I. Executive Summary

The Arbitrum DAO Procurement Committee (”ADPC”) has successfully completed the pilot phase of the Arbitrum Security Subsidy Fund (”SSF”), which was set up in this Tally vote to subsidise the costs of security services for projects within the Arbitrum ecosystem.

Below is a snapshot summary of the results:

- Sized at up to $2.5M USDC worth of ARB (with a total final OTC’d amount of $1.918M USDC), the SSF subsidised the costs of security services for 22 projects within the Arbitrum ecosystem over an 8-week cohort, from a total of 56 applications.

- 99.7% of the fund was allocated (i.e., the “operational maximum”) based on the projects’ initially selected quotes, while the final sum allocated was $1,807,955 USDC, amounting to 94.3% of the fund size.

- Out of the 9 whitelisted security service providers (from a total of 12 that applied to be whitelisted) that took part in the SSF, projects selected quotes from a total of 6 auditors. 9 projects chose Spearbit, 4 chose Sherlock, 3 each chose Cyfrin and Guardian, 2 chose Hacken, and 1 chose Immunefi.

- Of the 22 selected projects, 8 (i.e., 36.4%, more than one-third) had never conducted an audit previously. This indicates how the SSF strengthened the security of the Arbitrum ecosystem and simultaneously brought new projects over to Arbitrum, achieving a key goal of the program.

The one key takeaway for us was the following:

Many applicants indicated that the presence of the fund was a significant factor in their decision to deploy on Arbitrum, indicating the ‘pull’ the fund has in attracting projects.

Of the applicants that applied for the subsidy fund, 25% declared that the fund convinced the project to increase its participation or deploy in the Arbitrum ecosystem and a further 53.6% declared that the fund strengthened the project’s decision to increase its participation or deploy in the Arbitrum ecosystem, amounting to a total of 78.6%.

This statistic, coupled with the relative lack of builder support and project acquisition programs run by the Arbitrum DAO, highlights the value provided by the SSF and demonstrates the need for an expanded subsidy fund that builds upon the learnings of the pilot phase, providing consistent, long-term support to builders on Arbitrum.

List of Grantees

The list of grantees, along with a 1-line description of their projects, and the total subsidy allocated is as follows:

| Grantee | Project Description | Means Test Score Range | Subsidy % | Selected Auditor |

|---|---|---|---|---|

| Millicent One | The vertically-integrated blockchain unlocking RWAs and composable capital markets. | 7.5+ | 70% | Sherlock |

| Gamma Strategies | A protocol for active liquidity management and market-making strategies. | 7.5+ | 70% | Cyfrin |

| GMX | On-chain perpetual & spot exchange. | 7.5+ | 70% | Guardian |

| Takadao | Building Shariah-compliant tech that empowers communities to pool funds & protect each other. | 7.5+ | 70% | Hacken |

| D2 Finance | DeFi leader in tokenized derivatives strategies. | 7.5+ | 70% | Cyfrin |

| StableUnit | Overcollateralized stablecoin distributing profits from capital-efficient DeFi assets directly to holders. | 7.5+ | 70% | Sherlock |

| Collar Protocol | Liquidation-free, high LTV borrowing by hedging collateral through market makers and Prepaid Variable Forwards. | 7 - 7.49 | 60% | Spearbit |

| Umami Finance | Yield-optimized vaults and liquidity services for assets. | 7 - 7.49 | 60% | Guardian |

| DIVA Donate | Project enabling parametric conditional donations to support communities in need. | 7 - 7.49 | 60% | Cyfrin |

| Cod3x | Platform to launch personalized AI agents to execute financial tasks on blockchain. | 7 - 7.49 | 60% | Spearbit |

| Juicebox V4 | Onchain programmable treasuries for people and projects. | 7 - 7.49 | 60% | Spearbit |

| Arb Staking | Enhances Arbitrum’s governance and security by incentivizing active participation, increasing token utility, and creating a liquid staked token (stARB) compatible with DeFi. | 6.5 - 6.99 | 55% | Sherlock |

| SatsBridge | A cross-chain bridge facilitating seamless Bitcoin liquidity and BRC-20 token transfers across networks. | 6.5 - 6.99 | 55% | Spearbit |

| MUX Protocol | Perpetual trading protocol offering up to 100x leverage with unified liquidity across multiple chains. | 6.5 - 6.99 | 55% | Guardian |

| Variational | P2P trading protocol for perpetuals and generalized derivatives. | 6.5 - 6.99 | 55% | Spearbit |

| DAMM Capital | Decentralized mutual funds for treasury management and active market-making strategies. | 6.5 - 6.99 | 55% | Sherlock |

| Aspis Protocol | AI-powered decentralized asset management platform deploying on-chain funds with secure smart contracts. | 6.5 - 6.99 | 55% | Hacken |

| Nex Protocol | Crypto & RWAs indices for simple on-chain investing. | Below 6.49 | 47% | Immunefi |

| Velvet Capital | DeFi Trading & Portfolio Management OS powered by intents & AI. | Below 6.49 | 47% | Spearbit |

| HODL Protocol (fka Bear Protocol) | Systematic wealth-building tools for HODLers | Below 6.49 | 47% | Spearbit |

| Gifted | A platform for digital gifting. | Below 6.49 | 47% | Spearbit |

| NashPoint | Building an Onchain Banking System | Below 6.49 | 47% | Spearbit |

Note: The subsidy percentages were determined based on each project’s score on the Means Test. The Means Test ranges shown here are relative and based on the strength of this particular cohort in comparison with each other, and the scores have been normalised for comparability. The same Means Test score ranges may not translate into the equivalent subsidy percentages in subsequent programs.

This report provides a comprehensive deep dive into how the Security Subsidy Fund was set up and run, analyses the results of the pilot phase, and simultaneously presents a forward-looking vision into the future of the Arbitrum Security Subsidy Fund. With plans to expand the size of the fund and implement the key learnings made in the pilot phase, Areta, Axis Advisory, and Daimon Legal are determined to continue supporting the builder ecosystem on Arbitrum.

Please find the full Outcome Report here available to download.

Table of Contents

I. Executive Summary

Table of Contents

II. Introduction

III. Background

IV. End-to-End Fund Management Process

V. Communication, Reporting, & Marketing

VI. Outcomes Analysis

VII. Feedback Collection

VIII. Appendices

II. Introduction

The ADPC is pleased to present this comprehensive report detailing the progress made in the pilot program of the Arbitrum Security Subsidy Fund (”SSF”).

The report covers the following:

I. Background of the Security Subsidy Fund

- History of the SSF;

- Motivation behind the SSF;

- Recap of the legal agreements established in the ADPC’s Phase I, which enabled the SSF to be initially set up, and which were covered extensively in the ADPC’s Phase I Outcome Report.

II. End-to-End Fund Management Process

- Creation of the Means Test used to evaluate applicants and determine final subsidy percentages;

- The OTC process used to convert the 3.5M ARB allocated via the Tally vote establishing the SSF into USDC;

- The Declaration of Interest form shared with prospective applicants;

- The creation of the Security Subsidy Fund Notion Hub;

- The application form and the process for projects to apply to the Subsidy Fund;

- The review process;

- The matching process between shortlisted projects and whitelisted security service providers;

- The decision making process for the final subsidy allocations;

- Definition of payment flows;

- Generation and signing of work orders.

III. Communication, Reporting, & Marketing

- Comms & reporting with the DAO;

- Set up and management of comms channels;

- Communications with Arbitrum Foundation;

- Marketing of the application process;

- Marketing across channels post the selection of projects.

IV. Outcomes Analysis

- Analysis of Applicants;

- Analysis of Selected Projects;

- Marketing Analysis (i.e., how well did our Awareness campaigns perform).

V. Feedback Collection

- Process of collecting feedback;

- Analysis of feedback.

III. Background

III.1 History of the Security Subsidy Fund

The formation of the Security Subsidy Fund is closely linked to the creation of the Arbitrum DAO Procurement Committee (”ADPC”) and its scope of work in its first phase. To recap, the ADPC was established as a crucial component of the Arbitrum ecosystem’s governance structure, following a successful proposal and subsequent community vote in early 2024. To be precise, two of the five core mandates of Phase I of the ADPC pertained directly to the Subsidy Fund:

1. Subsidy Fund Research and Proposal

The specific mandate pertaining to the research of the Subsidy Fund was the following:

“The ADPC will be tasked with researching & drafting a proposal to the ArbitrumDAO to set up a subsidy-fund for security-oriented services that will be used to subsidize the costs for security-services for smaller projects within the Arbitrum Ecosystem.”

Initial Proposal

The ADPC created the initial proposal after extensive research, including a comprehensive benchmarking exercise with 10 leading security audit service providers to analyze costs and scope of typical security audits to determine the fund size and allocation. The ADPC also developed the Means Test (discussed in detail below), timelines and procedures for application submission and review, and checks and balances including conflict of interest provisions.

The initial proposal requested up to $10 million worth of ARB to provide financial assistance to both new and existing projects within the Arbitrum ecosystem, with the aim of funding up to 50 projects with a maximum subsidy of $500K per project (5% of the fund size) and a funding term of 4 cohorts of 8 weeks each.

Community Feedback

The community’s key points of feedback were concerns about the large fund size and potential for inefficient capital allocation and questions about the capacity to manage such a large fund, introducing the desire for a sub-committee to manage the fund.

This culminated in a governance proposal to create a separate “Security Services Subsidy Fund Sub-committee”; however, in the end the community decided to vote against the creation of the sub-committee and left the disbursement of funds under the subsidy fund to the ADPC.

Revised Proposal

The proposal was revised to the one that was passed in its final state: $2.5 million worth of ARB (75% reduction) to potentially fund up to 12 projects (and, depending on demand and size of the subsidies, even more) for one cohort of 8 weeks and with a maximum subsidy per project of $250K (10% of the total fund).

The onchain vote for this proposal passed on July 21, 2024, with the consent of 99.53% of the votes.

2. Development of Eligibility Framework ('Means Test')

The specific mandate pertaining to the development of the Means Test was the following:

“The ADPC will be tasked with researching & implementing a framework that will establish a set of qualitative & quantitative metrics that will be utilized so as to assess a project’s eligibility for the ‘Subsidy Fund’ referred above. This ‘Means Test’ (as referred to in traditional administrative practices), will be bundled in with the proposal that will set up the subsidy fund. The Means Test will be used to assess whether a project is eligible for security service-fee subsidies.”

The ADPC developed two key components for the administration of the Subsidy Fund:

I. Terms and Conditions for Applicants

These T&Cs established eligibility criteria for projects to get accepted into the Subsidy Fund, outlined the application process, defined fund usage and reporting requirements, and set clear accountability measures.

II. Means Test

The ADPC developed the Means Test as a structured approach to evaluate applications. The primary goal was to identify applicants who would benefit most from support with the potential for significant positive impact on the Arbitrum ecosystem while ensuring equitable access to subsidies within the Arbitrum Ecosystem.

III.2 Motivation Behind the Security Subsidy Fund

The security of smart contracts is a cornerstone of the crypto ecosystem, making it essential for all projects, whether large or small, to have access to robust security audits. These audits are not only critical for ensuring the integrity of smart contracts but are also a prerequisite for launching most projects. However, the highly technical nature of audits creates an information asymmetry between auditors and projects, making it difficult for projects to assess the quality of auditors. This challenge, coupled with the high costs of audits, often acts as a barrier to entry for smaller projects and can hinder their growth if they lack access to high-quality security services.

To address these challenges and foster a more inclusive ecosystem, the Arbitrum ecosystem introduced a Procurement Framework and RFP process through the ADPC. This initiative established a whitelist of vetted auditors, providing a seal of approval that simplifies access to reliable security services. By creating a competitive marketplace dynamic where whitelisted auditors compete for business, this framework not only ensures quality but also incentivises cost reduction. Such an approach makes Arbitrum more attractive to developers by lowering barriers to entry and encouraging more projects to build within its ecosystem.

The overarching goals of this initiative were twofold:

- To reduce the cost of building on Arbitrum as an incentive mechanism to attract new projects and position Arbitrum competitively against competing ecosystems;

- To avoid the inefficiencies of traditional grant programs by focusing funding on critical needs like user support and infrastructure.

The framework also emphasised “skin in the game” by requiring matching investments from projects themselves. To achieve these aims effectively, the subsidy fund was introduced as a key vehicle to operationalise this vision.

The subsidy fund brought several advantages that strengthened the ecosystem:

- By fostering competition among whitelisted auditors, it created market-driven price reductions while maintaining high standards.

- The accompanying marketplace framework and platform streamlined engagement with quality-assured auditors, saving projects time and legal costs typically associated with lengthy market research, approach to market (tendering), quote analysis and contract negotiations. This efficiency allowed builders to focus on innovation rather than administrative hurdles, offering a significant pull factor compared to ecosystems without such benefits.

- The ADPC estimates that abstracting the repeatable tasks involved in procurement to an ADPC-designed procurement framework along with the use of the online procurement platform reduced the sourcing of audit services from 2-3 months to several weeks and significantly reduced the disruption and distraction associated with this complex and time-consuming task.

- The fund also implemented rigorous means testing and comprehensive reviews to ensure that subsidies were allocated only to projects that provided tangible benefits to the ecosystem.

- Requiring projects to cover at least 30% of audit costs ensured their commitment while minimising the risk of misuse and misdirection of funds.

- Finally, direct payment of subsidies to selected auditors ensured tight control over fund usage while maximising benefits for participating projects.

By addressing both cost and quality barriers through this structured approach, the Arbitrum ecosystem has positioned itself as a leader in fostering secure and accessible development environments for blockchain projects.

III.3 Recap of Legal Agreements

The final documentation governing the Security Subsidy Fund and Security Services Procurement Framework is comprised of:

- A comprehensive Framework Agreement (Head Agreement) to be executed between the Arbitrum Foundation and the service provider providing, among others, for pricing structures and payment terms as well as liability considerations. This includes:

- Exhibit A, the specific grant agreement to be executed between the chosen security service provider and the Arbitrum Foundation;

- Exhibit B, the work order to be executed between the chosen security service provider and the project receiving the subsidy.

- For example:

- A project has selected a quote of $100K from Auditor A and has received a 70% subsidy. Therefore, the project must pay $30K while $70K will be paid directly to the Auditor from the Security Subsidy Fund.

- Auditor A must first sign Exhibit B with the project, send this over to the Arbitrum Foundation, and sign Exhibit A with them in order to commence the work.

- T&Cs for the engagement of service providers by projects that received a subsidy;

- An order form template designed to streamline the engagement process of the service provider;

- Conditions of tender for service providers to access the marketplace, effectively serving as an RFP for security service providers, outlining the evaluation criteria and response format;

The legal documents can be found here:

IV. End-to-End Fund Management Process

IV.1 Creation of the Means Test

As mentioned in Section III.1 above:

The ADPC developed the Means Test as a structured approach to evaluate applications. The primary goal was to identify applicants who would benefit most from support with the potential for significant positive impact on the Arbitrum ecosystem while ensuring equitable access to subsidies within the Arbitrum Ecosystem.

The Means Test developed a scoring system with a 1-5 rating scale, assigned weights to criteria based on importance, and included additional weightage for key verticals that are valuable to the Arbitrum ecosystem (i.e., Stylus, RWAs, and Orbit). The final Means Test used in the evaluation of applications can be found here.

The rating scale represented the following:

- Rating 1: Unsatisfactory

- Rating 2: Below expectations

- Rating 3: Meets expectations

- Rating 4: Above expectations

- Rating 5: Exceptional

Each of the sub-criteria in the Means Test had varying levels of importance, with each having a weighting attached. A weighting of 1 indicates low importance, 2 indicates neutral importance, and 3 indicates high importance. The sub-criteria with the highest weights were the following:

- Ecosystem Contribution

- Accountability Measures

- Funding Gap Rationale

- Reasonableness of Subsidy Amount Requested

- Security Requirements

Ecosystem Contribution: Specificity to Arbitrum

We wanted to ensure an approach that was tailored to the specifics of Arbitrum and incentivised applications building in key verticals that the Arbitrum ecosystem wanted to grow. As such, the Ecosystem Contribution metric included an assessment of the types of projects building in the Arbitrum ecosystem and identified a few verticals that the ecosystem would benefit from funding.

While the initial verticals included RWAs & Tokenization, Gaming, and Collab Tech, the onchain Tally proposal replaced the latter two verticals with Stylus Adoption as a key vertical. This is because there are a number of grants programs already centred around Collab Tech, while the Gaming vertical is sufficiently incentivised via the GCP. On the other hand, as a newly-released core Arbitrum technology, it was important to incentivise Stylus adoption as much as possible. If a project was found to be building in either of these two verticals, they were assigned a higher score on the Ecosystem Contribution vertical, which was already weighted at “3”, indicating high importance.

IV.2 OTC Process

As per the onchain Tally vote, the total amount transferred was the proposal was 3.5M ARB, which was aimed to be converted into up to $2.5M, as voted on by the community to be the size of the pilot Subsidy Fund cohort.

The transaction history is as follows:

| Date | Value | Description | Wallets | Tx Links |

|---|---|---|---|---|

| 24 Jul 2024 | 3,500,000 ARB | Receipt of 3.5M ARB from passing of Tally vote | Recipient: Arbitrum Foundation ADPC Multisig | Link |

| 11 Oct 2024 | 3,500,000 ARB | Transfer of 3.5M ARB to Coinbase Prime | Sender: Arbitrum Foundation ADPC Multisig, Recipient: AF Coinbase Prime Account (1) | Tx 1, Tx 2 |

| 11 Oct 2024 | 3,500,000 ARB | Transfer of 3.5M ARB to Coinbase Prime | Sender: AF Coinbase Prime Account (1), Recipient: AF Coinbase Prime Account (2) | Link |

| 04 Nov 2024 | 1,918,737.5 USDC | Transfer of USDC (converted from ARB) to MSS Multisig | Sender: Coinbase Prime Deposit Funder, Recipient: MSS Subsidy Fund Multisig | Link |

The 3.5M ARB approved in the Tally vote was received by the Arbitrum Foundation’s multisig created for the ADPC on 24 July 2024. This ARB was moved to the Arbitrum Foundation’s Coinbase Prime account to be converted into USDC on 11 Oct 2024. The Arbitrum Foundation converted the 3.5M ARB into ~1.92M USDC between 11 October and 04 November 2024, lower than the intended $2.5M due to market conditions. The total USDC amount of 1,918,737.5 was sent to the MSS multisig on 04 November 2024, where the funds currently still sit.

IV.3 Declaration of Interest Form

In order to gauge the volume of applications and drum up interest for projects to apply to the Security Subsidy Fund, the ADPC first created a simple Declaration of Interest form and shared it with Arbitrum delegates, whitelisted security service providers, and the broader community. The form has now been taken down, but the questions were the following:

- Contact Person

- Contact Email

- Telegram ID

- Project Description

- Link to Project Documentation

- Status of Project’s Deployment to Arbitrum

- Types of Security Services Required

- Reason for Security Services

The ADPC received a total of 49 responses, giving us a good base to directly reach out to interested projects at the time of applications opening. It streamlined engagement and enabled increased awareness creation without requiring much (if any) commitment on the project’s end. We were able to directly email interested projects the application form and create a Telegram group to enable seamless communication.

In terms of tooling, we utilised Noteforms since it is directly connected to Notion. However, the app is not the best tool and we have since switched to utilising Fillout, which offers much more flexibility in creating surveys than Noteforms. Fillout can also be connected to Notion, making it an effective tool for the ADPC.

This was an extremely effective tool and our learning and recommendation is to use it for any broader outreach process going forward.

IV.4 Security Subsidy Fund Notion Hub

The Notion Hub is the home of all information about the Security Subsidy Fund for whitelisted security service providers, prospective applicants, and all DAO stakeholders. The intention is for it to serve as a comprehensive one-stop shop for all stakeholders to understand how to engage with the SSF and track its progress.

The front page of the Notion Hub is a structured landing page where stakeholders can first find the most critical information about the Subsidy Fund: the application opening and closing dates, application form link, and contact details of key ADPC members. The front page also highlights the selected subsidy recipients prominently.

The sub-pages are nested within 4 key categories:

- About the SSF: Providing information about what the Security Subsidy Fund is, details about the ADPC team, highlighting the Conflict of Interest policy, and answering FAQs about key program details (e.g., size of the fund, payout currency, application process, etc.).

- How to Apply: Providing the link to the Application Form, giving detailed instructions to applicants on the Application, Review, and Post-Selection Processes, providing details about the Evaluation Criteria (i.e., exactly how projects will be judged), and highlighting the Code of Conduct policy.

- Resources: Miscellaneous resources including links to the legal documents underpinning the Security Subsidy Fund, links to the Areta Marketplace, and providing the list of whitelisted security auditors with their profiles attached.

- Reporting: Providing updates from the ADPC Update Thread specifically on the Subsidy Fund and tracking how the SSF has allocated its funds across grantees.

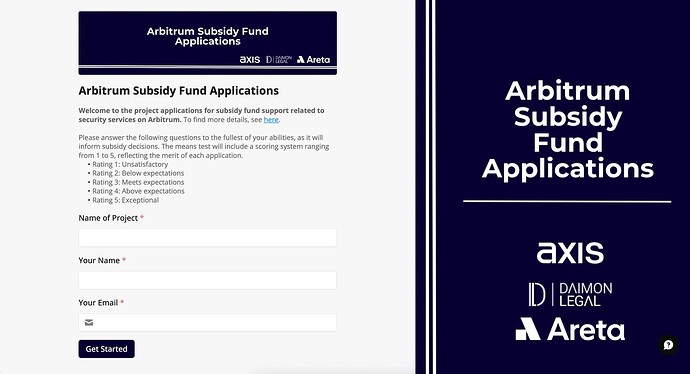

IV.5 Application Form & Process

Creation of Application Form

The Means Test was the basis on which the application form for projects was created. We took each criteria from the Means Test and created questions intended to answer each criteria. The questions were separated into 4 ‘buckets’ which aligned with the 4 buckets of the Evaluation Criteria:

- Arbitrum Ecosystem Contribution;

- Business Model & Need for Subsidy;

- Financial Analysis;

- Risk Analysis.

The final section, the Annex, was intended to capture key information about the security services required by the applicant, including:

- The latest date on which the requested security services need to be finished. This information would be communicated with the whitelisted security service providers, who could then map out their capacity and ability to respond with a quote;

- Gitbook link. This would also help the security service providers map out the scope of work.

- Private codebase. In case a project had a private codebase, the ADPC did not want to be in a position to view it. As such, we provided instructions to each project with a private codebase to get in touch with the ADPC via email at arbitrumdaoprocurementcommitte@gmail.com to discuss next steps and directly get connected with interested security service providers.

All in all, the application form enabled us to comprehensively gather information about each applicant and granularly assess their suitability for a subsidy against the Means Test.

Tools Used

While we used Noteforms for the Declaration of Interest form, we realised that we needed a more flexible, cleaner application form to attract as many responses as possible. As such, we decided to use Fillout, which allowed us to add application form logic to clean up the appearance and minimise any undue burden on applicants.

Using Fillout, we were able to:

- Split questions into Yes/No with follow-on logic pending response;

- Enable multiple-choice questions with logical flows in the application;

- Utilise custom logic, e.g., for the private codebase question: if the Applicant responded with “Yes”, an instruction to email the ADPC is displayed, and if they responded with “No”, an instruction to provide the public codebase is displayed.

We were able to download each response in PDF and CSV formats as well and link Fillout to Notion. This made the application review process much smoother. Overall, the experience of using Fillout was far superior than any other form provider.

Application Process

The application process was relatively straightforward via the Fillout form, with all applications to be received in a submission period of 2 weeks.

Applications were open from 00:00 UTC on September 30th, 2024 to 23:59 UTC on October 14th, 2024.

We will provide further detail about the communications with applicants in the ‘Communication and Marketing Strategy’ chapter below.

IV.6 Review Process

The ADPC received a total of 56 applications for the pilot cohort of the Security Subsidy Fund. This was even higher than the 49 Declarations of Interest received, providing a window into the success of the marketing and awareness campaign.

The review process followed the below steps:

- The ADPC judged all 56 applications according to the process defined in the Evaluation Criteria on the Notion Hub.

- First, we conducted an initial screening to ensure that the highest quality and most relevant applicants are selected.

- We assessed the following sub-criteria with the highest weights in the Means Test: Ecosystem Contribution, Funding Gap Rationale, Reasonableness of Subsidy Amount Requested, Accountability Measures, and Security Requirements. This approach allowed the ADPC to rapidly screen out applications that only provided cursory responses to Means Test or otherwise scored well below their peers in the cohort.

- The initial screening divided the 56 application reviews between the 3 ADPC members, with Axis Advisory reviewing 19 applications, Areta reviewing 19 applications, and Daimon Legal reviewing 18 applications.

- In order to account for fluctuations and discrepancies between each individual reviewer, we normalised each score out of 10. We did this by calculating the Mean and Standard Deviation for each reviewer’s set of reviews, used these to calculate the Z-Score per application (i.e., how many standard deviations each score is from the mean for that particular reviewer), and then scaled them to a 0-10 range using the following formula: 5 + (Normalised_Score * 1.5).

- As a result of this initial evaluation of critical criteria, we moved 35 of the 56 applications to the second review stage for deeper analysis.

- Please note that these normalised scores are relative and based on the strength of this particular cohort in comparison with each other. The “threshold” below which applications were eliminated is therefore relative.

- Following this, we assessed each of the remaining 35 applicants against the entire Means Test.

- We again divided the 35 application reviews between the 3 ADPC members, with Axis Advisory reviewing 12 applications, Areta reviewing 11 applications, and Daimon Legal reviewing 12 applications.

- Again, in order to account for fluctuations and discrepancies between each individual reviewer, we normalised each score out of 10 using the same process as above.

- We moved 25 of the 35 applications to the initial shortlist of projects to receive subsidies.

- The same disclaimer as above regarding the normalised scores applies.

Once we had this initial shortlist of 25 projects, we moved on to the next stage of the process, covering Steps 5-8 in the diagram above: the matchmaking process between security service providers and shortlisted projects.

Feedback for Rejected Applicants

The ADPC sent individual rejection emails with feedback for the 31 rejected applicants. Each email contained 2-3 bullet points outlining specific reasons as to why their applications were not taken forward, and where requested (as with a specific applicant), the ADPC provided even further feedback over a call.

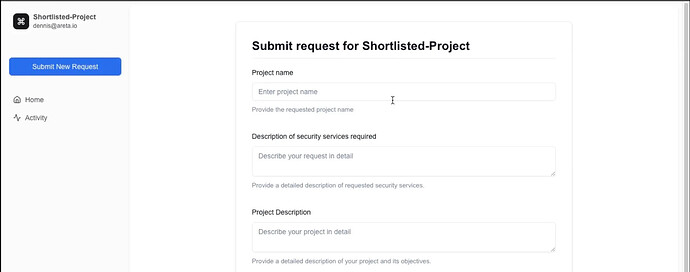

IV.7 Matching Process Between Shortlisted Projects & Security Service Providers

Once the shortlist of 25 projects was identified by October 30 2024, the next steps were for projects to reach out to the whitelisted security service providers and request them for quotes. Being shortlisted did not mean that they qualified for a subsidy as there were a few remaining steps prior to a subsidy being confirmed by the ADPC as well as the amount granted.

Matching Process

Given that the ADPC had to work within a budget, the final set of grant recipients and grant amounts could only be determined once we could understand the anticipated spend based on the quotes accepted by the project team. As such, we initiated the below matching process:

- Each project input their requirements for security services via an individualised link that they received on their email through the Areta Marketplace (further information in section below). The process for doing so can be found in this walkthrough video. Each provider also obtained an individualised link via which to access the marketplace.

- Once these requirements were inputted, they were automatically forwarded to the 9 whitelisted security service providers.

- In case the project had a non-public codebase, each project was instructed to share their email while they inputted their requirements. Instructions on how to do so were provided in the walkthrough video. Each provider was then instructed to reach out to this email address to bilaterally solve how this codebase should be shared.

- The whitelisted service providers were given a deadline of 23:59 UTC on November 17 to respond to each project’s requirements with quotes.

- Based on the quotes received, each project was required to select its top preferred auditor, with the selection to be marked on the Marketplace. The projects were able to select their preferred auditor at any point, and latest by 23:59 UTC on November 22.

- Using the information gathered from the Means Test and the selection of the preferred service provider from shortlisted applicants, the ADPC would make the final decision on the successful recipients and amount of subsidy grant. Each project was free to choose its preferred service provider and the ADPC did not interfere in their choice.

Areta Marketplace

Independent of the ADPC (i.e., created internally), Areta has created a marketplace to facilitate matching between security service providers and projects. The marketplace provides an easy-to-use experience where:

- Projects and providers receive individualised links to access the marketplace. This is a private link that is not to be shared with anyone outside of the project or provider’s organisation since it provides access to their private dashboard.

- Projects submit their requirements by clicking ‘Submit New Request’. They see a form where they input the Project Name, Description of Security Services Required, Project Description, their GitHub link, Security Services Needed (choose one or more services from the options indicated), and Latest Date of Audit (i.e., the final date by which they require the security service to be completed). They can also upload as many files as required.

- If their codebase is private, the project must write “Private Codebase” in the GitHub Link field along with their contact information for the security service providers to be able to bilaterally contact them.

- If their codebase is private, the project must write “Private Codebase” in the GitHub Link field along with their contact information for the security service providers to be able to bilaterally contact them.

- When a project submits a request, all whitelisted providers automatically receive an email notifying them. Their dashboard is also updated:

- The provider clicks on “View Details” and can see a summary of the request. The provider can then click the “Submit Offer” button and enter a summary of the offer, the cost, the proposed deadline (i.e., the final date by which they will complete the security service), and upload the offer document.

- Once they submit an offer, the project automatically receives it via email and their dashboard is updated:

- When the project clicks to “View Details” of its request, it can scroll down and see the offers received for that request. The project can view the offers in-depth by clicking on “View”, message (i.e., email) the provider who submitted the offer by clicking on “Message”, and Accept or Reject the offer.

- Once a project Accepts an offer, all other offers are automatically rejected. The project can Accept / Reject offers at any time and does not have to wait for all offers to come in to do so.

Amendments to the Matching Process

Given that the deadline of 23:59 UTC on 17 November for whitelisted service providers to respond to each project’s requirements with quotes proved to be right after DevCon, this deadline was shifted to be in line with that of the projects’ deadline to select their preferred auditor, i.e., 23:59 UTC on November 22. Please note that this did not cause any delays to the process.

Engagement Between Security Providers and Projects

The security providers conducted bilateral discussions with projects during the matching process.

Given the complexity of the code and the varied services offered by the security service providers, this was a necessary step; each provider needed the opportunity to offer a “bespoke” quote to each project.

Nuances in Matching Process

Given the bilateral engagement and negotiations between projects and security service providers, some projects had special requests with nuances. Some of the nuances can be found below:

- Projects were permitted to accept separate proposals from different providers to address distinct scopes, as allowed under the process. For instance, if a project required both a private audit and an audit competition, they could choose quotes from two different providers. The total subsidy amount was capped at $250K, with the maximum subsidy percentage across both requests limited to 70%.

- Projects were not permitted to apply for audits in the future; their audits had to take place imminently, since one of the key Means Test criteria, “Funding Gap Rationale”, assessed the need for a subsidy.

- Amend the cost and scope for a security service after the preferred security service provider was elected. This was permitted only where the scope was reduced, not increased, and any additional costs associated with scope expansions beyond the originally agreed-upon terms would need to be addressed separately and outside the scope of the current work order.

- Permission was also granted to allow projects working with two auditors to transfer funding to a single auditor, provided that the subsidy remains based on the lower of the two quotes. This aligns with the principle outlined above, ensuring that the audit scope cannot be expanded. Part of the rationale behind this decision was to avoid forcing projects to continue with a specific auditor if they preferred or needed to switch, acknowledging the sensitive nature of audits.

Shortlisted Project Drop-Outs

Due to the cost of the security services and the matching requirement from the projects (i.e., the minimum 30% payment required from the projects), 3 of the 25 shortlisted projects had to drop out during the matching phase. The rationales were the following:

- Change in direction for audit budget, and cannot cover the 30% of costs;

- Not at a stage in their company lifecycle where they are prepared for audits;

- Cannot cover 30% of the matching costs.

Ensuring Integrity of Matching Process

Prior to the ADPC moving on to the next step, it is important to note that we spent a significant portion of time alongside the Arbitrum Foundation investigating whether any unfair behaviour had occurred during the matching process. The ADPC and the Arbitrum Foundation conducted a thorough investigation over a 2-week period and came to the conclusion that there was no malfeasance and it amounted to a minor misunderstanding of the process from a pricing perspective that was clarified and rectified.

Both parties dedicated significant man-hours to this process and can confidently conclude that the process was conducted above board.

At the end of the matching process, a total of 22 projects had received and selected their preferred security service providers. The split in the quotes selected by service provider was the following:

- Spearbit - 9 projects

- Sherlock - 5 projects

- Cyfrin - 3 projects

- Guardian - 3 projects

- Hacken - 2 projects

- Immunefi - 1 project

OpenZeppelin, ThreeSigma, and Zellic were not selected by any projects.

IV.8 Final Subsidy Allocation Process

Once each of the 22 projects had selected their preferred security auditors, the ADPC mapped each project’s score on the Means Test and the cost of each quote. A key consideration was the budget allocated of $1.918M.

The Means Test was used as a determinant of the level of “value” offered by each project to Arbitrum, and as such, was the key factor in determining the percentage of the final quote that would be subsidised. As such, we utilised a tier-based system to allocate subsidies:

- Projects in the highest tier (normalised means test score ≥ 7.5) received a 70% subsidy;

- Projects in the second tier (normalised means test score 7-7.49) received a 60% subsidy;

- Projects in the third tier (normalised means test score 6.5-6.99) received a 55% subsidy;

- Projects in the lowest tier (normalised means test score ≤ 6.49) received a 47% subsidy.

As mentioned previously, these normalised scores are relative and based on the strength of this particular cohort in comparison with each other.

The below table provides a summary of the allocations:

| Grantee | Subsidy % | Selected Auditor |

|---|---|---|

| Millicent One | 70% | Sherlock |

| Gamma Strategies | 70% | Cyfrin |

| GMX | 70% | Guardian |

| Takadao | 70% | Hacken |

| D2 Finance | 70% | Cyfrin |

| StableUnit | 70% | Sherlock |

| Collar Protocol | 60% | Spearbit |

| Umami Finance | 60% | Guardian |

| DIVA Donate | 60% | Cyfrin |

| Cod3x | 60% | Spearbit |

| Juicebox V4 | 60% | Spearbit |

| Arb Staking | 55% | Sherlock |

| SatsBridge | 55% | Spearbit |

| MUX Protocol | 55% | Guardian |

| Variational | 55% | Spearbit |

| DAMM Capital | 55% | Sherlock |

| Aspis Protocol | 55% | Hacken |

| Nex Protocol | 47% | Immunefi |

| Velvet Capital | 47% | Spearbit |

| Bear Protocol | 47% | Spearbit |

| Gifted | 47% | Spearbit |

| NashPoint | 47% | Spearbit |

Projects initially selected quotes that amounted to 99.7% of the fund being allocated. Over the contract execution process, some of them amended and reduced their selected quotes due to changes in their project conditions, scope, etc., leading to the final sum allocated amounting to 94.3% of the fund size, i.e., $1,807,955 USDC.

The ADPC decided to be flexible in allowing for these quote changes because the ultimate goal of the Security Subsidy Fund is to incentivise value-additive projects to build on Arbitrum and see it as a home. Therefore, being too prescriptive or rigid would be a detriment to their experience, while enabling a degree of flexibility, in a way that ensured responsible stewardship of DAO funds, would incentivise them to continue building on Arbitrum.

Each project was sent an email confirming the allocated subsidy amount.

Note: We are not disclosing the final subsidy amounts for each project because, when combined with the subsidy percentages, it would be easy to deduce the exact cost of the security services provided. This would compromise the providers’ business confidentiality and competitive position in relation to their pricing and fees.

IV.9 Payment Flow Definition

The next step was for the ADPC to define payment flows in coordination with each project. The subsidy would be paid upon the earlier of the completion of the security service or when the payments from the projects have been completed.

Some projects requested non-standard payment terms with nuances, which had to be approved by the ADPC and also by Arbitrum Foundation as the counterparty. Some of these include monthly instalments, which were limited to be paid over a 6 month period, or requesting the commencement of security services prior to contracts being executed, which was permitted at the project and security service provider’s risk.

In one instance, one of the projects transferred the funds before any of the work orders had been signed. Upon discovering this, the security service provider was informed that the process could not proceed until the funds were returned. We then requested and verified proof of the transaction, including the transaction hash, to confirm that the funds had been returned as requested.

Once the payment flows were approved, each project was asked to move on to the next stage, i.e., the signing and execution of work orders, specifically Exhibits A and B.

IV.10 Signing & Execution of Work Orders

As mentioned in Section III.3 above, two key documents were to be executed before any work could commence: Exhibits A and B. Exhibit B, the agreement between the security service provider and the project would need to be executed first and sent over to the Arbitrum Foundation. Once this was received, the Arbitrum Foundation would send Exhibit A, the grant agreement between the Foundation and the security service provider, via DocuSign.

Once both of these documents were signed, the security service could commence.

Please note that theoretically, as explained to the projects and providers, work could commence upon the signing of Exhibit B, at risk of the security service provider’s agreement for the payment of the subsidy not being executed.

It should also be noted that despite providing two work order forms i.e. a blank template to be filled in and a replica with comments to guide participants, several errors were still observed. Notably, these included incorrect entries for the unsubsidized amount as well as missing signatures, among other issues. As a result, multiple rounds of communication were required between the ADPC, projects, and security service providers to resolve these discrepancies, leading to delays in the process.

All Exhibits A and B have been signed by projects and providers now. The only remaining step is monitoring and ensuring that payments are made via the MSS as explained above: upon the earlier of the completion of the security service or when the payments from the projects have been completed.

V. Communication, Reporting, & Marketing

V.1 DAO Communication & Reporting

The ADPC maintained clear, frequent communications with the DAO during the management of the Security Subsidy Fund. This was done through the following means:

- ADPC bi-weekly call updates;

- ADPC bi-weekly forum updates via the Update Thread;

- Reporting updates via the Subsidy Fund Notion Hub;

- Communication with the Arbitrum Delegates Telegram group.

V.2 Communication Channels

- Applicants: Created a public Telegram group for communications with applicants.

- Security Providers: Created a private Telegram group for communications with whitelisted security service providers.

- Shortlisted Applicants: Created a private Telegram group for communications with shortlisted applicants.

V.3 Communications with Arbitrum Foundation

Given that Arbitrum Foundation is the counterparty between all projects and security service providers, coordination with the AF was an important aspect of the fund management process.

We already had pre-established channels with the AF on Telegram and via email. The key points of coordination were:

- Co-marketing of the Security Subsidy Fund;

- Confirmation of defined payment flows for all 22 projects with the Arbitrum Foundation;

- Coordination of signing of work orders between the 22 accepted projects, 9 security service providers, and Arbitrum Foundation as the counterparty;

- Engaging in marketplace investigations and policing of marketplace participants (where required). This included:

- Establishing secure and legally privileged communication channels;

- Monitoring communications;

- Gathering evidence and preparation of advice and recommendations for further action.

All of these activities involved multiple calls and significant time spent on daily communication.

V.4 Application Process Marketing

As mentioned above, the ADPC first created a Declaration of Interest form to drum up interest for projects to apply to the Security Subsidy Fund. This form received 49 responses; we collected each respondent’s email and Telegram IDs and directly reached out to them to announce the opening of applications and other communications.

We also conducted a comprehensive marketing effort to attract applicants; the details are in Section VI.3 (Marketing Analysis) below.

V.5 Marketing Post-Selection of Projects

- Axis Advisory posted an article on X announcing the selection of projects.

- We also reached out individually to the selected projects to ask them to post tweets announcing their selection for subsidies. This resulted in 16 posts from 15 projects, with the ADPC drafting template messages for the projects. The list of posts is below:

VI. Outcomes Analysis

VI.1 Analysis of Applicants

A total of 56 projects applied to receive subsidies, which is higher than the 49 projects that filled the Declaration of Interest form.

- Of these, a majority (36, i.e., 64.29%) were DeFi projects. This highlights the significantly DeFi-and-finance-centric nature of Arbitrum. The rest of the projects varied across categories:

- RWAs (5 projects, including 2 insurance projects);

- Infrastructure (4 projects);

- Launchpad (3 projects);

- Cross-Chain Protocols (2 projects);

- NFTs (2 projects);

- Donations (1 project);

- Domain Names (1 project);

- Stablecoins (1 project);

- Fundraising Platform (1 project).

- Of the 56 projects, moreover, 40 (71.4%) had raised investor funding, while 16 (28.6%) were self-funded or funded via grants.

- 23 of the 56 projects were not yet deployed on Arbitrum, while 33 projects were already deployed on the chain.

- 44 of the 56 applicants (i.e., 78.60%) stated that the Security Services Subsidy Fund either convinced the project to deploy on Arbitrum or strengthened their decision to deploy on Arbitrum.

- 19 of the 56 applicants (33.93%) had never conducted a security audit previously.

- 8 projects (14.29%) applied for Stylus audits.

- 20 of the applicants had previously worked with at least one of the whitelisted security providers.

- On a separate note, applicants responded overwhelmingly positively to the question “Assuming that the ADPC will provide procurement services for different verticals in the future (e.g. RPC providers), how important/helpful is it for your project to use the procurement service of the ADPC?” with an average score of 8. This indicates the amount of demand for builder support programs from the Arbitrum DAO.

- In terms of the timing of when the projects submitted their applications:

- 6 projects submitted their applications by 30 September 2024, the date the applications opened;

- A further 22 projects submitted between 30 September and 13 October 2024;

- Exactly half, i.e., 28 projects, submitted their applications on the last day of 14 October 2024.

VI.2 Analysis of Selected Projects

A total of 22 projects were selected to receive subsidies. As mentioned earlier, 25 projects were shortlisted for the matchmaking process, and 3 of these projects dropped out due to various reasons.

- 15 of the 22 selected projects (68.18%) were DeFi projects, which is slightly higher than the 64.29% of applicants that were DeFi projects. Of the remaining 6 selected projects:

- RWAs (3 projects);

- Fundraising (1 project);

- Donations (1 project);

- NFTs (1 project).

- 8 of the 22 selected projects (i.e., 36.4%, more than one-third) had never conducted an audit previously. This indicates how the SSF strengthened the security of the Arbitrum ecosystem and simultaneously brought new projects over to Arbitrum, achieving a key goal of the program.

- 2 of the 8 projects that applied for Stylus audits (25%) were awarded subsidies.

- 4 of the 5 RWA projects that applied (80%) were shortlisted, and 3 of them (60%) received subsidies (one had to drop out).

- Note that many other projects responded that they were RWA projects; however, from the ADPC’s analysis during the review process, many of them were DeFi protocols that included RWAs to some degree, but were not “explicitly” RWA-focused projects.

- 15 of the 22 selected projects (68.18%) had raised investor funding, while the remaining 7 (31.82%) were self-funded or funded via grants. However, we funded 37.50% of the applicants that had raised funding (15 of 40 applicants), while funding 43.75% of the applicants that were self-funded or funded via grants (7 of 16 applicants).

- The range of audit quotes was significant, reflecting the variety in the scopes of work requested by the projects. The lowest quote was $16,500, while the highest was $345,979. The average quote was $140,134.

VI.3 Marketing Analysis

Marketing of Application

The below table outlines the public marketing effort to market the fund to potential applicants:

| Post | Link | Impressions | Likes / Comments / Reposts | Platform |

|---|---|---|---|---|

| SSF Launch Announcement | Link | 46,000 | 114 | |

| SSF Launch Security Service Provider Reposts | Cyfrin; Immunefi; Zellic; Sherlock; Three Sigma; Guardian; Cyfrin | 24,400 | 207 | |

| SSF Launch Arbitrum Repost | Link | 17,000 | 329 | |

| SSF Launch Announcement | Link | 1,800 | 50 | |

| SSF Info Session | Link | 3,700 | 62 | |

| SSF Application Announcement | Link | 27,000 | 60 | |

| SSF Application Announcement | Link | 1,100 | 23 | |

| SSF Applications Open | Link | 1,050 | 17 | |

| SSF 4 Days Left to Apply | Link | 27,500 | 43 | |

| SSF Applications Closing | Link | 3,200 | 29 | |

| SSF Applications Closed | Link | 1,009 | 21 |

Over 17 posts and re-posts by stakeholders on Twitter and LinkedIn, we generated 150,000+ impressions and 950+ likes, comments, and reposts. This attracted 56 applications and significant mindshare towards Arbitrum’s efforts in supporting builders.

Overall, the marketing effort to attract applicants was very successful, providing a blueprint for DAO programs.

Marketing Post-Selection of Projects

As mentioned earlier, we reached out individually to the selected projects to ask them to post tweets announcing their selection for subsidies. This generated the following engagement:

| Post | Link | Impressions | Likes / Comments / Reposts | Platform |

|---|---|---|---|---|

| DAMM Capital | Link | 4,118 | 31 | |

| Juicebox | Link | 392 | 20 | |

| Collar Protocol | Link | 324 | 6 | |

| SatsBridge | Link | 73 | 4 | |

| Takadao | Link | 181 | 12 | |

| Nex Protocol | Link | 1,675 | 23 | |

| MUX Protocol | Link | 1,043 | 15 | |

| Variational | Link | 4,773 | 194 | |

| Millicent One | Link | 4,669 | 903 | |

| Umami Finance | Link | 961 | 17 | |

| GMX | Link | 5,563 | 173 | |

| Cod3x | Link | 6,607 | 97 | |

| GMX | Link | 118 | 2 | |

| D2 Finance | Link | 619 | 15 | |

| Tally | Link | 598 | 7 | |

| Velvet Capital | Link | 1,781 | 40 |

Over 16 posts from 15 projects on Twitter, we generated 33,495 impressions and 1,550+ likes, comments, and reposts. Overall, the post-subsidy fund marketing effort can also be considered as successful.

VII. Feedback Collection

VII.1 Feedback Collection Process

In order to identify the performance of the Security Services Subsidy Fund, we conducted a comprehensive feedback collection process with projects (all applicants) and whitelisted security service providers. The forms were first created on Notion, where feedback was collected internally within the ADPC, and were then transferred to Fillout for distribution and tracking.

The links to the feedback forms can be found below:

We reached out to applicants and security service providers via their respective Telegram groups, while we reached out individually to subsidy recipients and security service providers as well.

We received 10 responses from projects and 5 from the security service providers. These numbers are lower than we would ideally want them to be, while acknowledging that collecting feedback is never a straightforward process. However, it is a clear aim for us to boost these numbers in the future.

VII.2 Analysis of Feedback

Applicants

The responses gathered from the projects that replied to the feedback form have been very positive, with all of them rating their overall experience favourably. Two-thirds gave it an “excellent” rating and 70% of projects found the application process to be very clear and straightforward.

A key highlight was the effectiveness of our evaluation framework - 89% of projects endorsed the Means Test as fair and appropriate. This was complemented by exceptional feedback on the whitelisted auditor marketplace, which received “Excellent” ratings from 80% of users and “Good” from the remaining 20%. The marketplace proved particularly effective in achieving competitive pricing, with 90% of projects confirming competitive quotes and 70% finding them reasonable.

Looking at impact, the program shows promising signs of catalysing growth across Arbitrum. Nearly 90% of projects are eager to participate in future rounds, with several planning new product launches. We’re even seeing unexpected positive outcomes, such as one project exploring Arbitrum Stylus integration - exactly the kind of technological adoption we aimed to encourage alongside stronger security practices.

However, there is certainly room for growth. While half of the projects reported that the subsidy fully covered their needs, the other half found it only “somewhat adequate.” This feedback, combined with the high satisfaction rates and strong market dynamics, suggests that scaling up the fund size could unlock even greater ecosystem development while maintaining the program’s proven effectiveness.

Security Service Providers

Out of the 9 whitelisted security service providers, 5 responded to our feedback survey. All respondents reported a smooth whitelisting process, and the initial whitelisting requirements were universally understood, with 20% finding them very clear and 80% clear. Communication channels proved effective, with all providers confirming they had adequate ways to report concerns, while quote submission timelines also worked well for 80% of providers.

That being said, the feedback also highlights areas that can be streamlined better going forward, particularly around the quote-matching and submission processes. Despite this, overall satisfaction remained positive, with 60% of providers expressing satisfaction with the procurement framework. The sole project to indicate their dissatisfaction with the procurement process highlighted in their replies that this was mainly due to the timing of the subsidy amount communications, specifically the desire to have subsidy amounts determined before quote issuance, in order for projects to be able to forecast their budget and make an educated business decision, a valuable insight for improving future rounds.

VIII. Appendices

VIII.1 Legal Documents

VIII.2 Forum Links

- Proposal to establish the Security Service Providers Procurement Framework here

- Proposal to establish the ADPC here

- Proposal to establish the Subsidy Fund here

- Proposal to add DeDaub to the ADPC to support on whitelisting security service providers here

- RFP Security Providers here

- Proposal to set up a sub-committee for the Subsidy Fund here

- ADPC Phase II reporting thread here

VIII.3 Snapshot & Tally Vote Links

- Snapshot vote to establish the Security Service Providers Procurement Framework here

- Tally vote to establish the ADPC here

- Snapshot vote to establish the Subsidy Fund here

- Tally vote to establish the Subsidy Fund here

- Snapshot vote to add DeDaub here

- Snapshot vote to set up a sub-committee for the Subsidy Fund here

VIII.4 Dashboard & Comms Channels

VIII.5 ADPC Members

Axis Advisory

Axis Advisory is a DeFi-focused lawfirm specialising in corporate, legal and regulatory advisory. Its services consist of 4 main verticals targeting:

- Governance Contributions [Axis Advisory is a member of the dYdX Operations Team, created the Arbitrum Research & Development Collective and the ArbitrumDAO Procurement Committee of which it is a member, and is developing Arbitrum’s Optimistic Governance Module];

- Legal Advisory [Axis Advisory advises clients in various Ecosystems such as Arbitrum, Berachain, Bitcoin, Ethereum and Cosmos on ongoing legal matters such as drafting and negotiating commercial agreements, legal administration of capital raising rounds, and ongoing corporate advisory];

- Regulatory risk identification, assessment and mitigation [Axis Advisory specialises in providing comprehensive regulatory advisory & regulatory risk mitigation services, assisting clients in navigating complex regulatory landscapes to ensure compliance with evolving industry standards. Axis, being an EU registered lawfirm, offers services in relation to the Markets in Crypto Assets Regulation];

- Asset Valuations [Axis Advisory’s hybrid capital raising methodology aids clients attribute a fair, quantitative data-driven methodology to their capital raising round].

Areta

Areta Governance specializes in helping foundations and DAOs establish and grow decentralized governance structures. We develop tailored solutions in governance inception and optimization, ecosystem growth, and service provider selection. Our connected investment bank with deep strategic expertise, enables us to serve our partners holistically, rather than working in isolated governance silos.

We have had the privilege to work alongside industry leaders such as Uniswap, Arbitrum, Safe, Aave, and dYdX.

Daimon Legal

A veteran and OG across crypto, DeFi and Web3 platforms, Daimon Legal provides support to a wide range of clients and is active in key legal and crypto communities including LexDAO, LexPunks and LobsterDAO.

Daimon Legal provides advice on a range of issues including company incorporations, structuring, capital raising, NFTs, GameFi, intellectual property rights and all types of legal documentation, contracts and terms of service including many of the procurement and RFP terms used by the ADPC.

We are proud to have supported Tier 1 DeFi protocols including Maker DAO, Uniswap and Arbitrum. The Principal of the firm, Paul Imseih has been a board member of several DeFi projects, and is currently a board member of the DAI Foundation and a proud committee member of the ADPC.