SECTION 1: APPLICANT INFORMATION

Applicant Name: Dan Peng, CPO

Project Name: Vela Exchange

Project Description:

Vela Exchange is a decentralized perpetuals trading platform with a vision to compete with the best of TradFi applications by combining the powers of DeFi with the performance of centralized trading desks.

Our platform includes the following features, team composition, and metrics:

- Delta-neutral LP yield structure (VLP), which offers attractive ‘real yield’ for USDC.e deposits

- Expansive feature set mirroring the best CEX experiences - ie in-chart trading, complex triggers, advanced notifications, multilingual capabilities, and more

- Fluid trading across 4 markets and 40+ assets

- Doxxed team with a professional record of success and innovation within the industry

- Our cumulative volume since beta launch is $6.2B, and a total of over 50k users (https://app.vela.exchange/analytics)(https://dune.com/purif/vela-exchange-analytics)

Team Members and Qualifications:

Travis Skweres (https://www.linkedin.com/in/travisskweres/):

Founder at Vela Exchange - a crypto veteran with 10+ years of experience in the blockchain space where he has been highly focused on the DeFi landscape, successfully co-founding 3+ decentralized projects. Along with this, he is a senior engineer and architect who has built web and mobile applications for Fortune 500 companies, as well as spearheaded numerous UI and UX-driven projects.

Dan Peng (https://www.linkedin.com/in/thedanielpeng/):

Co-Founder at Vela Exchange. Technology and product management leader with 11+ years experience in product, marketing, blockchain, and finance sectors.

Anthony Oko (https://www.linkedin.com/in/anthony-o-59397783/)

Current COO at Vela with a deep understanding of project engineering, analytics, and trading. Former quant trader with Masters of Science and Engineering, previous Relay Chain Director of Analytics.

Berke Sengel (https://www.linkedin.com/in/berke-sengel-3570a2b5/)

CBO at Vela Exchange with a background in strategic partnerships and a Masters degree in Blockchain and Digital Currencies.

Project Links:

Website: https://www.vela.exchange/

Docs: https://docs.vela.exchange/vela-knowledge-base/

App Link: https://app.vela.exchange/

Medium: https://medium.com/@vela_exchange/

Twitter: https://twitter.com/vela_exchange

Discord: VelaToken

Telegram: Telegram: View @vela_exchange

Contact Information:

TG: @Vela_Djinn

Twitter: @vela_exchange

Email: dan.peng@vela.exchange

Do You Acknowledge That Your Team Will Be Subject to a KYC Requirement?: Yes

SECTION 2: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 1M [updated amount]

Grant Breakdown:

150k for Multi-Chain / Fiat Onboarding

- Vela Exchange was among the first projects to POC and launch a multi-chain deposit and LP minting integration with Squid/Axelar

- We are improving the UX and planning to incentivize users who bridge and trade / provide LP

- Fiat onboard/offboarding integrations are also being optimized and we wish to add an incentive to utilize our fiat integrations in the form of $ARB tokens

400k for Social Features / Trading Leagues

- We building a trading league system that will offer $ARB / $esVELA rewards - this system will connect into the other social features of Vela Exchange, including social profiles, profile tracking, etc

- Our team is also integrating social platforms including Discord, Telegram, Twitter throughout the platform to increase trader retention and build upon the community we have created - we wish to improve on social sharing with small incentives per action

- Trading leagues will have a cap on incentives based on fees earned to prevent any wash trading → this is further prevented by being focused on PnL, although volume may play a factor

100k for Bot / Automated Trading Incentives

- We are the 2nd DEX integration with Astrabit and are in the process of integrating up to 4 additional partners in the bot trading space

- Our team is planning to build internal bot trading capabilities that layer onto partner applications

- Incentives to trial new bot partnerships and automation will help drive more institutional and retail use of high volume generating strategies using our bots

350k for VLP Vault Rewards

- Hyper VLP is a liquidity program that helped bootstrap our VLP vaults, but we intend on adding another layer for new liquidity

- $ARB as well as $esVELA will be distributed to VLP vault providers that contribute and keep their USDC in the vaults over several epochs

Funding Address: arb1:0x678c29a2DA4Ae423457db591FF78bE8C9c63378C

Funding Address Characteristics: 2 out of 4 gnosis multisig with private keys securely stored

Contract Address: 0xDB15AA13d01834B114Bd57a115ec17330698fe5A (Op Lvl 3)

SECTION 3: GRANT OBJECTIVES AND EXECUTION

Objectives: DeFi ecosystems require an ongoing flow of new users, liquidity, and relevant feature sets in order to maintain relevance and to be sustainable. Vela Exchange is not only developing a trading platform that boasts advanced features like triggered orders and account abstraction, but also a social platform with achievements, gamification, and monetization potential.

Our aim is to:

- Increase TVL, empowered by multichain deposits

- Increase overall trading activity

- Promote bot building onboarding incentives on Vela Exchange

- Encourage ecosystem collaboration and power the technical frontier on Arbitrum

Key Performance Indicators (KPIs):

Success is measured by Unique Active Wallets (UAW), Total Volume, Total Value Locked (TVL), and the performance of our liquidity provider token, VLP. We also consider Google Analytics site performance, and the reach of our social communities and accounts in order to gauge our market share and interest.

Specifically for each initiative:

Multi-Chain / Fiat Onboarding: Overall multi-chain transfers, fiat transfers in volume

Socialfi: User retainment, trades per user, time in-app

Bot / Automated Trading: User onboarding into each bot partner, volume traded through bots

VLP Rewards: New VLP minted

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem?:

We chose Arbitrum as our home because we viewed the network as a place where competition can thrive and projects constantly innovate to stay ahead of the curve.

Through the initial grant allocation, we will be able to aggressively pursue bringing new liquidity and traders from across the DeFi landscape. We also believe that pushing the frontiers of tech requires incentivization for participants to take the risk on the newest tech (like multi-chain collateral / LP minting).

The Vela Exchange has partnered with a growing number of highly regarded, powerhouse teams (including but not limited to Camelot, Seashell, Astrabit, Vaultka). We believe our collaborative nature and reliability makes us the perfect team to invest into for maximum network effect and growth for Arbitrum.

Justification for the size of the grant:

Vela Exchange has fostered substantial interest and growth on Arbitrum, which led to some of the largest trade volumes on the network to date. Our doxxed team is highly qualified and motivated to position the exchange amongst industry leaders in the perpetuals ecosystem, and we believe that our vision of creating the next generation of trading experiences on Arbitrum will increase the competitive atmosphere and push forward innovation.

Our vision is set and the requested grant will make our go-to-market more possible. Innovation and adoption requires a slight push for users to adopt the unknown or novel, and we believe that the allocation requested is perfect to get the ball rolling for some of the newest features at Vela Exchange.

Execution Strategy:

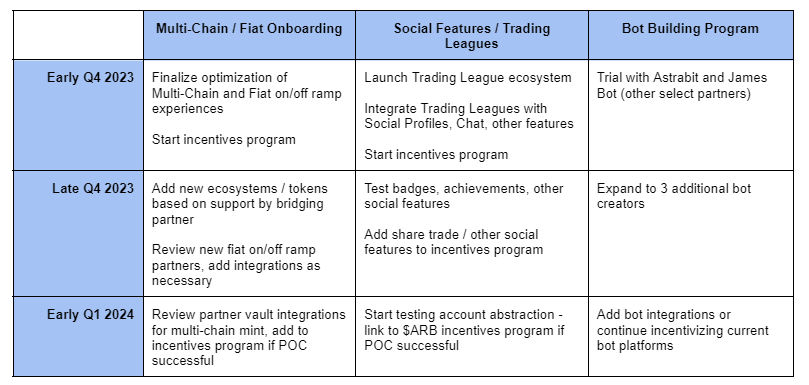

Our execution strategy will differ across the different feature / incentive allocations, generally following the schedule below:

Grant Timeline:

Our efforts should span all of Q4 with result turnaround biweekly to review progress of each initiative. Data should give us insights to adjust / improve any of the processes and proposed adjustments will be shared with the DAO.

Funding Tranches:

Oct 2023 - 400k $ARB, biweekly distribution ~200k

Nov 2023 - 175k $ARB, biweekly distribution ~87.5k

Dec 2023 - 175k $ARB, biweekly distribution ~87.5k

Milestone Descriptions:

Milestone #1 - Incentives Kickoff

Early Q4 2023 will see overhauls of Fiat Onboarding/Offboarding and Multi-Chain Deposit along with the launch of Trading Leagues.

With the launch of each of these initiatives, Vela Exchange will start allocating $ARB as well as esVELA into each bucket based on the ratios proposed above in the Grant Information section.

This period will include analytics infrastructure to track each of the initiatives and provide reporting to the DAO.

Milestone #2 - Optimization Round 1

Towards the middle/end of Q4 2024, we will review both user feedback, hard metrics, and adjust / enhance the experience and incentives as needed. We are big proponents of a test and learn methodology and expect strategy changes to best utilize the grant funds.

Milestone #3 - Optimization Round 2

In early Q1 2024, we will facilitate our last round of user experience / incentives performance review for any remaining changes required to ensure program success.

SECTION 5: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the Protocol Native to Arbitrum?:

Yes, Vela Exchange initially deployed on Arbitrum network during our beta and later followed by the official launch. Our team has been building on Arbitrum since early 2022.

On what other networks is the protocol deployed?

Since September 2023, we are now also deployed on the BASE chain, with full support between the two supported chains in-app.

What date did you deploy on Arbitrum?:

Beta on Mainnet began on January 31st, 2023 and led to the official launch on June 26th, 2023.

Protocol Performance:

After an explosive launch, Vela Exchange is currently rank #6 for TVL among derivative exchanges on Arbitrum with a total $10M USDC in our vault. At our height, TVL was one of the largest USDC vaults in DeFi, with 53M+ USDC liquidity provided.

Our all time volume since June 26th official launch is $680M, with a daily average volume of $5.3M (https://app.vela.exchange/analytics)

All milestone KPI data is tracked via 3rd party analytics through monitoring our smart contracts, Google Analytics, Defillama and other social media platform analytics (ie Twitter)

Protocol Roadmap:

Q4 2023

- Optimized multi-chain deposit experience, completely overhaul UI

- Launch incentives strategy for multi-chain deposit

- Open bot partner integration program

- Open trading leagues, integrate with existing social profiles

- Notifications Center upgrade - increase granularity of notification controls and types of alerts within application

- Price feed infrastructure improvements

- NFT Forge [Tentative]

Q1 2024

- Rollout Spot Aggregation

- Launch account abstraction upgrades

- Trading league trophies / badge system

Audit History:

Smart Contracts Audit #1 (Jan 2023; completed, but now deprecated and replaced with below)

https://wp.hacken.io/wp-content/uploads/2023/02/Dorado_09112022_SCAudit_Report_FINAL.pdf

Smart Contracts Audit #2 (June 2023; completed) https://drive.google.com/file/d/1Wxf2-hm2bQu9gNmQZfbveH79VB01e7Vr/view

SECTION 6: Data and Reporting

Provide details on how your team is equipped to provide data and reporting on grant distribution.

Is your team prepared to create Dune Dashboards according to program requirements for your incentive program?:

Yes. We currently have a 3rd party analytics page on our site and are developing in house APIs to ensure uniformity and accuracy of data. We will hook up our latest APIs to Dune to provide industry standard tracking in accordance with the reporting standards outlined.

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread?:**

Yes - Absolutely

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?:**

Yes