SECTION 1: APPLICANT INFORMATION

Applicant Name: Meta World Peas

Project Name: Peapods Finance

Project Description:

Peapods introduces a new concept called ‘Volatility Farming’; the ability to tokenize the volatile price movements of any token, and return it as yield for protocol stakeholders by creating and capitalizing on arbitrage opportunities.This has the benefit of increasing three vital ecosystem metrics; TVL, Volume and Transactions

Peapods works by wrapping one or more tokens into a pod [vault], and creating a synthetic pod receipt token that is made liquid via an incentivised liquidity pool. The pod receipt is always redeemable for its vault tokens, and therefore arbitrage opportunities occur whenever the liquid pod price deviates from its net asset value. Yield is generated by imposing wrap and unwrap fees on bots through the monopolized arbitrage path.

Furthermore we enable the first permissionless yield bearing crypto ETFs, which is currently an underserved $7.7T TradFi addressable market.

Every aspect of Peapods is composable and permissionless. We intend to become a positive-sum addition into the Arbitrum ecosystem, through providing:

- New DeFi primitives capturing an untapped yield source on Arbitrum; Volatility.

- Permissionless vaults that invoke sticky TVL

- Boosted DEX fees and trading volume through arbitrage

- Enabling new sources of yield for any liquid Arbitrum token

- Composable lego-brick mentality, able to leverage and be leveraged by other protocols

- Permissionless creation and trading of liquid ETFs by anyone from anywhere

- Sustainable and sticky Liquidity campaigns via Liquidity-as-a-Service model

Team Members and Roles:

Eaturpeas – Lead Developer

Peapod Intern – Business Dev / Conceptual

Meta World Peas – Business Dev/Socials

NonFinancialAdvisor – Back-end Developer

Iammazda – Brand & Marketing

Shiroyasha – Front End Developer

Project Links:

Website

DApp

X/Twitter

Telegram

Discord

Contact Information:

Point of Contact: @MetaWorldPeas

Point of Contact’s TG handle: @MetaWorldPeas

Twitter: @meta_world_peas

Email: team@peapods.finance

Do you acknowledge that your team will be subject to a KYC requirement?:

Yes.

SECTION 2a: Team and Product Information

Team experience:

Team all have prior experience in designing and delivering DeFi protocols. Our lead dev has developed contracts securing over $1B in funds across various projects. We can provide these details to our LTIPP Advisor privately upon request and are willing to privately KYC upon successful application.

Although the team is publicly anonymous, the protocol is decentralized and permissionless, and all contracts are audited and immutable.

What novelty or innovation does your product bring to Arbitrum?

Peapods brings the first and only fully sustainable Volatility Farming protocol to Arbitrum.

Our platform captures and tokenizes relative price movements between our pod vault assets and their liquid receipts. This novel tokenized volatility yield is fully composable and can be applied across the Arbitrum Ecosystem.

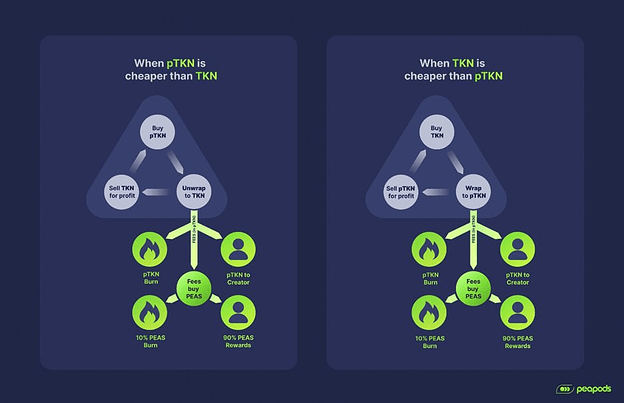

The Peapods protocol works by depositing one or more tokens into a vault [pod]. When the underlying tokens (TKN) in the pod appreciate in value, the synthetic pod token (pTKN) becomes underpriced in its LP. Arbitrage bots will then buy the underpriced pTKN, and unwrap for TKN to sell as profit. Likewise, when TKN depreciates, arbitrage bots will buy TKN and wrap for pTKN to sell overpriced. In both cases, the arbitrage bot must pay the wrap or unwrap fees, which are returned to the pod stakeholders.

All pod fees are collected in the pTKN. Part of these pTKN are burned, such that the amount of TKN each pTKN receipt is redeemable for increases over time. This means, the pTKN is continually appreciating/ “up-only” with respect to TKN, and means that any ERC20 can be added to a pod to create a source of yield, as seen in the image below.

The other part of the pTKN fees are sold back into its LP pair, and used to buy the PEAS token. 10% of the PEAS bought are burned, and the other 90% are provided to the LPs as yield. This means LPs get the AMM fees of token trading, plus the wrap and unwrap fees of arbitrage and/or users speculating on future pTKN yield. This also means that all rewards are distributed from market-bought $PEAS, which adds irreversible net buy pressure to the PEAS token as a result of the 10% burn mechanism.

All aspects of our protocol are composable, and as a result, this provides the following novel benefits to the Arbitrum Ecosystem:

New untapped source of yield for any ERC20

Peapods can create a new “up-only” yielding liquid derivatives for any ERC20. These can be used in DeFi such as yielding collateral in lending markets or CDP protocols, yield speculation, interest rate swaps, etc

Yield bearing Index / ETFs

Peapods enable the first permissionless yield bearing crypto ETFs, which is currently an underserved $7.7T TradFi addressable market. Indexes are pegged through arbitrage, and require no oracle integration. Any ERC20 can be added into the index, in any weighting, and is made liquid through the liquidity pool incentivized through volatility yield.

Liquidity-as-a-Service, funded by volatility

Peapods uses the natural volatility of a token, or its paired asset, to generate fees and tokenize the volatility as yield. A portion of this yield is automatically attributed back to the LP. This solves the age-old issue of obtaining and then keeping LP’s incentivized. This means any and every protocol on Arbitrum can leverage Peapods to create self-incentivized liquidity, without needing to pay for emissions or bribing.

Increases TVL of DEXes

All our pods automatically come with incentivised liquidity through our fee buyback and burn. Our chosen partner to host this liquidity is Camelot, and therefore our success will necessarily incentivize significant TVL to their platform.

Increase volume and transactions across all Arbitrum DEXes

Our pods create arbitrage opportunities between our incentivised pool and all other sources of liquidity. This forces constant trading volume between our pods hosted on Camelot to any other DEX hosting liquidity of the underlying (e.g. Ramses / Uniswap / Sushiswap / etc)

As a result, Peapods as a novel protocol on Arbitrum will increase TVL and liquidity across the network, as it forces arbitrage opportunities in the market that previously did not exist. This additional activity and constant arbitrage transactional volume improves the metrics of Arbitrum and its native protocols, versus other layers/chains.

Is your project composable with other projects on Arbitrum? If so, please explain:

All aspects of the Peapod protocol are fully composable.

Any protocol can add their composable tokens into a Peapod vault to earn yield on volatility. This includes composable staked derivatives, where Peapods can provide additional yield through volatility and also incentivized sticky LP and TVL. Furthermore, the “up-only” receipt tokens of the pod, and the PEAS yielding staked LP positions, are all fully composable and therefore ready to be reintegrated into the wider Arbitrum DeFi ecosystem.

Peapods does not rely on any oracles or integrations, and is completely permissionless to use.

Methods of composable integration include:

- Third party protocols adding any one or more token(s) into a Peapods pod to generate a native yield source for their derivatives, and/or create a sticky TVL sink.

- Using Peapods to create self-incentivizing liquidity for otherwise illiquid tokens.

- Using staked pod LP receipts used as a liquidity mining campaign fully funded through volatility. These composable receipts can be further staked on third party protocol as ‘proof of liquidity’ which can be rewarded with additional benefits.

- Adding composable staked liquidity receipts into Arbitrum based vault yield protocols to auto-compound volatility yield in to more LP

- Using yielding pod receipts across third party Arbitrum protocols. For example, such liquid yielding tokens can be used as CDP collateral, money market collateral or debt, PT and YT derivatives, interest rate swaps, etc.

- Pods can integrate and promote any composable token as a pairing token, which in turn can create demand for the token, and generate volume and fees back to their POL. For example, Peapods integrated OHM on L1 leading to a 15% appreciation in OHM price, and triggered the issuance of Reserve bonds for the first time in the history of their protocol [source].

- The PEAS token itself is a deflationary proxy for the aggregate volatility of all pods hosted on the platform through its buyback and burns. Further, the token has deep cross-chain liquidity across its main pairings and multiple pods. This token can therefore find interesting use-cases in DeFi to speculate on market volatility.

- As a fully-backed and liquid ERC-20 asset, pod tokens (and pod LP receipts) can also be seamlessly integrated within the ecosystem of any project in the same manner as any ERC-20 token, including their own native token.

Furthermore, Peapods does not compete with any other protocol, yet provides mutually beneficial opportunities for cooperation and creating network effects. For example, for our Arbitrum launch, Peapods have already publicly partnered with:

- Camelot Exchange as the hosting AMM for all Peapod liquidity. Pod LPs will be incentivized perpetually through our sustainable tokenized volatility model, as well as ad hoc GRAIL incentives from the Camelot team. Providing GRAIL incentives to further deepen pod LP is in Camelot’s interest as it increases their TVL and trading volume metrics.

- Olympus DAO recently voted in OIP-157 with unanimous support to bridge 6-figures of POL liquidity to Camelot for the explicit purpose of continuing its partnership with Peapods on Arbitrum. As detailed in the OIP, Peapod’s integrations have accumulated the largest concentration of OHM liquidity in the market today, all funded by real yield without emissions. The fact that Olympus voted to follow Peapod’s lead in expansion to Arbitrum is testament to Peapods’ network effects.

- We also have many other non-public planned integrations and partnerships, including discussing supporting protocols to migrate to Arbitrum through our liquid pod bridge. We are respectful of our potential partners’ privacy but we have active discussions with a number of established projects from the Arbitrum ecosystem.

The Peapods protocol can be used to permissionlessly integrate primitives from other Arbitrum protocols into pods, and the receipts provided with all interaction of Peapods can be used in other Arbitrum protocols. Therefore, Peapods offers composable lego-bricks that can build upon the existing Arbitrum ecosystem, to build a new and novel yielding base layer for other protocols to build upon in turn.

Pods create novel, liquid, yield bearing, composable primitives that are “up-only” versus the tokens they represent in the vault. Pods can therefore be integrated into the Arbitrum DeFi ecosystem as a lego-block to add tokenized volatility yield to existing primitives, or be integrated into other protocols as yielding collateral.

Pods can accept any composable ERC20 interfacing token, and the yielding receipt tokens can be used in any number of Defi applications, presenting endless possibilities for further integration within the ecosystem.

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

Peapods are a first mover and still the only protocol currently offering a sustainable “Volatility Farming” product on any layer / chain. The closest comparable protocol would be a DEX incentivising liquidity, however we are not competitive with any DEX as we instead direct TVL and volume towards them as opposed to drawing TVL or volume away from them.

How do you measure and think about retention internally?

Our protocol success is predicated by TVL and this is our major KPI metric.

The greater the depth of liquidity, the greater the depth of profitable arbitrage. This is because the arbitrage bots can buy or sell more pTKN within the profitable slippage limitations. More arbitrage increases fee accrual for the protocol, which in turn leads to greater yield for liquidity providers, thereby attracting more TVL in a flywheel fashion.

Due to our embedded wrap and unwrap fee structure TVL is sticky, as it incurs an exit cost when supply in a pod is contracted. Our TVL retention is clear from looking at the TVL metrics on DefiLlama which shows non-PEAS TVL steadily increasing over time, despite mainnet gas providing a significant barrier to entry.

Relevant usage metrics:

We will report on TVL, Liquidity, number of pods and depositors as well as our ratio of LP:TVL.

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

Yes.

The team wallets (i.e. multisig treasury, deployer) will not add any of its liquidity to Arbitrum pods until the LTIPP incentive period is over.

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

No.

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?

No. Peapods initially launched on Ethereum Mainnet and have expanded to Arbitrum One before the deadline to finalize LTIPP applications.

On what other networks is the protocol deployed?

Peapods is currently only deployed on Ethereum Mainnet.

What date did you deploy on Arbitrum mainnet?

We deployed on Arbitrum One Mainnet on the 14th of March, 2024.

Transaction ID:Arbitrum Transaction Hash (Txhash) Details | Arbiscan

PEAS contract address: 0x02f92800f57bcd74066f5709f1daa1a4302df875

Deployer Address: 0x21FE3e26E824783cA7E374355A8D30Ae8BBf6E37

Do you have a native token?

Yes. Our native token is PEAS and details can be found at PEAS Tokenomics - Peapods FinanceThe PEAS token on Arbitrum is an OFT, bridged from mainnet using LayerZero’s cross-chain messaging service.

The PEAS token is deflationary and is used as a rewards and utility token within the ecosystem. All rewards are market bought using yield generated from pods, where a portion is burned, and the remainder is given to pod LPs.

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

We have not run any Liquidity Mining campaigns. However through our deflationary Volatility Farming model we have attracted >$10M of non-PoL PEAS liquidity and over $20M of non-native TVL. Our total TVL peaked at $63M and currently sits at ~$49M.

You can see data related to the TVL of Peapods at https://defillama.com/protocol/peapods-finance

Current Incentivization: How are you currently incentivizing your protocol?

Our protocol is currently incentivised from real yield, derived from users and arbitrageurs participating in the protocol and generating fees. There are no emissions or inflationary rewards used, and all PEAS used as rewards have been bought from the open market using these fees. Since the price of PEAS does not impact the $ value of rewards received per fees earned, there is no risk of reward incentive tapering with fluctuations to PEAS price, as is common across other rewards token models.

In total, pod fees have market bought >4% of PEAS total supply, at present prices representing ~$2M in yield. You can track our protocol real-time performance using this community Dune dashboard.

On our expansion to Arbitrum, we have partnered with Camelot Exchange who will provide GRAIL to further incentivize pods ad hoc.

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

No.

Protocol Performance:

Through a fully sustainable model, with all rewards being derived from the open market, Peapods has achieved on Ethereum Mainnet;

- $60M TVL incl. PEAS

- $20M of non-PEAS TVL

- Over $2M of Real-yield to LPs and pTKN holders

- 61 unique pods, created permissionlessly by users

The concept of sticky TVL has been proven, with non-native TVL has been increasing since launch.

Since our launch on Arbitrum on the 14th, we have accumulated over $3.3M in TVL, and 22 Pods, adding LP and yield to many tokens on Arbitrum.

Protocol Roadmap:

There are a number of ambitious roadmap items that we are actively working towards. These have not yet been publicly announced so we will provide a brief overview:

- Integrated protocol upgrade that allows users to add LP with greater capital efficiency and exposure to their chosen pTKN

- Additional utility for our native PEAS token which may lead to additional real-yield opportunities, paid in stables

- Additional protocol functionality designed to increase revenue directed toward specific pods

Audit History & Security Vendors:

We work with yAudit and select private auditors who review all of our contracts. You can see the latest audit report from yAudit for our native token and all active contracts, here.

Further we can provide access to our private repo which includes the outcomes of our bug bounties.

We also have also had multiple audits with Solidity (Formerly Source Hat), here

Security Incidents:

[Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

Yes on December 13, 2023 1 1 a white hat exploited a vulnerability in our core pod code that resulted in the ability to extract underlying pod collateral. This was allowed due to a logical bug from not locking state changes during a flash loan against the pod. Upon identifying the exploiter had drained the majority of tokens from one of our pods, we exchanged on-chain messages, got the white hat in our telegram DMs, and negotiated a return of funds in exchange for a small bounty for identifying the issue. We stayed in constant communication both on our primary project telegram group and on twitter, and have since invested heavily in security reviews/audits from a number of firms, primarily and namely yAudit (a subsidiary of Yearn Finance) who has done several thorough code reviews and audit reports for us. For any future project functionality we employ on chain we are committed to the utmost security and ensure said code is reviewed and fully audited by either yAudit or a comparable future audit partner to prevent any possibility of future incidents from occurring.

All users affected by this were reimbursed 110% from a combination of team treasury plus recovered funds.

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 360,000 ARB

Justification for the size of the grant 22:

Our protocol aims to provide the liquid yield market on Arbitrum. Peapods intends to attract tokens and primitives TVL from other protocols in the Arbitrum ecosystem, to create new yielding primitives in vaults with proven sticky TVL characteristics.

Once pods are seeded with TVL, the proven integrated flywheel mechanism takes over to attract more TVL, and to retain existing TVL through consistent yield and exit fees. However, obtaining the initial TVL into a pod to start the flywheel has been a challenge on mainnet. Therefore, the Arbitrum LTIPP rewards can be used to bootstrap the initial TVL needed to kickstart the flywheel.

Another targeted area for improvement from mainnet is the conversion rate of passive receipt token holders into liquidity providers. We intend to use the LTIPP grant proceeds to focus on incentivising only liquidity providers within important or strategic pods.

Our deployment on mainnet has proven that the greater the liquidity, the more depth of arbitrage occurs, leading to higher yield generation for the pod, and thus attracts more TVL. Having pods reach critical mass where they become successful benefits all stakeholders, including partner protocols who’s tokens are podded, the DEXes where the liquidity is hosted, and those who are leveraging the yielding pod receipts in their ecosystems. Therefore, the LTIPP grant enabling successful pods can help attract and retain TVL across all protocols involved, thus benefiting the whole Arbitrum ecosystem.

As pods are permissionless, it is impossible to pre-determine which pods to incentivize as many will be added during the 12 week campaign timeframe. Instead, the $ARB rewards will be distributed to LPs of important or strategic pods weekly as determined by snapshot voting of Arbitrum bridged PEAS stakeholders. Team controlled PEAS (ie held by the deployer and/or multisig) will be ineligible to vote to ensure that no bias can be attributed to team in the reward distribution process.

Grant Matching:

Our PEAS token launched fully diluted, and therefore has no emissions or reserved rewards to provide grant matching.

However, our native token PEAS will continue to be bought from the market and used as a perpetual incentive for the platform alongside any LTIPP rewards.

Funding Address:

0xc64bc02594ba7f777f26b7a1eec6e6dc4a56362b (4/7 Multisig)

Funding Address Characteristics:

Safe Wallet 4/7 multisig, requiring signatures from 4 of the 6 team members, and deployer.

Each signer’s private key is stored on a hardware device.

Treasury Address:

All addresses listed below are relevant for ETH Mainnet and Arbitrum;

Deployer: 0x21fe3e26e824783ca7e374355a8d30ae8bbf6e37

Multisig: 0xc64bc02594ba7f777f26b7a1eec6e6dc4a56362b (4/7 Multisig)

Arb bot: 0xb84b33406d30f96ad63350989f6122fe4675c8f1

Contract Address: [Enter any specific address that will be used to disburse funds for grant recipients]

0xc64bc02594ba7f777f26b7a1eec6e6dc4a56362b

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives:

We intend to leverage the grant to incentivise non-native TVL growth, and particularly to entice greater participation in terms of liquidity provision to pods. This is to ensure greater depth of arbitrage, which in turn will enable greater volume and fees to flow through the protocol (and wider Arbitrum ecosystem) with the intent to retain sticky liquidity.

The objective outcomes of the LTIPP grant would be to incentivize:

- 10 pods with >$100k TVL of Arbitrum-native primitives

- Sufficient LP into pods to kickstart the self-incentivizing flywheel

- Generate new DeFi primitive liquid yield derivatives that spur integration within wider Arbitrum ecosystem

- Create a sticky TVL sink for Arbitrum primitives

- Boost liquidity and TVL on the Camelot DEX

- Stimulate volume across all liquidity sources and DEX’s on Arbitrum

- Attract further Defi participants to Arbitrum through our network effects (ie Olympus OHM)

- Entice protocol TVL to move from Ethereum mainnet to Arbitrum

Execution Strategy:

We will utilize the grant to incentivize LP for our pods to boost yield during the bootstrapping phase. This approach will accelerate the process of establishing arbitrage depth to a level where the protocol’s flywheel of organic yield generation can consistently deliver attractive returns, enabling the protocol to sustainably retain liquidity post reward period.

The 360k ARB grant sought will be divided into twelve 30k ARB reward epochs.

The 30k ARB will distributed weekly per below;

- 29k ARB distributed between 5 pods as per voting mechanism described below.

- 1K ARB will be reserved for a apARBETH pod to ensure there is constant incentivisation for ARB LP via our platform. This will represent a minimum weekly reward for this pod, but it will be eligible to receive rewards from voting as well.

The ARB rewards will be distributed to pods on a weekly basis, determined by snapshot voting of Arbitrum bridged PEAS stakeholders. This provides a tangible incentive for users to bridge their PEAS from Ethereum mainnet to Arbitrum, further driving TVL to the ecosystem.

The vote will last for one week and rewards will be distributed across the following week as broken down below.

Note:The team controlled wallets will be ineligible to vote to ensure no biases of reward flow. The team also reserves the right to adjust the weekly voting list based on criteria, or remove any pod from contention for rewards if it appears to be nefarious or maliciously ‘gaming’ the rewards system.

The voting process will determine the relevant pod winners for each weekly epoch;

# 1: 29K ARB to the Top 5 Voted Pods

- Pod that receives the most votes will get 12,500 ARB rewards deposited over 3 transactions

- Pod that receives the second most votes will get 7,500 ARB rewards deposited over 3 transactions

- Pod that receives the third most votes will get 5,000 ARB rewards deposited over 2 transactions

- Pod that receives the fourth most votes will get 2,500 ARB rewards deposited over a single transaction

- Pod that receives the fifth most votes will get 1,500 ARB rewards deposited over a single transaction

# 2: Guaranteed 1K ARB to incentivise the pARB Pod

Rewards will be distributed ONLY to apARBETH (0x78214a48762062934eece023fff7695c1fa20677) in a single transaction each week

Depositing of the rewards will be randomized over the week to ensure users can not game the system and encourage sticky liquidity throughout the week.

We will provide regular updates on the progress and results of each weekly vote period with a specific focus on sharing that the funds were provided via the LTIPP grant program and will seek to highlight the results of pods created by other LTIPP participants.

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric?

First, liquidity in pods exhibits a certain degree of stickiness due to unwrap fees, which incentivize long-term holds.

Secondly, as liquidity increases, a positive feedback loop activates that leads to progressively higher real yield generated by arbitrageurs which attracts more LPs and token holder TVL.

Thirdly, since our pod tokens are all liquid assets, we are able to work with partner projects who support their pod tokens in order to integrate these tokens further into their ecosystems.This provides additional demand and incentive for users to interact with and speculate on pod tokens.

Combining all these effects, we anticipate a scenario where users find it more attractive to hold - and partner projects find it more attractive to integrate - yield-generating pod tokens with substantial utility compared to plain vanilla assets. Consequently, we expect most users and partner projects to be unlikely to feel incentivized to exit.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy.

There are four major KPIs we are focussed on with regards to this grant, as they will indicate that the grant funds have been successful in achieving our major goals of attracting sticky liquidity and incentivising greater participation in Liquidity Provision.

The four KPIs we are most focussed on are;

- Total Value Locked (Split by Total, and non-PEAS)

- LP Total Value Locked (Split by Total, and non-PEAS)

- LP:TVL Ratio

- Number of pods created

Grant Timeline and Milestones:

We have an ambitious target for delivering $25M of total TVL on Arbitrum over the 12 week LTIPP period which we believe that the grant can help us to achieve. This reflects just over half of the TVL to what we currently hold on Ethereum Mainnet, which we were able to accrue in just 3 months and solely via real yield incentives.

We believe the low gas environment of Arbitrum, plus the LTIPP grant incentives should make it easier to attract more TVL than ETH mainnet, however lower estimates were provided to ensure a reasonable proposal.

We are also aiming to increase LP participation across the protocol and have a protocol-wide target of 30% LP:TVL. We feel that with a generous grant, we should be able to reach these milestones on Arbitrum.

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?

An ARB grant would enable Peapods to provide an attractive and enticing boost to yields for LP TVL during the important bootstrapping phase for the protocol. As our protocol yield is driven entirely via real yield from protocol fees, an Arbitrum grant instantly makes Arbitrum the most appealing ecosystem for anyone seeking to participate in Volatility Farming with Peapods. Our voting mechanism also acts as a motivation for users to bridge their PEAS tokens and liquidity to Arbitrum in order to vote. We strongly feel that once users migrate to Arbitrum, they will have very little incentive to leave as the low gas experience is synergistic to the performance of our protocol.

Once TVL is secured within the protocol, it tends to be very sticky. This sticky liquidity has multiple positive impacts on the broader Arbitrum ecosystem as it leads to greater trading volume and liquidity depth. This directly results in more volume, TVL and transactions across the entire ecosystem.

Furthermore, our recent ‘Green Arrows’ pod update (v2) included a mechanism that allows volatility yield to accrue to the pod token (vault receipt) itself. This means, we can create liquid yielding derivatives of any Arbitrum token or index of tokens. Such a liquid yielding derivative is perfect for integration within the wider Arbitrium DeFi landscape.

Therefore we expect further innovation to occur to be based on unique and novel applications and integrations of our platform into the wider Arbitrum ecosystem.

You can see L1 maintain TVL data displayed at; defillama.com/protocol/peapods-finance 1

And data for the yield we tokenize back into our pods on our website in terms of the ‘CBR APR’ Peapods Finance

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream? [Yes/No]

Yes.

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 19. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO?

Yes.

Are there any special requests/considerations that should be considered?

No.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard?

First Offense: In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program?

This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.)

Yes.

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?:

Yes.