Summary (TL;DR)

88% of LTIPP dApps & Protocols that spent $ on off-chain ads & content campaigns in 2024 indicated that it’s the 2nd most effective user acquisition strategy. However, only 54% of dApps have used it last year, with only 21% being able to calculate their CAC and 0% calculating their users’ LTV.

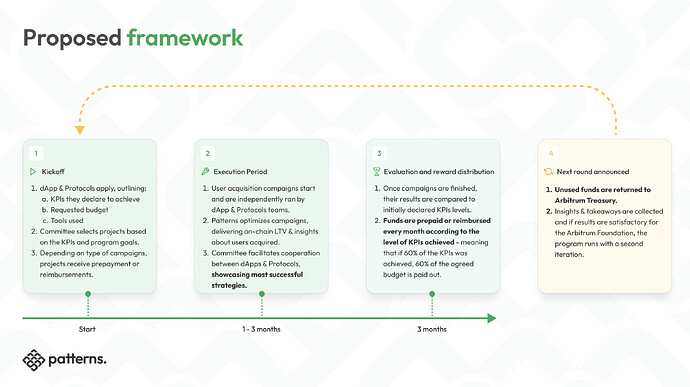

Patterns proposes a 1st iteration of a program for dApps & Protocols to cover the costs of their off & on-chain user acquisition campaigns - up to a level they manage to achieve out of self-declared category KPIs. Participants can design their campaigns freely with a requirement for all of them to be measurable and Patterns will calculate ROI (CAC + on-chain LTV) for all campaigns to focus on the most efficient strategies in the next iteration.

The challenge

-

The main goal of incentive programs such as STIP & LTIPP is to increase the user inflow into the ecosystem that will lead to higher network usage, TVL and finally - the price of $ARB.

The main goal of incentive programs such as STIP & LTIPP is to increase the user inflow into the ecosystem that will lead to higher network usage, TVL and finally - the price of $ARB. -

Even though the budgets for these programs are increasing, their results are temporary and most metrics fall back to their baselines right after the program is finished, which is underlined by many ecosystem stakeholders, including IOSG in their latest proposal

Even though the budgets for these programs are increasing, their results are temporary and most metrics fall back to their baselines right after the program is finished, which is underlined by many ecosystem stakeholders, including IOSG in their latest proposal

![]() Patterns team (f.k.a. Tokenguard) analyzed projects that took part in the LTIPP program and identified multiple reasons of this and similar programs not achieving long-term results that were expected:

Patterns team (f.k.a. Tokenguard) analyzed projects that took part in the LTIPP program and identified multiple reasons of this and similar programs not achieving long-term results that were expected:

-

No off-chain marketing - most protocols didn’t communicate rewarding to new users in other ways than using existing SM channels such as Twitter and Telegram.

-

Lack of knowledge of on-chain user acquisition funnels - only 37% of protocols have off-chain tracking tools installed for marketing purposes, which makes it impossible to run successful user acquisition campaigns.

-

No consideration for ROI and over-expenditure on non-performing projects - as discussed during ARB Liquidity Incentive calls, most teams don’t have any active marketing & growth teams that would take care of CAC & LTV ratios for their marketing campaigns.

These insights along with the supporting data were presented at ARB Liquidity Incentives calls organised by L2Beat (thanks to Kaerste & Sinkas):

- 09.10.2024 - summary, recording & transcript are available here

- 27.11.2024 - summary, recording & transcript are available here

The above reasons make most incentivization programs attract only a small group of existing Arbitrum users and / or users that interact with cross-chain protocols available on Arbitrum.

Insights from dApps & Protocols

While working on this proposal, our team conducted surveys amongst LTIPP participants to understand their perspective on user acquisition and most efficient strategies they used. Out of 40 protocols we’ve contacted, 19 filled out the survey. The results bring in some significant new conclusions:

-

84% of surveyed protocols indicated covering user gas fees & airdrops as the most efficient user acquisition strategies

– However, 53% of protocols haven’t spent a single dollar on off-chain user acquisition in 2024

– Out of 47% of protocols that spent $ on off-chain user acquisition in 2024, 88% indicated 2 off-chain strategies (paid posts & ads; newsletters) as the second most efficient user acquisition tool. -

Only 21% of surveyed protocols know their CAC (“Customer acquisition costs”)

-

0% of protocols know their LTV (“Lifetime value of a user”)

Further questions uncovered more interesting insights about user-related development plans of dApps & Protocols:

-

Even though 84% of surveyed protocols mentioned covering gas fees & airdrops as the most efficient user acquisition strategies, only 37% of protocols are aware of or have plans to implement ERC-4337 standard (Account Abstraction standard allowing to easily onboard users and cover their gas fees).

-

Only 37% of dApps & Protocols have some kind of off-chain tracker installed - which is a crucial prerequisite for running successful user acquisition campaigns and calculating CAC & LTV

-

As many as 68% of surveyed dApps & Protocols mentioned metrics other than TVL as the most important for them.

The solution

Patterns would like to propose an iterative program, complimentary to the one proposed by IOSG, that would solve these challenges by helping protocols run and measure their off & on-chain user acquisition campaigns. The aim of the program is for protocols & ecosystem to learn how to run these campaigns successfully and build a culture of web3 user acquisition through measurable marketing that finally allows to calculate the LTV / CAC and ROI.

Duration: 3 months per iteration

Budget: $3m (first iteration)

Scope: Patterns will run a program to boost user acquisition by dApps & Protocols into the $ARB ecosystem. All projects will be divided into categories, based on the ecosystem user acquisition funnel:

Budget will be spent on helping these projects achieve predefined measurable goals through all the steps of the above user acquisition funnel:

-

Off & on-chain performance campaigns - consisting of measurable ad campaigns in networks such as Twitter, Linkedin and on-chain networks such as Hypelab and Slise; Paid content and landing page creation; Paid newsletters and cold outreach; Setting up off-chain tracking tools.

-

On-chain incentivisation - including gas fee coverage, rewards and long-term on-chain incentives; Setting up Account Abstraction infrastructure to make Arbitrum products user-friendly and easily acquire new users.

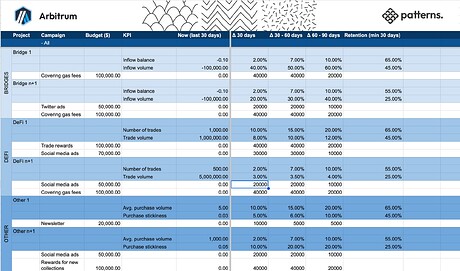

Program KPIs: Each category will have a different set of on-chain KPIs connected to its role in the Arbitrum Ecosystem according to the user acquisition funnel:

- Bridges, On-Ramps & Wallets (up to 5 projects) - the only purpose of bridging & on-ramp projects is to bring in as much funds into the ARB ecosystem as possible and make them as hard as possible to move out. This strategy has worked really well in LTIPP projects and should be continued.

- DeFi (up to 10 projects) - this segment is characterized by high to medium value transactions and wallets. It’s main purpose is to generate as many high volume trades as possible to keep users’ capital engaged in the ecosystem for as long as possible. Additionally, offering assets available only on ARB would be highly appreciated.

- Others (up to 5 projects) - this segment includes all non-financial products within the Arbitrum Ecosystem - such as NFT Publishers & Marketplaces, Games, Social Platforms, AI Platforms and others. All of them are characterized by low value transactions and require high user stickiness to be sustainable. From ecosystem perspective, incentivizing these projects can be beneficial only if users stick with them for long, making their lifetime number of transactions high enough to generate sequencer fees.

| Goals | KPIs (every 1 month) | Retention KPIs (after 3 months) | |

|---|---|---|---|

| Bridges, On-Ramps & Wallets | - Maximize inflow of new funds into $ARB ecosystem; - Minimize outflow of funds out of $ARB ecosystem | - Net inflow balance; -Net inflow volume | - % change in inflow balance; - % change in inflow volume |

| DeFi | - Maximize number & value of trades; - Increase TVL & trade volume on assets available only in $ARB | - Number of trades; -Volume of trades; -TVL | - % change in number of trades; - % change in volume; - % change in TVL |

| Others (NFT, Gaming, Social, AI) | - Maximizing stickiness; - Maximizing in-product purchase | - Monthly Active Purchasing Users; - Avg. in-product purchase volume per wallet | - % change in Monthly Active Purchasing Users; - % change in purchase volume per wallet |

Application process:

- Arbitrum dApps & Protocols apply to the program by filling out a predefined form, where they specify:

1.1. KPIs they declare to achieve every 1 month as well as Retention KPIs after the campaign.

1.2. Requested budget with expected items & costs

1.3. Tools used for running and off-chain measurement of the campaign * All activities must be measurable and Patterns will receive access to tools used (eg. Google Analytics, Mixpanel, Meta Ads, etc.). If activities include KOLs, paid content creation, SEO - all of these need to be fully measurable. - After all applications are collected, the Committee assesses all applications and chooses projects at its own discretion based on the following factors:

1.1. KPI to budget ratio

1.2. Existing track record

1.3. Size of the project * The goal of the program is to both set up a successful campaign examples coming from the most experienced teams, as well as, amplify marketing efforts of smaller and promising projects. - Depending on the type of campaigns, projects will either receive a prepayment for the upcoming month of campaigns or will be reimbursed afterwards. The Committee decides about the payment type.

- User acquisition campaigns start and are independently ran by dApp & Protocols teams.

- Committee monitors and optimizes campaigns, delivering on-chain reports & insights about users acquired. Patterns delivers LTV value of wallets.

- After every month campaign results are compared to initially declared KPIs levels.

- Prepayments or reimbursements for the next month of campaign operation are paid out based on the level of achieved KPIs.

- Unused funds are returned to Arbitrum Treasury.

- Insights & takeaways are collected and if results are satisfactory for the Arbitrum Foundation, the program runs with a second iteration.

DAO Reporting:

Project’s results will be measured for each campaign separately and for the program as a whole. Pattern’s will be transparently showcasing information following the below frame:

-

Start: Publishing information about which campaigns were accepted along with an explanation for the decisions made. All KPIs declared by applicants will be shared with the DAO on the forum along with links to real-time dashboards measuring these KPIs (every metric will be linked to Dune Analytics or DefiLlama or Tokenterminal or Flipsyde). The templates are subject to change:

-

30 days after & 60 days after & 90 days after: Results of campaigns ran by dApps & Protocols will be showcased to the Arbitrum community for every month with a community Q&A section. Patterns will be calculating on-chain LTV and real CAC will be collected to derive the overall ROI on campaigns (exemplary data on the image). 5 most successful campaigns will be explained and showcased to the community. The templates are subject to change:

-

Summary after 90 days: Results of the whole program will be published, along with the information about KPIs, CAC & LTV achieved by each campaign financed within it.

-

Methodology: All metrics mentioned in the proposal will be calculated in a following way:

- LTV - Wallet X Arbitrum Ecosystem: Sum of all sequencer fees generated by a wallet while interacting with the network. Data will be displayed in Patterns app and DAO reports.

- LTV - Wallet X dApp: Sum of all fees generated by a wallet within a dApp based on smart contract events by dApp teams. Data will be displayed in Patterns app and DAO reports.

- CAC - Campaign X dApp: The cost of marketing spending per wallet acquired to interact with the dApp. Data will be displayed in DAO reports.

- Ecosystem ROI = Ecosystem LTV / CAC - Campaign X dApp: The overall value of sequencer fees generated for the ecosystem by a specific campaign divided by campaign’s CAC. Data will be displayed in DAO reports.

- dApp ROI = dApp LTV / CAC - Campaign X dApp: The overall value of dApp revenue / fees generated by the campaign dividied by its CAC. Data will be displayed in DAO reports.

- Category KPIs & Retention KPIs - per dApp: Each dApp’s KPIs will be measured using Dune Analytics or DefiLlama or Patterns app.

- A recommendation on continuing or discontinuing specific campaigns will be delivered to the DAO along with showcase of the 5 most successful campaigns that had the highest ROI and an explanation from a marketing expert on why this specific campaigns were successful.

List of acceptable strategies:

Below you can find an exemplary but not exhaustive list of campaigns acceptable within the program. Any strategy that is measurable can be used in the program:

- Off-chain:

- Inbound:

- Ads: Twitter, LinkedIn, Meta, Google Ads, PropellerAds, Farcaster, others

- SEO: Backlinks, paid articles, SEM

- Content: Sponsored news, articles, paid newsletters, blog posts, videos

- Events: Online webinars and events

- Affiliate marketing: KOLs, Affiliate networks

- Outbound:

- Cold-mailing, newsletters

- Telegram, Discord, LinkedIn campaigns & outreach

- Outbound sales: Apollo, Lemlist, 3RM, Convrt, Growbots, others

- Inbound:

- On-chain:

-

- Ads: Hypelab, Slise, Addressable, others

- Quests: Layer3, Galxe, Tide, others

- Gas fee coverage: Setting up and financing an ERC-4337 Paymaster

- On-chain rewards: Different types of conversions - adding liquidity, trading, creating new token pairs, etc.

- On-chain rewards: Airdrops

-

Application requirements:

Every application requires the following information:

- Name of the applicant:

- Category (Bridge, DeFi, Other)

- KPIs for the last 6 months (specific for each category) with minimum 1-week granularity available on Dune Analytics or DefiLlama or TokenTerminal or Flipsyde or Patterns. In case of multichain dApps, all KPIs must be measured for Arbitrum chain only.

- List of other than Arbitrum chains the applicant has deployed its smart contracts on

- Share of MAU or DAU on specific chains for the last 6 months

- Results and budgets of previously conducted off & on-chain campaigns

- For every planned strategy:

- Strategy description

- Requested budget

- Minimum 50% of the budget needs to be spent on off-chain marketing

- Maximum 30% of the budget can be spent on on-chain rewards

- Overall maximum budget per applicant is $200k

- Requested type of funding: % of upfront + % of arrears

- Expected category KPIs at the following time-points:

- Start of campaign

- 30 days

- 60 days

- 90 days

- Tools required for measurement

- Expected CAC

Application assessment:

The Committee holds a right to choose and deny applicants at its own discretion for any reason. Factors that will be taken into consideration while choosing applicants:

- KPI to budget ratio - a metric derived by dividing expected KPIs growth at the end of the campaign by the campaign’s budget

- Type of payment - arrears payment will increase the chance of winning an application

- Track record and previous results of off & on-chain campaigns for the past 12 months

- Applicant’s share of activity on Arbitrum blockchain

- Direct interviews with applicants

Committee:

The program will have a decisive committee consisting of:

- Arbitrum DAO representative - 1 person selected from DAO candidates

- Off-Chain Labs representative - 1 person appointed by Off-Chain Labs

- Arbitrum Foundation representative - 1 person appointed by Off-Chain Labs

- Patterns representative - 1 person appointed by Patterns

- Independent marketing consultant - 1 person selected from experienced candidates

Committee will hold bi-weekly meetings will all protocols and will be responsible for:

- Accepting or denying projects into the program (3 out of 5 votes needed),

- Putting incentives of a specific project on hold (3 out 5 votes needed),

- Monitoring the campaigns and consulting on their realization,

- Optimizing campaigns, including sharing the best results coming from other projects,

- Sign transactions via multi-sig to disperse funds to projects.

Additionally, Arbitrum Foundation marketing team will prepare a unified marketing package for participating projects to help them bootstrap their marketing efforts. DAO representative and marketing consultant role will be gratified with a monthly remuneration of $2.5k.

Budget & costs:

The $3m budget dedicated for the program will be divided as follows:

- $2.82m will be disbursed to dApps & Protocols as campaign budgets. All unused funds will be returned to the Arbitrum Treasury. We expect to support ~20 applicants with this budget.

- $100k will be spent on Patterns KPI off & on-chain LTV tracking for all participating dApps & Protocols as well as setting up required external tooling - GA, Mixpanel, etc. Full budget cost can be found here.

- $7.5k * 2 / month will be spent on 2 dedicated data analysts from Patterns to facilitate and help dApps & Protocols achieve their goals. Specialist requirements:

- Min. 5 years of experience in web3 analytics

- Min. 2 years of experience in Solidity & smart contracts

- $7.5k / month will be spent on 1 external marketing specialist to help set up marketing campaigns.

- Min. 5 years of experience in web2 performance marketing

- Being responsible for ad budgets of at least $1m

- $2.5k / month will be spent on 1 DAO representative to help optimize and supervise campaigns.

Who are we?

Patterns (formerly known as Tokenguard) is an experienced team of web3 data & user activity analysts who build a web3 user acquisition tool with DeFi & dApp builders in mind. Our tool offers a web3 CRM for builders and growth specialists to boost their conversions & revenue. We started working on this idea in early 2023 and quickly gained traction with protocols and companies such as Optimism Foundation, Polkadot, Aleph Zero, Astar Network, Sygnum Bank, Bitcoin. com and others. Our work includes:

- Optimism Foundation - co-developing on-chain activity metrics for Account Abstraction ERC-4337 standard (ERC-4337 Data & Attribution Standards for the Superchain)

- Polkadot DAO - delivering on-chain user acquisition insights for Polkadot DeFi protocols (including Hydration, Bifrost, StellaSwap)

- Aleph Zero Foundation - boosting on-chain growth through actionable user acquisition insights for dApps & DeFi

Discussion & sources

Most important materials and insights regarding user acquisition & incentivization in the Arbitrum Ecosystem (from newest to oldest):

- IOSG proposal on increasing liquidity depth to attract DeFi trading (04/12/2024)

- Patterns aka Tokenguard discussion on new user acquisition program (27/11/2024)

- Gauntlet insights on LTIPP results (10/11/2024)

- OpenBlock Labs insights on LTIPP results (14/10/2024)

- VendingMachine thoughts on STIP & LTIPP (30/10/2024)

- Patterns aka Tokenguard LTIPP insights & user acquisition funnel discussion (09/10/2024)

- L2Beats incentive detox proposal (22/07/2024)

- OpenBlock Labs on sybil & mercenary users in STIP (25/02/2024)