Information about STIP/STIP Backfund

1. Can you provide a link to your previous STIP proposal (round 1 or backfund)?

2. How much, in the previous STIP proposal, did you request in ARB?

- 1,000.000 ARB (with ~65K unused ARB rewards returned back to the DAO - tx hash)

3. What date did you start the incentive program and what date did it end?

- 26.12.23 - 29.03.24

4. Could you provide the links to the bi-weekly STIP performance reports and Openblocks Dashboard?

5. Could you provide the KPI(s) that you deem relevant for your protocol, both in absolute terms and percentage change, month over month, for the first of each month starting from October 2023 until April 2024, including the extremes? If you don’t know what KPI might be relevant for you or how to properly define them, please refer to the following document:

-

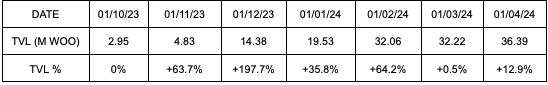

WOOFi Earn TVL

-

WOOFi Stake TVL

-

Monthly swap volume

-

Monthly perps volume

-

No. of Arbitrum-inbound cross-chain swaps

In retrospect, WOOFi’s incentive program was far more than just a win for the WOO community - it was a win for Arbitrum at large. We set out to boost the visibility of budding Arbitrum projects that were flying under the radar, and we achieved this with WOOFi’s cross-chain carousel which spotlighted 13 builders over 13 consecutive weeks. This initiative alone triggered 18,347 cross-chain swaps into the ecosystem and showcased some of the attention-starved gems innovating at Arbitrum’s application layer.

We led more collaborative efforts when we teamed up with Layer3, GMX, Trader Joe, Radiant Capital, Silo Finance, and Camelot to launch WOOFi’s Quest for the Holy Grail of Arbitrum. This campaign was designed to reward users who completed the quest collection with the Holy Grail NFT, giving each holder a guaranteed share of 25,000 ARB. Originally slated to go live on March 5th, the initiative was postponed due to a WOOFi Swap pricing exploit but is still scheduled to go ahead in May.

Concerning WOOFi specifically, data shows that our metrics boomed from the incentives. Not only did the TVL of WOOFi Earn Arbitrum vaults more than triple from $4.6m to $15.2m, but the staked WOO also jumped from 19m to 35.6m, with 3,300 new stakers on Arbitrum. In tandem, perps flourished as WOOFi Pro 7-day volumes more than 100xed from $13.3m in late December 2023 to $1.36B in early March. In this same period, cumulative WOOFi Pro users multiplied by more than a factor of 8 from 5,429 to 45,867.

Prior to the pricing exploit in early March, WOOFi Swap also observed 24-hour all-time-highs across the board with regard to swap volume ($61.7m), swap fees ($14,381), DAU (17,951), and number of swaps (21,449). It should therefore come as no surprise that Arbitrum is now home to more WOO token holders (47,666) than any other chain, surpassing even the token’s birthplace, Ethereum (19,932).

6. [Optional] Any lessons learned from the previous STIP round?

What we have learned is that if designed correctly, incentives can really help users, make it more frictionless to onboard new ecosystems and try out new applications. For WOOFi’s STIP program, WOOFi Earn, Pro campaigns and cross chain swap fee refund are the most effective ones, as proven by the metrics in the section 5 and 9. Therefore, we would like to increase the allocation for these categories to double down.

In terms of improvements, we noticed some mechanism has room for sybil attacks. We had been finetuning the rewards distribution method to proactively prevent this. In the bridge program, we will generally tie all rewards to $ value of the transaction to further prevent sybil attacks. This will also make the incentives more efficient.

New Plans for STIP Bridge

7. How much are you requesting for this STIP Bridge proposal?

- 395,000 ARB (39.5% of the STIP backfund budget)

8. Do you plan to use the incentives in the same ways as highlighted in Section 3 of the STIP proposal?

- It will mostly follow the same ways with slight improvements on the distribution based on the lesson learned to double down on the areas with the highest impact

9. [Only if answered “no” to the previous question] How will the incentive distribution change in terms of mechanisms and products?

We propose to tweak the % of ARB allocated to each distribution category as follows:

- WOOFi Earn 35% (+5%)

- WOOFi Pro 30% (+10%)

- Arbitrum-inbound cross-chain swaps 25% (+10%)

- WOOFi Stake 10% (-5%)

- WOOFi Swap 0% (-10%)

- Quests & cross-protocol integration 0% (-10%)

Justifications:

WOOFi Earn

The combined TVL of WOOFi’s wBTC, ARB, ETH, and USDC.e vaults more than tripled from $4.6m to $15.2m during STIP. We see this as clear evidence that these incentives were used effectively and therefore we propose to up WOOFi Earn’s allocation by 5%. Please note: we will incentivize a new native USDC vault instead of the previous USDC.e vault which has now been deprecated.

WOOFi Pro

WOOFi Pro cumulative volume more than 240xed from $2.6m to $6.4b during STIP. At the same time we recorded our highest ever 7-day volume of $2.28b, saw 28-day average DAU explode from 56 to 1,258, and witnessed cumulative gross income rocket from $26k to $640k. On the back of such incredible growth, we propose to increase WOOFi Pro’s allocation by 10%.

Arbitrum-inbound cross-chain swaps

7-day fees from cross-chain swaps into Arbitrum rose steeply during STIP from $6.5k at the start, to $25.3k at its peak. This growth then naturally tapered off due to a WOOFi pricing exploit that took place on March 5th. Despite this, evidence suggests that incentives used in the leadup to the exploit were highly effective, and with the situation now resolved, we propose to boost the incentives allocated to this category by 10%.

WOOFi Stake

Total WOO staked on Arbitrum jumped from 19m to 35.6m during STIP, with 3,300 new stakers on Arbitrum. While the growth was strong, we consider WOOFi Earn, Pro, and cross-chain swaps to have exhibited stronger growth, and so we propose to decrease the incentives allocated to this category by 5%.

WOOFi Swap

Despite strong evidence for an uptick in Arbitrum volumes during STIP, we propose to axe incentives for this category. Of the 65k unclaimed ARB we returned to the DAO, much had been earned via swap incentives. We theorize that many users were swapping on WOOFi while unaware of the swap incentives being distributed, suggesting WOOFi Swap is able to attract users/volume without incentives.

Quests & cross-protocol integration

We planned to host one large quest with Layer3, Camelot, GMX, Trader Joe, Radiant Capital, and Silo Finance but it was paused just 3 hours after launch due to the WOOFi pricing exploit. In addition, only one cross-protocol integration was achieved with Cool Wallet. We consider the progress underwhelming relative to WOOFi Earn, Pro, and cross-chain swaps and have therefore decided not to incentivize this category again.

https://twitter.com/_WOOFi/status/1765030948700041727

10. Could you provide the addresses involved in the STIP Bridge initiative (multisig to receive funds, contracts for distribution, and any other relevant contract involved), and highlight if they changed compared to the previous STIP proposal?

- Multisig to receive the incentives: 0xC8b2b7A07892644a71cc42eEC809b7A4296a715A

- Merkle distributor: 0x1109E03516eB25eAb2150D0b274B8D4F5F3cF549

- Staking ARB rewarder: 0x401ff5f78B52EDb57aB019c8988e0Be933AaABCb

- Earn ARB supercharger distributor: 0xdF0006994c46F4d006eCb2b5aF3e212D94df23e1

- Earn ETH supercharger distributor: 0xfBBfcCAE3f76AFc0979f20920b4d04d608F873bF

- Earn USDC supercharger distributor: 0x181d8Eb2EEff20C647073c4798111Cbd1B423A60

- Earn WBTC supercharger distributor: 0xA397FbA8c5C1aeF9137601C185F6AB0E9CF43662

11. Could you share any feedback or suggestions on what could be improved in future incentive programs, what were the pain points and what was your general evaluation of the experience?

Overall we think the STIP program benefited the Arbitrum ecosystem and dApps significantly, made it the de facto general purpose L2 as a substitute of Ethereum L1. One feedback or suggestion would be instead of doing one size fit for all in the incentive program, could be more beneficial to allow more flexibility in the time period of the reward distribution. It is to avoid projects trying to catch the deadline and distributing all rewards for the sake of it. WOOFi has returned some unallocated ARB tokens to the Arbitrum DAO. Allowing dApps to design the most effective way for themselves and judging by the result might be a more effective approach, it also avoids unnecessary sell pressure for the ARB token.