TLDR: This post calls for a working group to explore M&A for Arbitrum DAO to equip us to take advantage of this growth segment. We invite the community to join our first working group call on Wednesday, March 20 at 13:30 ET to get involved.

Hi all, kicking off the Arbitrum M&A working group out of discussions in Denver.

As M&A is one of the largest growth opportunities for Arbitrum we are extremely excited to move this topic forward!

Please find below more details:

I. Context on the M&A Working Group

II. Background on the Arbitrum M&A Opportunity

We are meeting on Wednesday, March 20 at 13:30 ET (18:30 CET) for our first weekly call. Please find the invite in the Arbitrum Governance Calendar and below.

I. Context on the M&A Working Group

What? M&A Working Group

Why? To explore the potential for M&A within Arbitrum DAO

How? Starting with a month of exploration, we will focus on one milestone each week to explore the potential of M&A for Arbitrum DAO and to develop a structured plan.

When and Where? Kick-off of Weekly Calls on March 20 at 13:30 ET.

Our next meeting will take place on Wednesday:

Arbitrum M&A Working Group - Community Call #1

Wednesday, March 20 · 13:30 – 14:30 ET

Google Meet joining info

Video call link: https://meet.google.com/dgk-cbvp-qfx

Milestones:

For the next 4 weeks, we will work along 4 milestone topics to advance the topic. This is a first suggestion, obviously this is open for discussion and input.

- Week 1: Understand DAO/DeFi M&A basics

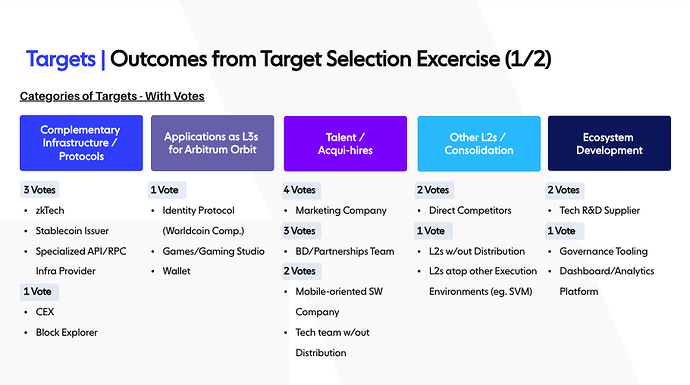

- Week 2: Discuss M&A target areas for Arbitrum DAO

- Week 3: Assess risk and mitigation strategies for M&A for Arbitrum DAO

- Week 4: Develop a conceptual structure for M&A for Arbitrum DAO

Who?

Everyone passionate about the topic is welcome to join and contribute.

This group is open to all major stakeholders, not just those listed.

To date, this group has a couple of initial members: @jacobpphillips, @Matt_Gauntlet, @JoJo, @MattOnChain, @juanbug, @AbdullahUmar, @raam, and @sid_areta.

We also invite @stonecoldpat @cliffton.eth and other Arbitrum Foundation members to attend. Areta offers to lead the group and facilitate the discussion.

Outcome?

An ideal outcome after a month of exploration would be to equip ourselves with enough knowledge and align our efforts, gaining conviction to advance the topic with the next practical steps. These would be (in our mind) to involve an independent legal party to assess the possibility of Arbitrum DAO M&A from a regulatory/legal perspective. But let’s see where the working group discussion will lead us.

II. Background of the M&A Working Group

Abstract

This thread outlines the opportunity for Arbitrum DAO to identify and execute on M&A opportunities.

Arbitrum is among the largest, most active DAOs in the space with a $8 billion treasury. One of the primary ways for Arbitrum to scalably deploy capital and grow rapidly is to get in the M&A game, and the upside is potentially massive. Additionally, this is a largely untapped opportunity in crypto, only explored by a few different projects in the space; therefore, delving deeper into M&A would enable Arbitrum to get a jump-start on its competitors.

1. Motivation and Opportunity

Why Arbitrum Should Consider Exploring M&A

Arbitrum DAO has significant potential to be the first movers in this market. Other leading ecosystems have started to explore the opportunity as well (e.g., Uniswap’s former discussion which is not moving ahead at the moment), and Polygon has made M&A a cornerstone of its growth strategy.

Several M&A market catalysts are converging:

- Early Industry Maturation: Incumbents buying companies with high growth potential.

- Protracted Bear Market Distress: Leads to increased distressed sales.

- Buy or Build: Newcomers to web3 consider acquiring instead of in-house development.

- Regulation & Compliance: Companies acquire those with necessary licenses to navigate regulations.

- Acquihire: Companies buy others mainly for their web3 developer talent.

Preliminary M&A Target Areas for Arbitrum

There are several initial ways in which M&A could act as a key growth driver for the Arbitrum ecosystem (non-exhaustive):

1. Tech Talent Acqui-Hires

Acquire or acqui-hire a team and enable them to focus on building tech for (or otherwise servicing) the Arbitrum DAO. The best opportunities are tier-1 tech teams who need distribution.

There are already examples of this occurring in Web3, one which is close to home for Arbitrum:

- Polygon acquired Mir in Nov 2021 for $400M. Mir’s system generates recursive zero-knowledge proofs which results in one of the fastest and most efficient L2 options (see case study). This transaction presents a compelling narrative for Arbitrum: The founders of the Mir protocol had technically built the best ZK chain, but launching a token would likely have led to failure. Therefore, the acquisition was mutually beneficial.

- Offchain Labs bought Prysmatic Labs, one of the core engineering teams behind the Merge, bringing in 11 new engineering talents to the Offchain Labs team.

- Hadron Labs brought Duality Labs to Neutron, an app-chain on Cosmos, as a core team. Hadron Labs allocated 2.5% of the NTRN supply as a long-term incentives package to current Duality Labs members with a 1-year lock and 3-year linear unlock.

Other adjacent examples include: Governance tooling that can potentially be scaled and licensed out to other DAOs (e.g., grants management platform, improved governance portal, etc.).

2. Acquire or Strategically Invest in Complementary Infrastructure / Protocols

Zero-knowledge technology, e.g., could play a large part in Arbitrum’s future and strategic acquisitions / investments could accelerate the realization of this vision. Arbitrum can super-charge its entry into the ZK space by acquiring or investing in pioneers in the ZK space, such as Lagrange, Panther Protocol, Herodotus, Ingonyama, or Supranational (these are just examples for illustrative purposes).

3. Acquire L2s

The L2 space is saturated and extremely fragmented at the moment and is only expected to grow in the future. While there are efforts to unify liquidity and enable interoperability across the ecosystem, these will take time to be perfected, and in the meantime, will fragment users and liquidity. With its large treasury, Arbitrum could potentially acquire L2s to unify the ecosystem, grow its user base, and reduce competition and fragmentation in the space.

4. Acquire Applications as L3s for Arbitrum Orbit

Arbitrum is a clear leader in the derivatives and DeFi markets and has made great strides in DeFi generally, while there are 50+ projects currently confirmed to be launching as Orbit chains. However, M&A presents the DAO with an opportunity to identify gaps in the types of applications Arbitrum supports and that it thinks present strategically important use cases going forward in the crypto space - these could range from borrowing and lending protocols, PERP DEXs, NFT DEXs, gaming, etc., and would enable the Orbit ecosystem to scale even more rapidly.

2. Background on Crypto M&A

Status of M&A in Crypto

As with every early-stage industry, crypto is incredibly fragmented, with the open-source nature of crypto further adding to this fragmentation. The crypto M&A market is still very nascent, presenting significant opportunities to scale and grow for active market participants. M&A and consolidation is crucial to the crypto space maturing; this trend was seen in the early stages of the technology market as well, and as can be seen in the below chart, M&A is well and truly active across tech today:

There is a substantial opportunity, moreover, for web2 buyers to enter the crypto M&A space at the moment. As one of the most well-capitalized entities in crypto, Arbitrum DAO would benefit greatly from being one of the first movers. As can be seen below, the time to learn and act is now, before larger/experienced Web2 buyers enter the stage:

3. Case Studies

Several protocols have already experimented with M&A. Although not all of the below have led to sustainable success, the case studies provide good insights into some of the dynamics involved.

Polygon’s Acquisition of Mir

Polygon acquired Mir in Nov 2021 for $400M. Mir’s system generates recursive zero-knowledge proofs which results in one of the fastest and most efficient L2 options. This, along with Polygon’s acquisition of Hermez, allowed it to scale its ZK-vision and build solutions like the AggLayer that was recently announced. The acquisition was completely in line with Polygon’s strategy of focusing on ZK cryptography as the end-game for blockchain scaling, and is also emblematic of Polygon’s complimentary buy-and-build strategy:

Klaytn & Finschia: The First Blockchain Merger

Klaytn and Finschia are both large L1s in Asia that recently merged in Feb 2024; their combined market cap is ~$887M, with a combined Web3 community of 410K+ members. The merger has allowed Klaytn + Finschia to become Asia’s number one blockchain by infrastructure and Web3 services by providing the following benefits:

- Integration of messenger-based Infrastructure and existing Web3 ecosystem

- Burning 23.6% of issued tokens and building a new 3-Layer burning model

- Providing an integrated network environment compatible with Ethereum and Cosmos

- Establishing the largest Web3 governance in Asia and maximizing decentralization

Fei Protocol’s Acquisition of Rari Capital

One of the most infamous examples in the crypto M&A space is when algorithmic stablecoin Fei acquired Rari to vertically integrate their permissionless money market protocol. There was significant controversy around valuation with objective voices agreeing on $RGT holders being underpaid, and the deal left a critical precedent for on-chain M&A.

Since the teams negotiated the transaction parameters themselves, a key takeaway is that specialized advisors could have helped on the questionable valuation and eased communication.

Looking forward to seeing you soon in our weekly call at 13:30 ET!