- Amount requested in arb?

-

The Lodestar Finance DAO is requesting 325,000 ARB tokens. This is a 14% lower ask to what our protocol would be eligible following the STIP-Bridge request recommendation, this reduction due to the fact of our TVL is lower at the moment of the writing of this addendum which is the metric outlined in the original STIP to guide request size.

-

While TVL is one metric, it is highly influenced by HNWI. The STIP did have a positive impact on Lodestar Finance in term of user growth and retention: the amount of unique users and daily active users has risen substantially from pre-STIP levels and users who were introduced to our unique emission flywheel remained active in shaping the protocol’s liquidity at elevated rates compared to pre-STIP. We value the growth in our core users who engage in regular market activity, protocol governance and gauge participation. The STIP brought many of these types of users to Lodestar and we look forward to building on what worked in the previous STIP to continue this growth.

- Amount received during STIP?

- The Lodestar Finance DAO received 750,000 ARB tokens from the Arbitrum DAO during the STIP program.

- What date did you start the incentive program and what date did it end?

- The STIP incentives distribution started on Lodestar on Monday 13th November and ended on the week of the 28th March.

- Could you provide the links to the bi-weekly STIP performance reports and Openblocks Dashboard?

-

The Lodestar Finance Biweekly STIP performance report: [Lodestar Finance] Bi-Weekly Update

-

The Lodestar dedicated Openblocks Dashboard: https://www.openblocklabs.com/app/arbitrum/grantees/Lodestar

- Could you provide the KPI(s) that you deem relevant for your protocol, both in absolute terms and percentage change, month over month, for the first of each month starting from October 2023 until April 2024, including the extremes?

-

The Lodestar Finance STIP execution ranked among the most efficient of the program according to the onchain data according to the Open Block data analysis:

OpenBlock Labs STIP Incentive Efficacy Update (12/29)

-

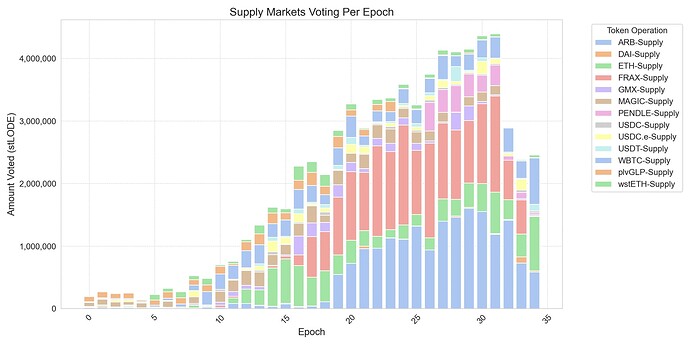

One of our key KPIs as mentioned in the introduction is the participation in our emission gauge. During the initial STIP program, 5% of the ARB incentives were distributed to gauge participants. As we can see in the graph below, the amount of stLODE voting at each epoch has grown significantly during the STIP period and stayed above pre-STIP once ended:

-

Daily Active Users remains nearly twice that than of the month before the initial STIP program

-

During this first STIP period, our protocol has partnered with other builders of the ecosystem to take advantage of the ARB incentive distribution to introduce Lodestar as one of the key building blocks on Arbitrum:

-

Frax Finance partnered with Lodestar to bribe stLODE holders on Hidden Hand and grow the available FRAX liquidity on our protocol.

We recently published a Medium article containing a deep dive into this partnership and the impact it had on our protocol: https://blog.lodestarfinance.io/the-lodestar-hidden-hand-market-a-three-month-review-2f5d49d6eaca -

Harvest Finance released auto-compounding vaults built on top of the Lodestar USDC and WBTC markets: https://x.com/harvest_finance/status/1750447067607048250

-

Lodestar Finance was integrated to Contango, a leverage trading platform built on top of lending protocols that allowed users to open leverage-long and short position while earning ARB incentives and using onchain liquidity: https://medium.com/contango-xyz/contango-x-lodestar-b72619ac6da3

-

-

The Lodestar team has setup a Dune Dashboard that tracks the KPIs requested by the Arbitrum DAO during the STIP period. This dashboard is available through this link: https://dune.com/lodestar/lodestar-stip-dashboard

-

Additionally, the OpenBlock Labs team has created its own Lodestar dedicated dashboard to track key KPIs at this link: https://www.openblocklabs.com/app/arbitrum/grantees/Lodestar

- Any lessons learned from the previous STIP round?

-

The Lodestar DAO used 95% of the initial STIP grant to incentivise market participants while using 5% to introduce the Arbitrum community to our unique gauge system.

-

We believe that more of the STIP incentives should be directed to the protocol’s emission gauge, this time directly through integration with Redacted’s Hidden-Hand platform instead of a direct airdrop to voters.

Users who were introduced to the flywheel, thanks in part to the STIP incentives, were engaged users. Those users leveraged lodestar’s liquidity and participated in positive user behaviour that is value adding.

Through the data (shown in the KPIs), we can see that users introduced to the Lodestar flywheel were retained within the ecosystem after the STIP at significantly higher rates than those who only participated in the lending markets. These users had positive behaviours such as having advanced/leveraged positions (generating protocol fees), creating positions that connect apps across the Arbitrum ecosystem (interoperability) and allowed them to control the incentive structure of the protocol (governance). -

You can read more about our emission gauge and a case study on its efficiency through this link: https://blog.lodestarfinance.io/the-lodestar-hidden-hand-market-a-three-month-review-2f5d49d6eaca

New Plans for STIP Bridge

- Do you plan to use the incentives in the same ways as highlighted in Section 3 of the STIP proposal?

-

We will be using the incentives of the STIP-Bridge in the similar way, twice-weekly snapshots and distributing ARB incentives to all market participants equally based on the cumulative ETH value of their position (supply + borrow).

-

For this STIP-bridge program, we will incentivise gauge participants through Redacted’s Hidden-Hand platform.

Our plan however is to increase the proportion of STIP incentives directed to the emission gauge participants from 5% of the request to 15%.

- How will the incentive distribution change in terms of mechanisms and products?

-

The Emission gauge voting incentives will shift from a weekly reward airdrop to a weekly distribution through our Hidden Hand market:

- the ARB bribes will be distributed to each market (borrow and supply side) proportionally to the base emission speed of LODE incentives that can only be changed via Snapshot governance.

- For example, the USDC.e supply market receives 8% the base LODE emissions: 8% of the bribes dedicated ARB tokens will be deposited to the USDC.e supply Hidden Hand bribe market.

- All our emissions speeds are available in our documentation: LODE Emissions | Docs

- the ARB bribes will be distributed to each market (borrow and supply side) proportionally to the base emission speed of LODE incentives that can only be changed via Snapshot governance.

-

In order to foster partnerships with other protocols in the ecosystem (such as FRAX for the previous grant program), we will be matching users and protocol bribes on Hidden Hand.

- What this means is that when anyone bribes a market, the base ARB distributions on Hidden Hand for every market (described above) will be lowered proportionally in order to match the bribe’s value 1:1 in ARB.

- If no bribes are deposited during an Epoch by a partner, then the ARB weekly voting incentives will be distributed evenly across all the markets

-

This change in the incentive distribution targets our main KPI for this STIP-Bridge program:

- stLODE voting participation: for example, 4 week moving-average of total stLODE utilisation measured 90 days following the conclusion of the bSTIP versus 4 week moving average of total stLODE utilisation prior to bSTIP

- Growth of partnerships in the ecosystem: comparing the moving average of total weekly bribes from partner protocols before and after the bSTIP

- Daily active user growth over the duration of the grant period and following the conclusion of the bSTIP

- Could you provide the addresses involved in the STIP Bridge initiative (multisig to receive funds, contracts for distribution, and any other relevant contract involved), and highlight if they changed compared to the previous STIP proposal?

- The Lodestar DAO would use the same multisig address as for the first round of STIP incentives, running through a 3 / 4 multisig at this contract address : arb1:0xfA62A3A0722a0aF7739c23a361E2285F5B75ecE7

- Could you share any feedback or suggestions on what could be improved in future incentive programs, what were the pain points and what was your general evaluation of the experience?

-

We believe that the STIP Program is an excellent first step to improve the attractiveness of the Arbitrum Chain, while maintaining its leadership in the Defi race.

-

We are looking forward to see the implementation of a global grant framework for protocols to request incentives from the DAO instead of periodical programs such as the STIP, LTIP or STIP bridge.