This report aims to give a comprehensive overview of the OpCo Oversight & Transparency Committee (OAT) and OpCo’s activities from inception through October 31, 2025. It highlights major developments in organizational setup, governance, hiring, and DAO collaboration as OpCo continues to establish itself as the operational backbone of the Arbitrum DAO.

Organizational Development

Since its inception, OpCo has made significant progress in building and operationalizing its foundational structure:

-

Bylaws finalized: The OpCo Bylaws have been completed and shared for community review, outlining internal processes, accountability mechanisms, and decision-making frameworks.

-

Governance cadence: The OAT maintained a consistent schedule of weekly meetings with full attendance, ensuring strong coordination, transparency, and steady progress.

-

DAO oversight role: OAT began formally exercising its mandate to review and approve allocation recommendations, including those under Entropy’s TMC proposal.

-

Operational infrastructure: OpCo has engaged an accounting provider and initiated the development of its own website to enhance transparency and operational independence. Additionally several efforts have been undertaken to improve the coordination between the different AAEs.

-

Community engagement: Direct lines of communication have been established with the majority of active delegates and Arbitrum Alliance Entities (AAEs), strengthening feedback and accountability loops.

Hiring and Team Growth

Team expansion has been one of the most impactful milestones during this period:

-

New hires: OpCo has successfully hired Tamara as Head of Operations and Sinkas as Program Manager. Both are now fully onboarded and operational, driving day-to-day execution and coordination across initiatives.

-

Capacity building: These additions significantly enhance OpCo’s ability to manage governance processes, ensure transparent reporting, and execute DAO initiatives efficiently.

-

Active recruitment: Searches are ongoing for a Head of OpCo, Director of Finance & Treasury, and Legal Counsel — key roles that will further solidify OpCo’s organizational maturity and compliance posture.

DAO Collaboration and Program Oversight

OpCo continues to deepen its collaboration with the DAO and support ecosystem programs:

-

Program management: OAT serves as the counterparty for Entropy’s Year 2 and Year 3 proposal, overseeing a 10M ARB allocation focused on incentive mechanism development. Conversations with Entropy are ongoing, the OAT has started to conduct a due diligence and additional updates will be shared in due time.

-

Governance engagement: The team participates in DAO calls and governance discussions, providing updates, addressing community questions, and incorporating feedback to enhance transparency.

-

Operational leadership: OpCo is hosting bi-weekly Office Hours and took over facilitation of the Governance, Risk, and Compliance (GRC) and Open Discussion of Proposals calls.

-

Operations for other AAEs: OpCo will lead background and reference checks for the upcoming AGV council elections.

-

Proposal development: OpCo’s first proposal was published and the team is actively collaborating with DAO stakeholders to refine and advance it. At the same time as the counterparty of the DIP program, OpCo has been actively involved in discussions of the next version.

-

Community presence: Organizing the “La ArbiCasa” event during Devconnect, strengthening community engagement and fostering collaboration among DAO contributors.

-

Additional revenue streams for the DAO: the OAT and OpCo are engaged in helping the Arbitrum DAO establish new products and business lines. Currently, the team is working on one such opportunity in collaboration with another AAE; details of which will be shared in due time.

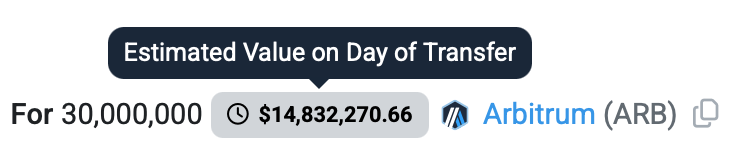

Financials

As of October 31st 2025, OpCo has incurred the following expenses:

Please note:

- Funds in ARB and USDC are held in the following wallet: 0xf67DB74DEc758fE7C3fB521aB0dB77E8Df9c8178