SECTION 1: APPLICANT INFORMATION

Applicant Name: Joshua Scigala

Project Name: TheStandard.io

Requested Grant Size: 125K ARB

Project Description

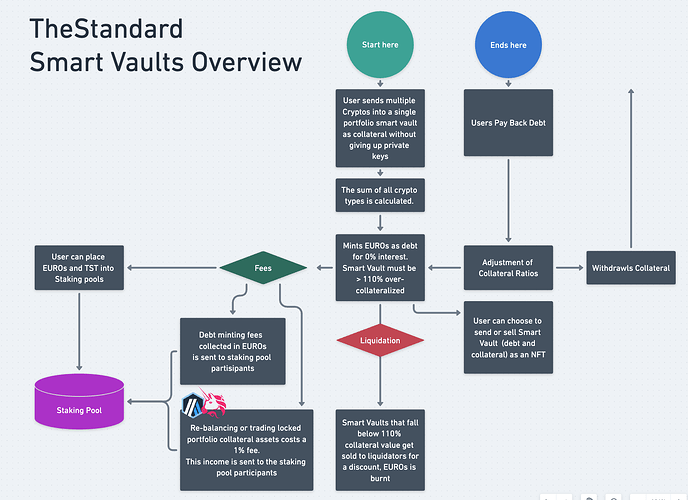

TheStandard is an Arbitrum native CDP protocol, focused on borrower flexibility with:

- Portfolio / multi collateral lock up into a single account abstracted vault

- Trading between collateral types using arbitrum Uniswap

- 0% interest loans,

- True 110% collateral (no random 3d party redemptions),

- Liquidation pools make sure there is always more collateral locked up than stables in circulation

- Income from collateral trading fees, debt minting fees, and more distributed to staking pools.

- Multi stablecoin output Starting with EUROs. Launching USDs soon.

- Dynamic NFT represents the CDP smart Vault, so users can sell their debt and locked collateral in a single transaction.

- Provide the easiest and cheapest way to borrow value against a portfolio of assets, without giving away your private keys and offering a sustainable yield.

The ability to borrow at 0% fixed interest while still having flexibility to trade your portfolio attracts more capital into Arbitrum from other chains.

UserFlow

- User logs in with web3 wallet

- Creates EUROs or USDs smart vault

- Smart Vault generates an arbitrum address that is only controlled by that users web3 wallet.

- Smart Vault can hold a whole portfolio of collateral assets at once, not just one. Currently ARB, LINK, ETH, WBTC, PAXG and soon GMX and more.

- The smart contract uses chainlink to determine the sum of all collateral value.

- User borrows (mints EUROs) against the collateral making sure to be at least 110% over collateralized (pays a one off minting fee currently between 0.5 to 5% but NO ongoing stability or interest fees)

- Users can trade between collateral types. (Smart Vaults contracts use Arbitrum Uniswap in the background and pays 1% fee. This income gets given to stakers that lock up TST and EUROs.

- User has the choice to sell his smart vault as a dynamic NFT (sells key to collateral and debt)

- User pays back debt and withdraws collateral.

Team Members, Project Links and Contact Info

Team Members and Roles:

Joshua Scigala - Co-Founder

Philip Scigala - Co-Founder

Ewan Sheldon - Lead Developer

George Papp - Business Development & Marketing Lead

Thorex - Community manager

Project Links:

Website: https://www.thestandard.io/

X .com: https://x.com/thestandard_io

Github: The Standard · GitHub

Contact Information

Point of Contact: GPG (George Papp), Joshua Scigala

Point of Contact’s TG handle: @ GPG13; @ vaultoro

Twitter: @ Renegade_George; @ JScigala

Email: george@thestandard.io

Do you acknowledge that your team will be subject to a KYC requirement?: Yes

SECTION 2a: Team and Product Information

Team Experience

Joshua Scigala: Active in the Bitcoin ecosystem since November 2010, Joshua Scigala’s experience includes navigating the tumultuous waters of the Mt. Gox exchange collapse, which catalyzed the creation of the glass books transparency protocol for centralized exchanges. With a rich background that encompasses launching the world’s inaugural Bitcoin/allocated gold orderbook exchange in 2014 alongside his brother in Philips, Joshua’s expertise spans the crypto landscape, tokenization of real-world assets, economic theory, and the precious metals market, with a keen eye on EU regulatory frameworks. His passion for decentralization is rooted in its potential to offer a pathway away from tyranny, showcasing his commitment to leveraging technology for greater freedom and security.

LinkedIn

X .com

CoinTelegraph 2015

Philip Scigala: Before co-founding the first Bitcoin / allocated gold orderbook exchange in 2014, Philip Scigala honed his entrepreneurial skills by running his own software company for many years. His journey continued as he adeptly secured venture capital funding for the venture, demonstrating a keen ability to navigate the ever-evolving regulatory landscape of a crypto and gold exchange. Philip’s pioneering work didn’t stop there; he also led the integration of Bitcoin’s Layer 2 (lightning network) into an exchange, marking a first in the world. His story reflects a profound commitment to innovation and the determination to see long-term projects through to success.

George Papp: George Papp brings a robust blend of traditional finance expertise and crypto innovation, transitioning from eight years in investment banking within London’s high-stakes FX sales and trading at HSBC, JP Morgan, and Deutsche Bank. Now at the forefront of DeFi with TheStandard.io, George applies his deep knowledge of traditional finance to revolutionize the DeFi space, embodying the bridge between two financial paradigms.

Ewan Sheldon: Ewan Sheldon has over 7 years experience working as a software engineer, first at a small networking company, providing cloud-based WiFi management solutions, before joining a software craftsmanship consultancy. There he worked on a major software modernisation project with a major cloud-based medical software service, while also developing his architecture and DevOps skills. Since starting his journey as a Smart Contract engineer with TheStandard.io, Ewan has focused his energy on Smart Contract security and architecture.

What novelty or innovation does your product bring to Arbitrum?

TheStandard is the only 0% interest CDP that lets users lock up many different collateral types at the same time into a single vault and then trade between those collaterals even though they have borrowed against them. This offers flexibility for borrowers with the predictability of 0% fixed interest loans.

Fees (Trading, minting, and more) are collected across the protocol to offer a strong sustainable initial use case for the EUROs.

List of unique features

- Multiple collaterals in a single vault

- Fixed 0% interest loans are possible due to income being derived from locked collateral trading.

- Yield income from collateral rebalancing , general trading, vault alarms and more features planned

- Vaults controlled by a Dynamic NFT so users can sell their CDP (sell debt & collateral in single tx)

- Locked collateral swaps so that users are not locked into positions

- True fixed 110% collateral without random 3rd party redemptions

- Users can CHOOSE to automatically pay down their own debt at a discount if TheStandard stables fall below peg.

- Multi Stablecoin output starting with EUROs and soon to release USDs, INRs and many more.

- A focus to bring real world assets into CDP’s as well as volatile cryptos

Our protocol introduces a unique risk mitigation by incorporating Chainlink’s decentralized oracle network for more secure and reliable asset price feeds, enhancing the protocol’s resilience against market manipulations and oracle failures.

Unique Appeal

TheStandard protocol is designed to appeal to a large number of users drawing liquidity from other chains into Arbitrum. As far as we know, TheStandard is the only protocol that offers interest free loans while simultaneously giving users the flexibility to continue trading their collateral into different assets. Our integration of Li.Fi makes it simple for people to bring TVL into Arbitrum from any chain so they can take advantage of TheStandard Protocol.

Is your project composable with other projects on Arbitrum?

Yes, TheStandard.io is designed for high composability with Arbitrum projects through key integrations and collaborations:

Diverse Collateral Types: Supports ARB, LINK, WBTC, ETH, and GMX. We plan to add two new collateral types per week over the next 4 months, including Radiant, FRAX and more to be announced. The more collateral options, the more trading happens, and the more fees generated.

Chainlink Integration: Chainlink Labs has invested into TheStandard through the Chainlink Build accelerator program. Chainlink ensures secure, decentralized price feeds for our CDPs, enabling synergy with projects utilizing Chainlink oracles. We also utilise Chainlink automations for the liquidation pools.

Arbitrum native DEX Collaborations: The smart vault contracts trade collateral on Arbitrum Uniswap. This enhances liquidity and trading volume directly on Arbitrum even though collateral is locked.

Through these avenues, TheStandard protocol integrates deeply within the Arbitrum ecosystem, promoting a more interconnected and efficient DeFi environment.

We are in talks with several wallets and dapps to integrate TheStandard smart contracts directly into their interfaces. THis will also further decentralized TheStandard.

Comparable protocols within the Arbitrum ecosystem or other blockchains

LIQUITY PROTOCOL

While Liquity protocol on Ethereum is a notable comparison in terms of offering low-interest over collateralized loans, TheStandard.io distinguishes itself within the Arbitrum ecosystem by being written from the ground up as a true next-get CDP. Unlike Liquity, which is pivoting away from 0% interest borrowing due to fundamental issues with their redemptions model, TheStandard.io maintains a sustainable model for 0% interest borrowing. Our approach leverages the potential of using hundreds of crypto assets as collateral rather than a single asset and enables active trading between them. This not only diversifies risk for borrowers but also introduces a robust income stream that is used to incentivize staking and generates yield outside of traditional interest, ensuring long-term viability and user benefits without relying on loan interest. We hope to attract a large portion of liquidity users once they introduce interest bearing loans.

MAKER DAO

Respectfully building on MakerDAO’s pioneering foundation in DeFi, TheStandard.io introduces key innovations within the Arbitrum ecosystem. We expand on MakerDAO’s CDP concept by supporting a broader range of crypto assets as collateral, enabling greater risk diversification and capital efficiency through active collateral trading and no stability fees. Unlike the single or limited collateral approach, our model allows for enhanced user flexibility. Furthermore, TheStandard.io’s unique fee model fosters a sustainable ecosystem for 0% interest borrowing, leveraging non-interest income streams to incentivize staking and yield generation. In doing so, we aim to complement and advance the DeFi landscape inspired by MakerDAO’s groundbreaking work.

Metrics, target KPIs

We need to see growth on multiple fronts at a balanced rate. Too much borrowing without people placing that into the staking pools could risk of De-peg. Our KPI’s are a measured and balanced growth of Smart Vault TVL > Debt minted > EUROs placed in Staking pools and liquidation pools > trading volume generating income.

https://dune.com/the_standard/smart-vaults

How do you measure and think about retention internally? (metrics, target KPIs)

During the bootstrapping process we have to focus on the first use case which is yield from the staking pools. Without this users will simply want to borrow and sell, depleting LP and risking a depeg.

As more TVL is locked into smart vaults users will naturally want to continue taking advantage of the markets by trading their collateral. This means that our second target KPI is collateral trading volume.

Our DUNE dashboard is currently giving us great insights although we plan to move over to spaceandtime.io once they incorporate Arbitrum into their data warehouse. We are currently in talks to make this happen.

We will aim for the following KPI’s

- TVL locked in Smart Vaults

By week 3: 2.5M

By week 6: 5.9M

By week 9: 11.3M

By week 12: 17.8M

For a full break down of the distribution model please see the google sheet

-

Number of Stablecoins over time (EUROs) in circulation (Minted - Burned.)

-

TVL in liquidation pools

-

Depth of liquidity on DEX’s

-

Collateral Trading Volume

-

Daily Transaction Count:

-

Daily Protocol Fees collected

-

Daily Borrowing Volume

-

Liquidations measured in USD

-

List of Depositors into ARB incentivise liquidation: The list of addresses will be able to be pulled from the blockchain

-

CDP Utilization Rate (overcollateralization):

Agree to remove team-controlled wallets

Do you agree to remove team-controlled wallets from all milestone metrics AND exclude team-controlled wallets from any incentives included in your plan:

YES ABSOLUTELY. The goal of the grant is to grow the protocol and strengthen Arbitrums DeFi ecosystem. The team will be far better off in the long term when the protocol is successful rather some short term payments.

Did you utilize a grants consultant or other third party not named as a grantee to draft this proposal? If so, please disclose the details of that arrangement here, including conflicts of interest (Note: this does NOT disqualify an applicant):

NO

SECTION 2b: PROTOCOL DETAILS

Is the protocol native to Arbitrum?

Yes, TheStandard DAO have strategically chosen to concentrate our efforts exclusively on Arbitrum for the foreseeable future to avoid the dilution of liquidity across multiple chains. In alignment with this focus, we are actively engaged in research and development initiatives aimed at enhancing the seamless integration of liquidity from various chains into Arbitrum.

This will enable users to more efficiently leverage their assets from across networks for borrowing purposes over on Arbitrum, reinforcing our commitment to optimizing user experience and liquidity utilization within the Arbitrum ecosystem.

On what other networks is the protocol deployed?

While we initially deployed on the Ethereum mainnet, we decided to abandon this deployment because we needed to focus all liquidity in one place and too many people were complaining about L1 fees.

The contract addresses for the Mainnet contracts are

TST on Mainnet

The Standard: TST Token | Address: 0xa0b93b9e...46e989b53 | Etherscan

EUROs on Mainnet

sEURO | Address: 0xb3995116...feAed9A00 | Etherscan

What date did you deploy on Arbitrum mainnet?

29TH AUG 2023 + 0x8243858e69e8b6cf00d3083f37d88598bb6b5435fc13ca3f2772b0103ac0e0ba

Do you have a native token?

[Yes link tokenomics docs]

Past Incentivization

To enhance liquidity and incentivize participation, TheStandard DAO previously engaged in a collaboration with Camelot, incorporating GRAIL incentives into their Nitro pools. Despite the innovative approach, we observed that the concept of concentrated liquidity pools presented challenges for our users, with many inadvertently placing liquidity in suboptimal positions, even with guidance from our partnership with Gamma protocol. This insight led us to pivot towards Merkle incentives, which yielded more favorable outcomes by simplifying the participation process for our users.

Overcoming adversity

Following a vulnerability exploit in late December where someone could withdrawal collateral without paying off the debt, our focus shifted towards reinforcing the security and integrity of our protocol with strong audits from Cyfrin/Codhawks. The period between December until 1 March has been on comprehensive code audits and development enhancements rather than growth.

Audit submissions and final report can be viewed here.

DEX Liquidity

We have recently onboarded advisor Robert Mullins AKA 0xluude from the DeFi collective as liquidity advisor,. Robert is known for guiding Liquity.org’s liquidity strategy and helping it achieve deep liquidity. His insights so far have been invaluable, and we’re proud to have him as an advisor to TheStandard.

Looking ahead, TheStandard DAO is excited to announce a focus on our partnership with Ramses DEX and on establishing a EUROs / agEUR liquidity pair. This initiative is part of our Ramses liquidity strategy, which has been meticulously developed and refined over the past month. The plan has been put into action on the 12th of March and will take a while to build sustainable.

NOTE: This grant is NOT used to incentivise liquidity on any exchange but rather focus on building a real yield feedback look driving real use of the EUROs rather than short term LP incentives.

Current Incentivization:

Current Incentivization: How are you currently incentivizing your protocol?

TheStandard is incentivised by organic yield but we fall under a chicken egg problem where there is not enough TVL to generate a strong yield yet and not enough yield to attract TVL.

The DAO is placing all its efforts to building a renewable growth strategy by placing 0.2 ETH per day to subsidize the current yield pools. We are currently subsidising the yield account from treasury.

Where does organic yield come from

FOR EXAMPLE:

A user has ETH and WBTC as locked collateral for a loan. Hearing about an upcoming major announcement from Arbitrum (ARB), they decide to include ARB in their collateral mix.

The process is simple: the user goes to their Smart Vault, selects ETH, and directly swaps 0.5 ETH for ARB even though they have borrowed against their ETH collateral. This swap is seamlessly executed by the smart vaults through Arbitrum’s Uniswap in the background.

The user finds the 1% trading fee reasonable, as it avoids the hassle of repaying the loan, withdrawing collateral and then making the trade.

They apply the same process to swap a portion of their WBTC for ARB. Now, their collateral is diversified into ETH, WBTC, and ARB, ready for the big market news.

Later, anticipating a market peak, the user decides to convert some collateral into PAXG Gold tokens, securing their collateral capital gains without needing to clear their debt first.

—------

The fees collected by this process will get dropped onto users that place EUROs in the staking pools.

This grant will help the treasury incentivise people to lock up ARB, GMX, LINK and other collateral types, borrow EUROs and USDs against that and lock those funds into the yield pools. The good returns will get people talking and attract more TVL locked and borrowed against. The more TVL, the more we can expect trading activity to be taking place through our ecosystem. This is because when you have borrowed funds you don’t want to pay back the loan just to trade, you will simply trade within the system and pay the fee.

Have you received a grant before

Have you received a grant from the DAO, Foundation, or any Arbitrum ecosystem related program?

We have received a small R&D milestone grant of $10K USD per major milestone. This has helped us afford the code audit and will also help in bootstrapping liquidity on RAMSES DEX. We are just invoicing for the first milestone now for the first 10K.

Protocol Performance

When we launched we have had consistent growth, being shown as the 3rd fastest growing protocol on Arbitrum for 4 weeks in a row.

https://twitter.com/ETH_Daily/status/1712427072151265402

https://twitter.com/arb_insider_TIG/status/1707670077737464119

This was reflected in our smart vaults Total Value Locked (TVL) on Arbitrum, which quickly ascended to one of the platform’s fastest-growing metrics from launch to the exploit date.

The exploit in mid December forced us to slow down and run another Audit. We did not want to re-peg or do any marketing until we were sure all contracts were water tight.

Our TVL has rebounded to surpass all-time highs, now exceeding $1 million.

Following the incident, the past three months have been dedicated to collaborating with Cyfrin Codehawks on a rigorous competitive audit, ensuring the security and resilience TheStandard moving forward. CodeHawks | The Standard Full report

As a testament to our dedication, our current TVL has not only recovered but now stands higher than pre-exploit levels, showcasing the strength of our commitment to project sustainability and growth.

Acceptance into the Chainlink BUILD program stands as a big achievement for our project, offering invaluable exposure and comprehensive feedback / support from Chainlink.

Protocol roadmap

Phase 1&2

![]() Build Community

Build Community

![]() Launch sEURO

Launch sEURO

![]() Over-collateralize initial EUROs

Over-collateralize initial EUROs

![]() Create Partnerships

Create Partnerships

![]() Launch 1st Smart Vault

Launch 1st Smart Vault

![]() Launch Smart Vault NFTs

Launch Smart Vault NFTs

![]() Launch on DEX

Launch on DEX

![]() Collateral trading

Collateral trading

![]() Launch Liquidation Pools

Launch Liquidation Pools

![]() DAO voting

DAO voting

![]() Code audit

Code audit

![]() KPI’s: TVL: $1,000,000, Smart Vaults opened: 100+

KPI’s: TVL: $1,000,000, Smart Vaults opened: 100+

All the above are now complete

Phase 3 (Expansion Q2 -Q4 2024)

- 30+ Collateral types (GMX, GM, and more)

- Launch USDs

- Minor CEX listing

- Stop Loss, Alarms

- 3 more stable assets

- Payment process partners

- KPI’s: .TVL: $10,000,000

Phase 4:

- Release 30 Stable Assets

- 100+ collateral types

- Smart DCA repay

- 10 tokenized RWA partners

- Stock/Share pegged stablecoins

- Commodity pegged stablecoins

- 5+ Major exchange listings

- Cross every major chain bringing liquidity into Arbitrum

END OF Q4

KPI’s: TVL: $10,000,000 .Vaults opened (users) approx: 5000

Audit history, security vendors and security incidents

Code hawks is the competitive audit arm of Cyfrin Who ex chainlink core developers.

Code hawks had over 250 white hats pen testing and providing feedback for a month.

You can see the full report. here

Security Incidents

The one and only exploit that happened was where a user managed to withdraw collateral without paying back debt. This was done because there was no PAXG/WBTC liquidity on Arbitrum and no slippage check on our swap contracts. The attacker effectively created the LP where 1 PAXG was worth 10 WBTC and then swapped their collateral in TheStandard.

Please see full details here.

SECTION 3: GRANT INFORMATION

Requested Grant Size: 125K ARB

Grant explanation

Justification for the Requested Grant Size of 125K ARB:

Arb is calculated to be valued at $2

TheStandard DAO requests a 125 thousand ARB grant to solve our Chicken/egg problem so that there is a good enough ROI in the beginning to bring in TVL to start earning an organic yield.

Users must lock up funds and borrow assets for our Liquidation/yield Pools to thrive, yet they need attractive yields as motivation, which come from users trading their value locked.

To kickstart this, we’re initially boosting yields with protocol incentives, to compete for TVL by enticing early users to participate. This sets off a cycle; more participation in locking up assets increases trading and, consequently, organic yields, making the pools self-sustaining. Essentially, the grant primes the system to overcome the initial incentive hurdle, leading to a naturally thriving ecosystem.

Our modeling and strategy focuses on transitioning from subsidized yields to self-sustained yields, driven by trading fees, smart vault liquidation proceeds, and debt minting fees generated within our ecosystem.

This approach ensures long-term engagement rather than temporary capital influx, gradually replacing initial subsidies with genuine, activity-based returns to foster a stable and flourishing protocol on Arbitrum.

In the chart below we see the Blue line represent subsidised yield slowly decreasing, the pink line represents organic yield growing as more and more people are lured in to lock up funds which generate the organic yield. Users get the opportunity to have 0% interest loans but are then forced pay 1% trading fees unless they pay back the debt and withdrawal their collateral. This income the pink line. The golden line is the cumulative yield Organic + subsidised. Once subsidies go to zero we project Organic yield be enough to keep pushing the yield higher.

Strategic allocation

Initial Capital Attraction: The grant will serve as a mechanism to attract initial capital, enabling users to leverage their assets at no cost. This is expected to significantly boost participation and liquidity within the ecosystem.

Bootstrap liquidation pools:

By directly incentivizing participation, we aim to quickly scale the utilization of yield and liquidation pools, creating a compelling value proposition for users to lock assets and borrow stablecoins.

Self-Sustaining ecosystem development

As more users engage, we anticipate a natural increase in collateral trading within our Smart Vaults.

We put this number at 10% of locked assets will get traded on a daily. The fees generated from these trades are projected to grow with the TVL. This will reduce the need for external yield subsidies.

The transition from subsidised to organic yield will bootstrap our long-term vision of sustaining real Total Value Locked (TVL) with genuine yield derived from active ecosystem participation.

Long-Term incentive alignment

This grant is not merely a temporary stimulus but a strategic investment into the foundational phase of building a self-sustaining ecosystem with genuine, user-generated fees. By the start of week 6, our modeling expects the natural trading activity income to overtake the subsidies to sustain the ecosystem’s incentives, aligning with the ARB Grant Program’s vision for fostering long-term growth and stability within the Arbitrum ecosystem.

Grant matching

The liquidation pools are only half of the equation. The other half is liquidity on DEX’s.

TheStandard DAO will contribute 200K made up of ARB, GMX and agEURO to help bootstrap LP and incentivise Ramses pools between EUROs and agEURO. Joshua Scigala will also add 100K to LP bribes and votes for Ramses liquidity.

Robert Mullins AKA 0xluude from the DeFi collective who helped strategically build deep liquidity for liquity.org when they where bootstrapping has joined TheStandard liquidity advisory board to do the same for us.

Grant distribution breakdown

Grant Breakdown:

(Subsidy Modeling Projections - Google Sheets) outlines the Projected Transition from Subsidy Dependence to Sustainable Organic Income

Funding address and characteristics

Funding Address: 0x99d5D7C8F40Deba9d0075E8Fff2fB13Da787996a

Funding Address Characteristics: SAFE 2/3 Multisig

Treasury address

|Treasury 1| 0xf0A13763a2102A6EA036078C602F154A2a5eEc7A

|Treasury 2| 0xf8503137ccb596ef2a8bfaa21322e48e21442e92

Contract Address we will use to distribute the grant to users

Contract Address to distribute the grant to users over 12 weeks

0x2a823EE5F731c5699E75E51AcA799e1141d29910

https://arbiscan.io/address/0x2a823ee5f731c5699e75e51aca799e1141d29910

SECTION 4: GRANT OBJECTIVES, EXECUTION AND MILESTONES

Objectives

Imagine a platform where early user incentives seamlessly transform into a vibrant, self-sustaining economy. Our vision is clear: The grant solves the chiken-and-egg bootstrapping problem. By Week 6, watch as our user-generated organic yield flourishes, outshining the initial incentives. This is not just a plan; it’s a reality unfolding on Arbitrum, where active participation and asset trading are the cornerstones of growth."

Execution Strategy

Here we will demonstrate our thorough understanding of our goals and lay out our execution strategy.

We visualize the influx of users drawn by substantial initial rewards as they lock in ARB, GMX, LINK, and more. We picture the surge in Total Value Locked (TVL) within the smart vaults as we educate the market about this bootstrapping opportunity. Our models foresee borrowed EUROs flowing into yield pools. With 10% of TVL becoming trading volume. The 1% trading fee will match the subsities becoming the new backbone of yield by Week 6, signifying a robust ecosystem on Arbitrum.

A five point execution strategy

Point 1. incentive Ramp Up

Roll out yield incentive plan that starts strong to attract initial capital to the Protocols yield / Liquidation pools and then taper them off over 12 weeks. We thoroughly understand that our goal is to match subsidized yield with organic yield by week 6 and eventually replacing them fully.

Point 2. Collaboration with other Arbitrum protocols and Education:

We will continue to implement targeted outreach and partnerships by releasing two new collateral types per week. Cross pollinating other Arbitrum ecosystem projects with TheStandard bringing more use cases on board.

Point 3. User Growth:

Target consistent growth in TVL and user numbers each week, tracking closely with projected KPIs to ensure the plan is on course. Releasing a permissionless white label front end will enable anyone to launch and market an Arbitrum 0% interest borrowing platform that will use TheStandard smart contracts in the backend.

Point 4. Income Balancing:

Balance subsidized liquidations and yield by following building out more organic income, gradually shifting the focus to self-generated earnings within the ecosystem.

Point 5. Feedback Integration:

Use user feedback to refine incentives and yield strategies, ensuring alignment with user needs and market conditions.

Sustainability Milestone:

By the end of 15 weeks, we aim to over take subsidized yield with organic yield and after 52 weeks the subsidies will be fully phased out indicating a mature, self-sustaining ecosystem.

Please find clear execution strategy modeling here. Subsidy Modeling Projections - Google Sheets

To ensure the longevity and sustainability of our ecosystem post-grant, we’re implementing a ‘Gradual Reduction Model’ for our incentives, which is designed to smoothly transition users from subsidized to organic interactions within our protocol.

[details="Incentive design for “Stickiness”]

Stickiness happens because people have borrowed against their collateral. This locks users into TheStandard ecosystem until they pay back their debt. If they wish to take advantage of the markets they must trade within TheStandard ecosystem paying the fees and perpetuating the yield accounts.

There is no other protocol that can offer yield as well as zero interest loans. They come for the zero interest loans and stick around for the yield. While they stick around, they are compelled to trade and pay fees within TheStandard.

[/details]

KPIs for success

- TVL Increase: We’re setting clear weekly targets for TVL growth, ensuring a balanced increase in ecosystem participation. Starting with an initial boost and aiming for a TVL of ~$6 million at the 6 week stage and a substantial rise to ~ $20 million at the end of 12 weeks, this progression reflects our commitment to sustainable growth.

- Trading Volume: By setting a conservative goal for trading volume to consistently represent 3% of TVL, we’re directly correlating ecosystem engagement with financial health, promoting active participation within our platform.

- Minting and Trading Fees:Monitoring minting and trading fees aims for a weekly increase, directly funding organic yield. This ensures our ecosystem’s financial activities translate into tangible rewards for users.

- Organic Yield Growth: The goal to increase organic income weekly from $1,000 to $12,340, while reducing subsidization to 0 by week 12, showcases our roadmap towards financial sustainability and ecosystem maturity.

- Subsidy Reduction: Our strategy to decrease subsidies from $5,952 to $0 daily as organic yield rises demonstrates our plan for a transition to a self-sufficient model.

- EURO Generation: Aiming to boost EUROs generated from €180,000 to over ~€2.8 million ensures that our stablecoin remains a central, actively used asset within our ecosystem.

Each KPI is designed with a direct linkage to our broader strategic objectives, providing clear, measurable outcomes that reflect both immediate progress and long-term vision for ecosystem health and growth.

For a full unpacking of KPI numbers please see our model google sheet..

Sybil and Wash Trading Resistance

TheStandard.io’s design has no inherent advantage for Sybil attacks and we are not incentivising LP with the grant so wash trading is also not a problem. Rewards in our yield and liquidation pools are distributed proportionally among participants, nullifying the benefit of controlling multiple accounts. This equitable approach ensures incentives directly support genuine contributions to our ecosystem’s liquidity and stability, promoting a fair and sustainable environment.

- Initial Boost (Weeks 1-3): Utilize grant funds to kick start and increase initial TVL and set the foundation for organic growth.

- Middle Growth (Weeks 3-6): Encourage liquidation/yield pool usage and trading within the platform to increase organic yields. Collect the same amount of Organic yield as subsidized yield.

- Transition Phase (Weeks 6 - 9): Continue to reduce subsidy injections as organic trading activities sustain yields.

- Maturation (Weeks 9 - 12): Reach a self-sustaining ecosystem where yields are predominantly organic and subsidies go to zero. 20 new collateral types have been added and TVL crosses 20 million mark.

Each milestone is designed with feasibility in mind, based on projected growth rates and the incentivization structure.

[/details]

Fostering growth and innovation within the Arbitrum ecosystem

The grant will enable TheStandard DAO to bootstrap the first major use case for a true 0% interest borrowing CDP while fostering the growth of well designed decentralized and over collateralized stablecoins. This drives assets flight over to Arbitrum to take advantage of zero percent fixed interest loans without auto redemption and strong organic yields. Our aim is to directly contributes to the Arbitrum ecosystem’s growth. By offering a capital efficient and flexible borrowing smart contracts. We aim to attract a broader user base and increase overall network activity, delivering tangible benefits to the Arbitrum blockchain.

Acceptance of funding terms

We agree to a linear vesting period of 12 weeks as proposed. For the first 2 weeks we will add to this out of the treasury, this enables us to start hard and taper off for a softer transition.

SECTION 5: Data and Reporting

Compliance with OBL’s data requirements

Is your team prepared to comply with OBL’s data requirements for the entire life of the program and three months following and then handoff to the Arbitrum DAO? Are there any special requests/considerations that should be considered?

Yes, Naturally TheStandard DAO will adhere to OBL’s data requirements for the program’s duration and three months after, ensuring a smooth handoff to Arbitrum DAO. We’re open to adapting our reporting metrics to align with evolving DeFi insights and developments.

Bi-weekly program updates on the Arbitrum Forum

Does your team agree to provide bi-weekly program updates on the Arbitrum Forum thread that reference your OBL dashboard?

We commit to bi-weekly updates on the Arbitrum Forum using our OBL dashboard. Our approach integrates automated tools and dedicated personnel for accurate and insightful data reporting, fostering transparency and community engagement.

*First Offense: In the event that a project does not provide a bi-weekly update, they will be reminded by an involved party (council, advisor, or program manager). Upon this reminder, the project is given 72 hours to complete the requirement or their funding will be halted.

Second Offense: Discussion with an involved party (advisor, pm, council member) that will lead to understanding if funds should keep flowing or not.

Third Offense: Funding is halted permanently

Acknowledging the importance of consistent updates, we will rectify any missed bi-weekly updates within a 72-hour grace period and remain proactive in communication to ensure alignment with the Arbitrum DAO’s expectations.

Final closeout report

Does your team agree to provide a final closeout report not later than two weeks from the ending date of your program? This report should include summaries of work completed, final cost structure, whether any funds were returned, and any lessons the grantee feels came out of this grant. Where applicable, be sure to include final estimates of acquisition costs of any users, developers, or assets onboarded to Arbitrum chains. (NOTE: No future grants from this program’s funding stream?: [Y/N]

Yes, a comprehensive closeout report will be provided within two weeks of the program’s end, detailing achievements, financials, lessons learned, and the program’s impact on the Arbitrum ecosystem, ensuring a thorough reflection on our initiatives.

In our final report, we will include an in-depth analysis of user behavior patterns and protocol interaction to provide insights into the effectiveness of our strategies and to inform future development directions.

Does your team acknowledge that failure to comply with any of the above requests can result in the halting of the for data/reporting]

Yes, we understand the significance of adhering to the compliance requirements and agree that non-compliance may result in the halting of the funding stream, emphasizing our commitment to accountability within the program.

Addressing concerns

How is that working currently without incentives? Do you believe that in a short program like this (only 12 weeks of incentives) you can achieve long term sustainability?

Yes, We believe that our income will as well as great user experience and the apeal of free borrowing while not losing flexibility of trading for other Arbitrum assets is what will drive long term adoption. The LTIPP grant is primarily used to solve the initial chicken / egg problem where people don’t want to lock TVL because there is no yield but there is no yield because there is no TVL in the system.

A concern is that demand for our stablecoin is driven by subsidized yield. What is the mid-term and long term plan for driving demand without the need of subsidizing yield? It seems like that when ARB incentives are gone, TVL will drop or the stablecoin will depeg because incentives to hold it won’t be there.

Our stablecoin’s demand hinges on two key offerings:

- Zero-Percent Loans: By allowing users to take 0% fixed interest loans against a robustly collateralized portfolio, we create an attractive entry point for locking in Total Value Locked (TVL).

- Integrated liquidation pools: These accounts offer yields derived from the ecosystem’s native activities.

Upon locking in TVL, users are incentivized to use our platform’s trading features, favoring a minimal 1% trading fee over having to pay back the loan , withdrawing the collateral and then making the trade. This behavior is substantiated by our market research. Consequently, according to our modeling, by week 6, organic yield is anticipated to match subsidized yield, and by week 12, it’s projected to fully compensate for the subsidy phase-out.

Full financial model can be seen here.

Our platform is distinctively positioned as one of the few Collateralized Debt Position (CDP) protocols that can boast of a truly self-sustaining yield. The initial subsidies are important for priming this economic engine. The Arbitrum grant is not just a catalyst; it’s an investment in a decentralized borrowing and stablecoin ecosystem, offering a viable alternative against the systemic global banking risks associated with centralized stablecoins. Something crypto was invented to be detached from. It’s a step towards the autonomy that the crypto world aspires to achieve.