Timeboost Revenue and LP Impact Analysis

The below report is available in document format here

Although this was not requested by the DAO advocate for the ARDC, in light of the Timeboost proposal vote, Entropy’s request, and the general concern around the impact Timeboost may have on LPs, Blockworks Research has performed an analysis on the revenue projections Timeboost could drive to the DAO, as well as an attempt to explain the impact on DEX LPs. We estimate that Timeboost could have led to an additional $19m to $95m increase in annual DAO revenue, implying 33-162% growth over the previous twelve months. We believe Timeboost is a net-positive for Arbitrum DAO value capture and that Arbitrum One LPs should still outperform LPs on competing chains. Additionally, we believe the DAO may want to consider a Timeboost Committee to closely monitor Timeboost activity and onchain market conditions, so that it can make informed decisions on adjustments to Timeboost’s parameters in the future.

Acknowledgements: We appreciate all the feedback we received from Derek and other members of the Offchain Labs team. Additional thanks to Andrea Canidio, Krzysztof Gogol, and Alex Nezlobin for discussions that helped shape our thinking.

Arbitrum’s Market Dominance in the Ethereum ecosystem

Historically, maintaining market share has been extraordinarily challenging in crypto due to airdrop farming, foundation grant dynamics, and other incentive programs. Users and founders are constantly being paid to switch to the next newest app or ecosystem, adding a challenging dimension to the user retention game. Despite the difficulties of Ethereum’s rollup centric roadmap and growing competition, Arbitrum remains a leading ecosystem by the most important KPIs.

Arbitrum’s market share of total crypto TVL, despite how gameable this metric is, and especially in the context of new ecosystems where native tokens with low float/high FDV dynamics are particularly inflationary to TVL, has remained sizable. In August, Arbitrum ranked the second and third most used chain for perps and spot market trading, generating $20.7B and $34.10B in volumes, respectively.

Arbitrum stands out as the ETH-aligned L2 with the most liquidity. Despite Base’s distribution, Arbitrum still leads in trading activity, attracting more sophisticated participants, which we believe indicates Arbitrum is more attractive to asset issuers relative to other L2s.

Timeboost Revenue Projection

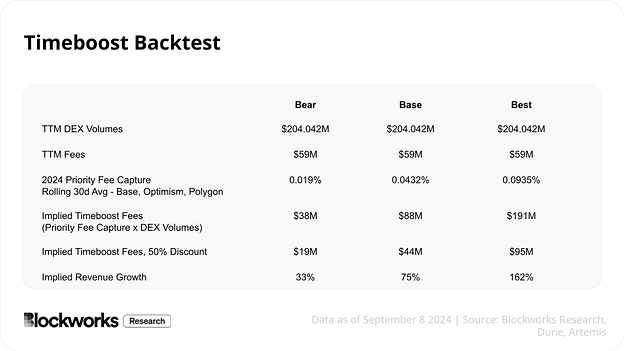

To estimate the revenue potential of Timeboost, which introduces an auction mechanism via the Express Lane (which effectively gives the winner of the auction a time advantage for transaction inclusion for multiple blocks), we take historical priority fees for select EVM L1s/L2s and calculate a time series of priority fees as a percentage of spot DEX volume.

We then take the 30-day rolling average of these time series, apply a blended average to Arbitrum One DEX volumes over the trailing 12 months, and discount the result by 50% given the inherent uncertainty in this new mechanism and the fact that this is a multivariate problem considering differences in block times, DEX volumes, market conditions, transaction costs, etc. We believe the following result serves as a conservative estimate.

According to this backtest, we estimate that Timeboost could have led to an additional $19M to $95M increase in DAO revenue, implying 33-162% growth over the previous twelve months.

Potential Impact on LPs

While Timeboost may be a boon for Arbitrum DAO revenue, this revenue will, at least partially, come at the expense of one of the largest stakeholders in the Arbitrum ecosystem, liquidity providers (LPs), in the form of Loss-Versus-Rebalancing (LVR). LVR quantifies the adverse-selection costs that LPs incur for quoting stale prices against market-makers on a centralized exchange (CEX), namely Binance. By introducing an express lane controller, a trader that owns the express lane can effectively win top-of-block slots, which should theoretically subject LPs to more frequent LVR for assets that are also listed on CEXs.

In a recent study, researchers attempted to quantify the arbitrage opportunities on Ethereum and different L2s (including Arbitrum One) by taking onchain data over a four-month period. This study derives Max Arbitrage Value (MAV), which is differentiated from LVR, whereby LVR sums the aggregate per-block arbitrage opportunities over a period of time, and MAV sums the unique per-block arbitrage opportunities.

Example: Imagine there is a $10 arbitrage that does not get taken for three blocks, MAV would be equal to $10 over that three block period, while LVR would be equivalent to $30. According to this study, LVR overstates arbitrage opportunities (LP losses).

Interestingly, if one compares the MAV in the chart above to the chain priority fee capture chart under the Timeboost Revenue Projection section, there are striking similarities (e.g.: Ethereum MAV at 0.15% of DEX volume and aggregate priority fees, including MEV Boost bids, hover around 0.15% from January 2024 to end of April 2024). Additionally, our base case for Timeboost value capture at 0.0432% of DEX volumes lines up with Arbitrum’s MAV of 0.04%. This tells us that while Timeboost revenue will largely come from LPs through LVR, instead of that value being extracted by external parties (searchers), the DAO treasury will accumulate these proceeds and in-turn can decide how to best allocate them (including redistributing a portion of this revenue back to LPs if it so chooses).

As mentioned by Camelot and other stakeholders, the concern around Timeboost is that the 200ms delay could exacerbate LP losses since block time is one of the main variables that impact LP profitability. A naive formula to calculate LVR imposed by longer (or shorter) block times is shown below:

Where: sigma = asset volatility, f= pool swap fee, t = block times

Keeping all else equal (trade volume, liquidity, LP fees, market conditions, etc), an LP going from Ethereum with 12s block times to a faster chain like Optimism with 2s block times should experience less LVR, by at least ~59% (sqrt(2/12) = 0.408 (59.2% decrease)). With Arbitrum One’s current FCFS ordering policy, block times are effectively 0, meaning LP LVR on Arbitrum One should theoretically be nonexistent using the formula above. In practice, with empirical evidence as demonstrated by the research referenced above, LVR currently exists on Arbitrum One.

When looking at MAV as a percentage of DEX volumes for both Ethereum and Optimism (table above), we see a decrease of ~66% (0.15% → 0.05%), roughly matching the formula’s expectation. Again, this can be attributed to Ethereum having blocktimes that are 6x longer than Optimism (12s vs 2s). Interestingly, the researchers did not find materially more MAV on Optimism (0.05%) in comparison to Arbitrum One (0.04%), despite the drastically longer block times (2s vs FCFS). With the Timeboost delay, effectively causing a 200ms block time from the LP’s perspective, LPs on Arbitrum post-Timeboost would theoretically experience ~68% less LVR compared to LPs on Optimism (sqrt(0.2/2) = .316 (68.3% decrease)). While this suggests Arbitrum One would still be the best place to LP out of competing L2s, we don’t have sufficient evidence to conclude that LVR with FCFS is materially better than Timeboost non-express lane transactions with a 200ms delay. Thus, estimating Timeboost’s impact on Arbitrum LVR is more nuanced than what prevailing literature suggests.

The researchers also found that the average MAV on Arbitrum One was higher than the average MAV on other chains and these arbitrage opportunities lasted for ~27 blocks (6.9s of decay), on average. This decay across rollups might sound perplexing–in particular, how could a $19.68 arbitrage opportunity exist for 6.9s, on average? On Base, the average MAV opportunity lasted for 420s! While it appears the authors did not explain the rationale behind these non-intuitive results, we believe these longer than expected price discrepancies are due to the costs and execution risks of capturing these relatively small opportunities in the absence of MEV-Boost.

Additionally, this analysis was performed specifically on Uniswap v3 pools from December 31st to April 30th, 2024, and we believe the longer decay times could also be partially due to liquidity and trading data using Uniswap v3, especially for Base and zkSync which lacked Uniswap v3 liquidity compared to Arbitrum One and Optimism during this time period. Furthermore, it’s possible performing this analysis on Uniswap v2 pools might reflect a more accurate picture for LVR, MAV, and decay across various block times, because these passive v2 LPs are more likely to quote uniform liquidity at stale prices more often.

Applying this logic to Arbitrum One, due to fast 250ms block times and the FCFS ordering policy–where the primary advantage between arbitrageurs is speed–we hypothesize that arbitrageurs have lower assurances to take on the inventory risks and execution costs associated with capturing CEX-DEX arbitrage opportunities compared to L1 and therefore take on less arbitrage opportunities. Instead, they wait until the CEX-DEX price discrepancy is wide enough to justify the cost and risks before execution of their arbitrage trade. Due to these lower assurances, the current ordering policy could be lowering the ceiling on total Arbitrum One DEX volumes and thus potentially swap fees available to LPs.

Overall, our expectation that LPs should still find Arbitrum more attractive than other L2s is in line with LVR and AMM research. Canidio and Fritsch show that LVR decreases with block times, Adams finds LPs on chains with shorter blocks times earn 20% more fees from arbitrage than mainnet, and Heimbach et al state a possible mitigation for non-atomic (CEX-DEX) arbitrage “would be to move DEX volume to Layer 2s such as Arbitrum and Optimism which already have shorter blocks times.” Note: while LVR on Arbitrum post-Timeboost will be much lower than LVR on Ethereum, Ethereum benefits from higher amounts of uninformed (retail) flow, a positive factor for LPs.

We believe it is possible that, in aggregate, (1) Timeboost has a neutral impact on LPs, and (2) given the expectation of additional trading activity and really small 200 ms slot times to extract LVR, Arbitrum LPs should still outperform LPs on competing chains. The questions are: to what degree do 200ms slots increase LVR per block, how does it compare to the LVR in today’s FCFS regime, and will the additional arbitrage volume beget more LP fees than other L2s (and potentially offset LVR, in aggregate)?

Final Thoughts

Ultimately, despite valid concerns around MEV, we feel the overwhelming conclusion that Timeboost is net negative for the ecosystem and its participants is not a straightforward one. Another important consideration is that the research is primarily centered around non-atomic arbitrage and does not ponder Timeboost’s impact on atomic arbitrage. Moreover, the way in which the DAO manages Timeboost, grows the ecosystem to more retail users, and eventually decentralizes Timeboost will play a more significant role in its success or failure in the long run.

Hence, there is an opportunity for the DAO to create a Timeboost Committee to closely monitor Timeboost activity and onchain market conditions, so that it can make informed decisions on adjustments to Timeboost’s parameters and/or where Timeboost revenues can be properly allocated or redistributed that ensures both DAO sustainability and a healthy ecosystem for its LPs.