[Silo Finance] Bi-Weekly Update [07/01/2024]

Recap of the Previous Two Weeks

Silo begun its incentivization at the beggining of last week upon claiming its first batch of ARB incentives. We will be following a similar philosophy to that of our previous grant cycle but with a bigger focus on derivatives such as Pendle PT tokens. In addition to starting rewards we’ve recently released the new September expiry pendle markets for EtherFi, Renzo, Kelp, and Ethena all which are seeing active use now. We look forward to enable more markets - also a big shoutout to Contango, Pendle and FactorDAO who have been streaming STIP-b rewards to our users via their leverage tools.

Below are the initial weights given to each silo aswell as the individual allocation to each asset within a market. We’ve also got a more comprehensive google doc for those that would like a closer look ($ARB STIP Bridge grant distribution (Reports) - Google Sheets)

| Silo | Rewardeds action | Silo’s allocation weight | sToken distribution allocation |

|---|---|---|---|

| PT-ezETH (Sep. 26) | Deposit ETH | 3.50% | 2,784.11 |

| PT-eETH (Sep. 26) | Deposit ETH | 3.50% | 2,784.11 |

| PT-rsETH (Sep. 26) | Deposit ETH | 2.50% | 1,988.65 |

| PT-USDe (Aug 29) | Deposit USDC.e | 8.00% | 6,363.68 |

| weETH | Deposit ETH | 7.00% | 5,568.22 |

| ezETH | Deposit ETH | 7.00% | 5,568.22 |

| tBTC | Deposit ETH | 3.00% | 477.28 |

| tBTC | Deposit USDC.e | 3.00% | 1,909.10 |

| RDNT | Deposit USDC.e | 2.00% | 954.55 |

| RDNT | Deposit ETH | 2.00% | 636.37 |

| ARB | Deposit USDC.e | 15.00% | 8,352.33 |

| ARB | Deposit ETH | 15.00% | 3,579.57 |

| GMX | Deposit USDC.e | 0.50% | 397.73 |

| GNS | Deposit USDC.e | 0.50% | 397.73 |

| GRAIL | Deposit ETH | 4.00% | 3,181.84 |

| MAGIC | Deposit USDC.e | 0.50% | 397.73 |

| PENDLE | Deposit USDC.e | 7.00% | 3,340.93 |

| PENDLE | Deposit ETH | 7.00% | 2,227.29 |

| PREMIA | Deposit USDC.e | 1.00% | 795.46 |

| rETH | Deposit USDC.e | 4.00% | 2,545.47 |

| rETH | Deposit ETH | 4.00% | 636.37 |

| SILO | Deposit ETH | 3.00% | 835.23 |

| SILO | Deposit USDC.e | 3.00% | 1,551.15 |

| wBTC | Deposit ETH | 15.00% | 3,579.57 |

| wBTC | Deposit USDC.e | 15.00% | 8,352.33 |

| wstETH | Deposit ETH | 13.00% | 3,102.29 |

| wstETH | Deposit USDC.e | 13.00% | 7,238.69 |

| 79,546.00 |

We look forward to bringing you more updates - thank you so much.

ARB Received Last Disbursement: 83,334

ARB Utilized as Incentives in the Last Two Weeks: 79,546 (Still streaming for another week)

Contracts incentivized over the last 2 weeks: $ARB STIP Bridge grant distribution (Reports) - Google Sheets

Contract address label Form completed for all addresses: Yes

ARB left over: 3,788

Plan for leftover ARB: ARB will be rolled back in to incentives in the next rebalancing

Summary of incentives: We’ve put a major focus on PT derivatives this time around, focusing the majority of our resources to target LRTs. We are actively researching top derivatives and vaults in the ecosystem to see what would warrant a highly scalable market. That being said small projects dont be discouraged - if we can enable it we will just reach out on our discord.

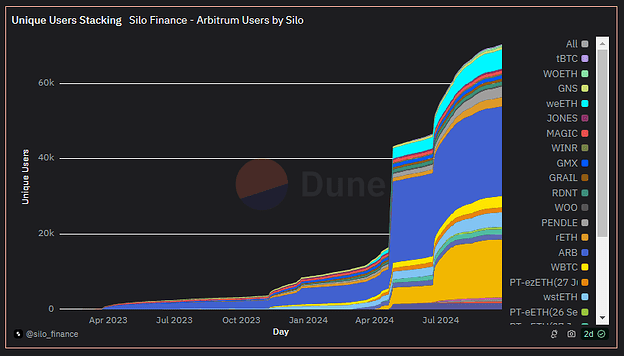

STATS

Average daily TVL: $107,792,937

Average daily transactions: 940

Average daily volumes: $12,501,183

Number of unique user addresses: 2,421

Link to Dashboard showing metrics:

- Overall Arbitrum Stats: https://dune.com/silo_finance/arbitrum-stats

- Per Market Analysis 1: https://dune.com/silo_finance/arbitrum

- Per Market Analysis 2: https://dune.com/silo_finance/arbitrum2

- SiloDAO Revenue: https://dune.com/silo_finance/revenue

- Silo Post-STIP Arbitrum Growth Plan: Growth Plan: April - June 2024 - Silo Governance

- Market and Oracle Analytics by Apostro: Silo Finance Overview

- https://silo.observer/ - Community Built Metrics by Jay Welsh

- https://www.openblocklabs.com/app/arbitrum/grantees/Silo%20Finance Openblocks STIP Dashboard (Also shows comparative analysis)

Plan For the Next Two Weeks

Amount of ARB to be distributed: 87,122

Contracts that will be incentivized: $ARB STIP Bridge grant distribution (Reports) - Google Sheets

Contract address label completed for all addresses: Yes

Mechanism for distribution incentives: All incentives are being distributed via a custom set of contracts with an offchain component built by our friends at Angle utilizing their Merkl system. The integration is also open to everyone so if protocols wish to stream rewards to their own markets they can do so completely permisionless although as always we are happy to help.

Summary of incentives plan: We will follow the plan we’ve mentioned above, following through on new markets with great agility and rebalancing between markets to find where capital is most sticky. We will also be gradually reducing rewards slightly to see if we can get to a

Summary of changes to the original plan: No changes as of yet this being the first week of streaming.