Summary

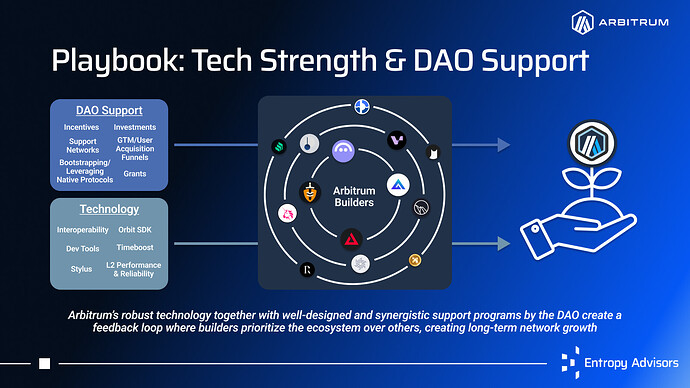

Entropy’s SOS submission is a culmination of countless back-and-forths with key delegates, builders, investors, and contributors. Our proposed objectives all build towards one single key goal: positioning and reshaping the DAO in a way that enables it to fully and continuously prioritize the most valuable resource the Arbitrum ecosystem has—builders—through capital allocations, support networks, user access, and providing stability and confidence in the DAO’s uninterrupted operations.

Our proposed two-year objectives are “Arbitrum is Recognized as the Indisputable Number One Home for Builders” and “Arbitrum DAO Positions Itself as a Digital Sovereign Nation”. By a digital sovereign nation, we mean that the DAO reinvests into value-creating and compounding growth opportunities by continuing to diversify its revenue drivers to include application-layer usage and income-generating investments in addition to its “natural resources,” comprising transaction fees from Arbitrum One, Orbit licensing fees, and soon Timeboost.

However, for Arbitrum to become the number one home for builders, we as a DAO can and must do more than simply allocate capital into the ecosystem. Builders must have access to a unified ecosystem growth pipeline, enabling an idea to grow into a product, as well as robust go-to-market and user acquisition channels through which both new and existing teams can achieve high demand for their solutions, especially when it comes to users who aren’t yet onboarded to crypto.

It’s unrealistic to try to prioritize everything simultaneously, and our opinion is that the DAO should start narrowing its focus on two levels. First, protocols with Arbitrum as their indisputable home chain should be given precedence. Second, while we should continue making calculated bets into emerging verticals—such as AI—DeFi (spot DEXs, perp DEXs, lending, liquid staking) and real-world use-cases with strong PMF (stablecoins, payments, RWAs) are at the heart of activity on Arbitrum, and justify a first-class seat at the table.

To be able to achieve the abovementioned two-year objectives, our opinion is that the DAO’s operations and the way we manage our treasury have to be first rebuilt. As such, our proposed one-year objectives are: “Arbitrum DAO Operates with Efficiency” and “Strong and Clear Financial Management Policies that Prioritize Ecosystem Growth and Sustainability”.

Most would agree that the DAO’s operations are currently inefficient. In accordance with the vision recently posted by the Arbitrum Foundation, our belief is that the solution to this problem is to establish Arbitrum Aligned Entities that work full-time with the DAO, have their responsibility areas which they fully own, and whose success is completely tied to the success of the ecosystem. But, efficient operations alone aren’t enough to form a robust organization. Strong and clear financial management policies are required to ensure that the DAO can maintain its operations not just in the short term, but into perpetuity, continue attracting and retaining builders, and reach its vision of Arbitrum becoming the home to the universal shift onchain.

Rationale

Looking at almost any data point, the Arbitrum network is doing extremely well. Arbitrum One is one of the most active chains when it comes to DeFi, the network is among the largest based on organic stablecoin balances and is growing quickly in the RWA vertical, and major protocols and enterprises such as Sky and Tether have recently joined the ecosystem or declared Arbitrum as their home-base for mission-critical operational functions related to their products/protocols.

It’s also objectively fair to say that Arbitrum is THE leader in L2 technology developments. According to L2BEAT, One is the closest of all major rollups to reach Stage 2 status, with BoLD having gone live in February, not to mention further pioneering solutions such as Timeboost and a universal intents engine on the horizon. Moreover, the Arbitrum ecosystem differentiates itself from other L2 frameworks by providing chain builders with unique optionality to create without arbitrary restrictions. Want to use an alternative DA solution or your native token as the gas token? You got it. Want to write smart contracts in Rust or C++? Stylus has you covered. Customizable block times? Arbitrum’s tech stack has your back. To summarize, Arbitrum is Freedom.

The Arbitrum DAO is unique in that it actually holds meaningful influence over chain upgrades, the treasury, and legal entities directly connected to the ecosystem. This has been true since the DAO’s inception, with the community having been more or less independently accountable for carving its path to support the broader ecosystem with its massive ARB treasury. There’s a vast number of contributors with varying characteristics and their own incentives—protocols, service providers, investors, university clubs, and individual contributors. As such, governance is also extremely active, with new proposals and ideas emerging almost on a weekly basis. There are countless contributors eager to influence the DAO’s direction and express their views across all subject matters.

This all sounds amazing on a high level. However, digging further into the network’s growth and the DAO’s effectiveness, which are highly interconnected with one another, some obstacles and shortcomings emerge. As should be common knowledge by now, industry-leading technology alone in crypto isn’t enough to attract builders to an ecosystem and thus to create network growth. Yes, it plays a vital role, but without additional support services, high-quality go-to-market and growth funnels, and financial assistance, it becomes highly difficult to convince builders to prioritize the network due to a high opportunity cost deriving from Arbitrum’s main competitors offering strong support across the aforementioned verticals.

Competition across ecosystems is increasing each day that goes by, and if Arbitrum DAO doesn’t introduce reforms, our position as a leading blockchain network will more than likely be in jeopardy. The industry’s confidence in the DAO’s ability to support new and existing builders, as well as utilize resources efficiently, undoubtedly has room for improvement. These two factors are closely interrelated as short- to medium-term growth is meaningless if it comes at the expense of the DAO’s long-term resilience. So, what are the root causes from which the aforementioned hurdles derive?

The above graph depicts our perspective of the pieces that together form a strong, late-stage DAO and how these pieces build on top of each other. Comparing this to how Arbitrum DAO is currently structured and how it operates, it’s clear that there is active governance in place, the DAO has access to a skilled workforce and vendor set, and some work is being done towards diversified, healthy cash flow through programs such as the venture investment initiatives as well as deploying the treasury into low-risk yield-bearing opportunities. However, the rest of the components are missing, and the DAO is currently set up in such a way that governance and the human capital and vendor network cannot be leveraged in a high-impact way. We’d argue that these missing attributes are the catalysts for most, if not all, of the frictions the DAO is struggling with.

For the DAO to reach its vision of Arbitrum becoming the home to the universal shift onchain, operations have to be selectively rebuilt. This structure isn’t the fault of any individual delegate or DAO contributor group. The DAO was fully decentralized when incubated with ecosystem contributors across diversified backgrounds left to figure things out themselves. Consequently, most delegates, no matter their specializations, core competencies, and unofficial roles, are focusing on everything. This creates a vast amount of noise and wasted resources, going against the basic principles of the division of labor.

This SOS submission emphasizes the missing components shown earlier, with each objective and its associated key results designed to enable the DAO to operate and allocate assets at full efficiency and for maximal impact. The core focus is on builder alignment through access to capital, user networks, and other support functions in high-potential market verticals for which the Arbitrum technology stack is well-suited, and compounding profits into further growth to establish a self-sufficient ecosystem that produces long-term value.

Short-Term Objectives (1 year)

Objective 1: Arbitrum DAO Operates with Efficiency

Per the vision recently posted by the Arbitrum Foundation, this objective focuses on establishing a full-time workforce for the DAO and dividing responsibilities across this workforce. Our opinion is that choosing any other goal as the DAO’s immediate objective is sub-optimal. The DAO’s current operational structure is so scattered that almost all initiatives proposed and facilitated face huge operational drag. We have to learn to walk before we can run.

Contributors have to go through a vast amount of bureaucracy, processes are overly complex, there’s a lot of overall noise within the organization, and most contributors’ success isn’t directly tied to the ecosystem’s/DAO’s success. Furthermore, many initiatives are one-off in nature (let’s experiment with xyz because we’re a DAO), have no synergies between each other (e.g., no clear path for venture grant recipients to “graduate” into late-stage incentives), and are supply-side based (an active delegate with the relevant skillset has to already exist within the DAO for an initiative to be initiated).

To remedy this, high-quality facilitators must be given more freedom to operate within their areas of specialization, and a clear delineation of roles and responsibilities is needed. This is accomplished by establishing initial focus verticals, with each vertical having one full-time Arbitrum Aligned Entity (AAE) primarily responsible for deliverables within that operational area. AAEs must work with the Arbitrum DAO exclusively, and their incentives have to be directly aligned with the success (or failure) of the ecosystem. The initial cohort of identified AAEs comprises Offchain Labs, Arbitrum Foundation, GCP, OpCo, and Entropy Advisors, with each AAE’s as well as delegates’ responsibility areas conceptualized to be initially divided as shown below.

Note that operational areas, such as go-to-market/user acquisition funnel creation, synergistic to partnerships, are absent, although vital to the growth of Arbitrum. In other words, additional AAEs will likely have to be established in the future. This structure would work in practice by AAEs being allocated, or already having as part of their original mandate, a budget for covering internal expenses, ensuring long-term alignment with Arbitrum, as well as enabling AAEs to outsource work to specialized vendors and individuals who can simultaneously serve other ecosystems where required. To become a new AAE, or for existing AAEs to renew their engagement with the DAO, an onchain proposal has to be passed. Unlike historical proposals, the new standard would be to define a higher-level strategy, responsibility area, vision, and business plan that the applying entity will be responsible for, defining their budget, and what the performance expectations are, instead of every single detail having to be laid out in length.

With this new structure in place, OpCo’s mandate would be streamlined for the entity to mainly become a communication layer, operational facilitator, and directly oversee AAEs. Before a proposal is posted to the forum, the expectation is that a proposer contacts OpCo, who then relays information to the AAEs, giving their opinion on whether or not the proposed vertical fits in with the strategy that is currently in place. If the aligned entities agree with the proposal, OpCo then passes on this information to the proposer, who publishes the proposal on the forum. Alternatively, if the AAEs don’t agree with the proposal, the expectation is that the proposer doesn’t continue with it to the forum, although nothing stops them from doing so, as is the norm in DAOs. However, delegates are highly encouraged to vote against a proposal that AAEs, through OpCo, haven’t endorsed.

Vendors, service providers, and individuals are also encouraged to contact OpCo in cases where a vertical that they’d want to facilitate work in is already owned by an AAE. For example, there already exists a party responsible for the DAO’s grants, but a grant manager is interested in spinning up a new grant program for the DAO. They can then put together a proposal that OpCo relays to the party responsible for the DAO’s grants. If this party agrees with the proposal, the grant manager will either be hired as a vendor who is accountable to the AAE or potentially established as a new AAE if the existing one doesn’t have the capacity/proficiency to facilitate the proposed strategy.

With this new structure in place, less pressure will be put on delegates. We expect the number of proposals hitting the forum and their length and complexity to decrease substantially. A delegate’s role will evolve from having to do everything to instead serving as the final oversight function, reviewing recurring oversight reports and strategy updates published by OpCo, and, more importantly, ensuring the network’s safety by guarding against malicious software upgrades, treasury raiding attempts, and other governance attacks.

Active discussion around DAO developments is still highly encouraged across delegates, with OpCo relaying valid, robust, and relevant ideas where a facilitator cannot be identified to the group of AAEs. Factors requiring a vast amount of context and understanding of the Arbitrum ecosystem, such as strategy setting or partnership proposals, should be fully driven by the AAEs.

By decreasing delegates’ operational stress, we expect key Arbitrum stakeholders that have historically been absent, including investors and additional Arbitrum-vital protocols, to begin ramping up their participation in the DAO. Delineating roles between AAEs and delegates should not only increase the effectiveness of operations but also enable high-quality ideas to surface and move to the execution stage in a more streamlined manner.

- Key Results

- The DAO recognizes a cohort of Arbitrum Aligned Entities, and a new operational structure is put in place

- Delegates assume a new role: safeguard the network from malicious upgrades and treasury misuse, while approving AAE engagements and overseeing them through OpCo

- All AAEs’ success is directly tied to the network’s success

- OpCo’s mandate is clearly defined

- Risks

- The DAO becomes more reliant on specific contributors

- Optimizing and standardizing the new operational structure will take some time

- Transforming vendors into AAEs for verticals that require high specialization might be difficult

- Alignment with Arbitrum’s MVP

- The envisioned delegate role aligns the position to the DAO’s purpose of defending and guiding the Arbitrum ecosystem, while the new operational structure enables DAO contributors to more effectively facilitate the mission of empowering people with the freedom to build their best onchain world.

Objective 2: Strong and Clear Financial Management Policies that Prioritize Ecosystem Growth and Sustainability

From our point of view, this is an area that has historically been widely overlooked. There are no policies in place for budgeting, capital allocation, or portfolio management, no consensus on how unprofitable/profitable the DAO should aim to be in the coming years, and service providers and contributors are largely compensated through just-in-time liquidity from ARB being converted into cash-like assets (no working capital management policies in place). Some treasury diversification has already taken place through the STEP v1/v2 initiatives, and the TM v1.2 is currently ongoing. However, both of these programs have been motivated by experimentation and by the high opportunity cost the DAO is facing by simply holding idle ETH in the treasury instead of being driven by a wider-reaching strategy. Consequently, even with the two aforementioned initiatives having passed an onchain vote, the DAO still lacks consensus on which “primary category” these initiatives belong to.

Without clear financial planning, the DAO exposes itself to unnecessary risks and frictions when it comes to decision-making. This is something that will now have to be retrofitted based on already-made allocations. Excluding capital allocated to the Arbitrum Foundation through AIP-1.1 and any DAO-owned assets that are in offchain custody, the DAO currently owns ~3.4B ARB, ~20K ETH, and ~$35M worth of cash and cash equivalents.

That is, the DAO only holds ~$65M worth of non-native assets, with ~94% of the DAO’s $-based holdings being denominated in ARB. Of these holdings, ~545M ARB (~91% accounted for by the Foundation’s partnership budget, OpCo, and GCP) has been earmarked for current initiatives. At ARB’s current price of ~$0.28 and assuming a 3-year lifetime for these initiatives, these allocations result in $46M in yearly realized ARB sell-downs. The challenge here lies in that, from the DAO’s perspective, ARB should not be treated as akin to non-native assets in the treasury since selling down the position will dilute the DAO’s valuation in the short term.

Before creating a comprehensive budget that also accounts for new allocations for upcoming initiatives within the operations, grants, incentives, etc. categories, the DAO needs to come to a consensus on how unprofitable it wants to be during the next 12 months, and how much it’s willing to issue tokens from the treasury to finance itself.

Annualizing Mar ‘25 figures for blockchain profit and STEP yield, and assuming Timeboost will generate $30M during the first 12 months, none of the aforementioned streams are reinvested, ETH price at $1,485, ARB price at $0.28, and an average APY of 5% on actively managed strategies results in ~$45M in yearly income for the DAO. In other words, based on the aforementioned assumptions, the DAO would already be selling down more ARB than revenue generated in dollar terms in the next 12 months. As an anecdote, the DAO has operated at a loss in every complete quarter since Q4 2023, but when excluding incentives, grants, and investments, the margin has hovered around 60-80%.

We strongly believe it’s acceptable that the DAO continues operating at a deficit over the next 12-24 months, mainly because it’s important that we continue investing in the ecosystem’s growth. However, the way this is done has to be refined such that we are increasingly relying on non-native assets to finance expenses while allocating capital with maximal efficiency and impact. Historically, practically all of the DAO’s expenses have been financed by either directly covering expenses in ARB or through just-in-time liquidity by converting ARB into stablecoins. Accrued revenue has been used to support the BoLD initiative, while some is in the process of being reinvested.

On the one hand, the treasury’s high weighting in ARB makes the DAO subject to concentration risk and double exposure to downside since operational underperformance also directly affects ARB price. On the other hand, this is natural as ARB is the ecosystem’s native token, and we want to avoid sending a negative market signal from excessively selling down our position and to maintain the upside that materializes in the token as the DAO increasingly creates long-term intrinsic value.

What we’re getting at here is that we’re comfortable with continuing to finance initiatives with ARB in the short term, building up yield-earning assets in the treasury, and decreasing the concentration risk. However, the DAO needs to start preparing for a holistic portfolio construction and management strategy, answering questions such as what the targeted mix of non-native asset is, what the cap on issued ARB should be, at what point have we amassed enough yield-earning capital that revenue is redirected to covering operational expenses and growth initiatives, what our working capital/liquidity buffer should be, and should strategies like hedging, borrowing, or other active asset management strategies be utilized to further change the risk/return profile of the treasury?

Since we will likely be in a position where most initiatives are still directly covered with ARB from the treasury in the short- to medium-term, the DAO should put weight into standardizing its ARB liquidation strategy and methodology. Will we continue utilizing just-in-time liquidity, or should an adequate amount of ARB to cover USD-based expenses based on a budget be set aside for conversion over a longer time period? Should this allocation be hedged such that the minimum execution price is secured? How should the liquidation be performed—OTC sales, selling on the open market, more complex strategies such as covered call selling or providing liquidity to AMMs, etc.?

For the above to be possible, it’s likely that the creation and proposal of a holistic financial strategy for the DAO needs to be “owned” by a central party. Consequently, we should aim to combine the different initiatives and committees related to finances, treasury management, and stable investments so that the DAO can benefit from strong financial planning and management.

- Key Results

- Set short- and long-term profitability targets and establish annual budgets

- Unify all initiatives related to finances, treasury management, and stable investments

- Consensus on target portfolio composition and management strategies

- Standardized process for converting and managing ARB and related assets allocated as working capital

- Decision on when to start using revenue to cover expenses

- Risks

- Capital allocation strategy is too strict/undisciplined, leading to foregone growth opportunities/unnecessary spending

- ARB issuance caps set too high, diluting the treasury value in the short term and restricting the DAO from supporting ecosystem growth

- The DAO ends up taking on too much risk with respect to its treasury

- Alignment with Arbitrum’s MVP

- This objective mostly relates to the DAO’s ability to execute its mission of empowering people with the freedom to build their best onchain world. If financial management isn’t taken seriously, the DAO’s treasury could be at risk in the long term, at which point its ability to support growth through structured programs, capital allocations, etc., would be minimal. Poor capital allocation and excessive ARB issuance will also inevitably lead to a decrease in the token price, lowering network security and impeding the DAO from fulfilling its purpose of defending and guiding the ecosystem.

Medium-Term Objectives (2 years)

Objective 1: Arbitrum is Recognized as the Indisputable Number One Home for Builders

Our view is that for as long as the DAO has existed, its main priority has rightfully been to support builders. We’ve run several ecosystem growth programs that directly and solely distributed capital to new and established builders. These include the Short-Term Incentive Programs (STIP, STIP Backfund, and STIP-Bridge), the Long-Term Incentives Pilot Program, one-off incentive programs for protocols that went directly to the DAO, and the DDA grant programs. The aforementioned initiatives account for ~90% of the ~$170M of realized DAO expenses since its inception. Despite this, we are increasingly hearing unsatisfied feedback from builders across all sizes. Arbitrum-focused builders feel like the DAO doesn’t support them enough, protocols deployed in other ecosystems looking to migrate to Arbitrum feel like they’re treated unfairly compared to Arbitrum incumbents, while new builders looking to create something on Arbitrum say they are missing the resources to do so effectively. In our view, these problems can be traced back to the following factors:

Ecosystem Growth Pipeline – The DAO, together with the Foundation, has put a vast amount of resources into ecosystem growth, covering everything from hackathons to incentives for well-established protocols. So, the problem isn’t that there haven’t been opportunities and support programs for builders, but rather that these have been one-off in nature without clear continuity and interconnections with each other. For example, once a team has received a grant and “graduated” through the DDA program, there hasn’t been a clearly laid out path for them when it comes to the next steps. As for incentives, the DAO hasn’t yet found a way to build up a high-return, continuous program for later-stage projects. As identified in research performed by Castle Labs and DefiLlama Research, the ecosystem growth initiatives should form a unified funnel that provides stability, with a clear path for advancing through the whole system, comprising, among other things, hackathons, grants, support networks, DAO investments, and protocol incentives. For this vision to be viable, each part has to fit together, and based on our experience and research, specialized full-time actors are required for facilitation. We won’t delve deeper into this here, as @maxlomu covers the unified builders’ funnel well in his SOS submission.

Go-to-Market & User Acquisition Channels – Comparing Arbitrum to some of its main competitors, it’s apparent we’ve fallen behind when it comes to providing builders with clear user onboarding and acquisition pathways. Examples include integrations with wallets and CEXs, which enable applications to instantaneously reach a large potential user base, as well as strong ecosystem promoters and tailor-made programs that continuously bring new applications in front of a big target audience. Our opinion is that the DAO’s role isn’t to target greenfield partnerships or major integrations since OCL and the Foundation are already heavily focusing on these verticals. That said, the DAO should and can do more for builders than simply function as a capital allocator. Examples of initiatives synergistic with OCL’s/the Foundation’s efforts include membership programs, boosting Arbitrum’s visibility on distribution platforms that OCL/the Foundation have created partnerships with, possibly providing access to services such as market making, or targeting focused verticals in local markets through full-time community distribution programs. Similarly to the Ecosystem Growth Pipeline paragraph, a deeper dive is outside this write-up, as @maxlomu’s SOS submission covers this point well.

Recenter Focus on Core & High-Potential Verticals – This point somewhat relates to all of the ecosystem growth programs the DAO has historically run, but this is especially relevant when it comes to incentives. Programs have been open to protocols across all market segments, and although Arbitrum is often referred to as THE DeFi chain, it feels as though the DAO has lost this identity to a certain degree by focusing on everything at once. Our opinion is that going forward, all ecosystem growth-related programs the DAO runs should be prioritizing one of these two verticals and submarkets: DeFi (spot DEXs, perp DEXs, lending, liquid staking) and real-world use-cases with strong PMF (stablecoins, payments, RWAs). This isn’t to say that we shouldn’t make calculated bets into new markets showing high potential, such as dePIN, privacy, and AI, but DeFi and real-world use-cases with strong PMF deserve a first-class seat at the table. The important part here will be to tailor each program’s structure and staffing based on the specific vertical it’s targeting and to ensure the funding is available to move nimbly.

Arbitrum-Aligned Protocols – With more targeted programs, a unified ecosystem growth pipeline, user acquisition channels, and investments from the Arbitrum DAO, an increasing number of protocols should naturally start considering Arbitrum as their “home chain”, consequently prioritizing the ecosystem more than others. However, we think the DAO should go one step further, defining a set of transparent criteria that provide a project an “Arbitrum Aligned” status, giving them access to exclusive support and capital programs. Basically, any project should be able to transition into an Arbitrum-aligned protocol if it makes Arbitrum its indisputable home. This will make the unified ecosystem growth pipeline effect even stronger and establish a stickier alignment between the DAO and the ecosystem of Arbitrum projects. At the end of the day, Arbitrum wouldn’t be anything without its ecosystem of builders, protocols, and partners, and we as a DAO have to provide those who choose Arbitrum as their home/create value for the DAO, the best opportunities to thrive.

- Key Results

- Establish an end-to-end ecosystem growth pipeline

- Introduce >2 DAO-led programs creating/supporting new user acquisition pipelines, synergistic with OCL’s/the Foundation’s efforts within this area

- Arbitrum is a top 3 blockchain based on combined TVL in DeFi and RWAs (including stablecoins)

- Arbitrum is recognized as the de facto home for at least one new, mainstream vertical that emerges in the future

- Risks

- DAO puts a vast amount of resources into projects that then leave the ecosystem or expand their activity to other chains, which become the main hub for them

- DAO becomes overly fixated on certain verticals, failing to support future winners and falling victim to the sunk cost fallacy

- Programs designed in a way that no target builder type is fully satisfied

- Alignment with Arbitrum’s MVP

- For the DAO to reach its vision of Arbitrum being the home to the universal shift onchain, we must attract the best builders and teams to the ecosystem and maintain them here. With competition increasing by the day, industry-leading technology isn’t enough to achieve the aforementioned, which is why the DAO’s role is so vital for the future of Arbitrum.

Objective 2: Arbitrum DAO Positions Itself as a Digital Sovereign Nation

The DAO already has a multi-faceted set of “natural resources” returning value to the treasury. These include Arbitrum One, Orbit licensing fees, and Timeboost soon. We’ve also taken the first steps towards income sources outside of simply selling blockspace. A small treasury diversification, which will shortly be increased, has been performed into fixed-income products, with an additional tranche being deployed into actively managed strategies in the near future. Moreover, the GCP is ramping up, providing investment returns correlated to the onchain gaming industry further down the road.

We believe there are two additional significant opportunities for value creation, which will likely require further commitments of ARB, before moving on to covering operations, incentives, grants, etc., mainly with already established revenue streams. Both of these opportunities are related to capturing growth on the application layer: mobilizing a generalized VC fund or comparable structure that would enable the DAO to unlock upside on the application layer through equity/token holdings, additionally fitting into the ecosystem growth pipeline, as well as diving into DAO-owned products.

At this point, the DAO would have three main income streams: Arbitrum blockspace (Sequencer fees, Timeboost, licensing fees), application-layer usage (DAO-owned products and direct equity/token holdings), and income-generating instruments (low-risk assets and yield on capital deployed into the ecosystem). Combining this with an objective introduced earlier in this post, Strong and Clear Financial Management Policies that Prioritize Sustainability and Ecosystem Growth, especially when it comes to the market having visibility into ARB-denominated expenses, will signal that the DAO is creating intrinsic value instead of just sustaining operations through dilutive financing.

The question then becomes, what should these “end state” income streams be directed towards? The answer is simple to us—continue reinvesting profits into the ecosystem until value-creating growth opportunities diminish. The crypto industry is still incredibly unexplored and unsaturated, with new economic zones of opportunity for blockchain ecosystems continuing to emerge. As such, our opinion is that we’re still extremely far away from the point where the return on invested capital that the DAO can reach falls below the cost of capital for tokenholders. Simply put, we don’t think the DAO should channel funds to ARB holders in the next 2 years. What is important for us to succeed is showcasing the path to long-term value creation, which requires the DAO to reach self-sustainability and reinvest to compound revenue drivers.

- Key Results

- Launch a generalist VC fund or investment structure/mechanisms comparable in nature

- The DAO owns at least one crypto product synergistic with Arbitrum-aligned protocols

- No value is returned to the token before the DAO is sustainably profitable and all value-creating growth opportunities have been exhausted

- Revenue streams exceed ARB sell-downs directly related to DAO initiatives

- Market views ARB as a direct way to gain exposure to current and future growth opportunities within the ecosystem

- Risks

- Balancing credible neutrality with opinionated bets

- Unsuccessfully conveying the long-term vision to external market participants

- Allocating capital to value-destructive opportunities

- Alignment with Arbitrum’s MVP

- This objective covers all three components of Arbitrum’s MVP. To be able to defend and guide the ecosystem in the long term, the DAO must become value-creative and prioritize reinvesting in further growth. If this objective were to be reached, reinvestment would take place through a number of channels, mainly: grants, incentives, and investments, all optimized to enable an unconstrained builder and user experience for Arbitrum to become the home to the universal shift onchain.