SECTION 1: APPLICANT INFORMATION

Applicant Name: Prashant Sharma

Project Name: Mercle

Project Description:

- Mercle is a distributed incentive network that powers On-Chain Identities using attestations.

- Using Mercle, protocols, chains, L2s such as Arbitrum (including ecosystem projects) can create user PoW in the form of attestations

- Mercle can be used as a platform that also rewards Liquidity Providers (LPs) in concentrated liquidity pools with customized token incentives from incentivizers.

To Summarize:

Mercle is a decentralized reputation graph protocol with a proof-of-work mechanism built using attestations, allowing Web3 users to build an on-chain reputation.

It enables decentralized apps (dApps) to incentivize users based on their engagement and on-chain interactions with their protocol. This allows them to attract new users, efficiently incentivize liquidity, and build a robust community.

We’re also starting to develop a mechanism to reward Liquidity Providers (LPs) in concentrated liquidity pools with customized token incentives from incentivizers.

Team Members and Roles:

Prashant Sharma (Pash) - Founder & CEO

Nishchit Prasad - CTO & Co-Founder

Devansh Dubey - Marketing Lead

Rohan Dubey - Business & Growth Lead

Hari Prasad - Full Stack Developer

Nitin Sharma - Lead Product Designer

Project Links:

Twitter: https://twitter.com/0xmercle

Discord: Mercle

Website: www.mercle.xyz

Contact Information

Point of Contact: Prashant Sharma

Point of Contact’s TG handle: @pash_161

Twitter: https://twitter.com/pash161

Email: prashant@mercle.xyz

Do you acknowledge that your team will be subject to a KYC requirement?: Yes we acknowledge.

SECTION 2a: Team and Product Information

Provide details on your team’s past and current experience. Any details relating to past projects, recent achievements and any past experience utilizing incentives. Additionally, please provide further details on the state of your product, audience segments, and how you expect incentives to impact the product’s long-term growth and sustainability.

We have worked with a wide range of projects, including pre-token, post-token & growth stage projects to plan incentivization structure, mechanism to get the desired ROI required. We’ve worked with projects like Polygon, Jumper Exchange, Shapeshift, LiFi, SynFutures, Router Protocol, Powerloom, Gnars DAO, etc.

Since our inception we have driven 1M+ actions, involved 125,000 users, working with 20+ protocols & drove 200,000+ mints of NFTs on chains like Polygon, Arbitrum, Base, Scroll, Linea, etc. .

Team experience (Any relevant experience that may be useful in evaluating ability to ship, or execution with grant incentives. Please provide references knowledgeable about past work, where relevant. If you wish to do so privately, indicate that. [Optional, but recommended]):

Prashant Sharma: Aerospace Engineer | 2x Founder (web2) | Hustler

CEO & Founder

Prashant founded his first brand advertising startup company in 2013 during his first year of college. This venture used disposable paper cups for advertising in key locations like airports, railway stations, and bus stops.

In 2016, he created a brand loyalty mobile app for offline businesses, which was later sold to a restaurant chain.

[Startup of the Day] Chandigarh-based Buck Apps rewards users for uploading restaurant bills

After completing his engineering degree in 2017, he founded a coworking space business named NEXT57. This provided flexible office space solutions in tier-2 cities. Over the next three years, he expanded this business to four cities and 14 locations, with an annual revenue of 2M.

In late 2020, he joined Polygon (formerly MATIC Network) as a growth specialist. His major contributions were towards the NFT ecosystem and web2 adoption for the chain.

From 2021 and for the next 1.5 years, he worked as Program Director at Tachyon (an Accelerator by Consensys Mesh). Here, he helped incubate teams with growth and PMF strategies.

Nischit: Computer Science Engineer | Founded Tradefi Exchange previously | Hacker

Co-Founder and Tech Lead

Nischit is recognized for his outstanding problem-solving skills and creative approach to technology. He excels in leading teams and innovating under pressure, consistently providing solutions that improve and streamline business operations. His eagerness to tackle complex challenges and his progressive mindset are defining characteristics of his personality.

Previous Experience:

- Led the development of a platform similar to YouTube Shorts at Quiph, focusing on real-time video sharing (2020-2021).

- Developed OYO OS for hotel receptions at OYO Rooms, used in 7 countries (2018-2020).

- Created a scalable Load Testing System and a fault-tolerant Orchestration System at OYO Rooms, enhancing service reliability.

- Contributed to a high-capacity crypto exchange and optimized risk management for leveraged users at Bittmax Crypto Derivatives Exchange.

Shreyaan: Computer Science Engineer | Hacker

Full Stack Engineer

Shreyaan’s journey as a full-stack developer began in 2020, marked by an unwavering commitment to mastering the craft. His passion for technology and innovation led him to participate in numerous hackathons, a platform where he honed his skills and embraced practical learning. The highlight of his journey was the triumphant win at the Smart India Hackathon 2023.

Devansh: Computer Science Engineer | Hipster

Marketing Lead and Front End

Started his tech journey at 15 by winning the Google India Dev Hackathon.

Fueled by a relentless passion for crafting compelling product stories and his early love for tech.

Rohan: Generalist & Everything in Between | Hustler

Business & Growth

Rohan began his journey in high school, participating in quizzes, debates, and physics. His diverse career spans content creation, marketing, partnerships, technology, and B2B sales, with a constant drive to improve.

He has created promotional reels for companies, authored newsletters, and used his personal brand to guide over 100 students. In addition, he has been featured on a podcast and interview.

From Twitter to GitHub, Rohan’s presence is ubiquitous.

Side note: Over 57,000 people resonated with his thoughts here!

What novelty or innovation does your product bring to Arbitrum?

Mercle has created this application to address a few challenges in the Arbitrum ecosystem:

Point 1: Unified User Reputation Profile

Brief: Mercle plans to create a unified user reputation profile depicting their contribution on different arbitrum projects & receive incentives based on their interaction for that particular protocol. For example, if a user is active in the GMX, Gains or TraderJoe communities, they are starting to create their profiles on Arbitrum based on their contributions to different protocols.

Point 2: Increase Retention or Sticky Liquidity on Arbitrum

Brief: Mercle aims to fix user engagement within the Arbitrum ecosystem through a strategic approach that takes account of user incentives with their contributions across various projects. By participating in different Arbitrum projects users are motivated not just by rewards, but by the goal of solidifying their reputation within the Arbitrum network. This system of reputation-based incentives ensures that users are more than just visitors; they become integral, engaged members of the ecosystem. This engagement directly contributes to fulfilling the KPIs of individual projects, attracting a more dedicated user base, and enhancing the overall value of the Arbitrum network. As a result, projects see a marked improvement in their growth metrics, while Arbitrum benefits from network fees & more committed community.

Point 3: Streamlining Cross-Project Synergies

Brief: Mercle aim to streamline the interaction across the Arbitrum ecosystem by connecting user reputations to specific actions like DeFi tasks, social engagements, and community contributions. This integration allows projects to directly recognize and reward users based on their cross-platform activities. Imagine I deploy a dApp on Arbitrum & want to incentivize users in the form of boosted APRs, I can directly reward users who have a good reputation on Arbitrum to bring liquidity on dApp.

Is your project composable with other projects on Arbitrum? If so, please explain:

Yes, our infrastructure is composable with Arbitrum. Our indexers are built to track on-chain activities on Arbitrum & ERC-721 profiles can be deployed on Arbitrum for user profiles.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

Though their are a few protocols who are similar to Mercle on a very broader level, Mercle differentiate itself in many ways:

-

Dynamic Incentives System: Unlike most competitors, Mercle implements dynamic incentives, ensuring that rewards for users are flexible and adapt to their ongoing interaction with the platform. This creates a more personalized and engaging user experience.

-

Reputation Profile (through Dynamic NFTs): Mercle’s idea of reputation profiles sets it apart, offering users a valuable, cumulative reflection of their contributions and activities across projects. This not only incentivizes quality participation but also fosters a sense of identity and community within the different ecosystem.

Relevant usage metrics - Please refer to the OBL relevant metrics chart 42. For your category (DEX, lending, gaming, etc) please provide a list of all respective metrics as well as all metrics in the general section:

We internally track mints, attestations issues, Mint v wallet growth, social, community & defi PoWs, top users, etc. Here’s the Dune Dashboard.

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan: Yes, agree

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

No, Mercle did not use a grants consultant or third parties

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Mercle is a decentralized reputation graph protocol with a proof-of-work mechanism built using attestations, allowing Web3 users to build an on-chain reputation.

It enables decentralized apps (dApps) to incentivise users based on their engagement and on-chain interactions with their protocol. This allows them to attract new users, efficiently incentivise liquidity, and build a robust community.

We’re also starting to develop a mechanism for to reward Liquidity Providers (LPs) in concentrated liquidity pools with customized token incentives from incentivizers.

In Web3, where users are scattered, and everything is on-chain, Mercle creates a unified user profile based on a variety of off-chain and on-chain activities. With these comprehensive user profiles, companies can target users who closely match their ideal customer persona.

Is the protocol native to Arbitrum?: We deployed first on Polygon & eventually integrated with most of the EVM chains.

On what other networks is the protocol deployed?: All major EVM chains

Do you have a native token?: No

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

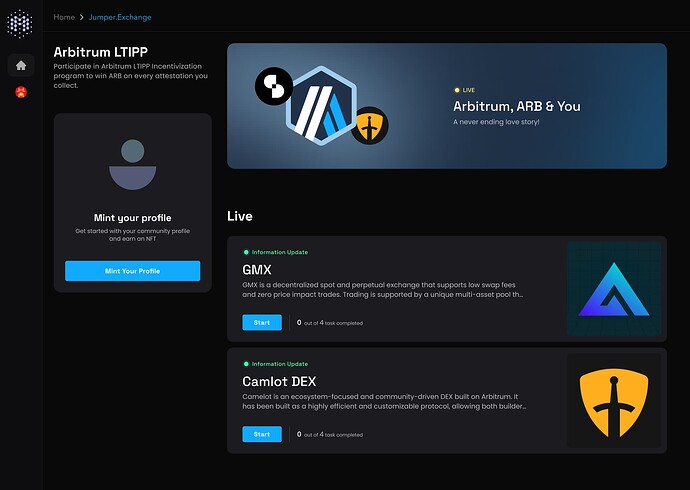

We’ve worked with more than 20 protocols with the names like Jumper Exchange, Polygon, Quickswap, Shapeshift, Powerloom, etc. Here’s a detailed breakdown of results & everything for major campaigns showing last 30 day growth.

Jumper Exchange

JUMPER BRIDGE TO LINEA CAMPAIGN

START DATE - 12TH FEB 2024

TOTAL BRIDGE EVENTS PULLED OFF DURING CAMPAIGN - 15.3K

REWARD DISTRIBUTED WORTH - $6000

CAC - $0.39 PER BRIDGE

ORIGINAL DATA BY - omid_raze

DATA LINK

JUMPER BRIDGE TO SOLANA CAMPAIGN ![]()

START DATE - 21ST FEB 2024

TOTAL BRIDGE EVENTS PULLED OFF DURING CAMPAIGN - 9.97K

REWARD DISTRIBUTED WORTH - $3800

CAC - $0.38 PER BRIDGE

ORIGINAL DATA BY - omid_raze

DATA LINK

Mercle MBadges

MBADGE Unique Holders - 36,849

Linea MBadge - 4567

Zksync MBadge - 10,654

Scroll MBadge - 7638

Berachain MBadge - 19,612

Swell MBadge - 3686

Blast MBadge - 10,500

Eth Bridged to Blast - 744

Eth Bridged - 2557

Here’s the Dune Dashboard w all the data & a ss attached.

Current Incentivization: None.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program? [yes/no, please provide any details around how the funds were allocated and any relevant results/learnings(Note: this does NOT disqualify an applicant)]

No, but we’ve got a few grants that helped us kickstart Mercle.

Biconomy: https://www.biconomy.io/

Grant Amount: 30K USD

Purpose: Sponsor gas fees for our users on Polygon to facilitate gas-less minting using their relayer network. The main was to utilise the relayer network provided my Biconomy

Results: Mercle Dapp supports gas, less minting for any community.

Polygon: https://polygon.technology/

Grant Amount: 20K USD

Purpose: Support Polygon chain and ecosystem dapps.

Results: Deployed 10+ loyalty NFT collections on Polygon driving 50k worth of on-chain contributions.

Protocol Performance: [Detail the past performance of the protocol and relevance, including any key metrics or achievements, dashboards, etc.]

We’ve have more than 125,549 unique users, isssues more than 1M+ Attestations with 200,000+ Dynamic NFT mints. For more detailed data, please check Dune.

We’ve have more than 100,000 unique users, isssues more than 550,000+ Attestations with 100,000+ Dynamic NFT mints.

For more detailed data, please check Dune.

Protocol Roadmap: [Describe relevant roadmap details for your protocol or relevant products to your grant application. Include tangible milestones over the next 12 months.]

- Launch our new UI/UX with more unified UX.

- Mercle’s own B2C incentivization structure

- Launch Mercle’s own Dapp level chain (L3) on Arbitrum.

Audit History & Security Vendors: [Provide historic audits and audit results. Do you have a bug bounty program? Please provide details around your security implementation including any advisors and vendors.]

No, we have got our dApp tested by a lot of testers, developers and community. We have plans to get this audited soon when we go Live with our app-level chain or L3.

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

No

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 197,000 ARB

Justification for the size of the grant 44: [Enter explanation. More details are better, including how you arrived at the required funding for individual categories of expenses covered by your grant plan]

Mercle requests 197,000 ARB to kickstart user journeys implementing reputation based profiles. We

will deploy different mechanism to incentivize users based on every action they do on the dapp.

Based on our calculation that includes parameters like transactions, users, TPU (transaction per user), SBT Mint Fee, DApps incorporated, Network Fee, CPA, we have come to this number (detailed breakdown below)

Our plan:

Objectives include:

- Bring unique addresses on Arbitrum

- Bring liquidity, users, etc. to Arbitrum Dapps

- Create a sense of belonginess using reputation profiles for Arbitrum ecosystem

- Help dApps target their users effectively - retroactive, perpetual, etc.

- Align with Arbitrum’s end goal and the growth KPIs of native dApps.

Structure:

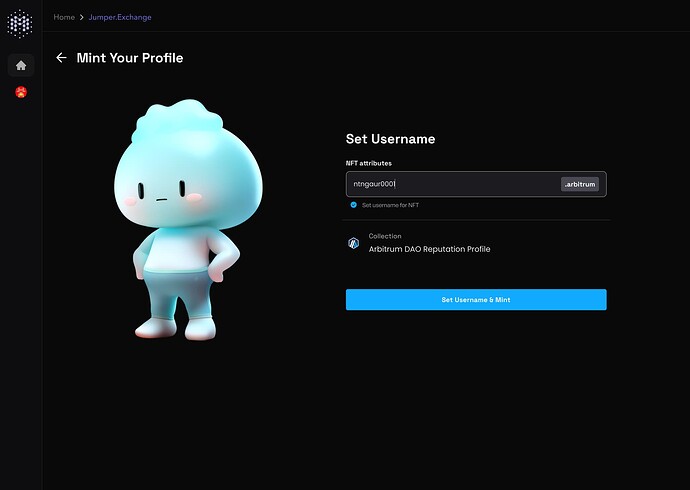

Before we start, we’ve planned to deploy a fun AVATAR specific to Arbitrum that will keep evolving & adding assets (skins) as & when a user contributes to different dapp on Arbitrum.

Month 1 - Go Live with 5 dApps & allocate 52,000 ARB to incentivize users for completing individual journeys for each protocol. Keep a tab of Data via Dune to study user behavior.

Month 2 - Allocate 62,000 ARB & go Live with 7 dApps to distribute incentives based on each user attestation. Based on previous month’s user behavior, we will iterate to make this month all about optimization.

Month 3 - Scale, scale & scale. We will deploy 82,000 ARB to scale by doubling the dApps & their journeys on Arbitrum.

Execution Strategy:

- Arbitrum specific community page (development is bootstrapped internally within the team)

- Deploy Dynamic NFT Avatar on Arbitrum that will be designed an independent NFT designer

- User Mints the NFT → enters the campaign → explore dApps → collect attestations → claim ARB

P.S. Detailed flow with design screen have been attached in section 4.

Grant Matching: [Enter Amount of Matching Funds Provided - If Relevant] N/A

Grant Breakdown: [Please provide a high-level overview of the budget breakdown and planned use of funds]

Grant will be used to completely incentivize users of Mercle & different protocols

| MONTH 1 | MONTH 2 | MONTH 3 | TOTAL | |

|---|---|---|---|---|

| ARB | 52000 | 62000 | 82000 | 197,000 |

| ATTESTATIONS (Actions/Transactions) | 276000 | 414000 | 552000 | 1242000 |

| USER | 46000 | 69000 | 92000 | 207000 |

| DAPPS | 5 | 7 | 10 | 22 |

| CPA IN ARB | 0.76 | 0.6 | 0.6 | |

| NETWORK FEE | 60260 | 89207 | 117760 | 267227 |

Funding Address: 0x02B2851E445955016be31c802Dc5f5a9f76EB3a2

Funding Address Characteristics: [Enter details on the status of the address; the eligible address must be a 2/3, 3/5 or similar setup multisig with unique signers and private keys securely stored (or an equivalent custody setup that is clearly stated). The multisig must be able to accept and interact with ERC-721s in order to accept the funding stream.

2/3 multisig with core team members & private keys securely stored.

Treasury Address: [Please list out ALL DAO wallets that hold ANY DAO funds] N/A

Contract Address: [Enter any specific address that will be used to disburse funds for grant recipients] Through a gnosis safe.

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Clearly outline the primary objectives of the program and the Key Performance Indicators (KPIs), execution strategy, and milestones used to measure success. This helps reviewers understand what the program aims to achieve and how progress will be assessed.

Objectives: [Clearly state the primary objectives of the grant and what you intend to achieve]

To be compliant with the Grant program requirement, grant funds will only be used to incentivize users & create reputation profiles of users & create user journeys.

| Objective | Description | KPI |

|---|---|---|

| #1 | A. New users that not only includes whales B. Revive the dormant wallets to get ARB as & when they collect attestations | 207,000 |

| #2 | Increase the usage of Arbitrum network & increase core growth KPIs of Arbitrum dApps | 1.2M transactions + 22 dApps |

| #3 | Launch Arbitrum specific reputation profile & dedicated gateway | 267227 in Network fees |

| #4 | Provide the Arbitrum DAO a detailed data on different metrics ensuring transparency. | Dune Dashboard |

Execution Strategy: [Describe the plan for executing including token distribution method (e.g. farming, staking, bonds, referral program, etc.), what you are incentivizing, resources, products, use of funds, and risk management. This includes allocations for specific pools, eligible assets, products, etc.]

We will be incentivizing users through a single unified Arbitrum specific gateway. There will be four types of rewards:

- ARB Incentives: for completing each task, users will be given ARB token, but that can be only claimed once a user completes the entire task of that particular dApp.

- Reputation Profile (Dynamic NFTs) - Users will be able to mint their Arbitrum specific Avatar that evolves (through assets). A visual representation of their Arbitrum interaction.

- Assest: As user completes a quest ( 1 quest = 1 dApp’s tasks), they will unlock a few assets that can be used to redesign their reputation profile and flaunt them.

- Points: For every action, users will be given points, which can make sense post Mercle goes Live with its own testnet incentive program in future.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric? [Provide relevant design and implementation details]

Here is the detailed breakdown of the flow with designs

- Arbitrum Specific Gateway

- Connect Wallet

- User mints their reputation profile by setting up a custom username (SBT) - this is a sample Avatar.

- User can start collecting attestation by doing a on-chain actions for each Arbitrum native dApp.

- As and when user goes into the journey, they can start claiming their assets to build their reputation profile. These assets are visual representation of the tasks completed.

- User is able to see their profile with task history and everything

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy. [Please also justify why these specific KPIs will indicate that the grant has met its objective. Distribution of the grant itself should not be one of the KPIs.]

| Objective | Description | KPI |

|---|---|---|

| #1 | A. New users that not only includes whales B. Revive the dormant wallets to get ARB as & when they collect attestations | 207,000 |

| #2 | Increase the usage of Arbitrum network & increase core growth KPIs of Arbitrum dApps | 1.2M transactions + 22 dApps |

| #3 | Launch Arbitrum specific reputation profile & dedicated gateway | 267227 in Network fees |

| #4 | Provide the Arbitrum DAO a detailed data on different metrics ensuring transparency. | Dune Dashboard |

Grant Timeline and Milestones: [Describe the timeline for the grant, including ideal milestones with respective KPIs. Include at least one milestone that shows progress en route to a final outcome. Please justify the feasibility of these milestones.]

Phase 1 ( 4 Weeks)

Objective: Go Live with 5 dApps & allocate 52,000 ARB to incentivize users for completing individual journeys for each protocol. Keep a tab of Data via Dune to study user behavior.

Allocation: 52000 ARB

Points:

- Launch our UI for Arbitrum specific campaigns

- Experiment with different categories:

- DeFis

- Perps

- P2E

- TradeFi

- NFTs

- Incentivize based on attestations (tasks done)

- Get to 276000 Transactions, 46000 Users with 5 dApps.

Phase 2 ( 4 Weeks)

Objective: Allocate 62,000 ARB & go Live with 7 dApps to distribute incentives based on each user attestation. Based on previous month’s user behavior, we will iterate to make this month all about optimization.

Allocations: 62,000 ARB

Points:

- Increase the dApps with more focused actions ( type of actions that have generated better ROI during phase 1)

- Push the sense of belonginess among users of Arbitrum & Web3 in general through our strong social media voice. (In short we’ll shit post & make defi fun)

- Get to 414,000 Transactions, 69,000 Users with 7 dApps.

Phase 3 ( 4 Weeks)

Objective: Scale, scale & scale. We will deploy 82,000 ARB to scale with 10 dApps & their journeys on Arbitrum.

Allocations: 82,000 ARB

Points:

- Retention, liquidity stickiness, user stickiness and positive vibes will be the focus.

- Increase the reputation profiles (SBTs) mints & push users to flaut them, push protocols to use our reputation profiles of users to target better & quality users. (not just whales)

- Get to 552,000 Transactions, 92,000 Users with 10 dApps.

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem? [Clearly explain how the inputs of your program justify the expected benefits to the DAO. Be very clear and tangible, and you must back up your claims with data]

- Every project in Web3 is uncertain about the best method for distributing incentives. This is a common issue we’ve found in over 500 projects, ranging from pre-seed to Series C funding stages. By creating reputation profiles, we aim to highlight that a user’s on-chain activities are what truly matter, regardless of their wallet value. Even if a user only has $100 in their wallet, their contributions to Arbitrum are valuable.

- We’ve received several growth stage grants. These have been used to develop Mercle in a sustainable way, ensuring that users are appropriately incentivized for their actions, with the protocol’s growth in mind.

Proven record of proven success using very small grants from Biconomy & Polygon. Our recent camapign bridge to Solana helped Jumper bridge 1M+ in amount to Solana. Number with bridge to Linea is significant too.

Here’s backing the claims - DUNE

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 40. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, the team is ready.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting]

Yes we are.

First Offense: *In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes we do agree on providing a final closeout report.

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?: [Y/N]

Yes

Contract Address: [Enter any specific address that will be used to disburse funds for grant recipients]

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream?

Yes