[Overnight Finance] LTIPP Application Final

SECTION 1: APPLICANT INFORMATION

Provide personal or organizational details, including applicant name, contact information, and any associated organization. This information ensures proper identification and communication throughout the grant process.

ANSWER:

Applicant Name: Maxim Ermilov

Project Name: Overnight Finance

Project Description: Overnight Finance is a DeFi protocol that provides a stablecoin, USD+, and other stablecoin-based financial assets (USD+, DAI+, USDT+) backed by delta-neutral strategies for stablecoin investors, emphasizing security and a user-friendly interface. It also offers a utility token, OVN, for risk management and to incentivize promotion, allowing holders to stake for insurance premiums and share in the yield or cover losses, promoting a secure and scalable system.

Team Members and Roles:

Maxim Ermilov - CEO & Founder

https://www.linkedin.com/in/maxim-ermilov/

https://twitter.com/maxim_ermilov

https://t.me/wmermus

Nikita S. - Tech Lead, CTO

https://www.linkedin.com/in/nikita-slezkin-859123215/

Viktor P. - Blockchain Engineer

https://www.linkedin.com/in/viktor-paramonov-7b64371a7/

https://github.com/valpaq

Vasiliy P. - QA Specialist

https://www.linkedin.com/in/vasiliy-pokrovskiy-2955a7229/

Ilya S. - Fullstack engineer

https://github.com/bgrusnak

Matvey B. - Frontend Lead

https://github.com/matt5346

Maria - Marketing Lead

https://www.linkedin.com/in/maria-moiseyenko-193b69a2https://t.me/Chilli_Moses

Polina T. - Head of Design

https://twitter.com/M4koCh4nhttps://t.me/m4koch4n

Scream - Community Lead / Content Manager

https://t.me/ScreamOvernight

Alterac - Due Diligence Expert

https://t.me/alteracx

Project Links: [Enter Any Relevant Project Links (website, demo, github, twitter, etc.)]

- App: https://app.overnight.fi/

- Website: https://overnight.fi/

- Twitter: https://twitter.com/overnight_fi

- Discord/Discourse/Community: https://discord.gg/overnight-fi

- Github: https://github.com/ovnstable

- Telegram: https://t.me/overnight_fi

- Linked In: https://linkedin.com/company/overnightfi

- Blog: Overnight Finance Blog

Contact Information

Point of Contact (note: this should be an individual’s name, not the name of the protocol): [forum handle] Maxim Ermilov https://forum.arbitrum.foundation/u/max_plus/summary

Point of Contact’s TG handle: [Telegram] @wmermus

Twitter: https://twitter.com/maxim_ermilov

Email: wmermus@gmail.com

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Provide details on your team’s past and current experience. Any details relating to past projects, recent achievements and any past experience utilizing incentives. Additionally, please provide further details on the state of your product, audience segments, and how you expect incentives to impact the product’s long-term growth and sustainability.

Team experience (Any relevant experience that may be useful in evaluating ability to ship, or execution with grant incentives. Please provide references knowledgeable about past work, where relevant. If you wish to do so privately, indicate that. [Optional, but recommended]):

Overnight team have been building for almost 2.5 years, and through trial and error has acquired very in-depth handson knowledge within the Web3 space, DeFI in particular. Beyond Web3, the team of 12 FTEs include 2 people with advanced degrees in mathematics and cryptography; the founder’s background includes almost 20 years in TradiFi (BCG, JPMorgan and Morgan Stanley), and education at multiple global institutions, including Stanford GSB, Insead, Essec. The team are backed by Hack.vc and FJLabs, with Hub71 (the startup investing arm of Mubadala, the UAE’s SWF) recently backing Overnight as well.

What novelty or innovation does your product bring to Arbitrum?

Our product: Overnight, brings innovation and novelty to Arbitrum by providing a stablecoin fully backed by delta-neutral strategies:

- the original design involved delta-neutral strategies based on farming positions in Uniswap USDC/ETH pools, with ETH hedged by borrowing it against USDC on protocols like Aave - the model which proved innovative, successful, but ran into scalability issues

- the V2 of our delta-neutral strategies, which we developed natively on Arbitrum, over the last 6 months, involves backing spot+perp strategies, e.g. long spot ETH with short ETH perp. These strategies have been developed natively on Arbitrum and Vertex protocol in particular, where Overnight currently represents over 50% of open interest, with further expansion planned to Hyperliquid and GMX.

Is your project composable with other projects on Arbitrum? If so, please explain:

USD+ as a stablecoin is composable with major DEXes and Lending protocols - it is a rebasing stable, but designed it to be compatible with CL DEXes like Uniswap V3 and lenders like Aave/Silo that dont natively support rebasing.

As we roll out our V2 delta-neutral strategies, the yield on USD+ on Arbitrum will become a proxy for perp funding rates. We believe there is a great potential to integrate USD+ into Pendle, the protocol used by institutional investors to hedge floating interest rates and take the niche of perp funding rate hedging

Do you have any comparable protocols within the Arbitrum ecosystem or other blockchains?

Overnight is built natively from scratch, and although stables, rebasing stables, and delta-neutral yield are not new, the combination of all these factors makes Overnight quite unique. With introduction of V2 delta-neutral strategies, the closest proxy to Overnight is the recently launched eThena protocol, and their stablecoin USDe (~400M TVL). The biggest difference b/w Overnight and eThena is that Overnight is fully onchain, i.e. the collateral, including perp positions, is kept onchain only, while eThena uses perp contracts from centralized exchanges. This makes Overnight more transparent to users, while somewhat less scalable.

As Arbitrum is the #1 perp-trading chain, and USD+ is built around real perp yield, Overnight is a sustainable, scalable product on Arbitrum even without a grant. We look for the grant to be used as liquidity incentives on partner protocols, including DEXes and Pendle, to acquire additional users, boostrap criticial mass of TVL and achieve significant trading volumes, to the amount sufficient for obtaining the chainlink oracle (2M USD per day, every day for 30 days minimum). With commencing bull market and abundance of grants on Arbitrum, the cost of stablecoin liquidity on Arbitrum is probably among the highest (40%+ at teh time of the writing) and competing for stablecoin liquidity with other projects under these market conditions before grant period is over without a grant is extremely challenging. Hence, our request.

By boostrapping liquidity into USD+, we would exercise a multiplied positive effect on the Arbitrum’s DeFI ecosystem, as our model positively impacts other protocols:

- we boostrap liquidity via DEXes, like Curve, PCS, etc.

- incentives through Frax Finance and other protocols

- liquidity is accumulated in USD+ collateral and redeployed into other protocols, in particular, in perp trading venues like Vertex and soon Hyperliquid and GMX

- in process, a high amount of trading volumes is generated:

- spot is traded on Uni V3 (USDC/wETH, USDC/wBTC, USDC/Arb)

- corresponding perp trading is generated on perp-trading venues

How do you measure and think about retention internally? (metrics, target KPIs)

Internally, we measure and think about retention through key metrics such as Total Value Locked (TVL) and the number of users. Our target KPIs include achieving $15m-$30m USD in TVL in Arbitrum chain, attracting up to 10k users.

At some point we should start measuring the TVL in active wallets by vintage (i.e. active wallet since 1 month, 2 months etc.), which has been a bit hard technically as often users would use USD+ to LP into other protocols, like DEXes.

Relevant usage metrics - Please refer to the OBL relevant metrics chart 10. For your category (DEX, lending, gaming, etc) please provide a list of all respective metrics as well as all metrics in the general section:

Daily active users

- Daily active growth

- Daily transaction count

- Daily protocol fee

- Daily transaction fee

- Daily ARB expenditure and user claims

- TVL for each asset

- Withdrawals

- List of current deposits, addressed, deposit size, duration of deposit and time-weighted deposits

- Daily trading volume

- Usage Breakdown

- Trading Volume

- Stablecoin Peg Integrity

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan: Yes

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant): No

SECTION 2b: PROTOCOL DETAILS

Provide details about the Arbitrum protocol requirements relevant to the grant. This information ensures that the applicant is aligned with the technical specifications and commitments of the grant.

Is the protocol native to Arbitrum?: [Yes/No, and provide explanation]

The Overnight Finance protocol is not native to Arbitrum, however, our perp-based delta-neutral strategies have been developped natively on Arbitrum as it is #1 chain for perp trading and deepest market for perp based delta-neutral yield. Hence, our deployment on Arbitrum is unique in contrast to other chains.

On what other networks is the protocol deployed?: [Yes/No, and provide chains]

Beyond Arbitrum, Overnight is deployed on Base, Optimism, zkSync, Linea, with BNB and Polygon being deprecated. There is ongoing deployment to Blast.

What date did you deploy on Arbitrum mainnet?: [Date + transaction ID. If not yet live on mainnet, explain why.]

Our first contract was deployed on Arbitrum on Feb 21, 2023, as confirmed by the transaction ID: 0xa77a3df5fc3a7bde86c0e56c06976ddc9bf05165c64c21b8712d736bda8df563.

Do you have a native token?: [Yes/No/Planned, link tokenomics docs]

Overnight has its native token OVN, which is used to promote USD+, but also as a means for community to benefit from Overnight’s revenue generation.

https://docs.overnight.fi/governance/ovn-token

$OVN Arbitrum Contract Address: 0xA3d1a8DEB97B111454B294E2324EfAD13a9d8396

Past Incentivization: What liquidity mining/incentive programs, if any, have you previously run? Please share results and dashboards, as applicable?

Previously, we received grants from the Optimism Foundation (400K OP tokens), which significantly contributed to our growth in 2023. Within the first six to nine months, our Total Value Locked (TVL) in USD+ increased from $6.5m to a peak of $20m, demonstrating the effectiveness of the incentives.

Although the vast majority of the grant was spent in H12023, Optimism has remained our core chain through the entire year and led to our very successful deployment on OP’s cousin chain - Base, where we are currently a top 10 protocol based on DeFiLlama ever since launch.

Current Incentivization: How are you currently incentivizing your protocol? OVN token as a means to acquire incentives from DEXes to direct rewards towards USD+ pools

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program? [yes/no, please provide any details around how the funds were allocated and any relevant results/learnings(Note: this does NOT disqualify an applicant)]

We have also received a 200K Arb grant from Arbitrum Foundation, of which 60K Arb has been transferred to our treasury, but is till unused. We have so far delayed the spending of the funds received until after STIP1, as the cost of liquidity on Arbitrum has quadrupled following STIP1, making funds received insufficient to achieve our grant TVL metrics. We plan to consume the grant in the period b/w Stip 1 end and LTIP start.

One of the learnings for this is that when designing incentive program, we should model liquidiity costs with the expectation of what impact the grant program can have at competitors

Protocol Performance: [Detail the past performance of the protocol and relevance, including any key metrics or achievements, dashboards, etc.]

Overnight’s TVL has peaked at over 50M USD largely due to a successful launch on Arbitrum last year, where our partnership, in particular, with Chronos, has led to over 35 M TVL on Arbitrum at its peak (across, USD+, USDT+ and DAI+ products).

Total number of users currently exceeds 100K active wallets, in particular, due to zkSync. We estimate that number of active users is ~10K across all chains. Currently, 3089 users on Arbitrum.

Currently, we have 106 unique holders for our $OVN token on Arbitrum (might not represent the whole number of users as we are multichain).

Our TVL for our stablecoin products on Arbitrum currently stands at ~$2.4m (~$1.23m USD+, $1m USDT+, $190k ETH+) and we are looking to grow this further with the help of grants and pair matching with OVN for our liquidity incentives.

The current incentives we have on Arbitrum is mainly run through PancakeSwap. We partnered with them and offer bribes to get emissions of $CAKE token as rewards for those who provides liquidity mainly in the form of USD+, USDT+, OVN. We plan to increase our rewards from the grant to bolster acquisition of liquidity and to achieve $30-$50m target TVL as stated on our projections. We are also getting a bribe efficiency of 1.5-3x on the PancakeSwap Platform with our current incentives. We think that this would be easily scalable once we have deployed sufficient rewards to be competitive in liquidity acquisition and with the help of the inherent utility of our stablecoin products.

The current Pool sizes that we have on different platforms are as follows:

- USDT+/USD+ - PANCAKE - $726K

- USD+/FRAX - CONVEX - $182K

- USD+/FRAXBP - FRAX FINANCE - $183K

Protocol Roadmap: [Describe relevant roadmap details for your protocol or relevant products to your grant application. Include tangible milestones over the next 12 months.]

Our most important roadmap item is the deployment of V2 delta-neutrals based on onchain perp protocols. The strategies have been designed, deployed and tested on Vertex protocol, including ETH+ ETH perp and BTC + BTC perp; We are testing ARB + Arb Perp.

We look to deploy V2 delta-neutral strategies further by leveraging Hyperliquid and GMX v2. Deploying further partnerships with DEXes and other protocols to assure sustainable distribution is key.

Audit History & Security Vendors: [Provide historic audits and audit results. Do you have a bug bounty program? Please provide details around your security implementation including any advisors and vendors.]

Our audit history can be found here https://docs.overnight.fi/other/audits

We have undergone successful audits by Hacken on Feb 3, 2022, for both our App and Core components and an additional audit by Ackee on Mar 3, 2023. We comissioned a private audit from Omniscia.

Security Incidents: [Has your protocol ever been exploited? If so, please describe what, when and how for ALL incidents as well as the remedies to solve and mitigate for future incidents]

Back in middle of 2022 one of our strategies, involving an LP into Synapse protocol on Avalanche, had been exploited due to bad oracle. There were incidents where Overnight was affected by exploits of 3rd party protocols, e.g. agEur’s depeg resulting from Angle’s exposure to Euler hack (103% of all funds lost were returned by us to our users once agEur peg had been restored).

We have undergone additional audits since, changed our dev practices (test coverage, obligatory peer code reviews, internal audit) and implemented obligatory DD process of 3rd party protocols required. Most important change was the shift towards delta-neutral strategies which enabled us to limit our fund deployments to high quality protocols only.

SECTION 3: GRANT INFORMATION

Detail the requested grant size, provide an overview of the budget breakdown, specify the funding and contract addresses, and describe any matching funds if relevant.

Requested Grant Size: 750K Arb

We believe achieving a 30M TVL we once had on Arbitrum is feasible, given the scalability of our V2 delta-neutrals. For a mid-size project like Overnight, a 30M TVL would take 20-60% APR to achieve and 15-40% APR to retain (the lower number corresponds to average market conditions, higher number - to high competition for stablecoin liquidity during, e.g. bull market & grant abundance).

Over 3 months, in competition with other grant recipients, reaching 30M TVL should result in a total cost of 2.6 M USD, split equally b/w Arbitrum’s grant and Overnight’s matching. To translate that into Arb equivalent, we assume a conservative rate of 1.8, with the logic being that a higher ARB price would be possible in a context of a bull market with higher cost of liquidity.

The grant sizing is based on the assumption that 60% APR is sufficient to grow TVL and 40% - to retain it. I’m conscious these numbers are significantly higher than usual 20-30% APRs, however:

- During STIP 1 we saw major competition among stablecoins for liquidity which led to higher costs, in particular, MIIM and crvUSD have been very active, offering yields in higher double digits

- We are in the middle of a bull market, where USDC borrowing rates have been constantly in the range of >50% over the last weeks, putting risk-free USDC yields in the range of 20-30%. we should be able to offer premium to that to achieve the KPIs

- When incentivizing USDC/USD+ pools, only USD+ TVL would count towards the TVL metric

Last but not least, we had obtained a grant from Arbitrum Foundation on a similar assumption of 20-30% cost of liquidity and could not utilize it during STIP I for the reasons i mentioned above. We have incentivized heavily with OVN tokens instead, our current costs of liquidity on PCS Arbitrum, during final days of STIP I, are below

Grant Matching: We will match Arb grant with OVN tokens worth 1.3M USD (assuming 1:1 matching)

Grant Breakdown: 100% spent on liquidity incentives across leading DEXes on Arbitrum - PCS, Curve, potentially, TraderJoe, others subject to market situation. The situation with DEXes is very fluid, with incentive efficiency fluctuating considerably on each DEX, will certainly will vary depending on the LTIP grant allocation. If we were to incentivize now, the incentives would be distributed as follows:

- PCS, USDC/USD+: 10%

- PCS, USD+/USDT+: 40%

- Curve, FraxBP/USD+: 10%

- Curve, USD+/USDT+: 40%

Funding Address: 0x08d89e98ec5d7261d182130e25EB281A01E348fc

Funding Address Characteristics: 2/3 multisig, safe wallet

Treasury Addresses:

0x08d89e98ec5d7261d182130e25EB281A01E348fc, 0xC0C4dD0E05D5E224E19eAF37ECA5eAfD8Fe51a67, 0xD1ab4484c26CFda01189C478562fE815dE511FBa, 0x784Cf4b62655486B405Eb76731885CC9ed56f42f, 0x9030D5C596d636eEFC8f0ad7b2788AE7E9ef3D46, 0xe497285e466227F4E8648209E34B465dAA1F90a0

Contract Address: 0x08d89e98ec5d7261d182130e25EB281A01E348fc

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Clearly outline the primary objectives of the program and the Key Performance Indicators (KPIs), execution strategy, and milestones used to measure success. This helps reviewers understand what the program aims to achieve and how progress will be assessed.

Objectives: Our primary objectives are to increase USD+ liquidity, attract a larger user base, and generate substantial trading volumes in the Arbitrum ecosystem. We plan to achieve these objectives by utilizing the grant for liquidity rewards and redeploying collateral into delta-neutrals with Vertex, Hyperliquid, and GMX v2.

Execution Strategy: [Describe the plan for executing including token distribution method (e.g. farming, staking, bonds, referral program, etc), what you are incentivizing, resources, products, use of funds, and risk management. This includes allocations for specific pools, eligible assets, products, etc.]

Execution Strategy: Our execution strategy includes distributing incentives through a liquidity mining program. The incentives are designed to increase USD+ liquidity and promote the use of our financial assets. Key partners to be involved are Curve, PCS, potentially, Trader Joe. Additional partners could emerge subject to market conditions.

If we were to incentivize now, the incentives would be distributed as follows:

- PCS, USDC/USD+: 10%

- PCS, USD+/USDT+: 40%

- Curve, FraxBP/USD+: 10%

- Curve, USD+/USDT+: 40%

Incentives would be split in 2 phases:

- Acquisition Phase, Weeks 1-6: Incentives per week will be gradually increased from ~60 to 350K per week (both Arb and OVN together), aiming at reaching 30 M TVL

- Retention Phase, Weeks 7-12: Incentives per week will be stabilized at ~230K USD per week for 6 weeks

Following expiry of the grant, Overnight plans to maintain bribes with revenue generated by the accumulated TVL.

| Phase | Week | Incentives per week (K USD) | Target TVL (M USD) |

|---|---|---|---|

| 1 | 1 | 58 | 5 |

| 1 | 2 | 115 | 10 |

| 1 | 3 | 173 | 15 |

| 1 | 4 | 231 | 20 |

| 1 | 5 | 288 | 25 |

| 1 | 6 | 346 | 30 |

| 2 | 7 | 231 | 30 |

| 2 | 8 | 231 | 30 |

| 2 | 9 | 231 | 30 |

| 2 | 10 | 231 | 30 |

| 2 | 11 | 231 | 30 |

| 2 | 12 | 231 | 30 |

What mechanisms within the incentive design will you implement to incentivize “stickiness” whether it be users, liquidity or some other targeted metric? [Provide relevant design and implementation details]

Our strategies are supported by the yield generated by perp funding rates: funding rates generate yield, that yield is used to incentivize OVN LP, OVNs used to incentivize USD+ and USDT liquidity.

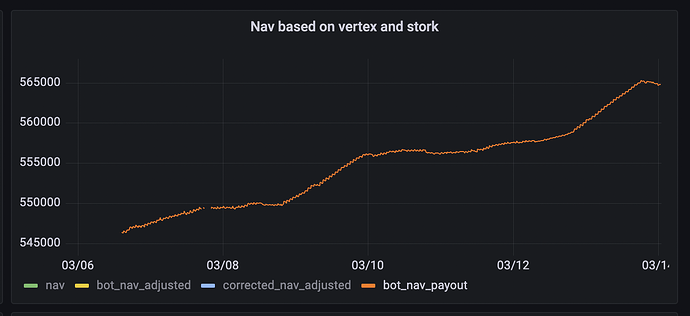

Example below demonstrates the performance of our delta-neutral wBTC strategy on Vertex, generating ~20K in profit on 545K position during first week of March.

This has to do with findung rates exceeding 68% on average during this period.

We beleive that once grant season is over, the natural yield generated by our delta-neutral strategies should be sufficient to incentivize retention of the TVL and remain profitable.

Specify the KPIs that will be used to measure success in achieving the grant objectives and designate a source of truth for governance to use to verify accuracy. [Please also justify why these specific KPIs will indicate that the grant has met its objective. Distribution of the grant itself should not be one of the KPIs.]

Overnight TVL on Arbitrum as per DeFiLlama - 30M USD broken down into 4 milestones as follows:

| Week | Target TVL (M USD) |

|---|---|

| 3 | 15 |

| 6 | 30 |

| 9 | 30 |

| 12 | 30 |

Additional metrics would track the amount of funds deployed into delta-neutral strategies underlying USD+ and USDT+. We look to have a total of [50]% of TVL redeployed into delta-neutral strategies with Vertex, Hyperliquid, GMX V2.

Grant Timeline and Milestones: [Describe the timeline for the grant, including ideal milestones with respective KPIs. Include at least one milestone that shows progress en route to a final outcome. Please justify the feasibility of these milestones.]

We expect to deploy the grant with 12 weeks from receipt, potentially, starting May 1st. The deployment would be conducted in 2 phases:

- Acquisition: 6 weeks to bootstrap 30M TVL

- Retention: 6 weeks at somewhat lower cost of funds, spent to retain 30M TVL

Thus, the milestone should involve achieving 30 M TVL around June 15th.

Additional metrics should be # of active wallets’ reaching 7-10K, share of TVL deployed into delta-neutral strategies - [50]%.

How will receiving a grant enable you to foster growth or innovation within the Arbitrum ecosystem? [Clearly explain how the inputs of your program justify the expected benefits to the DAO. Be very clear and tangible, and you must back up your claims with data]

By boostrapping liquidity into USD+, we would exercise a multiplied positive effect on the Arbitrum’s DeFI ecosystem, as our model positively impacts other protocols:

- we boostrap liquidity via DEXes, like Curve, PCS, etc.

- liquidity is accumulated in USD+ collateral and redeployed into other protocols, in particular, in perp trading venues like Vertex and soon Hyperliquid and GMX

- in process, a high amount of trading volumes is generated:

- spot is traded on Uni V3 (USDC/wETH, USDC/wBTC, USDC/Arb)

- corresponding perp trading is generated on perp-trading venues

Overall, the grant would further strengthen Arbitrum’s position as #1 chain for traders and trading, by deepening its spot and perp markets.

Do you accept the funding of your grant streamed linearly for the duration of your grant proposal, and that the multisig holds the power to halt your stream? Yes (better weekly linear stream, than time-linear)

SECTION 5: Data and Reporting

OpenBlock Labs has developed a comprehensive data and reporting checklist for tracking essential metrics across participating protocols. Teams must adhere to the specifications outlined in the provided link here: Onboarding Checklist from OBL 13. Along with this list, please answer the following:

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Ready to comply, no special requests

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard? [Please describe your strategy and capabilities for data/reporting] Yes

First Offense: *In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program can be given until a closeout report is provided.) Yes

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the program’s funding stream?: Yes