Abstract

The Quadratic Accelerator (q/acc) is the next evolution of web3 grant programs. Instead of distributing ARB to projects, often leading to immediate liquidation and subsequent repeated funding requests, q/acc creates a self-sustaining token economies for builders.

q/acc transforms how tokens enter the market with combined competitive application processes, ABCs, quadratic funding (QF), token lock-ups, and fair-launch mechanisms. This unique approach ensures alignment between protocols, projects, and communities in a manner that no other grant program has achieved before.

Arbitrum is the leader in defi among L2s, so it’s fitting and inevitable that q/acc, a defi powered grant program, should be added to its orbit. We can predictably grow TVL, create demand for ARB and improve other onchain metrics for the ecosystem. For builders, we create revenue streams through mint and burn fees, give a subsidized path for tokenization and create DEEP liquidity. And for the Arbitrum community, we enable early access and ownership, fulfilling the dream of web3.

We have had great success working out the kinks of this novel program with Polygon, running our first season on zkEVM, then migrating to POS. We are finishing up the second season over the next few weeks, and expect to run many more seasons with them. The early results of the first season though are impressive already, especially considering it was done on zkEVM.

We are actively following SOS discussions and will ensure our cohorts focus on builders that directly support Arbitrum and advance the priorities established through that process. We could not be more excited to start this program with a clear direction established for the DAO.

Motivation

The Problem with Traditional Web3 Grant Programs

Grant programs are essential to ecosystem growth, but many fail to create sustainable, lasting impact. Key issues include:

- Sell Pressure on ARB: Teams sell granted tokens to cover expenses, driving down ARB’s price and reducing ecosystem stability.

- Misaligned Incentives: Grants provide one-time funding, with no mechanisms to provide revenue, market validation or adoption.

- Dependency & Unsustainability: Some projects become experts at writing grant proposals rather than building great products.

- Lack of Community Engagement: Grants rarely create viral marketing effects or drive sustained community involvement beyond the initial funding, QF being a notable exception.

The q/acc Solution

q/acc flips the script on grants with a mechanism-driven, on-chain approach that allows for investment into small and medium-sized enterprises while creating lasting alignment between Arbitrum DAO, projects, and the community. It can’t replace all grant programs, as many teams should not tokenize; however for the ones that want to, this is an incredible opportunity for them.

Here’s how it works:

- Applicants chosen: Taking referrals from other grant programs and ecosystem leaders as well as hosting an open application round, our team will filter for the best builders. We would love AAE’s support in choosing the best candidates.

- Initialization: ARB is used to initialize the token economy for each chosen team, giving the team 90% of the tokens generated, while Arbitrum DAO and q/acc split the other 10% equally. All tokens are locked.

- ABCs: The ARB is locked in these bancor-style bonding curves which include tributes on mint and burns, creating recurring revenue for the builders, while locking up ARB as collateral, generating demand for ARB if there is demand for the builder’s tokens.

- q/acc rounds: These are fair launch token purchasing events where all participants get the same price for the locked tokens they buy (an actual fair launch) and they are run like a QF round where the matching pool is used to create secondary market liquidity.

- Liquid token listings: When the liquidity pool hits the open market, it is listed at a higher price than the locked tokens purchased in the q/acc round, but these are the only liquid tokens that exist so a price floor is guaranteed for several months, creating the ideal conditions that speculators crave to ape into.

- Graduation: If the builders succeed, and outgrow their bonding curve, achieving a reasonably sized market cap, as well as other KPIs, the minting of tokens is turned off, and the underlying collateral in the bonding curve is given to builders.

q/acc fundamentally changes how projects can be funded. By subsidizing the launch of projects’ token economies, Arbitrum DAO and the supporting community get to share in the upside of the project’s success.

Proven Success: Polygon zkEVM Season 1 Results

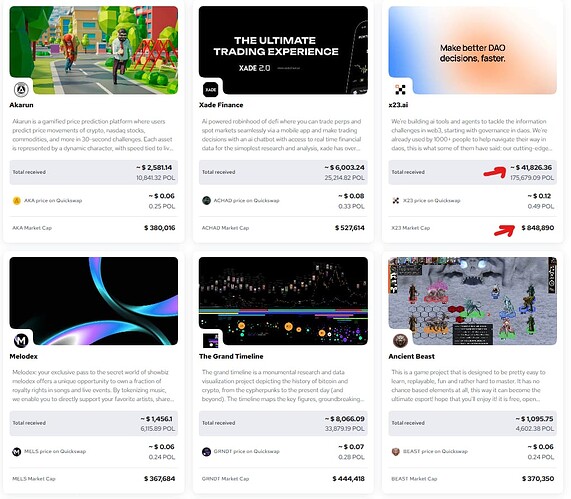

Our recent Season 1 cohort on Polygon has demonstrated the powerful impact of the q/acc model. Selected from over 200 applications (most having no prior plans to launch on Polygon), our first eight projects drove significant ecosystem value:

- Total Raised: 342,262 POL

- Unique contributors: 1,253

- First-time zkEVM users: ~97%

- Protocol Sponsorship: 1.76M POL

- Protocol Locked POL: 2.15M POL

- Onchain Growth: Total market cap of ~$4.5M (≈ 17M POL), representing a 10x grant multiplier

Spotlight: Top Projects from Polygon’s First Cohort

1. x23.ai

Official website: https://www.x23.ai/

X23 is automating the future of decentralized organizations by integrating AI tools to streamline the operation and governance of DAOs. Their platform brings together over 50,000 sources of data to provide a comprehensive overview of DAO activities, making governance more efficient and accessible.

Their AI Gov Assistant (available 24/7 via Telegram) has become a vital tool for DAO delegates, providing detailed and accurate answers to specific governance questions within seconds. By applying state-of-the-art machine learning and LLMs, x23 is solving critical information and decision-making challenges in the web3 space.

X23’s participation in q/acc has accelerated their development and provided the tokenomic structure to align their service with the communities they serve. Their token economy now directly benefits from Polygon’s growth.

2. Prismo Technology

Official website: https://prismo.technology/

Prismo is a layer-2 hybrid public-private blockchain platform already making significant real-world impact. Their solution addresses a critical need: allowing enterprises and governments to maintain data confidentiality while leveraging blockchain’s transparency benefits.

Even before completing the q/acc program, Prismo had implemented a functioning MVP within the Department of Budget and Management (DBM) of the Philippines, where it’s securing critical budget documents. This real government adoption demonstrates Prismo’s product-market fit and utility.

In December 2024, they launched their gas token $PRSM through q/acc, with a testnet planned for early 2025 and mainnet launch expected by Q2 2025. Prismo exemplifies how q/acc can support projects that bring blockchain solutions to traditional institutions, creating substantial ecosystem value.

3. Xade Finance

Official website: http://www.xade.finance/

Xade Finance, led by 18 yr old whiz kid Harshal Madnani, is building the AI-powered “Robinhood of DeFi” - a decentralized platform that makes sophisticated trading accessible through AI insights and tools. Their platform allows users to easily launch, interact with, and invest in no-code AI agents that can trade, tweet, and leverage over a thousand integrations.

Originally conceived as a “super decentralized bank” providing on-chain banking services through in-house DeFi protocols, Xade has evolved into a powerful gateway for AI-powered trading. Through q/acc, they’ve created a token for the first AI Agent on their platform, Alpha Chad. Holding the $ACHAD token gives you access to the AI trading tools they are developing..

Xade demonstrates how q/acc can help sophisticated DeFi protocols build token economies that drive adoption while creating lasting ecosystem value, while also demonstrating the AI Agent use case.

4. The Grand Timeline

Official website: https://grandtimeline.org/

The Grand Timeline is creating the first comprehensive, interactive visualization of blockchain and Web3 history. This historical research project has been developed over three years and will result in collectible NFTs and wearables that document the evolution of our industry.

This project exemplifies how q/acc can support public goods that serve the broader ecosystem. By tokenizing this historical archive, The Grand Timeline can sustain ongoing research and documentation while offering collectors ownership in this valuable historical record.

The creator, a product designer named Igor, considers this work a public good born from his fascination with Web3 history. Through q/acc, this labor of love has become a sustainable initiative with its own token economy.

5. Citizen Wallet

Official website: https://citizenwallet.xyz/

Citizen Wallet is bridging the gap between digital tokens and physical community engagement. Their mobile app and NFC wallet solution empowers communities and events to easily launch, use, and manage community tokens, bringing blockchain utility to everyday situations.

By focusing on accessible tools for real-world adoption, Citizen Wallet exemplifies how q/acc can support projects that extend blockchain’s reach beyond crypto-native audiences. Their token economy now benefits from every new community and event that adopts their platform.

—

And that’s just the beginning!

This next cohort is shaping up to be strong as well! We just launched Season 2 for To Da Moon, Web3 Packs, Gridlock & How To DAO. These 4 projects are launching their tokens on Polygon, because of our program, none of them have any requirements to launch on Polygon. If Arbitrum had q/acc, they could have launched here.

Rationale

Scope & Objectives

q/acc will launch with the following key deliverables:

- Deploy q/acc smart contracts on Arbitrum One.

- Integrate with Camelot & other leading ecosystem partners.

- Run a campaign collecting applications from the most promising teams in the Arbitrum ecosystem (and beyond).

- Launch 10 projects in Season 1— carefully selected for product-market fit, utility and aligned with SOS strategy.

- Host the q/acc round for Season 1 projects on a new, optimized platform.

- List the projects on Camelot.

- Evaluate performance and propose expansion for Season 2 based on results.

Project Selection & Quality Assurance

Our selection process ensures we only support projects with real utility and potential—not speculative tokens:

- Rigorous Application Process: Only 8 out of 200+ applicants were accepted in our first Polygon cohort, maintaining a <4% acceptance rate to ensure quality.

- Product-First Evaluation: We prioritize projects that already have working products or compelling MVPs, ensuring tokens support existing utility rather than being the product themselves.

- Experienced Team Assessment: Our evaluation includes team background checks, code & legal assessments, and business model validation. We are open to actively engaging AAEs to ensure alignment and value creation with the broader Arbitrum Ecosystem goals.

- Diverse Vertical Selection: We select projects across various sectors (DeFi, AI, gaming, infrastructure) to maximize ecosystem coverage and minimize short term narrative risk. We will however consider the outcomes of the SOS process heavily when selecting builders.

- Community Validation: The quadratic funding mechanism ensures projects must attract genuine community support to succeed, providing market validation.

Life Cycle of a q/acc Project

Marketing and Mindshare

The q/acc team are masters at driving narrative and mindshare. Our involvement in new ecosystems promotes broader interest and attention among token engineers, DAO operators, capital allocation designers, and crypto-native communities. This attention value is automatically included in new deployments. See:

- First Place in EthDenver’s Peoples Choice competition: “WTF is Protocol Sponsored Tokenization?!”

- Featured in the new “Onchain Capital Allocation” handbook: Mechanisms | Allo.Capital

- VCs: Unlikely Heroes of Crypto Fundraising? Expert Says Current System Is Flawed, Better Models Exist

- Quadratic Accelerator Launches on Polygon zkEVM - Altcoin Buzz

- q/acc Goes Live on Polygon zkEVM to Support Sustainable Token Launches - Crypto Daily

- Quadratic Accelerator Launches on Polygon zkEVM, Redefining Token Launches - TheNewsCrypto

- Quadratic Accelerator: The New Launchpad for Fair and Sustainable Token Economies on Polygon zkEVM | Blockster

- q/acc Goes Live on Polygon zkEVM to Transform Token Launches | Currency News

- q/acc Goes Live on Polygon zkEVM to Transform Token Launches (12 Dec): Guest Post by Chainwire | CoinMarketCap

- q/acc Goes Live on Polygon zkEVM to Transform Token Launches - Benzinga

- https://www.binance.com/en/square/post/17471786358626

- q/acc Launches on Polygon zkEVM to Redefine Token Economies

Funding Request

We request $1.05M in ARB ($1.3M to protect from volatility) to launch q/acc on Arbitrum, allocated as follows:

| Expense Category | Amount | Details |

|---|---|---|

| Initialize Projects ABCs | $500k | Launch up to 10 projects, each getting $50,000 of ARB locked in their ABC (Released to team upon graduation) |

| ABC Bots | $50k | $5000 for each team to bridge liquidity to DEX from ABCs (Released to team upon graduation) |

| Matching Pool | $250k | Used to create protocol-locked liquidity pools (Held in perpetuity by the protocol) |

| Development & Deployment | $170k | Deployment, infrastructure, initial marketing, BD, and partnerships (Overhead, one-time cost) |

| Operations & Scaling | $80k | 10% of the grants given to teams, used to run and operate the q/acc program (Overhead, recurring cost) |

| Volatility Buffer | $250k | Ensures total USD amount is available in ARB when needed (To be returned to the DAO if not impacted by ARB depreciation during the period) |

KPIs & Success Metrics

To measure success, we will track:

![]() Onchain Growth – 10x – Market cap growth (in ARB) compared to ARB granted to teams. E.g If we give the teams a total of 1M ARB, we will produce 10M ARB worth of market caps

Onchain Growth – 10x – Market cap growth (in ARB) compared to ARB granted to teams. E.g If we give the teams a total of 1M ARB, we will produce 10M ARB worth of market caps

![]() ARB Demand Ratio – 25% – Ratio of ARB in protocol vs ARB granted to teams. E.g If we give the teams a total of 1M ARB, we will capture 1.25M worth of ARB in the protocol, creating 250k worth of ARB buying pressure.

ARB Demand Ratio – 25% – Ratio of ARB in protocol vs ARB granted to teams. E.g If we give the teams a total of 1M ARB, we will capture 1.25M worth of ARB in the protocol, creating 250k worth of ARB buying pressure.

![]() Sustained Value – 1 year – Long-term market cap growth (in ARB) of tokens. E.g The 10x growth will last for at least a year.

Sustained Value – 1 year – Long-term market cap growth (in ARB) of tokens. E.g The 10x growth will last for at least a year.

![]() First-time Arbitrum Users – 500 – Number of q/acc participants new to Arbitrum that buy more than $10 of tokens. E.g 500 users that pass our sybil filter will have never used Arbitrum before.

First-time Arbitrum Users – 500 – Number of q/acc participants new to Arbitrum that buy more than $10 of tokens. E.g 500 users that pass our sybil filter will have never used Arbitrum before.

![]() On-Chain Activity – Varied – Trading volume, user participation, and liquidity metrics. This will be tracked but it is so gameable, it’s not worth creating an exact metric, but we will create a lot of onchain activity.

On-Chain Activity – Varied – Trading volume, user participation, and liquidity metrics. This will be tracked but it is so gameable, it’s not worth creating an exact metric, but we will create a lot of onchain activity.

Risks & Mitigation Strategies

| Risk | Mitigation Strategy |

|---|---|

| Smart Contract Exploits | Conduct rigorous security audits. |

| User Friction | Create a UX similar to Polymarket |

| Market Volatility | Hold treasury in stables, rebuy ARB right before it is needed |

| Regulatory Uncertainty | Ensure compliance conforms with conservative norms (Geoblocking, low limits without KYC) |

Governance & Execution

- Multisig DAO Oversight – q/acc operations will be managed transparently via an AAE, likely the foundation.

- Monthly Reports – Clear metrics and updates provided to Arbitrum DAO.

- Performance-Based Scaling – Detailed evaluation after Season 1 to inform expansion plans.

Conclusion

The q/acc model has proven its ability to create sustainable token economies that drive lasting ecosystem value. By implementing q/acc on Arbitrum, we can attract quality projects, increase ARB demand, and position Arbitrum as the premier L2 for token launches.

Our focused 10-project first season allows us to demonstrate value while managing risk, and minimizing overhead due to deployment costs. We have clear metrics to evaluate performance and inform future scaling. We invite Arbitrum DAO to join us in pioneering this next evolution of ecosystem growth.