, sustainable yield). A Liquity V2 fork, Nerite, is launching natively on Arbitrum.

- Basis Trading: Arbitrum’s Basis Trading TVL is $106M. StableLabs USDX (synthetic USD stablecoin backed by delta-neutral positions) is dominant on Arbitrum. Ethena (largest synthetic dollar protocol, backed by liquid stables and delta-hedged crypto, strong TradFi integration, migrating to Arbitrum Orbit chain Converge) and Resolv (issues USR stablecoin backed by ETH/BTC using delta-neutral design, RLP insurance pool) are key players.

- Liquid Staking: Arbitrum has no large-scale native liquid staking protocols, except Tenderize ($4M TVL). Lido (largest liquid staking protocol globally, stETH, deep composability, seamless staking, evolving with Lido V3 and stVaults for modularity) is deeply integrated through bridged stETH on Arbitrum. Other protocols include StakeWise (modular, vault-based, osETH) and Liquid Collective (enterprise-grade, LsETH, KYC/AML support for institutions).

- Restaking: Restaking activity resides on settlement layers, so Arbitrum cannot host native restaking protocols directly. EigenLayer (foundational restaking on Ethereum, modular shared security for AVSs) and Karak (restaking protocol on Ethereum/L2s, shifting to L1 for asset tokenization) are key. Arbitrum can indirectly benefit through LRTs and by facilitating AVS deployments.

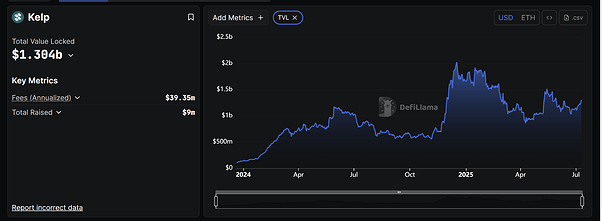

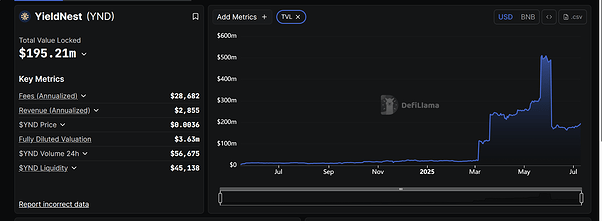

- Liquid Restaking: Arbitrum and Base dominate the L2 market for ETH LRTs (40-45% each). Protocols include Ether.fi (eETH, layered yield, crypto card), Renzo (ezETH, user simplicity, aggressive incentives), and Kelp DAO (rsETH, user-directed AVS selection, validator marketplace). YieldNest (MAX LRTs for unified staking/restaking/DeFi yield via AI engine) is another protocol. BTC LRTs have declining interest, with Lombard leading.

- RWA: Midas RWA (tokenization of private credit, focus on risk-adjusted yield for institutional investors) and Ondo (tokenized US Treasuries like USDY and OUSG, institutional alignment, regulatory focus) are prominent. Securitize (regulated tokenization platform, infrastructure for institutional-grade RWA, high-profile deployments with BlackRock) is also analyzed.

Recommendations and Action Plan for Arbitrum

The report concludes with actionable recommendations across verticals, identifying gaps and ranking opportunities for Arbitrum:

- DEXs: No major feature-level gaps, but effectiveness is tied to liquidity. Arbitrum should focus on asset/pool level incentivization for growing pools like WETH-USDC and WBTC-USDC.

- Derivatives: Arbitrum lacks a highly performant orderbook-based appchain like Lighter. Opportunities include supporting Ostium (unique RWA/macro asset coverage) and GMX (multichain launch). A long-term opportunity is to fund and develop a CLOB appchain built on Arbitrum’s Stack.

- Lending: Arbitrum lags Ethereum and Base in TVL. Gaps include peer-to-peer lending (Morpho V2) and lack of active rewards. Opportunities include incentivizing assets like wETH, wstETH, wBTC, USDT (where Arbitrum has high utilization but sometimes low TVL) and new assets like LBTC. Recommended protocols for incentivization include Morpho, Euler Finance, Fluid, and Aave. Boosting Arbitrum-based opportunities on Merkl and external collaborations with yield aggregators like Superform are key GTM strategies.

- Yield: Arbitrum accounts for 1.75% of total yield TVL. Gaps include Liquid Staking Tokens (LSTs) and Ethena-related assets not being fully utilized on Arbitrum. Pendle (high growth, high composability) is a top protocol to incentivize. Improving composability of yield-related assets (e.g., PT tokens from Pendle) is a key GTM strategy.

- CDP: Arbitrum’s CDP TVL is low (0.31% of total) and lacks diversity. Gaps include efficient CDP models and structured yield opportunities not widely adopted on Arbitrum. Opportunities involve incentivizing USDS and CrvUSD. Onboarding native CDP protocols (like Nerite, a Liquity V2 fork) and incentivizing lending/liquidity pools for CDP assets are crucial GTM strategies.

- Basis Trading: Arbitrum holds less market share than Ethereum/BSC. Gaps include Ecosystem and TradFi expansion strategies like Ethena’s. Opportunities are to leverage Arbitrum’s existing strength in Stable Labs USDX and incentivize Ethena (especially with its migration to Converge, an Arbitrum chain) and Resolv.

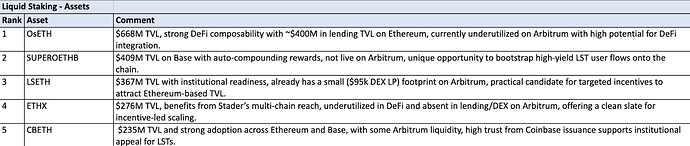

- Liquid Staking: Arbitrum holds 17.4% of L2 liquid staked ETH supply. Gaps include missing auto-compounding incentives and built-in compliance for institutions. Opportunities involve incentivizing assets like OsETH, SUPEROETHB (currently Base-only), and LsETH. Cross-marketing with liquid staking providers and coordinated incentivization on Merkl are key GTM strategies.

- Restaking: Arbitrum cannot host native restaking directly. The focus should be on LRTs (Liquid Restaking Tokens) and strategic AVS facilitation (collaborating with EigenLayer and Karak for technical facilitation and co-marketing).

- Liquid Restaking: Arbitrum and Base dominate L2 ETH LRTs. Gaps include lack of auto-compounding structured vaults (like YieldNest’s) and modular restaking strategy selection. Opportunities involve incentivizing WEETH (eETH), ezETH, rsETH, and LBTC (for Bitcoin liquid restaking, currently absent on Arbitrum). Supporting protocols like Renzo, Kelp DAO, and YieldNest to expand their LRT liquidity and products on Arbitrum is recommended.

- RWA: Arbitrum has grown significantly but lacks presence in private credit, commodities, and stock tokenization, and has no privacy layer like zkSync. Gaps include Ondo’s untapped potential on Arbitrum. Opportunities include incentivizing Midas RWA (private credit) and Ondo (tokenized Treasuries). Incentivizing assets like OUSG, USDY, BENJI, JTRSY, SPIKO T-Bills, and USTB can drive adoption. Key GTM strategies involve incentivizing liquidity, institutional collaboration, and fostering infrastructure for tokenization on Arbitrum.

Recommendations

Recommendations and Action Plan

The objective of this section is to summarise the findings from the previous sections into a vertical-by-vertical view of actionable gaps. It focuses on identifying areas where Arbitrum is missing critical features, GTM strategies, or asset maturity.

For each vertical, the analysis will be distributed in two sections, focusing on gap identification and opportunity ranking.

Gap Identification

Gap identification helps identify the features or the GTM strategy that is currently not adopted by protocols on Arbitrum (or Arbitrum itself). It also focuses on identifying protocol-level gaps based on assets or pools.

Opportunity Ranking

While the previous section highlights the gaps in the Arbitrum ecosystem, this section will focus on ranking the opportunities based on size, ease of resolution, and ecosystem readiness.

Results Presentation

The following sections provides a concise overview of the recommendations, accompanied by summary tables. The subsequent sections delve into the reasoning in detail, following the process described above.

Summary Tables

Recommendations - Summary Table

This section presents the selected pools and protocols, ranked where relevant, accompanied by a concise explanation of the opportunities they represent. It serves as a summary table of all recommendations before the detailed analysis that follows.

DEXs

No protocols selected in this vertical

Derivatives

No assets selected in this vertical

Lending

Yield

CDP

Basis Trading

Liquid Staking

No protocols selected in this vertical

Restaking

No assets and no protocols selected

Liquid Restaking

RWA

Source file: Ranking (Per Vertical) - Google Sheets

DEXs

DEXs - Recommendations

Currently, the DEX’s TVL on Arbitrum stands at approximately $511 million, representing only 2.5% of the total DEX TVL, which presents a significant opportunity for expansion. Ethereum represents 30.3% of the DEX TVL, with Base outperforming Arbitrum, which has a market share of 5.5%.

Gap Identification

Feature Level Analysis

From the shortlisted protocols, there were no major feature-level differences compared to existing applications on Arbitrum. The effectiveness of these features, however, was often impacted by the availability of liquidity and volume required to kickstart lasting ecosystem flywheels. For example, on Ethereum, we see the strong position of Curve, along with its ecosystem applications, such as Convex and Llamalend, which, possibly due to low liquidity on Arbitrum, struggle to gain meaningful traction.

GTM Analysis

GTM strategies for similar protocols at home and away from Arbitrum differ more. Each protocol treats newer ecosystems with a different view. Uniswap, for example, is funneling its incentives into Unichain in an attempt to develop its own ecosystem. Balancer, on the other hand, is attempting to add value to several new ecosystems without prejudice. Due to their LP token design and composability with top lending markets, Balancer can offer newer, less liquid chains the ability to bolster their DEX and Lending TVL in one swoop by posting Balancer LP tokens in lending markets.

Opportunity Ranking

Asset/Pool Level incentivisation

While incentivising swaps wouldn’t reap many benefits for Arbitrum, this section sheds light on the assets or pools that are gaining traction, which suggests an increased interest in these assets. This section won’t provide rankings for the pool.

WETH-USDC

The following Uniswap pool TVL is growing and has witnessed positive MoM growth over the last month. The pool’s major TVL is on Arbitrum and Base. The pool TVL has surpassed $110 million across chains, with $64 million on Arbitrum.

WBTC-USDC

The following Uniswap pool has seen stagnant growth but maintains a TVL of over $140 million across multiple chains.

WETH-USDT

The following Uniswap pool has declining TVL but has recently witnessed a positive trend in growth. The total TVL for the pool is approximately $150 million, with Arbitrum TVL at around $13 million.

WBTC-CBBTC

The following pool has its major TVL on Ethereum and a total value locked of over $60 million.

Derivatives

Derivatives - Recommendations

Currently, in the derivatives market, TVL is led by Solana, standing at approximately $2.43 billion, which represents around 51% of the total derivatives TVL. Arbitrum represents 11.5% of the derivatives TVL, led by protocols such as GMX and Ostium, followed by Hyperliquid, which accounts for 8.4% of the total TVL in derivatives. The total derivatives TVL stands at $4.721 billion.

Gap Identification

Feature Level Analysis

Highly Performant Orderbook-Based Trading: While Arbitrum has a set of protocols that offer different designs for Perpetuals, including the use of order books, the chain still lacks a highly performant perpetual protocol like Lighter, especially when viewed from the consensus that CLOBs are winning the perpetual race, and that they are much more competitive when designed into the chain infrastructure (e.g., Hyperliquid, Lighter, Paradex).

GTM Analysis

Gasless and Fast Trading Experience: Protocols like Lighter (currently invite-only) provide a fast trading interface to its users. Retail users benefit from zero trading fees and fast execution.

Opportunity Ranking

Protocol Level incentivisation

-

Ostium: Ostium offers a unique set of features and is a high-growth protocol, providing 50x leverage on crypto, commodities, FX pairs, and global indices. Its TVL on Arbitrum is ~$64 million. Ostium is currently deployed only on Arbitrum and presents a separate opportunity for exploration. Supporting Ostium and the growth of these newer assets on the chain is net positive for Arbitrum.

-

GMX: GMX is responsible for a significant portion of the TVL on Arbitrum and offers a comprehensive set of features, including GM pools for risk isolation and GLV pools for automated rebalancing and management. With the rise of more centralised perpetual competitors, GMX remains an alternative for those who still value a self-custodial, decentralised, and verifiable exchange experience. With the upcoming launch of their Multichain product, Arbitrum will remain its ‘home chain’ - positioning GMX to attract users and liquidity from other EVM ecosystems. Supporting GMX in this Multichain launch is net positive for Arbitrum.

GMX V1 was hit with an exploit on July 9, 2025, resulting in a net loss of approximately $42 million. This was later returned by the hacker in exchange for a white-hat bounty of $5 million.

-

Fund and develop a CLOB appchain built on Arbitrum’s Stack: For Arbitrum to truly compete with the types of performant CLOBs in development, one could be built using Arbitrum’s stack to showcase its suitability. This, however, would require a coordinated effort in funding and likely support from Offchain Labs in development (especially if Stylus is to be used), along with a specialised team with extensive experience in high-frequency trading.

-

Vertex: Vertex growth on Arbitrum is currently declining slowly, with the TVL being lower than its ATH in May last year. Vertex TVL on Arbitrum is $44.58 million. Vertex offers features such as a cross-margin system, subaccounts, and a good user experience for managing complex positions.

Vertex recently announced that it was shutting down all EVM deployments as part of a new deal with Ink chain.

GTM Strategies

Gasless and Fast Trading Experience: Explained above in the GTM Analysis section.

Lending

Lending - Recommendations

Currently, the Lending TVL on Arbitrum stands at approximately $1.2 billion, representing only 2.2% of the total lending TVL, which presents a significant opportunity for expansion. Ethereum alone represents 63.5% of the lending TVL, with Base outperforming Arbitrum, which has a market share of 3.6%.

Gap Identification

Feature Level Analysis

Peer-to-Peer Lending: Morpho V2 markets, which are still under development, aim to offer peer-to-peer lending services. This system will facilitate fixed-rate and fixed-term loans with customisable parameters.

Morpho Lite: Morpho Lite is a simplified app that features the main Morpho functionalities, including Earn, Borrow, and Rewards. It is mainly utilised for the easy deployment of Morpho across chains. Protocols can also deploy white-labeled versions of Morpho, utilising core features available through Morpho Lite.

The following are the features that are available on Arbitrum but currently have low traction when compared with chains like Ethereum or Base under the same protocol:

Permissionless Market Creation: Morpho enables the creation of permissionless markets, where a market consists of one collateral asset and one loan asset.

Euler Finance, also deployed on Arbitrum, offers more extensive features than Morpho. It provides a deeper level of market customisation, from single collateral-debt pairs, similar to Morpho, to fully customisable markets. These markets offer features like cross-collateralisation between markets during lending and borrowing.

Curators or Governors: Morpho and Euler both offer vault curation by risk curators or governors, but they have not been able to gain market share on Arbitrum like Ethereum and Base. Some growth is witnessed in protocols like Silo Finance and Euler Finance, where the Managed Vaults have grown to TVL greater than $10 million.

As Euler has been deployed recently, it is hard to comment on the above feature’s growth on the platform.

GTM Analysis

Rewards and Incentives: Many protocols use Merkl as part of their incentive process. On Arbitrum, there are no rewards active on Lending from the platform when compared to other chains, where Morpho and Euler have enabled rewards through the platform.

Source: Merkl

While protocols have been actively deploying rewards on other chains, the rewards on Arbitrum are lacking for lending protocols. The most recent rewards were from Fluid when it launched on Arbitrum with $1.5 million in incentives.

External Collaborations: Protocols like Superlend and Superform, which are lending and yield aggregators that provide users with different APY opportunities. These products are often deployed on other chains, for example, SuperUSDC from Superform, which is deployed on Base and Ethereum, earning yields through Morpho, Euler, and Fluid. Though the TVL on Base is lower, it is a potential opportunity to explore.

Asset Level Gaps

Asset Level Gaps identify assets that are growing in other chains but either don’t exist on Arbitrum or have a low value bridged or minted.

Note: Utilisation rates, wherever mentioned, refer to the utilisation rate of the chain with the highest TVL for an asset.

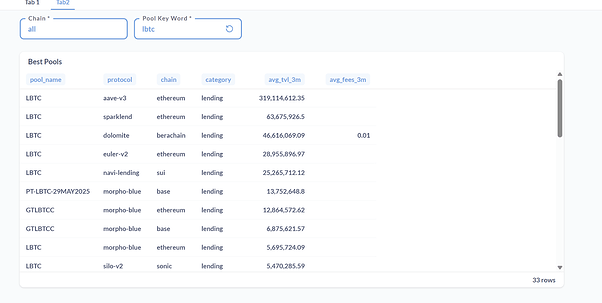

LBTC

LBTC is currently live on other chains, with the major TVL on Ethereum, followed by Base and other chains. Since the asset doesn’t exist on Arbitrum yet, it is also marked as a high opportunity asset to focus on. The TVL across chains for LBTC in lending exceeds $600 million, but the assets have lower utilisation.

CBBTC

cbBTC is minted by Coinbase and is currently present across two major chains, with a lower value present on Arbitrum (~$5 million). cbBTC is growing across the chain, natively minted on Base and Ethereum. The TVL across chains for cbBTC in lending exceeds $2 billion.

Since the minting of the asset is associated with Coinbase, it poses a potential hurdle.

SUSDE

SUSDE is a staked version of USDE, with the majority of its value currently locked in lending on Ethereum. Asset Lending TVL is $3 billion+. Asset utilisation is low (~20%).

SUSDE currently accounts for a very low value on Arbitrum and is externally bridged.

USDE

USDE is Ethena’s stablecoin, currently holding the majority of its value in lending on Ethereum with high utilisation (~71%). Asset Lending TVL is $300 million+.

USDE currently accounts for a very low value on Arbitrum and is externally bridged.

USDS

USDS is the stablecoin minted by Sky Protocol, currently has the major value locked in Lending on Ethereum with medium utilisation (~45%).

USDS currently accounts for approximately $100 million in value on Arbitrum and is externally bridged; however, it doesn’t represent a significant share of lending.

Opportunity Ranking

The opportunity ranking is classified based on its size, ease of resolution for Arbitrum, and ecosystem readiness.

Asset/Pool Level incentivisation

This section focuses on the already successful assets and pools on various chains, and it would be beneficial to incentivise them on Arbitrum as well. These assets/pools would be independent of the protocol, but can be linked back to the winning protocols from the next section.

- WEETH

WEETH has high TVL but low utilisation. Even on Arbitrum, it accounts for ~$300 million in value and is canonically bridged. The reason for lower utilisation is that the asset is used as collateral but isn’t borrowable on platforms like Aave.

- WSTETH

wstETH lending TVL is approximately $2.2 billion, with the majority of the share being on Ethereum, and can be further incentivised on Arbitrum. wstETH utilisation is low across chains.

wstETH currently accounts for ~$220 million in value on Arbitrum.

- WETH

WETH, wrapped Ethereum, has TVL across multiple chains. The asset utilisation on Arbitrum is high (~75%). The utilisation is also high on other chains, including Ethereum and Base. WETH TVL for lending on Arbitrum is $109 million with TVL across chains being $1.6 billion majorly contributed by Ethereum.

- WBTC

wBTC lending TVL exceeds $4 billion, but the value borrowed is approximately $500 million, indicating lower utilisation. It requires incentivising on the borrowing side.

wBTC currently accounts for ~$900 million in value on Arbitrum.

- USDT

USDT TVL in lending is high and is present across multiple chains. The asset utilisation on Arbitrum is high (>90%) but represents low TVL. Asset TVL in Lending is ~$1.8 billion.

Low TVL assets

These assets, in most cases, are present on a single chain but showcase high growth in terms of TVL.

- TBTC

- SRUSD

- MCWETH

- SOLVTC

- ETH+

Protocol Level incentivisation

The protocol-level incentivisation will be mapped from the assets shortlisted from the above section. The following tier list indicates which protocols Arbitrum should focus on first.

- Morpho

While Morpho is currently not deployed on Arbitrum, it remains an active opportunity due to its growth and unique set of features, including vaults, risk curation, permissionless market creation, and more. Morpho is currently at its ATH with the value locked at over $4.5 billion.

- Euler Finance

Euler Finance is an advanced lending protocol featuring a unique set of features, including Permissionless Market Creation, Hooks, and UX upgrades such as transaction batching and permissionless rewards streams. All these features combined make Euler a great competitor to Morpho.

Euler Finance’s TVL at the time of writing is $1.13 billion, and the TVL at Arbitrum only represents 1.1% with a good space to grow. Euler has recently launched on Arbitrum and offers an active incentive program worth $100,000.

- Fluid

Fluid positions itself uniquely with its features, such as Unified Liquidity Layer, Smart Debt, Smart Collateral, and high LTV ratios. Fluid’s expansion on Solana, in collaboration with Jupiter, shows the market’s growing interest in the features.

Fluid’s current TVL is $1.04 billion, with over $91 million on Arbitrum, and has shown consistent growth. Additionally, Arbitrum TVL accounts for 8.75% of Fluid’s total TVL, leaving ample room for growth. Fluid launched on Arbitrum with $1.5 million in incentives.

- Aave

Aave’s current TVL is at its ATH, and its TVL on Arbitrum is $839 million, making it the biggest L2 in terms of value locked for Aave. Aave has recently deployed up to $300k in rewards through its Merit Program on Base for performing certain actions.

- Silo and Dolomite

Silo’s current TVL is low when compared to the above-mentioned protocols, with less liquidity to attract from the protocol side. Moreover, Dolomite shifted its focus to Berachain, which currently has declining TVL.

Both these protocols offer a unique set of features. Dolomite allows the usage of LP assets as collateral, and Silo provides isolated vaults. Both of these protocols are currently lower than their ATH on Arbitrum.

GTM Strategies

These GTM strategies position lending protocols across chains uniquely and are currently not widely adopted on Arbitrum.

Boosting Arbitrum-based opportunities on Merkl

Merkl is a growing incentive platform used by many protocols to incentivise users, but lacks Arbitrum-based rewards in lending.

External Collaboration

Arbitrum shares in the growing protocols like Superform and Superlend are lower when compared to chains like Base and Ethereum. Although these protocols don’t represent high TVL, they are good to explore and collaborate with, as they are growing at a rapid rate.

Yield

Yield - Recommendations

Currently, the Yield TVL on Arbitrum stands at approximately $156 million, which represents around 1.75% of the total yield TVL, presenting a significant opportunity for expansion. Ethereum alone represents ~81% of the yield TVL, with Solana outperforming Arbitrum, which has a market share of ~4%.

Gap Identification

Feature Level Analysis

Liquid Staking Tokens: Convex offers a suite of Liquid Staking Tokens, including cvxCRV, cvxFXS, and cvxFXN, upon staking assets from the supported protocols, such as CRV, FXS, or FXN, on Convex. These token representations are DeFi-composable and used by other protocols.

While this is a protocol-level implementation and is primarily available on Ethereum, replicating it on Arbitrum is challenging, and it becomes plausible only with the incentivised growth of other supported protocols.

GTM Analysis

Asset Flywheel: Arbitrum’s composability for yield-related assets is currently low (for example, PT Tokens) compared to other chains. The utilisation of these assets in various DeFi protocols enables users to leverage additional use cases.

Asset Level Gaps

Ethena Related Assets

Ethena-related assets are heavily utilised in Yield protocols due to Ethena points and rewards, accompanied by protocol-level incentives.

EUSDE

EUSDE is consistently gaining market share in yield, experiencing significant growth over the past few months, and is currently at over $400 million. This asset doesn’t exist on Arbitrum yet and presents a potential opportunity, given Arbitrum’s existing ties with Ethena.

SUSDE

SUSDE has started to gain market share back, boosted by Ethena rewards, while lower than its ATH in value locked in the Yield protocols. SUSDE is externally bridged on Arbitrum and has a lower TVL (<$1 million) on-chain.

USDS

USDS from Sky Protocol is gaining traction due to rewards from the Spark Ecosystem. The asset already has major liquidity on the Arbitrum (~$100 million) and represents a great opportunity.

Opportunity Ranking

Asset/Pool Level incentivisation

- WSTETH

WSTETH is currently growing in the Arbitrum Yield Sector and has clear potential, given that the asset’s liquidity is already strong on-chain, with over $200 million externally bridged.

- WEETH

WETH is a growing asset in the Arbitrum Yield. The asset is part of the Ether Fi ecosystem and also earns points and rewards on platforms like Pendle.

Additionally, WEETH has a bridged value exceeding $300 million, indicating a substantial market to cover.

Protocol Level incentivisation

The Arbitrum Yield Sector is currently smaller in size, but it presents a significant opportunity to tap into. Major protocols like Pendle and Magpie already exist on Arbitrum, providing an added advantage. Deploying resources on the winning protocol across chains would help increase chain TVL in Yield.

- Pendle

Pendle is a high-growth protocol and has high composability in DeFi protocols. Its current TVL is approximately $4.9 billion, representing 56% of the DeFi Yield Market, which presents a substantial opportunity size.

- Magpie

Magpie is a distributed ecosystem that serves as a Yield optimiser and governance aggregator. The protocol has witnessed a positive MOM growth, but it is still lower than its ATH.

- Toros

Toros TVL on Arbitrum is $11.96 million and ranks third among yield protocols, offering a unique set of features, including Leveraged Yield Vaults, Delta-Neutral and Volatility Strategies, and Automated Rebalancing. Toros plays as an abstracted version of yield with integrations with GMX and Pendle.

- Aura

Aura is a yield and governance aggregator built on top of Balancer to maximise rewards for liquidity providers and governance token holders. Much of this depends on the success and traction of Balancer on the chain.

GTM Strategies

Improving Composability of Yield-Related Assets: Enhancing DeFi composability of yield-related assets (e.g., PT tokens from Pendle) ensures that new and successful assets have low barriers to growth on the chain.

CDP

CDP - Recommendations

The CDP sector currently has a total TVL of around $9 billion, with over 90% concentrated on Ethereum. On Arbitrum, CDP TVL has declined from $50 million to $35 million this year, representing less than 0.4% of the market and indicating a clear underrepresentation.

Most Arbitrum CDP activity is driven by a single protocol and lacks diversity, presenting a significant opportunity for growth by onboarding native CDP deployments, expanding the use of collateral assets, and incentivising stablecoin liquidity to establish Arbitrum as a stronger player in the CDP space.

Gap Identification

Feature Level Analysis

Efficient CDP Models

Protocols like Sky Lending and Liquity offer efficient, overcollateralized CDP systems using ETH and LSTs as collateral, with low collateralisation ratios and automated liquidation management while maintaining stablecoin pegs.

Stability Pools and Yield Layers

Protocols provide savings rates and structured yield opportunities for their stablecoins, but these are primarily active on Ethereum, with limited structured savings products present on Arbitrum.

Composable DeFi Usage

Stablecoins from CDP systems are used as collateral in lending markets, deposited in liquidity pools, and utilised within broader DeFi strategies, but these activities are currently limited in scale on Arbitrum.

GTM Analysis

Rewards and Incentives

Protocols like Sky Lending already offer incentives using governance tokens to encourage borrowing, lending, and liquidity provision on CDP stablecoins. However, these incentives are mainly deployed on Ethereum, with only limited programs and liquidity on Arbitrum. There is an opportunity to combine native CDP asset deployment with targeted incentives on Arbitrum to make borrowing, lending, and liquidity provision attractive for these stablecoins.

External Collaboration

Yield aggregators and liquidity routers like Superform and Pendle can integrate CDP *stablecoins to expand their use cases on Arbitrum, similar to how they have integrated CDP assets on other chains. Collaborating with these protocols could increase stablecoin utilisation while aligning with the broader DeFi ecosystem on Arbitrum.

Asset Level Gaps

Asset Level Gaps identify assets that are growing in other chains but either don’t exist on Arbitrum or have a low value bridged/minted.

USDS

USDS is a CDP stablecoin issued by Sky Money, and with a market cap of $7 billion, it is currently the largest CDP stablecoin in DeFi. It has seen wide adoption across lending protocols, with $1.7 billion deployed, yet only $2 million of that sits on Arbitrum. Similarly, USDS is used in DEX liquidity pools with $370 million in TVL across chains, while just $2.8 million is present on Arbitrum. This wide adoption, but low relative TVL on Arbitrum, highlights a significant opportunity to onboard more USDS through targeted incentives, thereby expanding stablecoin liquidity and usage on Arbitrum in line with its scale.

Opportunity Ranking

The opportunity ranking is classified based on its size, ease of resolution for Arbitrum, and ecosystem readiness.

Asset/Pool Level incentivisation

This section focuses on the already successful assets and pools on various chains, and it would be beneficial to incentivise them on Arbitrum as well. These assets/pools would be independent of the protocol, but can be linked back to the winning protocols from the next section.

CDP Collateral Assets

- WETH

WETH (Wrapped Ether) is the primary ETH collateral standard, minted by wrapping ETH to conform to ERC-20 standards while maintaining a 1:1 peg. It is deeply integrated across lending markets and CDPs, with $2.74 billion currently used as collateral within CDP protocols, making it the largest CDP collateral asset by TVL.

- WSTETH

WSTETH (Wrapped Staked ETH), issued by Lido, is a liquid staked ETH token that allows users to retain staking rewards while utilising it in DeFi. It is actively used within CDP protocols, with $586 million locked as collateral, supporting strategies that combine staking yields with CDP-backed stablecoin generation.

- WBTC

WBTC (Wrapped Bitcoin), issued by BitGo, allows Bitcoin holders to participate in Ethereum DeFi while maintaining BTC exposure. It is widely used to unlock liquidity in CDPs, with $546 million currently utilised as collateral, making it a major non-ETH collateral asset within CDP ecosystems.

- TBTC

TBTC is a trust-minimised, Bitcoin-backed ERC-20 token issued by the Threshold Network, enabling BTC holders to access Ethereum DeFi while maintaining Bitcoin exposure. While TBTC’s overall size as CDP collateral is smaller relative to ETH and LSTs, it has $23 million currently locked as collateral within CDP protocols, representing more than 10% of all collateral on crvUSD.

CDP Stablecoins

- USDS

USDS is a CDP stablecoin minted by Sky Money, and with a market cap of $7 billion, it is currently the largest CDP stablecoin in DeFi. It has seen wide adoption across lending protocols, with $1.7 billion deployed, yet only $2 million of that sits on Arbitrum. Similarly, USDS is used in DEX liquidity pools with $370 million in TVL across chains, while just $2.8 million is present on Arbitrum. This wide adoption, combined with a relatively low TVL on Arbitrum, highlights a significant opportunity to onboard more USDS through targeted incentives, thereby expanding stablecoin liquidity and usage on Arbitrum in line with its scale.

- CrvUSD

crvUSD is a CDP stablecoin minted by Curve, backed by crypto collateral within its protocol. It has a market cap of $119 million and is actively used in DeFi for trading and liquidity provision. Pools containing crvUSD currently hold around $51 million in DEX TVL across chains, reflecting meaningful usage in stablecoin swaps. On Arbitrum, crvUSD has approximately $6 million in liquidity, providing a solid foundation to build upon. With targeted incentives, there is a clear opportunity to grow crvUSD’s liquidity on Arbitrum, deepening stablecoin markets within the ecosystem.

Protocol Level incentivisation

The protocol-level incentivisation will be mapped from the assets shortlisted from the above section. The following tier list would indicate which protocols to incentivise first, as they would have common assets listed.

- Sky Lending

Sky Lending is the largest CDP protocol by TVL, enabling efficient CDP minting with ETH, LSTs, and WBTC as collateral and issuing the stablecoin USDS. While Sky Lending itself is not deployed on Arbitrum, USDS is bridged, and deeper usage remains limited. Bringing Sky Lending natively to Arbitrum would significantly strengthen the ecosystem by anchoring stablecoin liquidity and DeFi activity.

While Sky Lending currently appears to be a low probability protocol for full-scale deployment, there is still meaningful potential in its underlying infrastructure, particularly through Sky Gateway. If a full deployment is not feasible in the near term, a more targeted approach could focus on onboarding additional supported collateral assets and expanding USDS liquidity and usage within Arbitrum’s lending markets and DEX pools. Strengthening these foundational elements would not only increase protocol utility but also lay the groundwork for broader adoption, positioning Sky Gateway as a strategic enabler of stablecoin-driven DeFi activity on Arbitrum.

Ask ChatGPT

- Liquity V2 (Nerite)

Liquity V2 is a governance-free CDP protocol that allows users to mint the BOLD stablecoin against ETH and LSTs with high capital efficiency. While the protocol is live on Ethereum, a friendly fork called Nerite is launching natively on Arbitrum, bringing this proven CDP model to the network for the first time.

This creates an opportunity for Arbitrum to become the primary Layer 2 for Liquity-style CDPs, supporting native stablecoin minting with streamable USND and flexible borrowing. Incentives can focus on building early liquidity and lending markets around USND, encouraging adoption while positioning Arbitrum as the go-to environment for efficient, native CDP usage.

- CrvUSD

CrvUSD by Curve enables users to mint stablecoins using ETH, stETH, and other assets, while utilising LLAMMA to reduce liquidation penalties and enhance capital efficiency. Although actively used on Ethereum, crvUSD’s presence on Arbitrum is currently limited and underleveraged. Expanding crvUSD on Arbitrum offers an opportunity to increase stablecoin diversity while anchoring liquidity in lending markets and DEX pools. Targeted incentives can support the creation of lending markets and liquidity pools for crvUSD on Arbitrum, driving its adoption and integrating it as a core stablecoin within the ecosystem’s DeFi stack.

GTM Strategies

These GTM strategies position lending protocols across chains uniquely and are currently not widely adopted on Arbitrum.

Protocol Onboarding

A good first step is to actively onboard CDP protocols to Arbitrum, as currently, all major CDP protocols are not natively deployed on Arbitrum and, in some cases, only have their assets bridged to the network, representing just a small fraction of their total TVL. Focusing on protocols with strong potential for DeFi activity will be key. An example is Nerite, a Liquity V2 fork set to launch on Arbitrum, which can serve as a blueprint for attracting CDP protocols that align with Arbitrum’s ecosystem and expanding native CDP activity on the network.

Incentivising Lending and Liquidity Pools

Once CDP protocols are deployed, targeted incentives can be launched for lending markets and liquidity pools tied to these protocols. This will deepen liquidity for CDP collateral and stablecoin assets, reduce slippage, and encourage active usage within DeFi strategies on Arbitrum. Platforms like Merkl can be effectively utilised to distribute these incentives in a targeted and cost-efficient manner, ensuring rewards are aligned with liquidity and usage growth for CDP assets on the network.

Yield and Savings Rate Boosting

Arbitrum can offer coordinated incentives by boosting the savings rate or enhancing the yield on CDPs that decide to deploy natively on Arbitrum. This would provide an additional layer of attraction for protocols while offering users a compelling reason to migrate or utilise CDP positions on Arbitrum.

Basis Trading

Basis Trading - Recommendations

Currently, the Basis Trading TVL on Arbitrum stands at approximately $120 million, while the total TVL of this category is $8.1 billion, representing a significant opportunity for expansion. Ethereum alone represents a significant share of the market, with protocols like Ethena having a market share of ~82%.

Gap Identification

Feature Level Analysis

There are no feature-level gaps between the ecosystem, given that the Basis Trading category works on a similar design, utilizing delta-neutral positions to back the stable asset minted.

GTM Analysis

Ecosystem Expansion: Protocols like Ethena are increasing the distribution and utility of their assets by introducing a suite of applications, including Ethereal and Derive, where Ethena will supply its assets as liquidity to the protocol.

TradFi Expansion: Ethena is expanding its assets for broader use, which includes the launch of a savings and payments app within the Telegram ecosystem, featuring Apple Pay Integration.

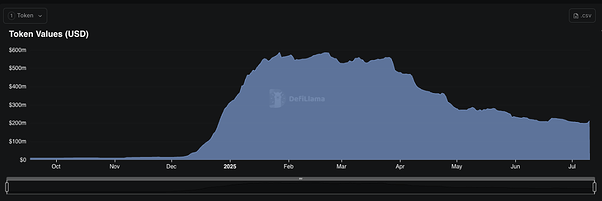

Asset Level Gaps

USDE

Ethena USDE is a growing asset and doesn’t have significant value bridged or minted on the Arbitrum chain.

Source: https://dune.com/entropy_advisors/ethena-protocol-metrics

Resolv Assets

USR

ETH and BTC back USR through the vanilla basis trading design. Its growth has been stagnant or slowly declining for months while the TVL is below its ATH.

Source: https://defillama.com/protocol/tvl/resolv

RLP

RLP is the liquid insurance pool to keep USR overcollateralized. While the USR TVL has been stagnant, RLP is witnessing a positive growth trend.

Source: https://defillama.com/protocol/tvl/resolv

Opportunity Ranking

Asset/Pool Level incentivisation

- USDX

USDX natively minted value on Arbitrum is one of the major protocols in the Basis Trading category for Arbitrum, with TVL across chains being ~$670 million and with Arbitrum minted value being ~$120 million.

Arbitrum already holds a strong position for USDX and can leverage it.

Source: https://defillama.com/protocol/tvl/stables-labs-usdx

Further down the list, assets to consider are USDE, USR, and RLP. These are explained above.

Protocol Level incentivisation

Basis Trading on Arbitrum currently holds a smaller market share compared to other chains. While it is doing well with Protocols like Stable Labs, there is a large market that is available to capture.

- Stable Labs USDX: Stable Labs is one of the prominent protocols in Basis Trading on Arbitrum, having shown a strong growth pattern. Its Arbitrum TVL is currently ~$120 million.

- Ethena: Ethena is one of the most significant contributors in the basis trading category, controlling ~82% of the market share and exhibiting a strong growth pattern, with expansion into multiple ecosystems and even TradFi.

- Resolv: Resolv comparatively shares a smaller market share than Stable Labs and Ethena. The protocol has witnessed stagnant growth in recent times, with TVL being below its ATH.

GTM Strategies

Ecosystem and TradFi Expansion: Protocols like Ethena are expanding by integrating TradFi with their assets and providing liquidity to other protocols within their ecosystem.

Liquid Staking

Liquid Staking - Recommendations

The liquid staking market has a total size of around $51 billion, with Ethereum capturing 96.6% of the liquid staked ETH supply, leaving only a thin layer for Layer 2s and alt L1s. Within the L2 landscape, Arbitrum holds 17.4% of the liquid staked ETH market (excluding Ethereum), positioning it as a strong contender and one of the leading L2 environments for liquid staking. However, as most minting and liquidity remain on Ethereum, there is significant upside if Arbitrum can attract deeper DeFi integrations and incentives to pull liquidity on-chain.

Gap Identification

Feature Level Analysis

Auto-Compounding Incentives

Protocols like SuperoETHb on Base provide chain-specific, auto-compounded incentives that enhance user returns when using liquid staking tokens in DeFi. This feature is currently missing on Arbitrum and represents a high-potential gap to close for driving liquidity and user activity.

Built-in Compliance and Institutional Readiness

Protocols such as Liquid Collective with LSETH incorporate built-in compliance, including KYC/KYB features that allow institutional participants to know their staking counterparties. As institutional adoption of liquid staking expands, supporting compliant liquid staking tokens on Arbitrum can position the network to capture regulated institutional flows seeking ETH staking exposure within DeFi.

GTM Analysis

Rewards and Incentives

Many protocols utilise Merkl to distribute incentives across chains, but currently, there is a lack of structured rewards targeting liquid staking token usage on Arbitrum. By deploying targeted incentives on Merkl across lending protocols and DEXs, Arbitrum can attract liquidity providers and users to actively utilise liquid staking tokens within its DeFi ecosystem.

Cross-Marketing with Liquid Staking Providers

A key GTM strategy is to engage in cross-marketing with liquid staking providers to promote the opportunities available on Arbitrum to their user bases. This approach can drive liquidity migration and usage of these assets on Arbitrum while aligning the ecosystem with the needs of existing liquid staking communities.

External Collaborations

Protocols like Superform and Superlend, which aggregate yield opportunities across chains, currently have limited deployment on Arbitrum. Collaborating with these protocols to support liquid staking tokens within their strategies on Arbitrum can drive incremental liquidity and usage, aligning with broader DeFi adoption goals while expanding the utility of liquid staking assets on the network.

Asset Level Gaps

SUPEROETHB

SUPEROETHB is minted by Origin Protocol on Base, where it currently holds around $409 million in TVL, making it one of the largest liquid staking assets on the chain. Unlike other LSTs, SUPEROETHB is currently only live on Base, presenting a unique and highly attractive opportunity to expand onto Arbitrum. Given Origin Protocol’s design focused on offering competitive yields, SUPEROETHB could drive new user flows while diversifying Arbitrum’s liquid staking asset stack.

Opportunity Ranking

The opportunity ranking is classified based on its size, ease of resolution for Arbitrum, and ecosystem readiness.

Asset/Pool Level incentivisation

This section focuses on the already successful assets and pools on various chains, and it would be beneficial to incentivise them on Arbitrum as well. These assets/pools would be independent of the protocol, but can be linked back to the winning protocols from the next section.

- OsETH

OSETH is minted by Stakewise on Ethereum, where it currently holds around $668 million in TVL, making it one of the larger liquid staking assets in the ecosystem. It has around $400 million in lending TVL, reflecting strong DeFi integration, though this is currently limited to Ethereum. Given its scale and composability, OSETH represents a high-feasibility candidate to onboard onto Arbitrum through incentives, offering clear pathways to attract a portion of its existing TVL into Arbitrum’s DeFi markets.

- SUPEROETHB

SUPEROETHB is minted by Origin Protocol on Base, where it currently holds around $409 million in TVL, making it one of the largest liquid staking assets on the chain. Unlike other LSTs, SUPEROETHB is currently only live on Base, presenting a unique and highly attractive opportunity to expand onto Arbitrum. Given Origin Protocol’s design focused on offering competitive yields, SUPEROETHB could drive new user flows while diversifying Arbitrum’s liquid staking asset stack.

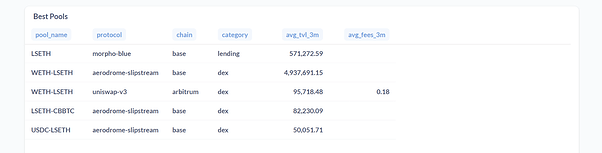

- LSETH

LSETH is minted by Liquid Collective on Ethereum, with $367 million in TVL and active DeFi integrations including $17 million in DEX TVL and $570,000 in lending TVL. $95k of liquidity is already live on Arbitrum, providing an anchor for further growth. However, its footprint remains modest compared to its potential, making LSETH a practical target for incentive programs to attract Ethereum-based TVL into Arbitrum DeFi while capturing an institution-friendly asset profile.

- ETHX

ETHX is minted by Stader Labs on Ethereum, where it has accumulated $276 million in TVL. While ETHX benefits from Stader’s multichain presence and solid staking infrastructure, its DeFi integrations remain limited. Currently, there is no lending or DEX TVL data of significance captured for this asset on Arbitrum, making it an attractive target for bootstrapping on the chain.

- CBETH

CBETH is minted on Ethereum by Coinbase, where it has achieved strong adoption, with $235 million in TVL, reflecting user trust and widespread use across the ecosystem. It has also seen solid traction on Base and has some liquidity already live on Arbitrum DEXs, providing a foundation for further growth. However, since Coinbase is the issuer, the feasibility is lower compared to other LSTs, unless Coinbase explicitly prioritises expanding DeFi integrations on Arbitrum.

Protocol Level incentivisation

At the protocol level, there is no need for direct incentivisation for liquid staking, as this is not the focus within this vertical. Liquid staking protocols do not require onboarding to Arbitrum directly, given that staking operations remain on Ethereum mainnet.

If protocol-level incentivisation were to be considered, it would be most effective through lending protocols and DEXes that support liquid staking assets, rather than targeting the protocols themselves. The recommended DEXes and lending protocols outlined in their respective sections can be utilised here to facilitate this, where relevant.

However, for liquid staking, the priority is on asset-level incentivisation. The focus should be on attracting and deepening liquidity and usage of liquid staking tokens within the Arbitrum DeFi ecosystem to drive activity, rather than directing resources toward protocol-level onboarding efforts.

GTM Strategies

These GTM strategies position lending protocols across chains uniquely and are currently not widely adopted on Arbitrum.

Cross-marketing with liquid staking providers

A key GTM strategy for Arbitrum is to engage in cross-marketing with liquid staking providers, ensuring that opportunities on Arbitrum for their respective tokens are actively promoted to their user bases. This helps drive user awareness and liquidity migration, enabling Arbitrum to position itself as the preferred Layer 2 for DeFi activity using these tokens.

Coordinated incentivisation on Merkl

To complement these partnerships, Arbitrum should coordinate clear and targeted incentivisation for liquid staking tokens across both lending protocols and DEXs using platforms like Merkl. This ensures that incentives are distributed effectively, driving the adoption and utilisation of liquidity in liquid staking tokens within Arbitrum’s DeFi ecosystem, while aligning incentives for protocols, liquidity providers, and users.

Restaking

Restaking - Recommendations

The restaking market currently holds around $12 billion secured on Ethereum and $5 billion on Bitcoin, with EigenLayer and Babylon accounting for approximately 84% of this combined TVL.

Restaking is included in a specific vertical in our mapping because the actual staking or restaking activity must happen on the settlement layer.

As a result, attracting or deploying settlement-layer restaking protocols like EigenLayer or Karak directly on Arbitrum does not make sense. The associated TVL will always remain on the underlying base chain unless a breakthrough changes how settlement and slashing are handled. This also means there are no assets to shortlist under this category for Arbitrum.

Gap Identification

Feature Level Analysis

Restaking on Arbitrum is not applicable by design

TVL related to restaking will always reside on settlement chains unless a significant technical innovation changes this structure. There is no actionable path for Arbitrum to modify this outcome. However, Arbitrum can indirectly benefit from Restaking solutions through LRTs as presented at a later stage of the report.

Lack of initiatives leveraging AVSs

Some blockchains have started exploring AVS solutions to scale their networks, notably with EigenDA, which has been adopted by chains such as Mantle, Celo, and AgentLayer for modular data availability. AVSs like AltLayer are also seeing early adoption among app chains and protocols, with examples including Xterio (on BSC) and Cyber, which leverage MACH for fast finality and decentralised sequencing.

GTM Analysis

Strategic AVS Facilitation

Arbitrum can proactively engage AVS builders to pilot deployments on its network, positioning itself as a restaking-aligned L2 while enabling AVS services to operate at L2 costs and speeds.

Collaboration with EigenLayer and Karak for technical facilitation and co-marketing will be essential, which can be achieved through builder campaigns, hackathons, or targeted incentives.

However, it is important to note that activity on AVSs remains relatively low at this stage. As such, these actions would primarily contribute to infrastructure and technical enhancement rather than driving immediate surges in user activity or TVL. This approach should be considered only if Arbitrum seeks to explore new technical pathways and innovation opportunities within its ecosystem.

Protocol-Level Incentivisation

As EigenLayer and Karak are restaking protocols that inherently operate on Ethereum L1, there is no need to offer incentives to these protocols directly. Instead, it would be more beneficial for Arbitrum to focus incentives on LRTs protocols within to capture restaking-aligned liquidity and activity.

Liquid Restaking

Liquid Restaking - Recommendations

Liquid restaking has grown rapidly, with over 3.5 million ETH restaked in liquid form and a sector TVL exceeding $10 billion.

The majority of activity remains concentrated on Ethereum, while Arbitrum and Base each capture 40-45% of the L2 market share for ETH liquid restaking tokens, reflecting a strong position in a competitive environment. Despite this, the sector is still in its early stages on Arbitrum, with room to deepen liquidity, collateral usage, and vault strategies to capture a larger share of the growing LRT DeFi market.

Gap Identification

Feature Level Analysis

Layered Yield Generation (EtherFi, Renzo, Kelp DAO)

Liquid restaking protocols like Ether.fi, Renzo, and Kelp DAO issue liquid restaking tokens (e.g., eETH, ezETH) that allow users to simultaneously earn Ethereum staking rewards, EigenLayer restaking yields, and additional DeFi yields via lending, liquidity provision, and structured DeFi products. This transforms passive staking into active capital deployment without sacrificing liquidity.

Auto-Compounding Structured Vaults (YieldNest)

YieldNest is building auto-compounding vaults for LRTs that automate the aggregation of staking rewards, restaking rewards, and DeFi yields into a single, easy-to-use asset. For example, YieldNest’s upcoming strategies allow users to deposit eETH or ezETH and receive compounded returns without manual restaking or redeployment. These structured products are not currently live on Arbitrum, representing a clear gap in user-friendly LRT yield products on the network.

Modular Restaking Strategy Selection (Kelp DAO)

Kelp DAO and others are exploring modular AVS selection, where users can choose which AVSs their LRTs are restaked to, potentially aligning their positions with specific restaking yields or risk profiles.

GTM Analysis

Rewards and Incentives

Liquid restaking tokens such as eETH, ezETH, and rsETH are present on Arbitrum but currently have limited liquidity and usage compared to their presence on Ethereum. While some pilot liquidity pools and lending markets exist on Arbitrum, structured incentives specifically targeting these assets are minimal. Launching targeted rewards to deepen liquidity and encourage borrowing and lending of liquid restaking tokens can help Arbitrum capture a larger share of this growing sector.

External Collaboration

Yield platforms and liquidity routers such as Pendle and Superform can integrate liquid restaking tokens to expand their utility on Arbitrum. Collaborating with these platforms can increase opportunities for users to earn and use liquid restaking tokens within the Arbitrum DeFi ecosystem, supporting broader adoption without focusing on protocol-level onboarding.

Asset Level Gaps

Asset Level Gaps identify assets that are growing in other chains but either don’t exist on Arbitrum or have a low value bridged/minted.

LBTC

LBTC is currently live on a separate chain, having the major TVL on Ethereum, followed by Base and other chains. Since the asset doesn’t exist on Arbitrum yet, it is also marked as a high opportunity asset to focus on. The TVL across chains for LBTC in lending exceeds $600 million, but the assets have lower utilisation.

Opportunity Ranking

The opportunity ranking is classified based on its size, ease of resolution for Arbitrum, and ecosystem readiness.

Asset/Pool Level incentivisation

This section focuses on the already successful assets and pools on various chains, and it would be beneficial to incentivise them on Arbitrum as well. These assets/pools would be independent of the protocol, but can be linked back to the winning protocols from the next section.

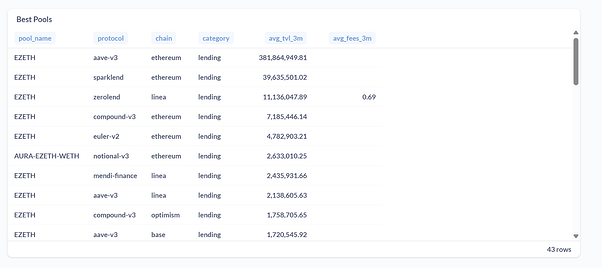

- WEETH (eETH)

WEETH (wrapped eETH) is Ether.fi’s liquid restaking token, holding $7.5 billion in TVL, making it one of the largest LRTs in DeFi. Its scale has made it a preferred asset for Ethereum-native DeFi, but its cross-chain footprint remains shallow, with only $9 million out of $130 million in DEX liquidity currently on Arbitrum.

WEETH’s design prioritises non-custodial staking while enabling users to retain composability for layered yield strategies. However, it remains largely untapped on Arbitrum, suggesting that structured incentives could convert its significant Ethereum presence into meaningful liquidity on Arbitrum, particularly if lending integrations follow DEX deployments.

- ezETH

ezETH by Renzo is the fastest-growing LRT among EigenLayer restaking assets, reflecting user preference for its simplicity and consistent rewards. With around $900 million in TVL, it has built early DEX liquidity across chains ($60 million), yet only $6 million sits on Arbitrum.

Unlike WEETH, which has deeper roots among Ethereum DeFi power users, ezETH has resonated strongly with retail restakers seeking layered yields with minimal friction. This leaves an opportunity for Arbitrum to position itself as the first chain to provide deeper ezETH liquidity beyond Ethereum, using incentives to bootstrap lending markets and capture user flows seeking efficient restaked ETH deployment.

- rsETH

rsETH from Kelp DAO has differentiated itself by actively integrating into lending markets, with $1.45 billion in lending TVL alongside $35.6 million in DEX liquidity across chains.

While it has made progress on Arbitrum with $5.5 million in lending TVL and $3 million in DEX liquidity, this footprint remains modest relative to its broader adoption. rsETH’s growth illustrates the market’s hunger for productive staked ETH that can be used in lending and structured strategies, making it a strong candidate for targeted liquidity mining or Arbitrum-native structured products that can attract its user base to migrate or mirror positions onto the network.

- LBTC

LBTC by Lombard is an emerging liquid restaking solution for Bitcoin, offering BTC holders staking and restaking rewards while unlocking DeFi composability. With $573 million in lending TVL and $85 million in DEX liquidity, LBTC has proven there is demand for productive BTC assets in DeFi.

Yet it has no current presence on Arbitrum, highlighting a unique market gap. LBTC’s expansion to Arbitrum would not only deepen Bitcoin-native liquidity on the network but could also serve as a flagship for Arbitrum’s broader Bitcoin DeFi ambitions, especially if coupled with incentives targeting BTC whales and DeFi traders looking for restaked BTC exposure.

Protocol Level incentivisation

The protocol-level incentivisation will be mapped from the assets shortlisted from the above section. The following tier list would act as which protocols to incentivise first, since they would have common assets listed.

- Renzo

Renzo is one of the largest liquid restaking protocols with $1B of tvl in its ezETH token, enabling users to earn ETH staking and EigenLayer restaking rewards while maintaining liquidity for DeFi use. While Renzo has established liquidity pools on Arbitrum, its usage and integrations remain limited compared to Ethereum.

While a deeper Renzo deployment on Arbitrum may not be strategically necessary given its Ethereum focus, it remains important to showcase the opportunities Arbitrum offers on the DeFi frontend. Supporting Renzo in expanding liquidity for ezETH, building lending markets, and integrating with vault products on Arbitrum represents a clear opportunity to anchor restaking TVL on the network. Incentives could focus on liquidity pools and lending markets to encourage ezETH adoption as a productive collateral asset.

- Kelp DAO

Kelp DAO issues rsETH, providing restaking rewards while allowing users to select AVSs, combining flexibility with composability in DeFi. With its $1.3B in TVL Kelp is a larger player in the liquid restaking space and has begun establishing liquidity on Arbitrum, but has room to expand both liquidity and protocol integrations.

While a deeper Kelp DAO deployment on Arbitrum may not be necessary given its broader Ethereum alignment, it is still important to showcase the opportunities Arbitrum provides on the DeFi frontend. Supporting Kelp DAO in expanding liquidity for rsETH, building lending markets, and integrating with vault products on Arbitrum represents a clear opportunity to anchor restaking TVL on the network. In parallel, efforts should be made to improve rsETH’s visibility and usability across key DeFi frontends such as aggregators, dashboards, and portfolio tools. This would enhance composability and drive rsETH adoption as a productive collateral asset within the Arbitrum ecosystem

- YieldNest

Yieldnest builds auto-compounding vaults for liquid restaking tokens, automatically aggregating staking, restaking, and DeFi yields into a single product for users seeking layered returns without complexity. Currently the protocol has $195M in TVL across Ethereum and BNB Chain.

Yieldnest’s structured vaults are not yet live on Arbitrum, and bringing them to the network would offer a user-friendly entry point into liquid restaking while capturing DeFi activity around LRT assets. Incentives could focus on supporting the initial liquidity and vault deployment of Yieldnest on Arbitrum, helping to bootstrap usage and position the network as a home for structured liquid restaking strategies.

GTM Strategies