M&A Pilot Phase Bi-weekly #1 (June 12) - Week 1+2

Thank you all for your trust in the initiative and a first productive bi-weekly call!

The bi-weekly updates call are an opportunity for interested parties to contribute, ask questions, and most importantly challenge deliverables. Find below key items of consideration:

- Recording: Bi-weekly Call #1 June 12

- Telegram Group: Invite

- Current working docs: Strategic Target Areas Long List

For these who would like to contribute on the Strategic Target Areas exercise - please see guidelines below and feel free to reach out via TG @bmitte.

Looking forward to the next call!

[Call to Action] Strategic Target Areas Review

Most important things first. A key element of discussion was the progress on the Strategic Target Areas for Arbitrum DAO. Find detailed context below.

In this workstream, we aim to achieve two main outcomes:

- List of Strategic Big Bets for Arbitrum: Strategic themes that foster user and builder activity, generate revenue, and enhance Arbitrum’s competitive advantage. This list will guide M&A targets and can be used by any other initiative across the DAO.

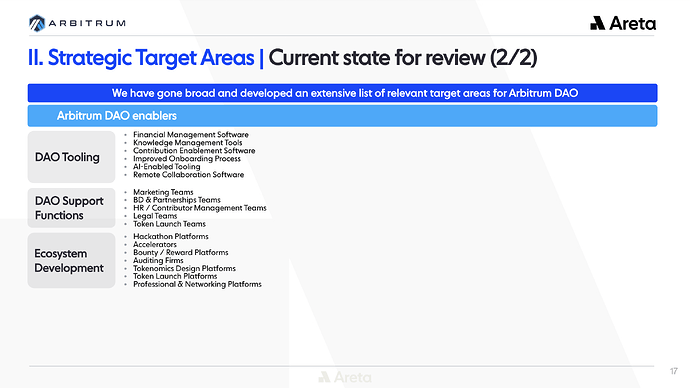

- List of Specific Target Areas for M&A: This includes some Strategic Big Bets as well as DAO enablers, i.e., additions that operationalize, scale, and streamline the DAO, that have undergone additional assessment for M&A fit.

Current Status

At this stage, we are exploring a broad range of (1) Strategic Big Bets and (2) DAO enablers for Arbitrum DAO, conducting directional assessments before in-depth analyses. We are currently considering 70 potential target areas and plan to distill these to an aligned set of 5-10 high-priority ones.

- For review: See the slide with the target areas below.

- For detailed descriptions and further on our initial view for M&A fit check the detailed list.

How to: Review current state of target areas

We invite you to review the current list of Strategic Target Areas and provide feedback via TG or here. We seek broad community and delegate input to ensure we cover all necessary areas and gain initial insights.

Things to consider:

- Is there any Strategic Big Bet or DAO enabler missing that you believe should be included/assessed?

- Which Strategic Big Bets and DAO enablers should be prioritized by Arbitrum DAO and why?

- Extra, if you want to go deep into the extended list: Do you agree with the initial ratings for M&A fit, or do you have strong opposing views on any?

[To Do] Strategic Target Areas for Review

Summary: Bi-weekly Call #1 - 12 June

Agenda

We used the first bi-weekly to guide through the following topics:

- Pilot Phase Scope Walkthrough

- Workstream Approach and Status: M&A Value Upside, Strategic Target Areas

- Discussion & Next steps

Summary of Outcomes

Here are the highlights of the call outcomes. We decided to include the key slides here as they are the easiest to grasp vs. written text.

Chapter 1: We discussed the scope and key deliverables

Chapter 2: We discussed the approach and status for 2 workstreams

M&A Value Upside

Strategic Target Areas

Chapter 3: Topics highlighted in discussion by call participants

These are topics highlighted by call participants that we deem high priority. Some were already included in our work packages and will now receive extra emphasis due to their importance, while others will be added anew.

- Post-acquisition integration: Details on integration of M&A targets into the DAO, incl. views on incentivization of stakeholders (team, managers, DAO participants) and integration flow.

- Buy/fork vs. build framework: Framework on buy/fork vs. build decisions.

- Open feedback to Strategic Target Areas: Platform for the wider community for feedback on strategic target areas next to direct outreaches to delegates (beginning of this thread).

- Areta research vs. delegate coordination exercise: Own in-depth research on strategic target areas, besides views collected from delegates and other stakeholders.

- Build up on existing strategy work: Inclusion of existing pieces on strategic target areas exercise.

- M&A acquisition upside metrics: Framework to measure financial/value upside for Arbitrum DAO.

- M&A next to other capital allocation initiatives: Overview on how M&A sits next to other initiatives.

- Acquisition payment in liquid ARB: Considerations on paying acquisition prices in liquid ARB (vs. equity and/or cash).